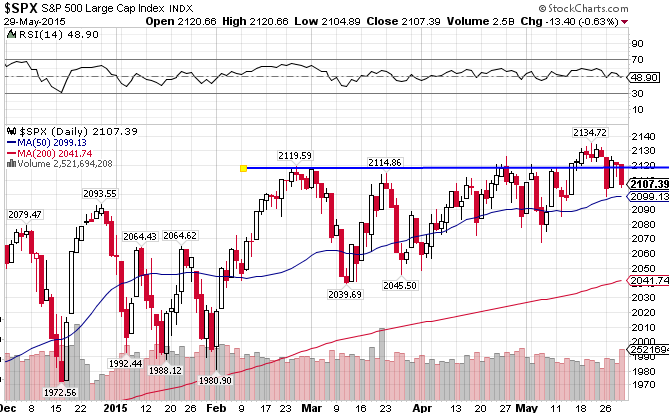

While the S&P 500 Cap-Weighted Index ((IVV)) surged to new all-time highs in the last week, the index has been trading within a tight range since February. Is this a sign of a tired market ready to correct? Or is it one of a market consolidating in preparation for a new move higher? The index has been straddling the 50-day moving average for some time now. If it can’t blast through the 2120 level, look for the index to retest the 50-day moving average yet again. The S&P 500 is up 3.26% for the year.

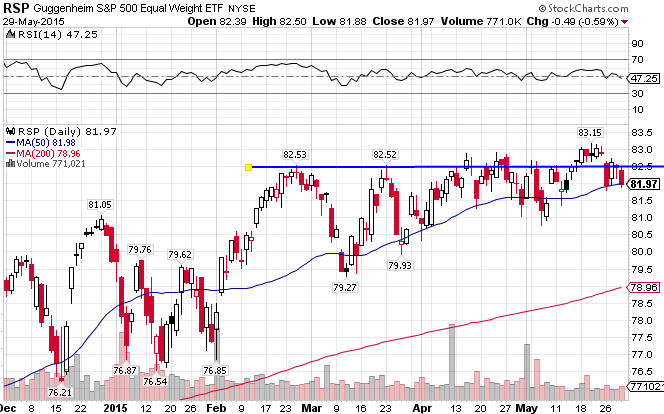

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. The index is up 2.81% year-to-date, slightly underperforming the cap-weighted index.

One of the themes of the past decade has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That was not the case in 2014, as the Russell 2000 Small Cap Index ((IWM)) underperformed by a wide margin. The trend for 2015 has been a little more mixed, as the index is outperforming YTD (3.89%) even as the technicals are telling a different story.

The S&P 500 versus the Russell 2000 Index, Weekly Chart. The Large Cap Index has outperformed since the beginning of 2014, and currently finds itself just above support at the 200-day MA. We could be inline for a big move, one way or another.

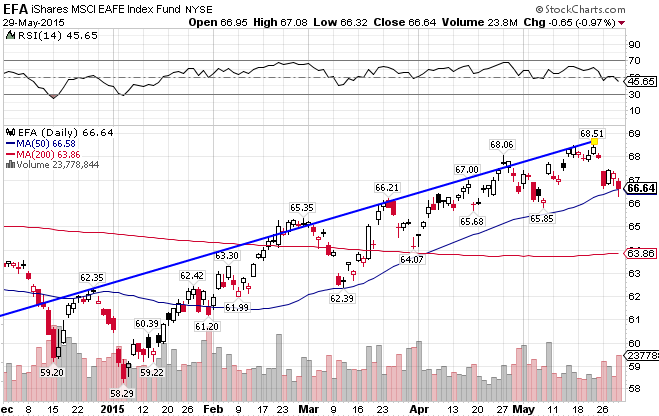

Unlike the US markets, the MSCI EAFE Index ((EFA)) staggered and stumbled throughout 2014, losing 6.20%. But it seems to have turned the corner this year, breaking through resistance at both moving averages on its way to establishing a textbook uptrend line. The index is up 9.53% since the beginning of the year, significantly better than its US counterpart.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better, with an impressive gain of 12.33% for the first part of the year. Like the US markets, in the short-term international small caps are outperforming the large cap index.

EAFE Large Cap Index vs EAFE Small Cap Index, Weekly View. It’s been a steady small cap outperformance until mid 2012. Things might be reversing soon though.

Stay In Touch