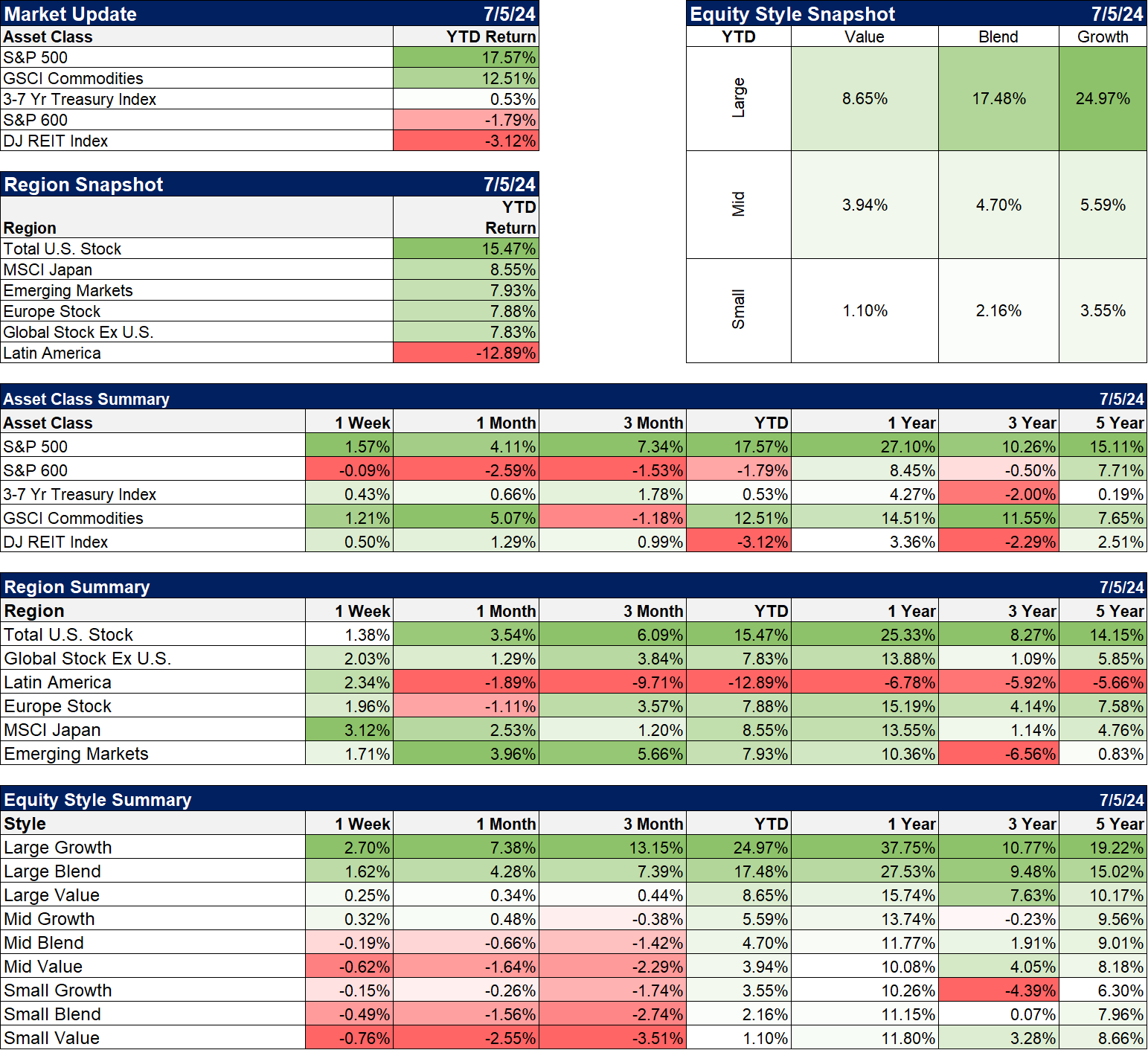

The economic data wasn’t particularly shocking or weak but it seemed as if last week may have marked a change in the economic outlook. The 10-year Treasury note yield only fell 7 basis points on the week but that only tells part of the story. Rates rose strongly on Monday, up 15 basis points at the high of the day. There was little economic news and what there was shouldn’t have moved the market that much. The S&P Global US composite PMI was a little less than expected but above 50 at 51.6 while the ISM manufacturing PMI was slightly less than expected at 48.5. In addition, the prices component, which has on several occasions produced negative bond market reactions, was down more than expected. New orders were up but were about as expected at 49.3 and still less than 50. Construction spending, which has been an economic bright spot for at least the last year, was reported down for May by 0.1%, the first negative reading since October of 2022. Construction spending on manufacturing facilities was up on the month by 1.3% but that wasn’t enough to offset weakness elsewhere. That doesn’t sound like the ingredients for a bond selloff to me.

