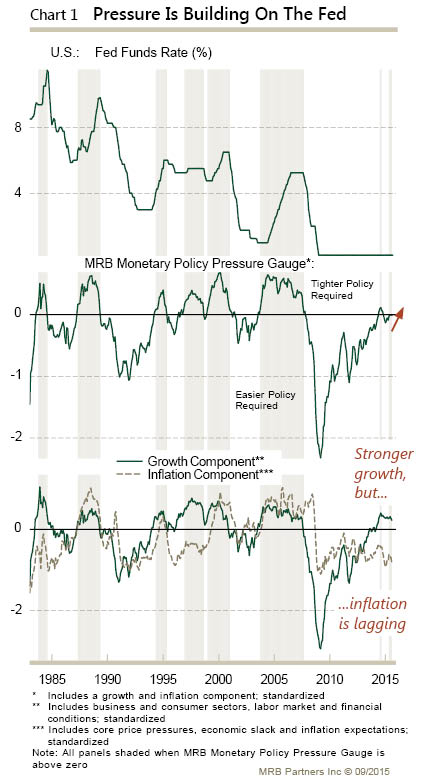

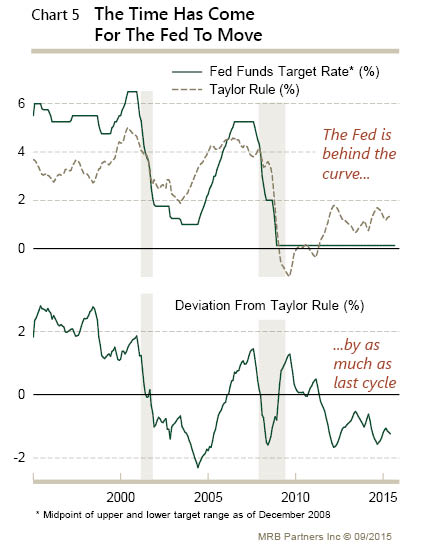

Research we follow is showing that the Fed is reaching a point where employment gaps have closed and output gaps are closing. By not raising rates soon, they risk falling behind the eight ball and over-stimulating the economy.

Deviation from the Taylor Rule is large.

Hosing Prices inflation indicate that rates are too low.

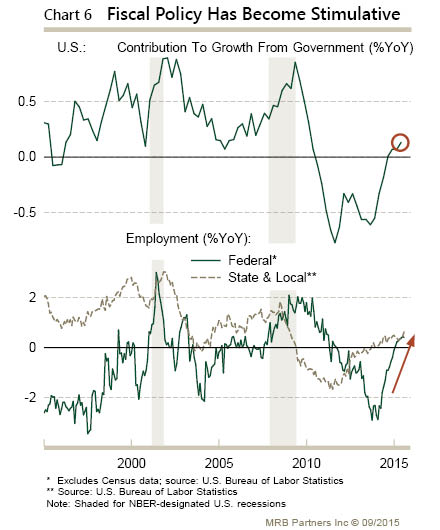

The Government is now adding to growth.

The drop in oil prices means we spend 2% less of GDP on oil as we did from 2010-2014. This affects inflation statistics and growth statistics but is not a negative. Once the bar is set lower on oil, we will get the real picture of what is going on in the economy.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch