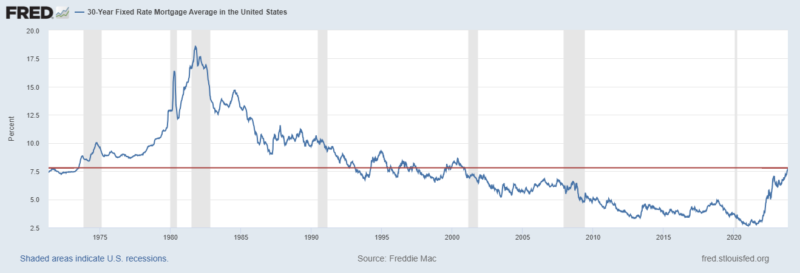

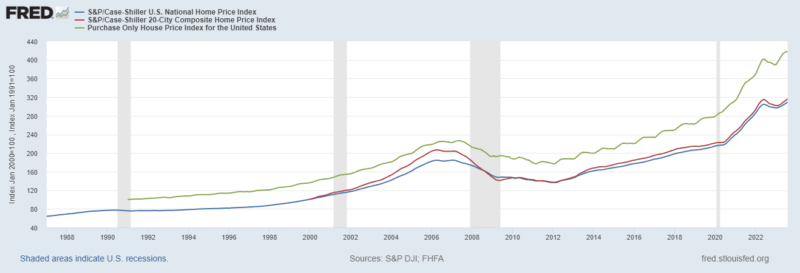

Housing prices were coming down this time last year. But, despite mortgage rates at their highest levels since 2000, housing prices are again appreciating and reached an all-time high in August.

Summary Conclusions:

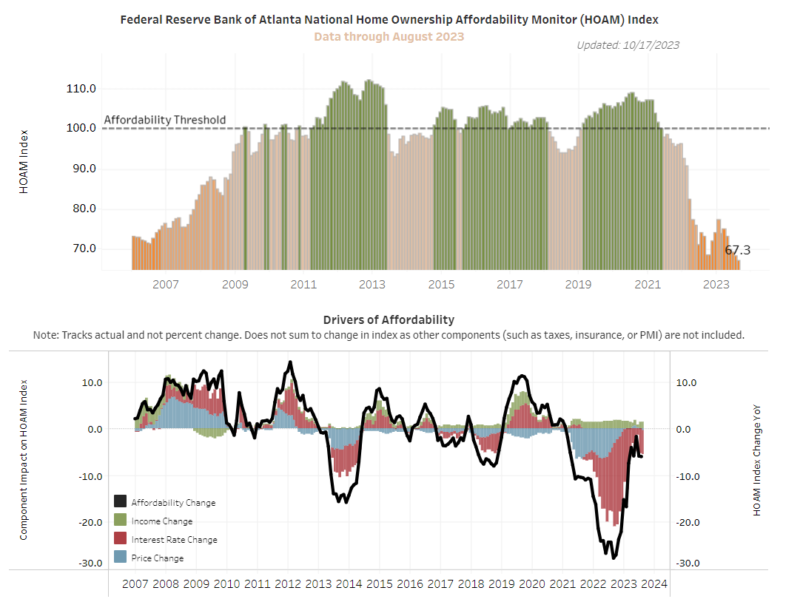

- Housing Affordability lowest since the early 80’s, surpassing 2006.

- Prices at an all-time high and rising.

