This was a very positive report. The consumer is showing no signs of pulling back or needing to pull back in the near term, buoying GDP and GDP expectations. Interest rates float higher on the news.

A quick comment on market dynamics and reactions to releases such as this one. First, everything is relative to expectations. And for a report like this, even expectations have some nuance. The consumer has been strong and expectations (statistical forecasting) expected consumers to remain strong. But pessimistic talk questions the sustainability of the consumer and qualitatively predicts a faster reversion to a longer term mean of slower consumption growth.

A report like this alleviates some concern that the consumer “must” tire. Meeting expectations of continued strength is actually a relief relative to underlying pessimistic reversion to the mean think which is fraught with time horizon and idiosyncratic fog. BUT, while strong wage growth is positive for continued consumption strength, it does mean higher costs for employers and potentially lower margins even though top line growth remains positive.

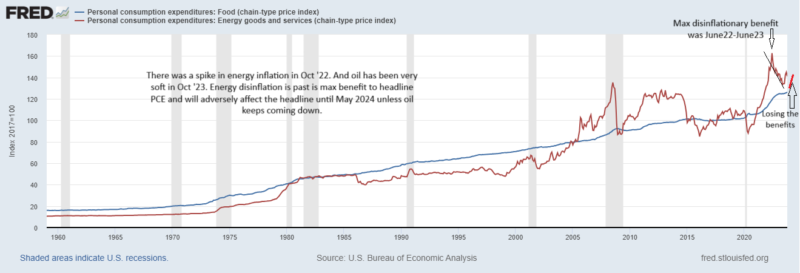

And finally, (the Fed is concerned about inflation), incomes are growing at a rate greater than inflation and even greater than the current Fed target rate. This report does not move us closer to a 2% inflation target or lower discount rates in the near term. In fact, there is every indication that headline PCE inflation will start to go up again. Aggregate wage growth above 5.35%, so the consumer can not only absorb 3%+ inflation, but could theoretically push it higher. A loss of energy deflation benefits over the next 6 months will also impact inflation to the upside. The concern is that this raises the expectation of higher interest and discount rates for longer. The longer interest rates remain restrictive, the more debt has to be issued and/or refinanced at restrictive levels.

Bullet point highlights:

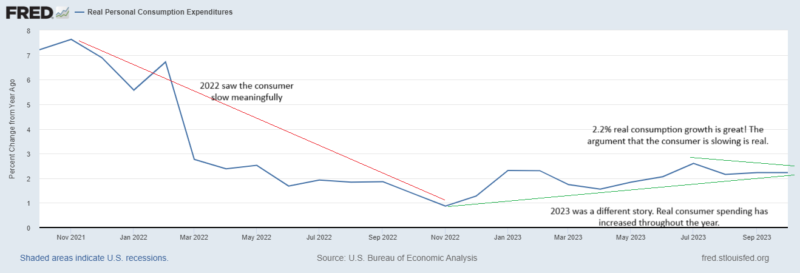

- Incomes are growing faster than inflation. Real disposable income growth is healthy. Aggregate spending power is increasing. This all buoys GDP expectations.

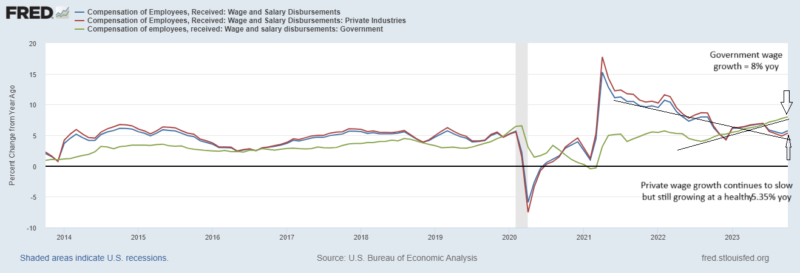

- Government wage growth continues to surge.

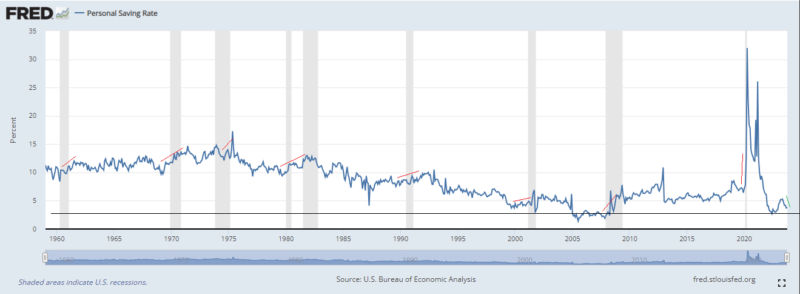

- The savings rate is very low and has been falling since the spring.

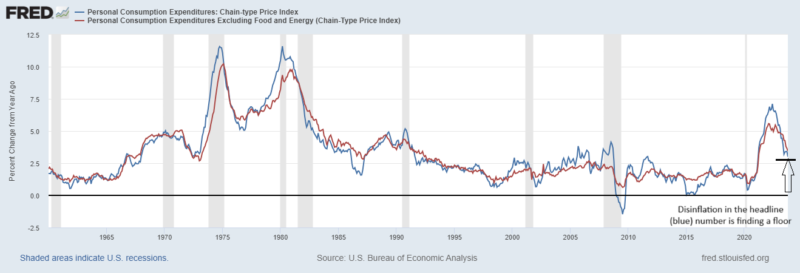

- Core inflation is 3.5% and currently falling slowly.

- Headline inflation is 3.0% helped by energy deflation. Energy deflation is likely coming to an end over the next 6 months.

- Will core inflation drop toward the headline number or will the headline rise toward 3.5%? Here’s where it gets sticky.

Income growth in the government sector is still accelerating. Private sector wage growth is slowing but still sits at a healthy level of 5.35% annual growth. This is well above 3% and also easily above core inflation at 3.5%. Real disposable income is positive and real consumption growth is above 2%.

Wage Growth

Real Consumption growth 2.2% and has seen healthy increases throughout 2023.

Increased real disposable income means confidence to spend. The savings rate is dropping. Perhaps people are earning more but still saving the same amount? Bad economies equate to a rising saving’s rate, that is not what is being signaled here despite the poor consumer confidence numbers.

PCE inflation 3.0%, Core PCE inflation 3.5%.

Energy inflation is currently -4.6%. If prices don’t rise at all, by December, energy inflation will be a positive contributor. At current price levels, by May, energy inflation will be 6%.

Stay In Touch