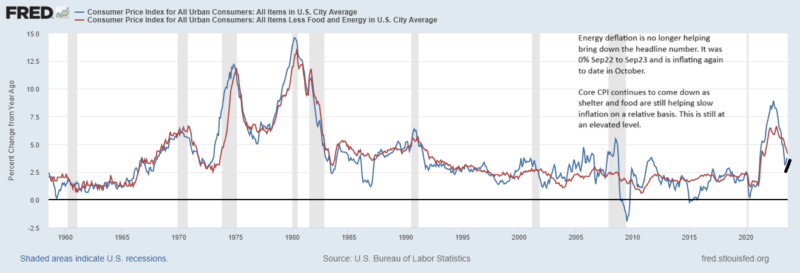

The most anticipated release of the week came in … “Unchanged” or sticky stuck from August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed be stickier for longer than we hope.

Let’s first start with energy which is about 7.5% of the basket. With the exception of the spike in oil coinciding with the Russian invasion of Ukraine, oil peaked in June 22 at around $122/bbl. For the 12 month period, June22-June23, oil was helping bring inflation down. In June22 energy inflation was a whopping 41.25% yoy. It abated drastically throughout the next 12 months, turning negative in March 23 and bottoming in June23 at -16.5% yoy growth. This June to June time period coincides with the peak of oil in 2022 and the low for oil in 2023. The reduction in energy inflation during this 12 month period was the largest ever going back to the late 1950’s. For energy to have the same accumulative effect on slowing inflation over the next 12 months, it will need to repeat the same level of incremental slowing as it did last year. Oil prices were -42.5% during this period, given the historic 1 year decline its unlikely that we will see a repeat performance, especially given oil is up around 29% since then. The Sep22-Sep23 change in energy prices is -0.5%. While not outright additive for the last year, a -0.5% rate growth in energy prices is higher than last month’s -3.6% change. An increase in the change of energy prices this year relative to the decrease we had last year, will cause the headline number to go up, all else being equal. This is the sticky dynamic we’re seeing and the reason the headline number is up since June.

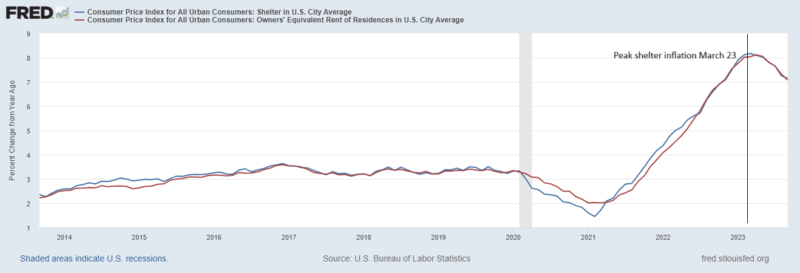

Now let’s move to the 2 biggest pieces of the consumer basket, food and shelter. Shelter is by far the largest at about 1/3 of the pie. Unfortunately, we are going to see the same sticky dynamic for food and shelter. The effects will be a bit delayed relative to the short term price translation of energy and not as extreme relative to the volatile prices of energy.

Starting with food, the sticky dynamic is starting to happen now given the peak in food inflation was August 2022 (11.3%). The rate of food inflation came down inch by inch at the end of 2022 before really slowing in the first half of 2023. In the current release of Sept23 data, food inflation is currently 3.7%yoy. Food disinflation on a relative basis is starting to have difficult comparisons, so incremental monthly changes will need to be more than the slowing we saw in 2022 to lower headline inflation. This dynamic will get more difficult in March 24. This is hard to conceptualize, but if inflation remains constant at this MOM level (higher than the Fed’s mandate), food inflation on an annual basis will decline at a slower rate from now until February 2024 and then start to actually go up in March 24 exacerbating the problem.

At this same time, the difficult comparisons for shelter will begin. Luckily the shelter component is like a tortoise compared to food and energy who have been excluded from the core. But it is a big piece of the basket so will certainly have a sticky dynamic for inflation unless it starts to comes down faster next spring than it did in the spring of 22.

And how about the implication for monetary policy? We’ll have to wait and see. The consensus is that a an 89% chance that rates will be held steady at the November meeting. But the Fed will see 2 more employment reports, 2 more PCE reports and 2 more CPI reports between now and the December meeting. Consensus puts the probability of a December hike at 32%. If the Fed does hike again, it is likely a continued strong jobs market and this sticky inflation dynamic that causes them to do so.

Stay In Touch