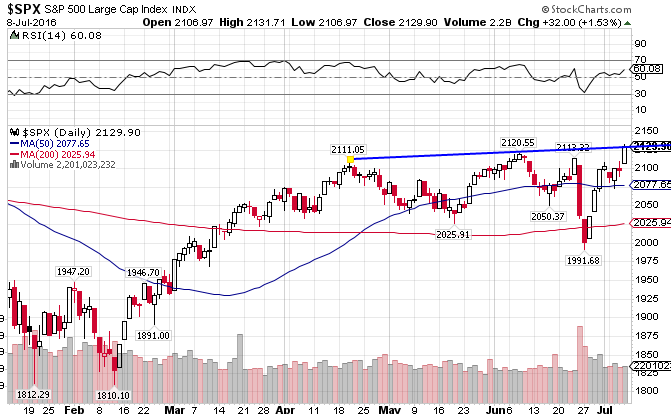

This past week, the S&P 500 Cap-Weighted Index ((IVV)) once again tested resistance at the 2100-2120 level, before finally blowing through to set new all-time highs for the market. It’s been a remarkable rebound from its crushing meltdown in January, and once again after the initial Brexit scare. And now the question becomes…will there be some follow through in this coming week, especially with bond prices hitting all-time highs as well? The market seem to be saying yes. The S&P 500 is up 5.46% for the year.

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating the market-weighting growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. So far this year, the index is up 7.27% year-to-date, significantly outperforming the cap-weighted index and in line with general market trends.

One of the themes of the past decade has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. That trend is once again valid for 2016, after the Russell 2000 index ((IWM)) underperformed by a wide margin in 2015. IWM is on par with the large cap index and is up 4.59% YTD. Other small and mid-cap indices are significantly outperforming.

The S&P 500 versus the Russell 2000 Index, Weekly Chart. After breaking out towards the end of 2015 and into 2016, the large cap index has come back down to Earth and pulled back to the 50-week MA.

Looks like the Brexit vote and the weakening Chinese economy managed to deflate the MSCI EAFE Index ((EFA)) in 2016. The index is down 3.97% since the beginning of the year, significantly worse than its US counterpart, continuing the trend that began in the second half of last year. In the last week of trading action, it seems to have bounced off the lower end of its trading range, so look for a possible bounce to the 59 level.

The MSCI EAFE Small Cap ((SCZ)) has performed slightly better than the large cap index this year (-2.72%), after impressively holding onto a 9% gain last year. Like the US markets, international small caps are outperforming their large cap index over the last 12 months.

EAFE Large Cap Index vs EAFE Small Cap Index, Weekly View. It’s been a steady small cap outperformance since October of last year.

Stay In Touch