In contrast, the data for the rest of the week was also mixed but the market seemed to seize on the weak parts. Tuesday brought the JOLTs report, which showed a rise in job openings and a steady quits rate, although the change from April was minimal. Wednesday’s reports were contradictory but, again, the market seemed to focus on the negative. Jobless claims rose but only by 4k, about as expected and still well below anything associated with recession. The trade reports showed a small drop in exports and imports but nothing dramatic. The contradiction came later in the morning with the S&P Global US Services PMI and the ISM Services PMI. The former was better than expected and at a high level (55.3) while the latter was less than expected and, at 48.8, consistent with recession according to ISM. I think there are some caveats to the ISM report though.

The survey is basically a measure of sentiment and is largely anecdotal. Respondents to this month’s survey reported that, in general, business was flat to lower with inflation easing. Flat to lower activity in services should not be shocking in the least given how fast it has been growing in the post-COVID recovery phase. Indeed, it has been surging services consumption that has kept us out of recession as the goods side of the economy has moderated over the last 18 months to work off excess COVID inventory. It would be perfectly normal in the context of the ongoing normalization of the economy to see services slow some as the goods side picks up again (which is tentatively happening already). But, for whatever reason, the market ignored the positive S&P report and focused on the negative ISM report.

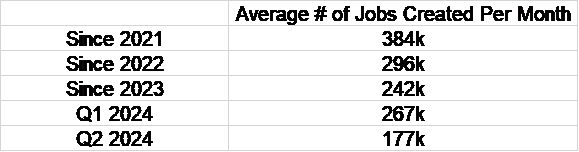

Friday, the employment report was released and while the headline number was a little better than expected, there were other parts of the report that weren’t. Of the 206,000 new jobs reported, 70,000 of them were government, which is above the monthly average since 2021 (39k) and since 2023 (55k). The private sector only added 136,000 jobs in June, which is below the monthly average rise in the labor force (roughly 170k/month). The unemployment rate is calculated from a different survey but the result is what you would expect, a rise as the number of jobs created doesn’t keep up with the labor force and the participation rate. There were also negative revisions to the April and May data, 111,000 fewer jobs created than previously thought. In a strong labor market, revisions tend to be positive. Average hourly earnings were up 0.3% month-to-month and 3.9% year-over-year, which eased inflation concerns somewhat while keeping real wages (adjusted for inflation) rising.

Overall, the employment report was not particularly bad but the trend is negative, especially over the last quarter:

