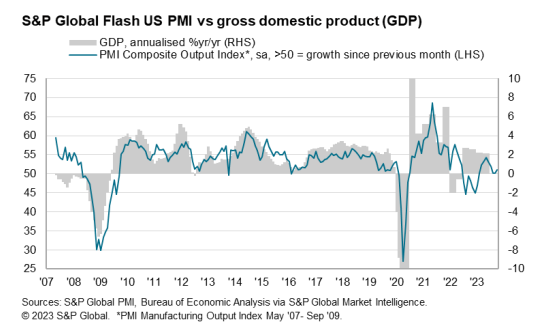

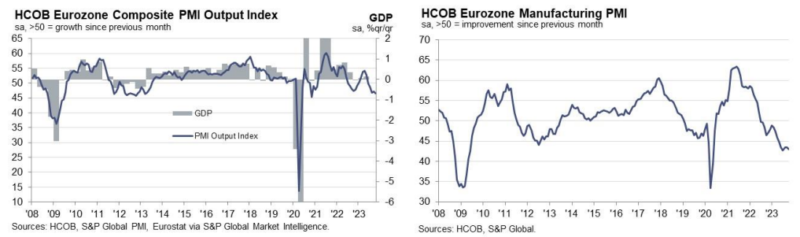

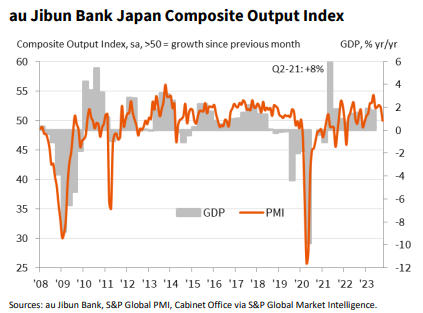

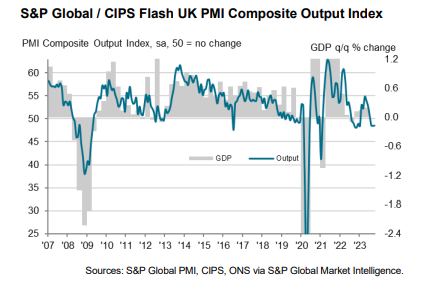

The initial print for October was good in the US. Europe continues to struggle. Japan weakens slightly. The UK flat-lines below 50. Australia drops. Numbers above 50 should indicate an economy is growing. FWIW, this data has been very choppy and even enigmatic.

Composite Output Index

- US — 51, up from 50.2 (a 3 month high)

- Eurozone — 46.5, down from 47.2 (a 35 month low)

- Japan — 49.9, down from 52.1

- UK — 48.6, up from 48.5 (2 month high)

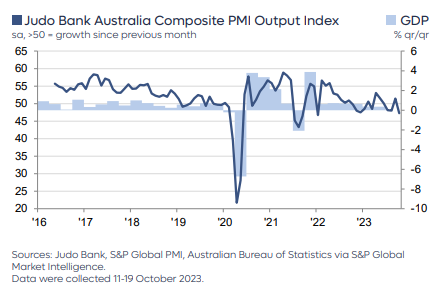

- Australia — 47.3, down from 51.5 (a 21 month low)

More broadly, the US has chopped above and below 50. It is a good thing that it is above 50, but there is no discernable trend. The Eurozone continues to outright contract. Japan has been trending better, but this print is at the low end of the choppy march higher and is concerning. JGB’s have been pushing to higher rates and the currency is at a fresh 30 year low. This merits watching to see if the positive momentum continues or if there is more to be concerned about. The general trend in the UK has been down. They may be trying to find a base to build on. Australia continues to slow. This is much about the mining sector as global demand has been slowing for the last 2 years and inflation is falling. A spike in inflation could change the trend down under.

Stay In Touch