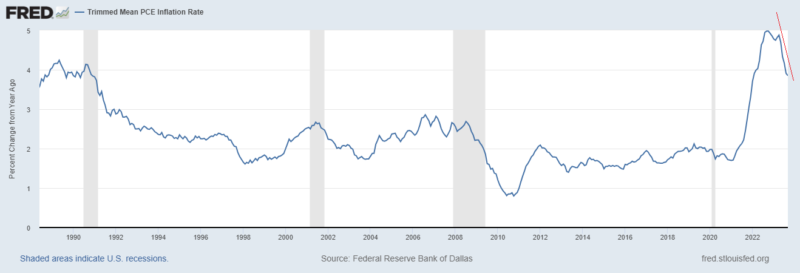

If we look at inflation on a year over year basis, the data series is smooth and it is coming down. The rate of decent has slowed, but that’s ok, the world doesn’t work in perfectly smooth arcs and waves.

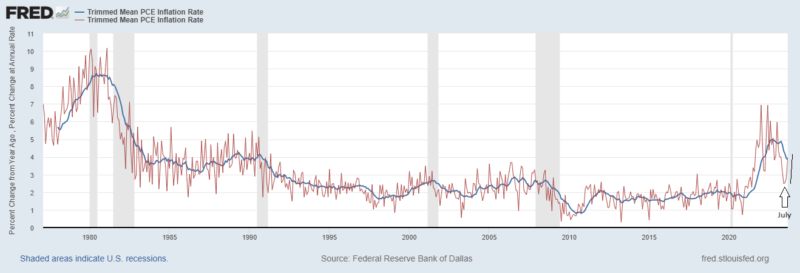

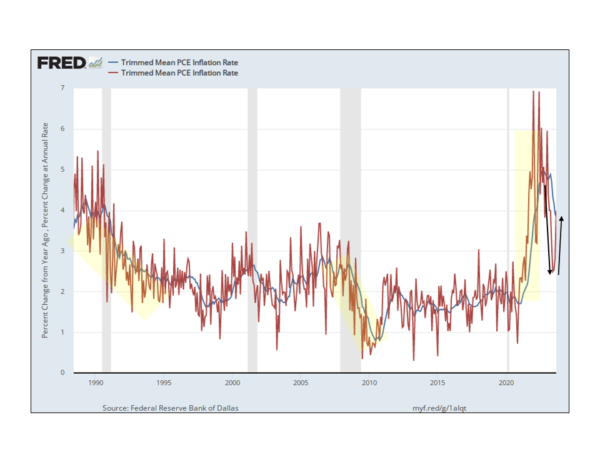

The month over month annualized rate is a shorter term (very volatile) rate. As such, it will lead when there is a change, but it will also give false signals. If we overlay the MoM rate on top of the YoY series, we see a potential big reversal of the disinflationary trend. The year over year change in prices is 3.85%, the month over month annualized change in prices is 3.99% (up from 2.53 in July). No alarms today, as we said this is volatile data. But, if this shorter term calculation (the red line) goes further above the yoy blue line, it will “drag” the blue line higher. You can see in the highlighted areas of the second graph, when the month over month number sustains itself above or below the YoY number it is leading.

The data dependent Fed is expected keep rates steady at the meeting next week. So they will wait to see whether or not this volatile data is signaling that inflation is not cooperating. It’s interesting, they almost certainly leave rates unchanged next week; but, the market is giving it a 19% chance that they raise rates in December and a 25% chance that rates are 25bps higher by January. So this type of data definitely has some concerned.

The job market is healthy. Real GDP is running close to 3% yoy. Wages are growing more than 5%. Core inflation is around 4%. And now high frequency data says inflation may stop going down. How does Powell sleep at night? How does he look at the current set of data and determine that a pause is appropriate?

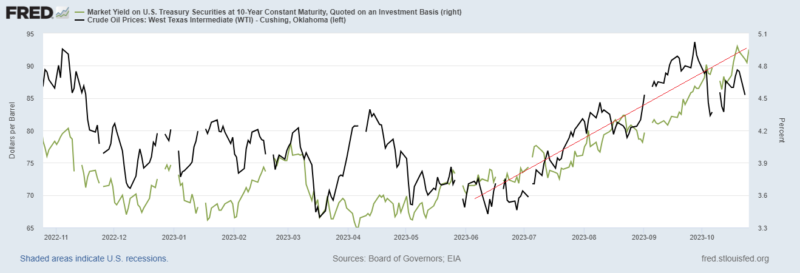

The real bugaboo here is the oil markets. But fortunately for the Fed Chair, he can afford to be patient because longer dated interests rates are following the oil market and doing the work for him, autonomous driving interest rates.

Stay In Touch