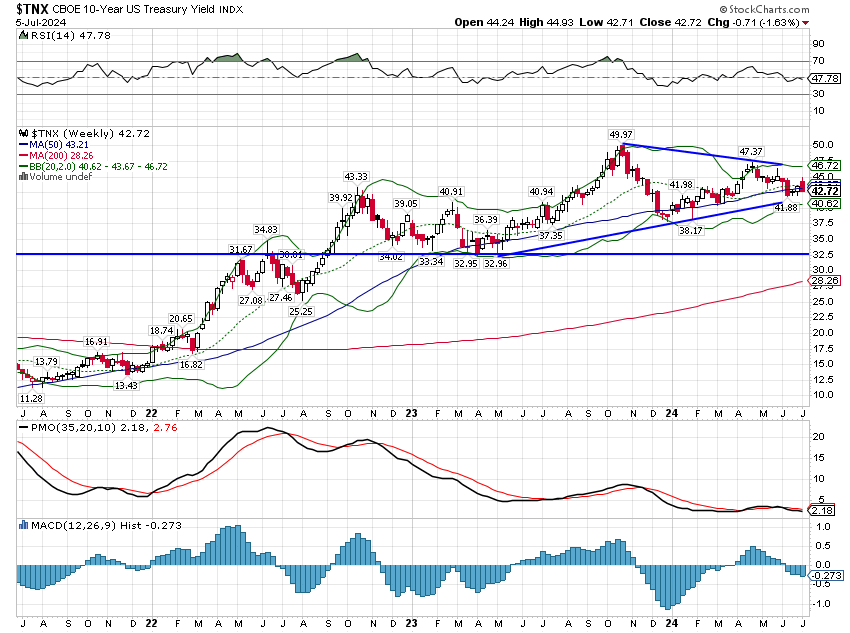

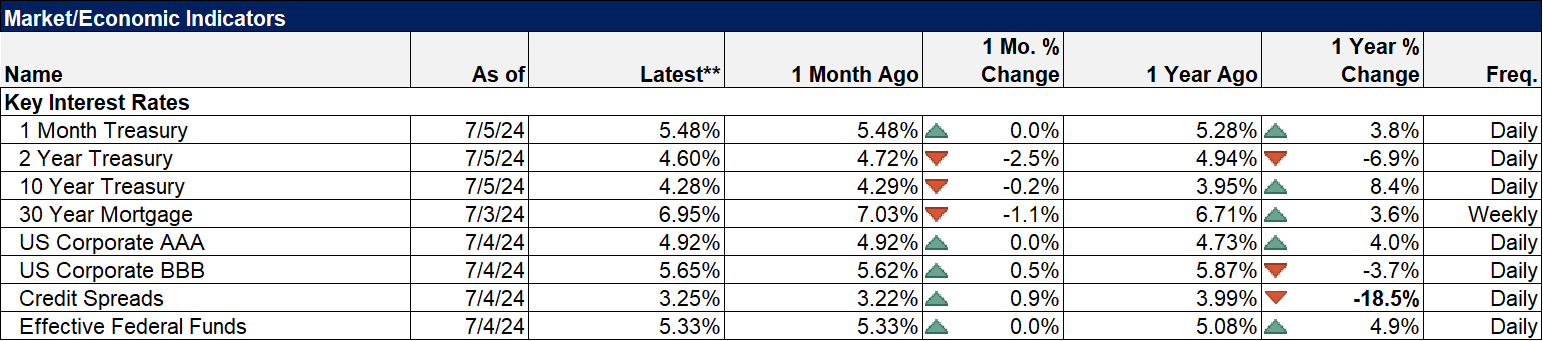

The market’s reaction, a 22 basis point drop in the 10-year yield from the weekly peak and a drop of 16 basis points in the 2-year yield for the week, was a classic reaction to a slowing economy. There are other indications that Q2 growth is looking a lot like Q1 (+1.4%) and not much like last year when growth accelerated through Q3 before slowing slightly in Q4. The Atlanta Fed’s GDPNow estimate for Q2 is currently at 1.5%:

Of course, we don’t have all the data for Q2 yet so this will get more accurate over the next month but directionally it reflects the weakening of the data over the last month.

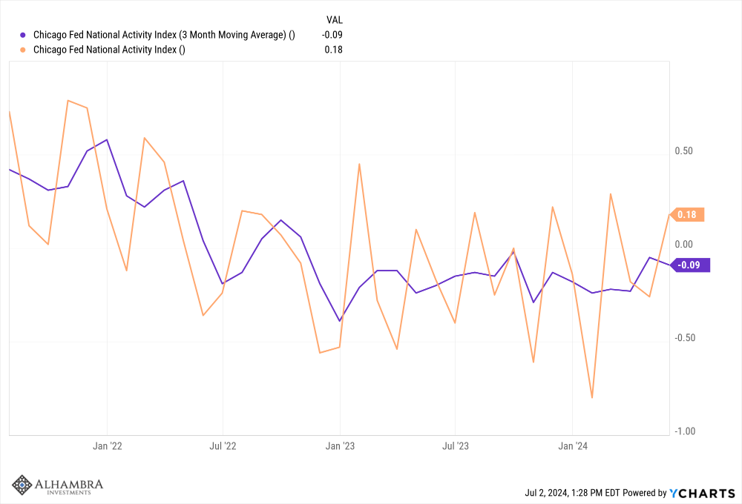

The Chicago Fed National Activity Index is also showing current growth as slightly below trend (around 2.1%):

The 3-month average is just below zero which indicates trend growth. A reading below -0.70 is associated with recession.

This is, of course, what the Fed has been trying to induce with its rate hikes. Nominal GDP growth (real growth + inflation) has averaged 4.5% a year since 2000 while the current year over year change is 5.4%. For inflation to get back down to the Fed’s target, NGDP growth probably needs to fall back to that level. What the Fed wants from that is 2% inflation and 2.5% real growth but their interest rate tool is very crude and can only impact the nominal variable. If they knock NGDP growth down to 4.5%, the change could all come from inflation or all from real growth or, more likely, some combination. In this latest slowdown, the nominal 10-year yield has fallen 46 basis points since peaking in late April while the 10-year inflation breakeven is only down 13 basis points. That would seem to indicate the market fears that the slowdown will take more out of real growth than inflation. So, the Fed may get NGDP growth down to 4.5% and find the breakdown is 2.5% inflation and 2% real growth. That would be unfortunate but not a disaster by any stretch of the imagination. The average year-over-year change in the CPI from 1990 to the end of 2019 (pre-COVID), was 2.46%. If you measure the period after 2008 and before COVID, the average was 2.2%.

Real growth fluctuates considerably during a normal cycle and most of it is just the ebb and flow of a – mostly – free market economy. The Fed has some impact but I think most of what goes on is just the same ups and down you’d expect from any natural process. This post-COVID cycle has been far from normal in some ways because of the government response to the pandemic. But the government action just amplified the natural process of returning to some form of equilibrium in this post-COVID world. How much the Fed had to do with it is impossible to quantify and while the economy has slowed after their rate hikes, it is probably a good time to remember that correlation is not – necessarily – causation.

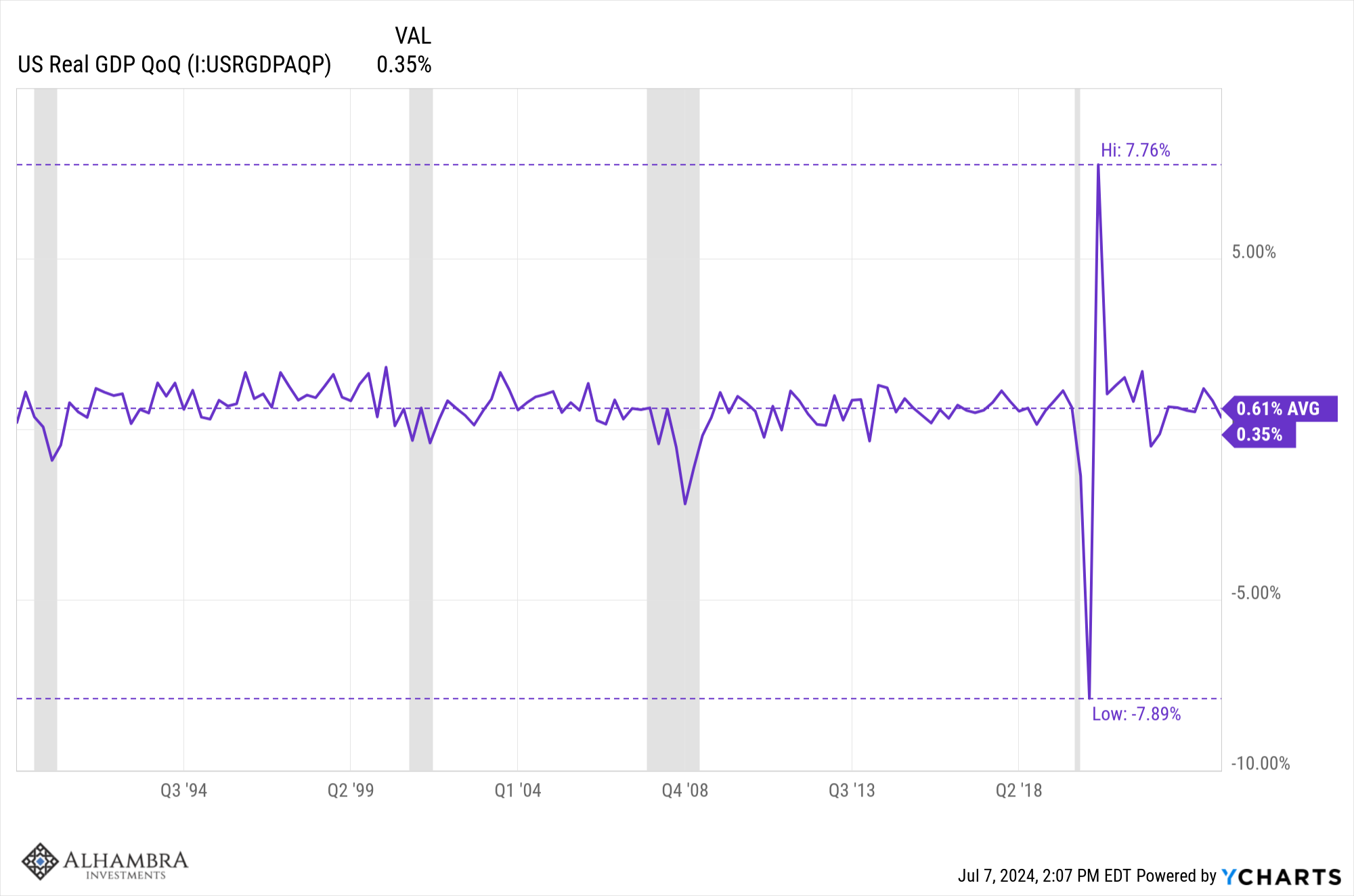

Quarter-to-quarter change in Real GDP

As you can see, last quarter’s change in GDP was below the average since 1990. You should also be able to see that this does not mean we are headed for recession. There are – obviously – regular readings below average during an economic cycle. There are even readings below zero (quarters when the economy contracted) that don’t add up to enough to call it a recession. And while the move in markets last week represented a markdown in the market’s growth expectations, we’ve seen that before in this cycle only for the economic bears to be disappointed.