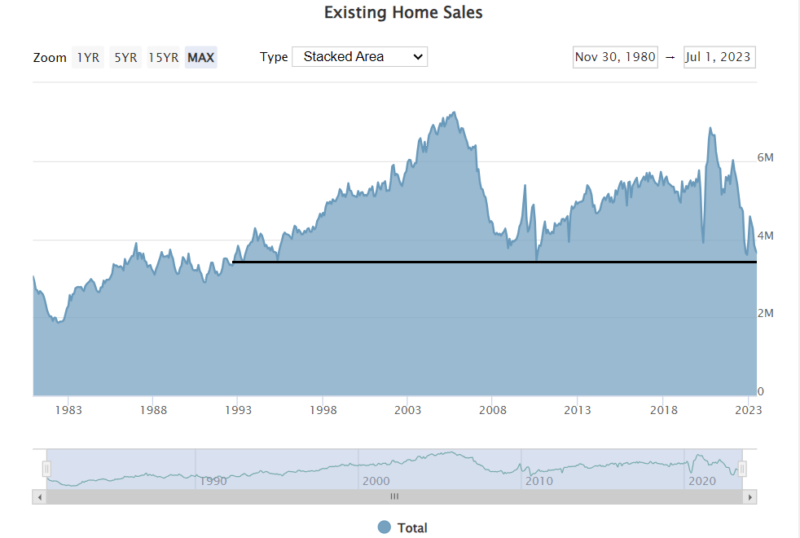

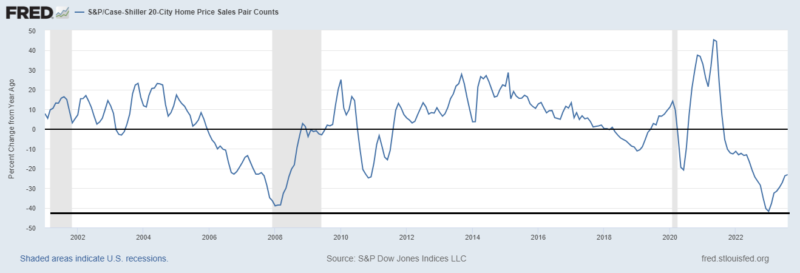

- Housing sales volume approaching the lowest of the last 25 years.

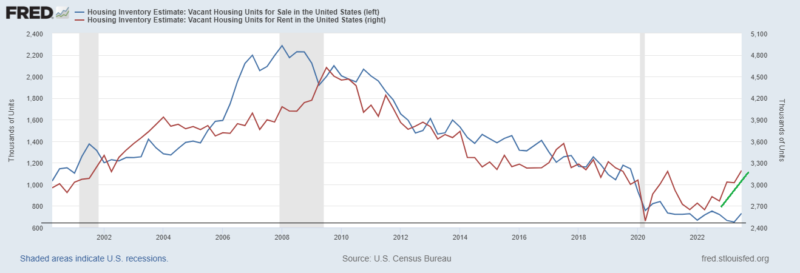

- Housing available vacant supply the lowest of this century.

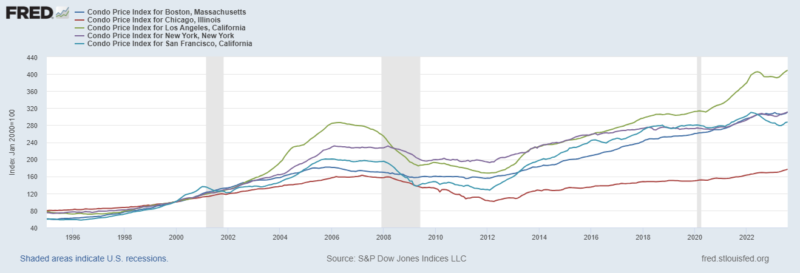

Except for San Francisco, condo prices reach all-time highs as well.

Having traded in the pits of the NY Merc and CBOT, price discovery is about liquidity, plentiful supply and demand coming together and trading high volume. This is not the case today in the housing market. The US has done a great many things to destroy efficient markets over the years. And pandemic economic policies have impaired this housing market. Affordability is at an all-time low, volume is approaching a quarter century low, and available inventory is at the low of this century. In this illiquid market, despite record low affordability (record high valuations), prices are still going up. So demand over the summer was greater than supply. What happens if that equation changes? We did see the supply of rental units rise, why sell when you’re locked in at 2.7%?

Affordability–lowest level going back to 2006 which was the lowest level since the early 80’s.bility

Volume–Approaching lowest level of the last 25+ years.

Volume dropped the fastest this century and is still falling.

Inventory of vacant housing for sale just bounced off the lowest level of this century (blue line). An increase in the number of available rental units (red line).

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the information herein constitutes an investment recommendation, investment advice or an investment outlook. The opinions and conclusions contained in this report are those of the individual expressing those opinions. This information is non-tailored, non-specific information presented without regard for individual investment preferences or risk parameters. Some investments are not suitable for all investors, all investments entail risk and there can be no assurance that any investment strategy will be successful. This information is based on sources believed to be reliable and Alhambra is not responsible for errors, inaccuracies, or omissions of information. For more information contact Alhambra Investment Partners at 1-888-777-0970 or email us at info@alhambrapartners.com.

Stay In Touch