A recent poll conducted by Harris and the UK news outlet The Guardian, produced some interesting results. Of those polled:

- 56% believe the US economy is in recession

- 49% believe the S&P 500 is down for the year

- 49% believe the unemployment rate is at a 50-year high

- 72% think inflation is increasing

The reporting on this has been mostly political because the poll also found that 58% blame the Biden administration for the current state of the economy. I think that goes with the territory in politics; if you’re the one in charge, you get the blame when things go wrong and the credit when things go right. I would also say that at any given time, there are policies from both parties affecting the economy. Are Trump’s tax changes still affecting the economy? (Of course they are.) Are Biden’s tariffs significantly different than Trump’s? (Only in that Biden may have imposed even more.) Has healthcare been a mess under both parties? (Yes.) Was it Biden or Trump’s excessive spending that caused the increase in inflation? (The only thing the two parties agree on is that they know how to spend our money better than we do.) What makes this poll interesting is that so many of the respondents appear to be experiencing a reality that is detached from…um….reality. Why? I don’t know but if perception becomes reality, the economy is in big trouble.

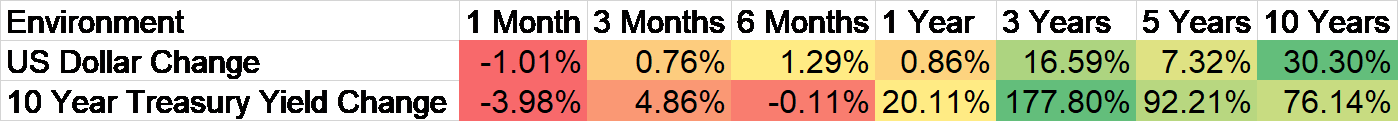

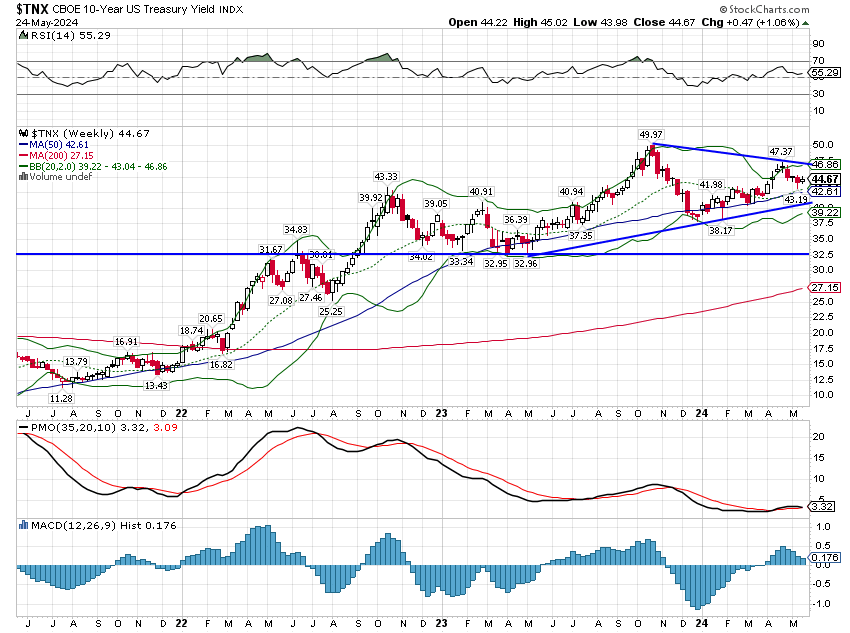

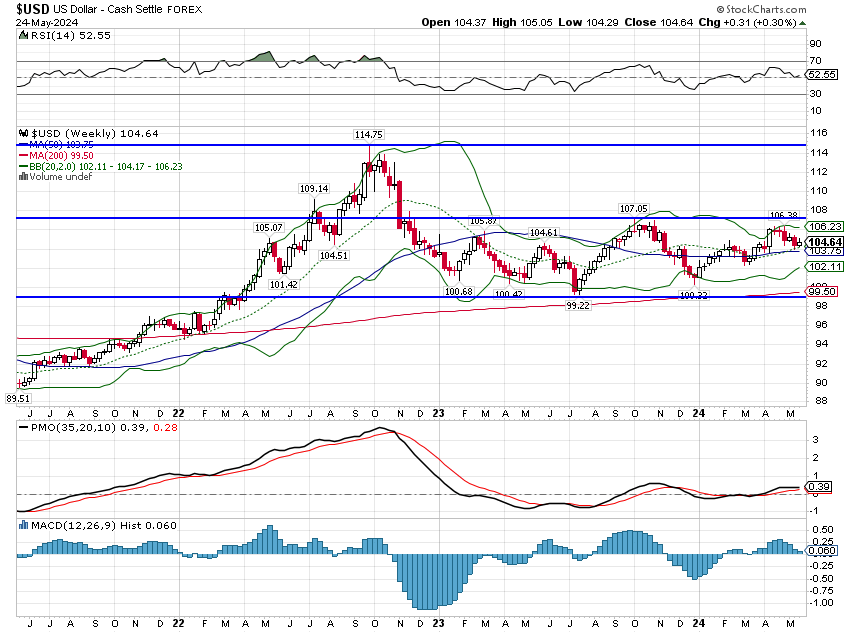

For investors, the state of the economy is obviously important but for most, a general sense of the state of things is sufficient. It doesn’t matter a lot whether the economy is growing at 2% or 1.5% or 2.5%; what matters is that it is growing and not shrinking. In fact, what really matters for investors is not the economy itself but how markets react to it. You can get a really good sense of the global economy by observing the trend in the 10-year Treasury rate, the 10-year TIPS rate, and the US dollar. The first two tell you about real growth and inflation in the US and the third, the dollar, tells you how the US is doing relative to the rest of the world. That covers a lot of ground with just three indicators you can check in a few minutes every day.

At any given time there will parts of the economy that are contracting while others are expanding, some parts growing rapidly, others growing slowly, some getting smaller while others are getting larger. Some of these things are driven by government policy and some of them are just natural cycles, short and long term. If you spend all your economic analysis time concentrating on the parts of the economy that are performing poorly, your view of the entire economy is likely to be skewed negative. And if you only look at the positive parts, your view will be skewed positive. There really is such a thing as too much information when it comes to the economy. So concentrate on the big picture and market-based indicators as much as you can. And realize that recessions are only obvious in retrospect. The 2008 recession was one of the worst we’ve ever had but it wasn’t obvious until at least the 3rd quarter of 2008, even though it was later officially dated to late 2007 when it really wasn’t obvious at all.

Initial jobless claims were basically unchanged from a year earlier in November of 2007 when the recession officially started. The ISM manufacturing index was a benign 49.2 in August of 2008, nine months after the start of the recession. The 10-year Treasury traded at a yield of 4.11% in October of 2008 and closed the month at 3.97% which was essentially unchanged for the year to date. The dollar was mostly unchanged in August of 2008 from November of 2007.

But there were signs that recession was on the way. T-bill rates and the 2-year Treasury yield were falling rapidly with the 2-year yield down 200 basis points from July 2007 to July 2008. Jobless claims, which were 300k in September of 2007 had risen to over 400k by July of 2008. Auto sales were around 16 million in November of 2007 but fell every month in 2008, hitting 12.7 million in July. Credit spreads were 2.5% in the summer of 2007 but rose over 500 basis points by March of 2008 (200 is our warning sign for recession). The 3-month average of the CFNAI (Chicago Fed National Activity Index) hit -0.77 in December of 2007, falling below the -0.75 associated with recession.

So, yes, there were some signs of recession in 2008 but most of the deterioration took place after October when Lehman failed. Prior to that, it was easy to convince yourself that a soft landing was on the way. There were numerous articles to that effect even into the summer of 2008. And since that’s where we are right now – in the soft landing zone – I don’t think we should just dismiss a poll that shows half of Americans think we’re in recession now as purely political. Assuming they are answering based on their political wants, they could end up being right for all the wrong reasons.

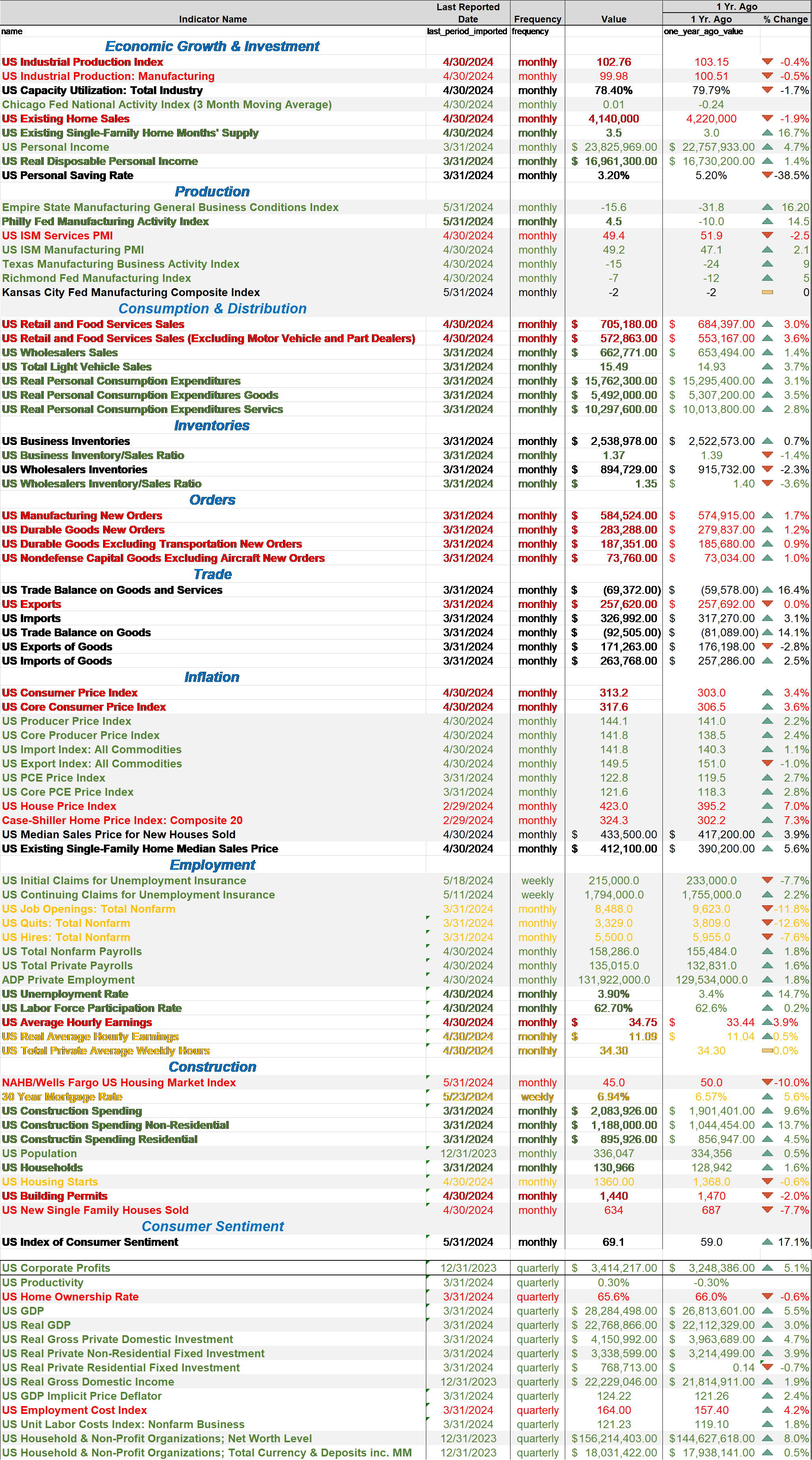

My view of the economy at present is that it is still growing at trend (around 2%), which is down quite a bit from 3rd (4.9%) and 4th quarter (3.2%) last year but only slightly for the whole of 2023 (2.5%). From a more granular view, there are some areas of concern, some of which are structural (Industrial Production) and some that are interest rate related (housing). Here’s a snapshot of economic data with the year-over-year change:

Reports I deem negative are in red, neutral are yellow, and positive are green. As you can see there are a fair number of negatives but more positives on the whole. The negatives that stand out are related to inflation and their perception of it. The housing data in particular is painful with home prices up 7% in the last year, the home ownership rate down, the inventory of homes for sale at just 3.5 months of sales, and the housing market index back below 50. The state of the housing market is something that touches every family and every generation. I would also point to real disposable personal income (after tax, adjusted for inflation) which is up 1.4% YoY, but that is only about half the average since 1980. Economic data is in aggregate too so there are some people, probably a lot of people, who are doing worse than the averages. Lastly, for the poll question on inflation, my guess is that most people don’t understand the distinction between a level and rate. Prices are still going up so someone has to get the blame.

For our purposes as investors, there are no signs of recession right now.

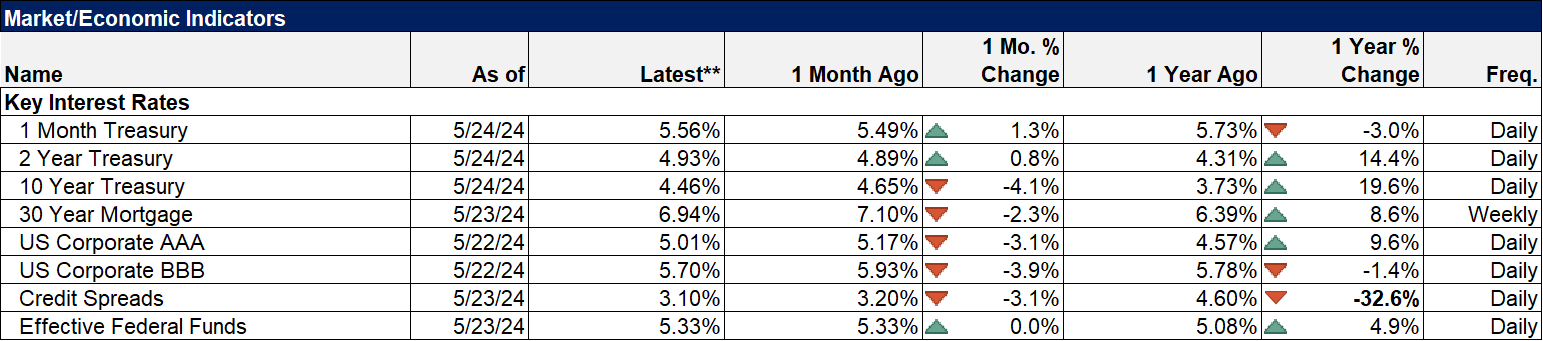

- The 10-year yield is up over the last year and flat over the last six months

- The 2-year Treasury yield has been trading sideways since late 2022 and is only down 30 basis points from its October 2023 peak

- Credit spreads are just over 3% and within 10 basis points of the low for this cycle

- Initial jobless claims are 215k, up from 195k at Christmas of 2021

- The unemployment rate is 3.9%, up from 3.4% in April 2023. In 2008, the unemployment rate rose from 4.4% in May 2007 to 6.5% by October of 2008

- The 3-month average of the CFNAI is 0.01; a reading of 0.00 is the economy is growing at trend

- The CPI YoY rate of inflation is down from 9% in June of 2022 to 3.4% last month. That brings it into the comfort zone for investors; the best returns happen with inflation between 2 and 4%.

- Corporate profits were up 5% YoY at the end of 2023 and Q1 2024 looks to be better

The economy is, probably, not in recession right now. I say probably only because economic data is subject to revision and the start date of the next recession will be determined well after the fact. The dating committee could date the start of the recession to now if things deteriorate rapidly from here. The S&P 500 is not down for the year, obviously, the unemployment rate is nearer a 50-year low than a 50-year high and the inflation rate is moderating even if prices are not falling. Are the people who took that poll that badly informed? Are they answering based on their political leanings? Are they answering based on their emotional feeling about the economy? I don’t know but this poll makes me nervous because a lot of economics is driven by the emotional state of the people who make up an economy. If this is any indication of the actual conditions these people are experiencing, there is the potential for the economy to deteriorate rapidly. I know a lot of economic and market watchers are hoping for lower interest rates right now but this may be one of those times when you need to be very careful about what you wish for.

Environment

The trends for rates and the dollar haven’t changed but as I’ve been saying for over a year, both appear to be peaking.

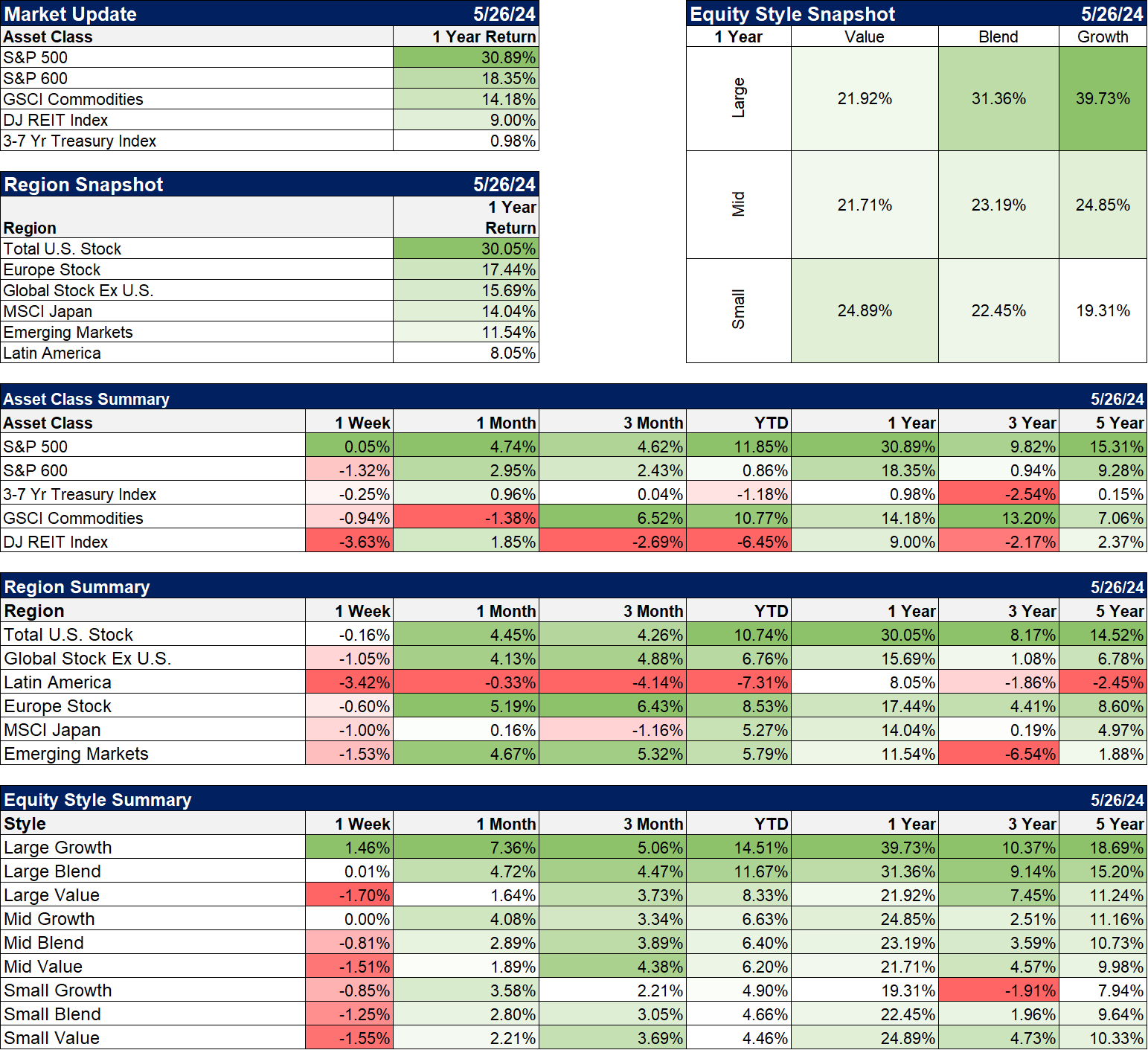

Markets

The S&P 500 managed to eke out a gain last week but most everything else was down, primarily due to interest rate fears. REITs were hit particularly hard again, down 3.6% on the week and now 6.5% YTD. They are up 9% YoY, however, which is consistent with what we’ve seen in the past when rates peak. If history is a guide, REITs will have a big run up when rates get into a short-term downtrend. Since the early 70s, when the industry emerged, REIT returns when the 6-month change in the 10-year Treasury yield is negative are double the return when rates are rising. The 6-month change in the 10-year rates has been negative for a couple of months now.

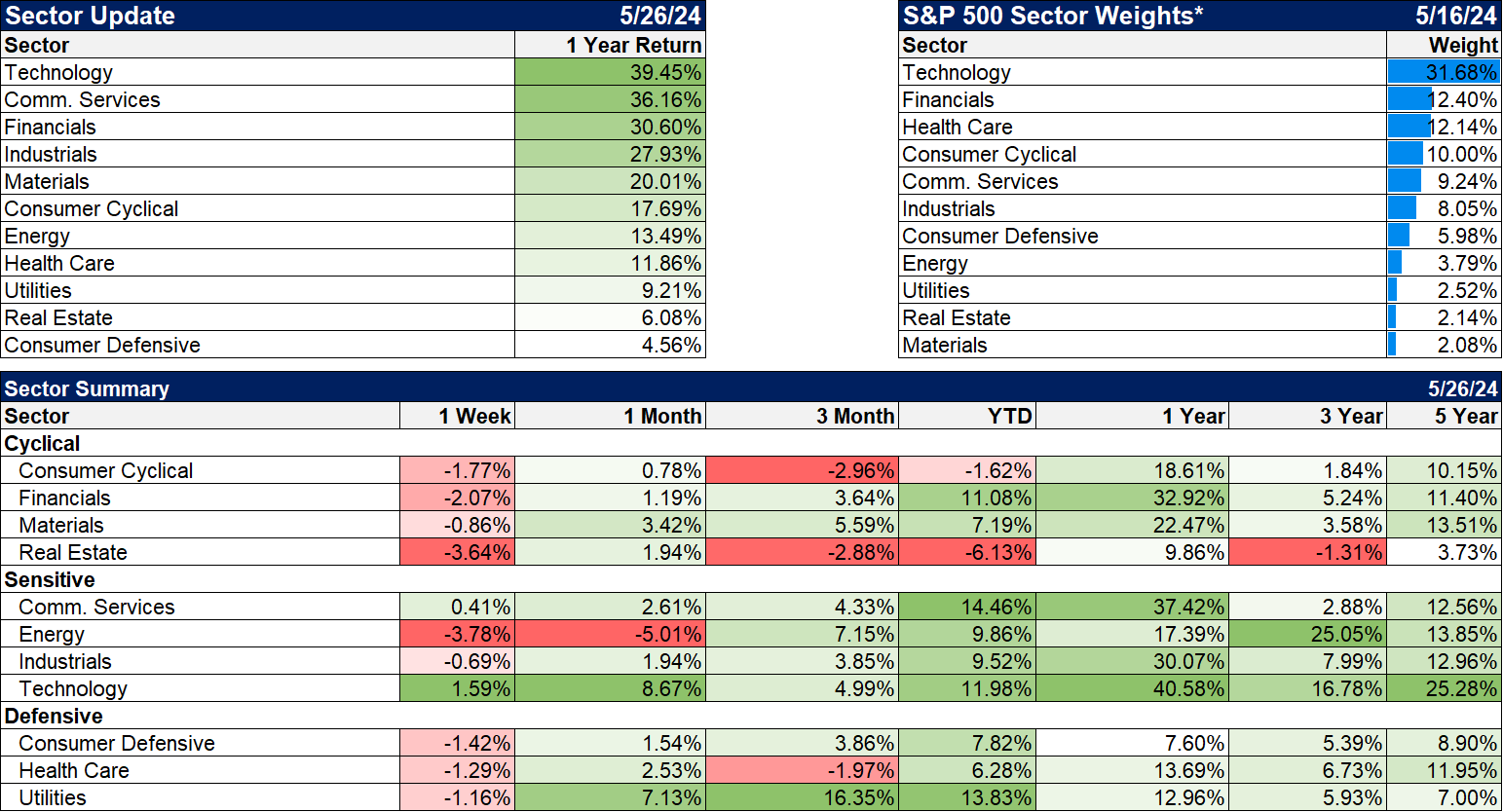

Sectors

Energy was down even more than REITs last week although the YTD and 1-year returns are very respectable.

Market/Economic Indicators

This week’s economic calendar:

Tuesday – Case Shiller Home prices

Wednesday – Richmond Fed Mfg. Index

Thursday – Q1 GDP first revision, Jobless claims, Pending home sales

Friday – Personal income and spending, PCE price index (Fed’s preferred measure of inflation)

Stay In Touch