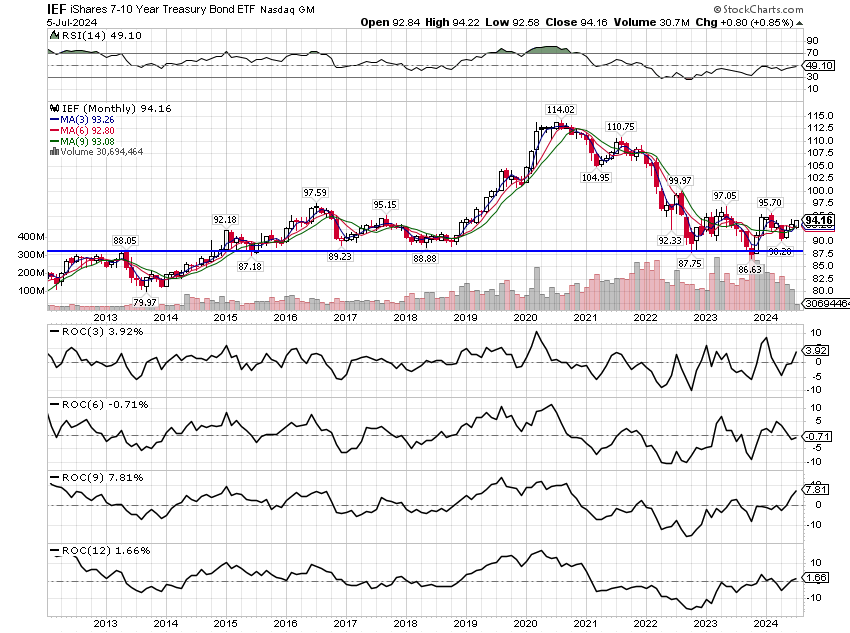

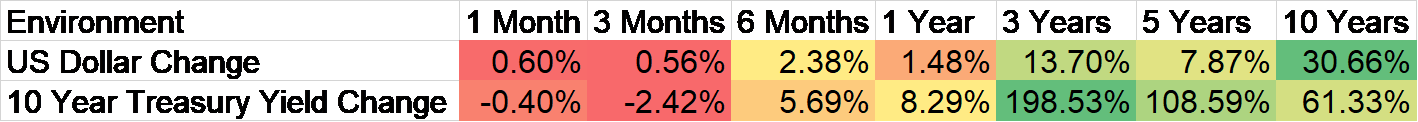

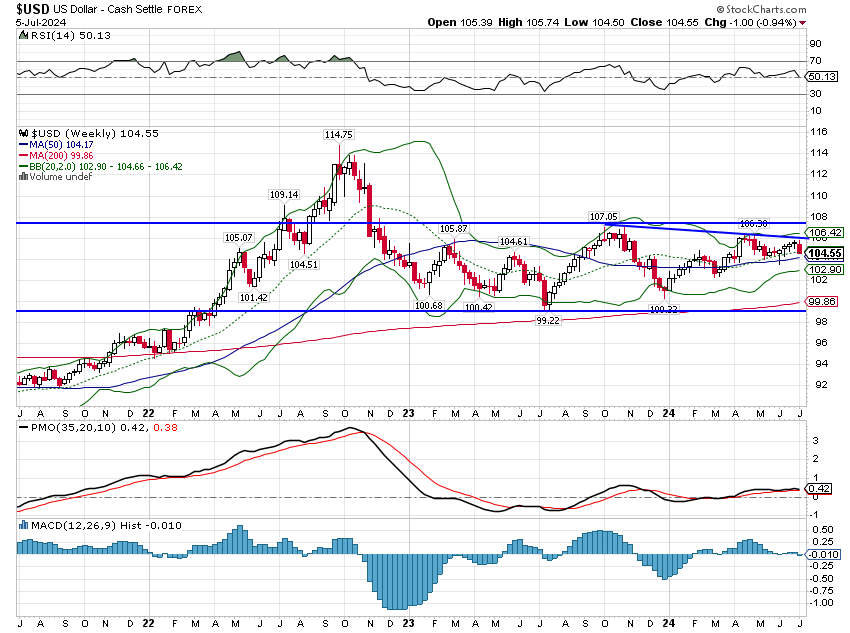

I don’t know if this will turn into more of a slowdown but the 10-year yield is now in a short term – very short term – downtrend as is the dollar. Both of them are, however, still in the trading range they’ve been in for over 20 months. That’s a two year topping process that sure looks like the beginning of a larger decline in both. Or if you prefer, it looks a lot like a two-year bottoming process for bonds:

If the slowdown persists, if we get more weak economic data, it may be time to start thinking about investing in a new economic environment. The assets that perform well when rates and the dollar are falling are a lot different than the ones that perform well when rates and the dollar rising. The most obvious change would be to extend the duration of your bond portfolio. If rates fall more from here, longer term bonds will outperform shorter term; TIPS might also be an option. Another obvious change would be to add more non-US stocks to your portfolio; you’ll have a currency tailwind.

One decision that is going to be difficult is value vs growth. Historically, growth stocks and technology stocks have performed well in a falling rate/falling dollar environment but in this case they’ve already bucked historical precedent. Growth and technology normally don’t do well in a rising rate, strong dollar scenario but they have this time to the point we’re at least thinking about whether AI stocks are in a bubble. There may be a similar difficulty in commodities and gold, both of which have performed contrary to the historical norm lately. They are, however, more sensitive to changes in rates and the dollar so their recent performance may have been in anticipation of the new environment.

The economy is slowing as it needed to to get inflation down. Every recession starts with a slowing economy that just keeps slowing until it contracts. (That’s also a normal process and probably shouldn’t be short circuited by government action but that’s a conversation for another commentary.) But every slowdown doesn’t turn into a recession and this one has barely begun. It isn’t time yet for big portfolio moves. But it is a time to pay close attention and make sure you have a plan if conditions worsen – or if they don’t.

Environment

The dollar and 10 year rate are in short term downtrends but the longer term trends haven’t changed.

Markets

Markets last week gave us a sneak peek of what a falling rate/falling dollar environment looks like. Commodities and gold both outperformed as did non-US stocks. Bonds also had a good week and the longer the duration the better the performance.

Growth continued to lead value last week, which is also consistent with history for a falling rate/falling dollar environment. Whether it continues will likely depend on whether AI lives up to the hype or not.

REITs were up last week but not as much as one might expect with falling rates. REITs do perform well when rates are falling but they don’t do well in recession so if rates keep falling they will probably do best if it isn’t too swift.

