Headline CPI came in at 3.12% in November, that’s .11% lower than October. From September to October the headline dropped .46%. For the year, we’ve averaged a monthly drop of .29%. So the pace of disinflation is slowing.

Additionally, YOY changes in prices are still higher than June, so we’ve made no progress in the 2nd half of the year.

The Core CPI dropped a measly .03% to 3.99% and both price measures remain above the 2% target.

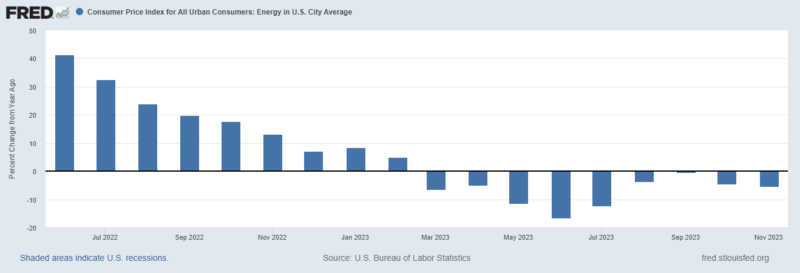

The headline number is being helped lower by energy prices which are down 5.4%.

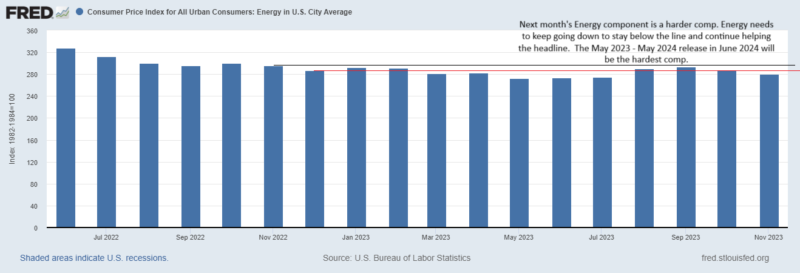

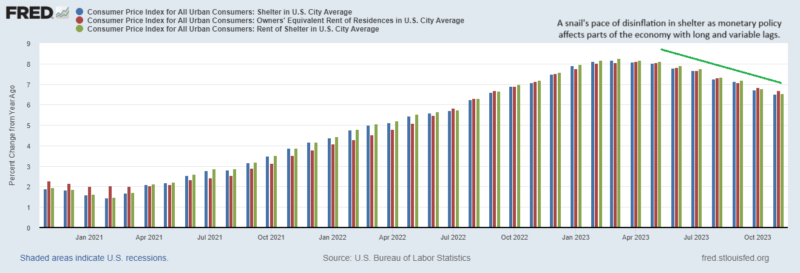

Core inflation and the headline will always converge as the volatile food and energy component oscillates higher than and lower than the slower moving core. The question becomes does core inflation come down to meet the headline number or will the headline pop back up. For now, energy takes the center stage on this question. Next spring, the conversation may turn to shelter. Oil continuing to come down is a good thing because energy will have a harder and harder time helping the headline lower. At -5.4% energy helped bring inflation down .4% since last year. But we are losing the benefit of energy disinflation. If energy prices stay at their current level, they will only be 2.4% lower than last December. All else equal, this would cause the headline to rise .23%. So we need shelter and food to keep rising a lower rates to compensate. It’s becoming hard for the food component to help offset (and food isn’t actually very volatile), it’s only helping bring down inflation about .o45% per month currently. Shelter is helping bring inflation down about .07% a month and with no outside shocks, come next spring, housing disinflation will have a harder time helping. But, the shelter component can actually be quite volatile, so we’ll see.

Here’s a look at how energy prices will find it hard to help the headline as much next month.

The Core is being buoyed by services inflation which is still running at 5.5% and shelter inflation which is running over 6.5%.

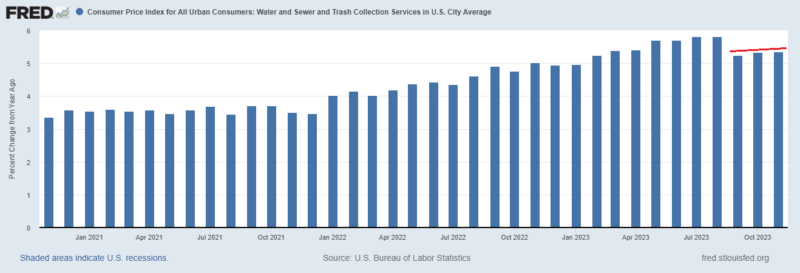

The inflation is not because of goods, its about labor and the cost of facilities. This shows up in a few series, notably in motor vehicle maintenance and repair. It’ll cost you 8.5% more in 2023 to take your car to the shop; but the parts cost the shop 1.5% less than last year. There is also a jump in water/sewer and trash collection which is still running hot at 5.35%. This isn’t surprising given all the union activity helping their members keep up with cost of living increases. You’ve been touched by the Teamsters.

The market reaction: Bond yields jumped 7 bps and oil went down 4%. Fingers crossed that oil keeps going down because the shelter component is being stubborn. The market is now giving a rate hike tomorrow a 1.6% probability, up from .2%. The market thinks the May meeting is the most likely time for a rate cut. A cut at the March meeting is being given a 42% chance.

Stay In Touch