First and foremost, Durable goods peaked in the short term in June. A repeated theme, we saw some strength in Sep, October is again weak, expect November to be better given a really bad Nov 22. Aircraft orders are significant.

The $16B drop in Durable Goods Orders is from a drop in non defense aircraft orders.

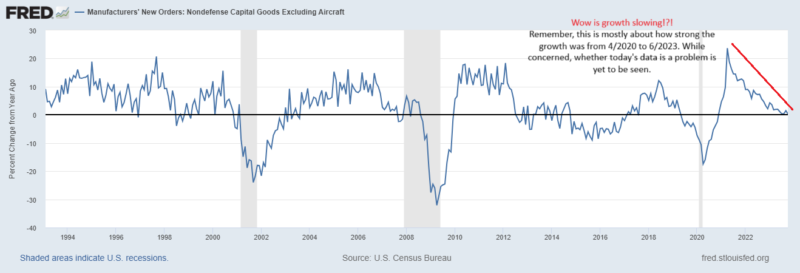

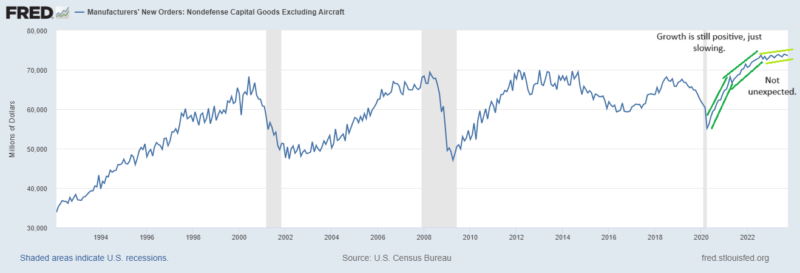

The following 2 graphs of the less volatile Capex series (Capital Good ex Aircraft) are a good example of a report that can be interpreted very differently depending on the biased eye. Someone might spin an economic number as very dire when in fact a reasonable economist would expect the series to present itself as such.

In 2020, we were in a state of unknown with the pandemic. We had an inital recovery from the extreme shock of March 2020. As the shock wore off, we came to understand the virus, feel more comfortable navigating the virus and we developed a vaccine. The economy not only recovered, but boomed with the addition of massive stimulus.

So, though it is the sharpest, extended decline of the last 30 years, the declining growth since April 2021 is much about how strong the growth was for 26 months starting in April 202o.

Since June 2023, there is no doubt we have slowed. This is especially true of the headline number with the loss of aircraft orders. But, growth in the less volatile capex series is still positive. We want to understand the nature of the slowdown. There are concerns, but this is going to take 1-2 more months to truly understand the level of concern. Should growth turn negative next month in spite of the easy Nov comp, then we would get concerned.

Growth looks like it’s falling off a cliff.

But, for now, we are just slowing from the best growth of the last 30 years.

Stay In Touch