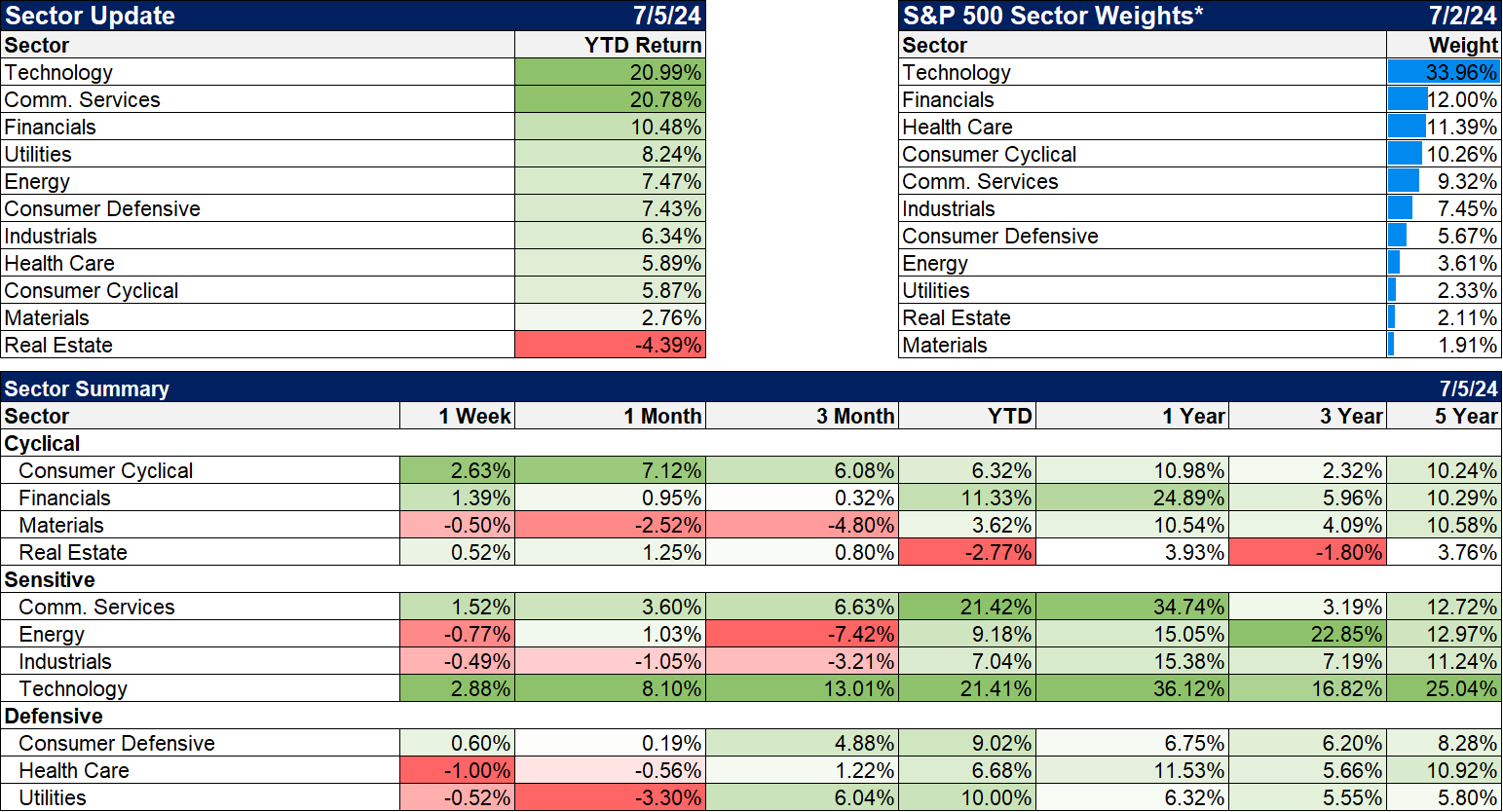

Sectors

Markets don’t always act as we think they should. Last week with the market concerned about growth, cyclical stocks were up and defensive stocks were down. Nothing seems to dent the enthusiasm for tech stocks though, up nearly 3% on the week.

Market/Economic Indicators

The 2-year Treasury note yield is now down over the last year. All that really says is that we’re getting closer to the first Fed rate cut. I don’t think it will come this month but September is looking more likely with the probability based on Fed Funds futures up to 71%. Chances for another cut in December have risen but are still less than a coin flip.

Stay In Touch