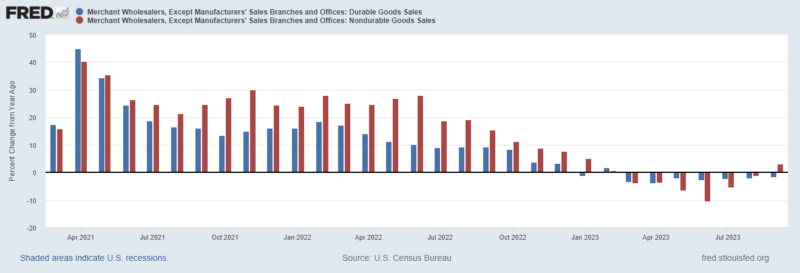

Sales of durable goods at wholesalers remains in decline versus a year ago. The drop is from professional equipment (computers and software) and minerals and metals. Non-durable has returned to growth. The growth is not broad but mostly about petroleum and to a lesser extent, drugs.

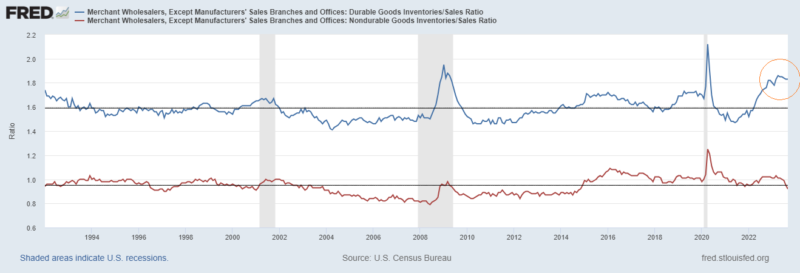

Durable goods’ inventories remain high while non-durable goods inventories have dipped just below the historic average.

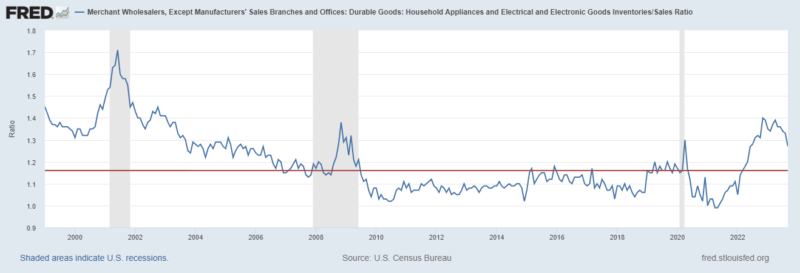

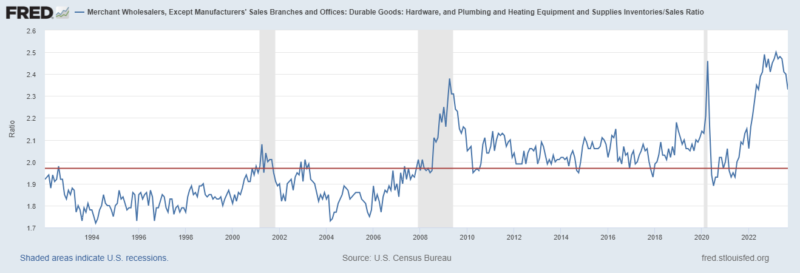

Apparel stocks have been extremely weak. Much of the weakness is likely a result of ordering way too much inventory coming out of the pandemic and navigating supply chain issues. Inventory is still elevated, but coming down. We see the same dynamic in appliances/electronics and hardware/plumbing/heating.

One call out and area of concern is machinery, equipment and supplies. This would be everything from belts and hoses to pavers. The concern is about both levels and that it is not reversing. Why do we have so much of this stuff sitting around and why is it still building up?

Stay In Touch