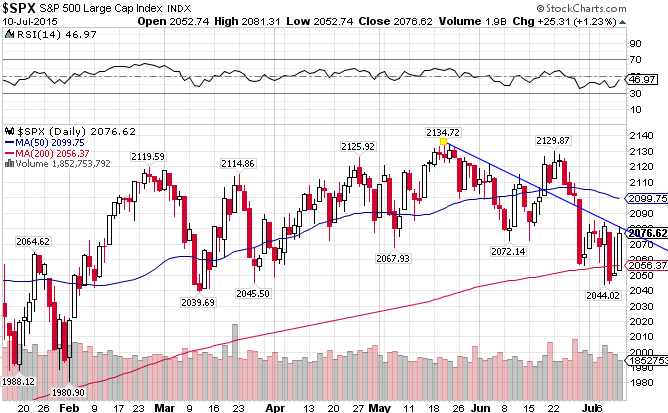

Since the beginning of the year, the S&P 500 Index (IVV) has been trading within a range of 150 or so points, testing support at the 50-day moving average over 10 times, and testing support at the 200 twice. If it can’t hold the 2050 level, we might finally be looking at a breach of the 200-day MA, something that we haven’t done since October 2014. The S&P 500 is up only 1.98% year-to-date.

The EMU Index ((EZU)), or the European Economic and Monetary Union, fell below both moving averages in the last two weeks but managed to bounce back (at least temporarily) on news of renewed talks between the EU and Greece. The index is up 8.50% for all of 2015.

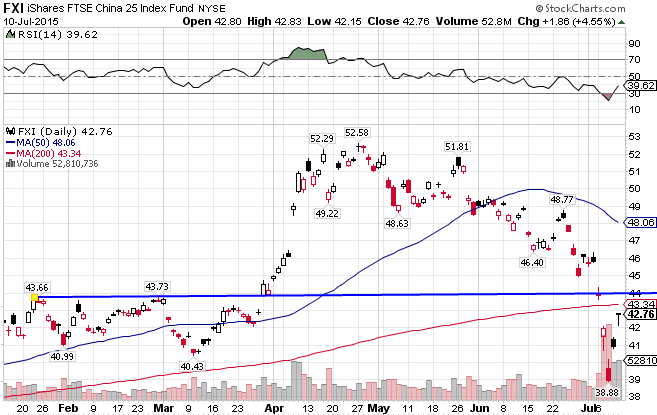

The news of the week also centered around the bubble that is the Chinese markets. After a huge run into April, the Chinese markets ((FXI)) plunged over 24%, breaking both MAs before rebounding back up to the 200-day MA. We could be in for another move lower if the index can’t get above resistance at the 44 level. The China Large Cap index is up only 3.27% in 2015.

The Russian Index ((RSX)) had been hit pretty hard by the US-EU-imposed sanctions, but it seems to have bounce-backed (at least temporarily) following the dramatic sell-off. It must hold support at the 17 level if it wants to continue its run. If it can bounce from there…..and if Putin will stop provoking and antagonizing the West…this index could have room to run, as it is extremely cheap. RSX is up an impressive 21.46% in 2015 after a harsh 2014 where it saw a 50% decline.

A stronger US dollar, civil war affecting just about the whole region, and crashing crude oil prices are just a few of the things the Middle East Index ((GULF)) has to contend with. The index may be looking at new lows in the near future. The supply of crude oil is probably the biggest driving factor of this market, and that is still a net negative for the index. Despite the headwinds, the index is only down 1.57% since the beginning of the year.

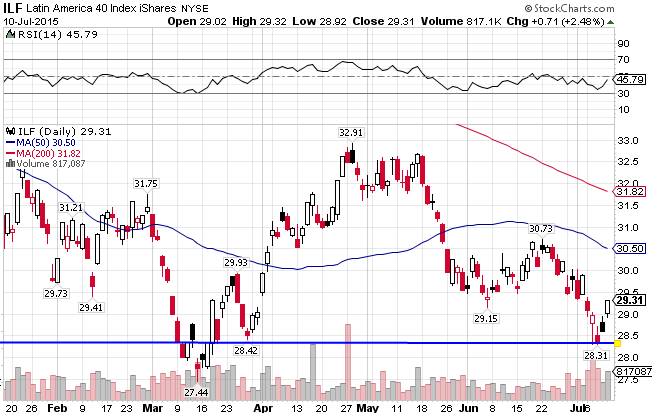

The Latin American market ((ILF)) broke down in May after an impressive recovery from its March lows. It broke through its 50-day and now finds itself right above support at the 28.50 level. It has moved concurrently with the crashing commodities market and is still struggling to hold any support. The index has recorded a loss of 6.88% this year.

Africa’s market ((AFK)) has managed to grind higher for most of 2014. But continued upheaval in Northern Africa, coupled with a weak global economy, has finally dampened Africa’s run. It is down 10.45% for 2015 after a tough last month.

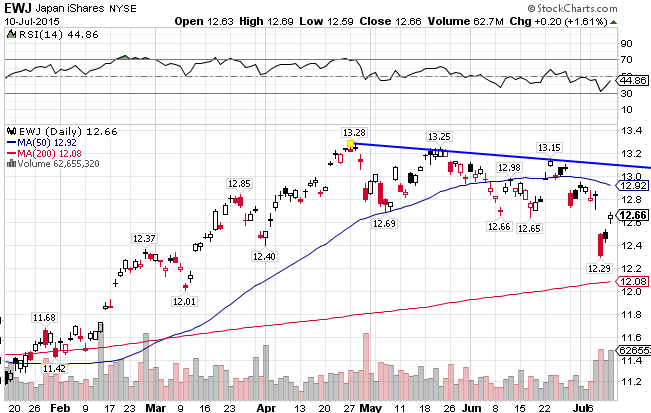

Japan ((EWJ)) is holding onto gains after the BOJ unexpectedly eased monetary policy in the beginning of the year. Japan is up 13.20% YTD, the second best performing market.

Stay In Touch