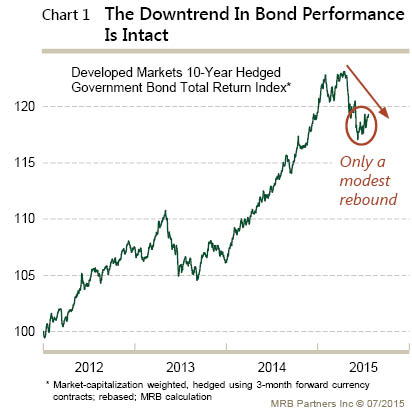

Tail risks have eased following the end to the current Greek crisis. The world now looks to move toward economic normalization. Bonds performed well during the flight to safety coinciding with the referendum and emergency meeting circuit in Europe during the first half of this month. Now that investors are collectively exhaling and eyes move toward the timing of the signaled, Fed rate move, bonds should resume this year’s downtrend.

The Taylor Rule currently indicates that the current Fed rate is almost 2% too low.

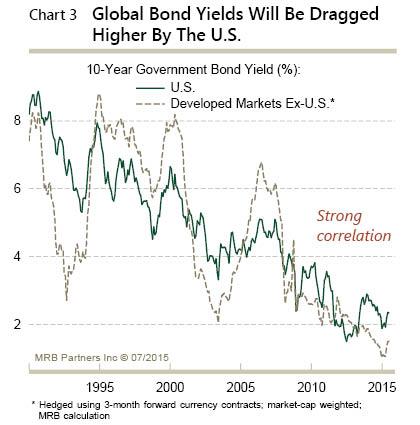

Global rates have a high correlation with the US, so don’t expect anything different from foreign bonds.

In this environment, one would expect continued dollar strength and pressure on commodities, similar to the mid to late 1990’s.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch