“While most investors were preoccupied with deflation, related to last year’s plunge in oil prices, and the seemingly hopelessness of quantitative easing, a stealth recovery in private sector global credit demand was underway. We examined prospects for credit growth..which highlighted some surprising developments relative to the economic pessimism that had caused government bond yields to massively undershoot:”

- “The monetary transmission mechanism in the major economies is functioning again: G7 private sector credit growth is expanding.”

- “Credit growth will reinforce the economic recovery, and…contribute to upward pressure on global real bond yields.”

- “The uptrend in bond yields has further to run on a cyclical basis.”

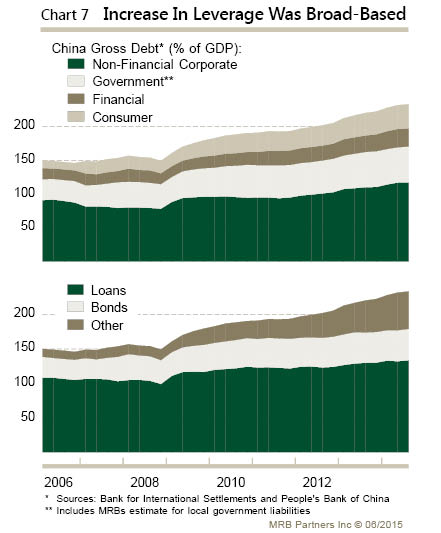

China held the torch with massive, broad stimulus when the rest of the world was flat on their collective backs. China undoubtedly needs/wants a little down-time after gross debt ballooned from 150% of GDP before the crisis to close to 250% of GDP currently.

Other major economies are hitting an acceleration phase which will buoy a resting and rebalancing China.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch