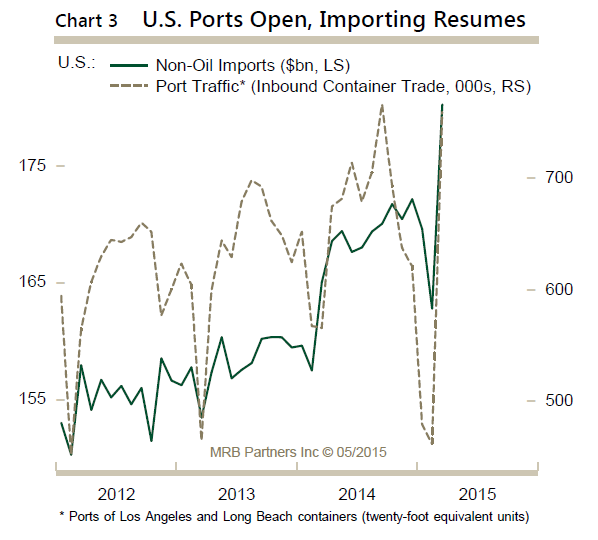

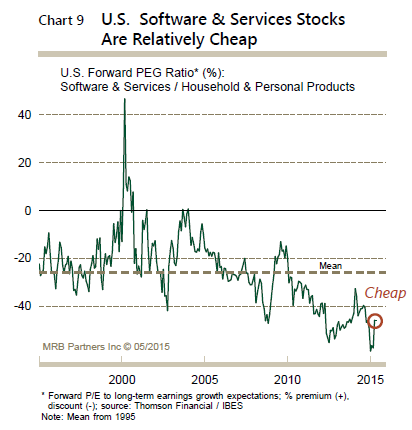

America is a powerful economy. Its health and appetite can determine the direction of the global economy. Macro factors show building momentum in the global economy. At the same time, the investment marketplace has a near term obsession with equities coined “safe plays” or “defensive stocks.” This obsession, to me, appears frothy; safe plays have become perceived safe plays. The obsession has opened up valuation gaps and cyclical growth is undervalued in the marketplace (see below: software & services versus household & personal products valuation comparison). Should the thesis of increased global trade accompanied with increased business capex play out, profitable cyclical companies will be a nice portfolio allocation.

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Past investing and economic performance is not indicative of future performance.

Stay In Touch