Retail sales make up about a quarter of GDP, so an important monthly number. I saw a lot of headlines saying this was a disappointing number. But that isn’t the case, the print was actually good. Sequentially, expectations were low for this print because September 2023 and October of 2022 were so strong. The sequential number was expected at -.3% and came in better than expected at -.1%. Additionally, September was revised even higher to .9% growth MoM.

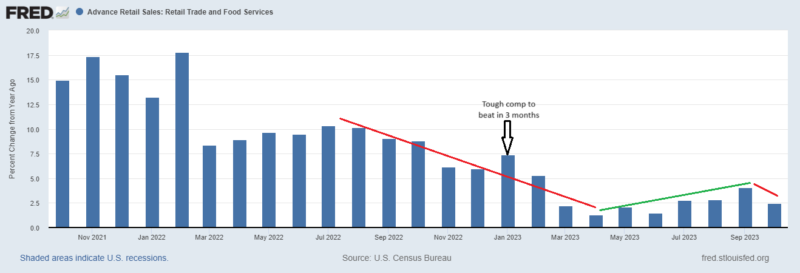

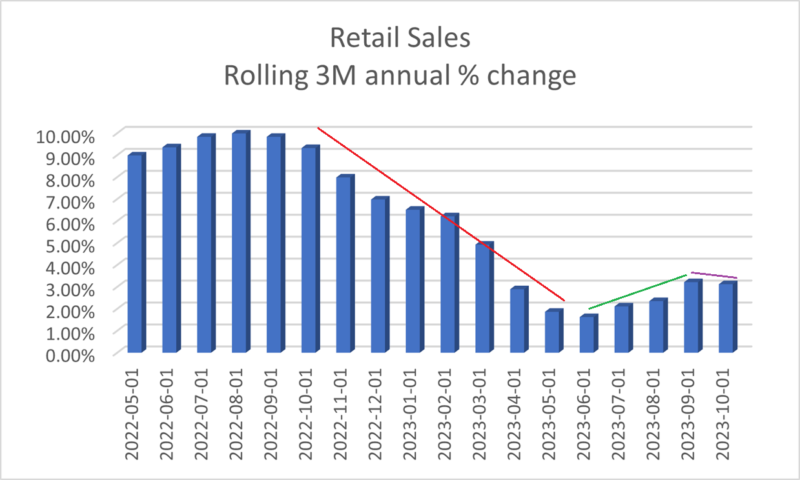

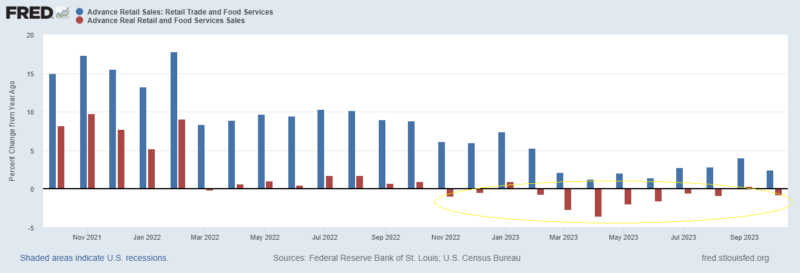

On an annual basis, we do see some trends that are concerning. The strength building this year may have culminated in September. The medium term trend appeared to be turning back positive but this is now in question. We also see this in the real retail sales number. After turning to positive annual growth in September, we are back to negative YoY real retail sales growth in October. And real growth YoY has been negative 10 of the last 12 months. On the bright side, November and December 2022 were so bad, that Nov and Dec 2023 have a good chance to get the trend back in the right direction. For annual sales growth to move lower from the current rate of 2.5% nominally, next month’s number would have to be down more than 1.3% sequentially. For real annual sales growth to remain negative, next month’s print would have to be 1% lower MoM. The series tends to be pretty volatile, so this is not out of the question. Looking at rolling 3 month annualized growth to get a smoother picture, we did drop from 3.2% to 3.1% growth. Again, I wouldn’t expect this to be a problem the rest of the year given weakness at the end of 2022. If the Nov or Dec 2023 numbers are so weak that we continue the annualized downward trend, this would be a problem, especially since Jan 2023 was strong (that becomes a hard comparison and the growth would then start to look pretty bad).

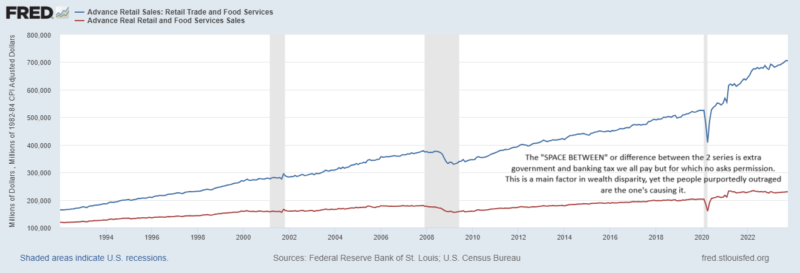

Real Growth has been mostly negative as inflation pulls forward sales and eats away at purchasing power. This next graph is a good reflection of the damage inflation causes to the economy. Sure, some of the inflation has been related to supply shocks. But as we approach the 3rd anniversary of vaccines, the inflation is much about the real cost of extreme government spending policies on our behalf.

The difference between the blue line and the red line is inflation. Inflation here is essentially a tax, Governments and Central Banks don’t get your permission for this tax, they simply tell you it’s in your best interest. To a certain extent, they are right, but the lack of disciple over the last 20+ years is concerning.

Stay In Touch