Overall, the economy continues to grow at a solid pace. But the inflation and labor market data show an evolving situation. The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate.

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

– Jerome Powell, Jackson Hole Conference, August 2024

Jerome Powell declared victory over inflation last week but in his speech, it’s clear that he doesn’t think the Fed had much to do with causing the inflation or relieving it. In his short speech, Powell blames the inflation flare up mostly on things that have nothing to do with monetary policy:

Supply chains were snarled by a combination of lost workers, disrupted international trade linkages, and tectonic shifts in the composition and level of demand…

Where did that “level of demand come from”? Not the Fed:

Congress delivered substantial additional fiscal support in late 2020 and again in early 2021. Spending recovered strongly in the first half of 2021. The ongoing pandemic shaped the pattern of the recovery. Lingering concerns over COVID weighed on spending on in-person services. But pent-up demand, stimulative policies, pandemic changes in work and leisure practices, and the additional savings associated with constrained services spending all contributed to a historic surge in consumer spending on goods.

The Fed at the time thought that because the inflation was caused by increased demand and constrained supply – neither of which had anything to do with monetary policy – it would be “transitory” and wouldn’t require a change in monetary policy. Why they thought 0% interest rates in that environment were ideal Powell doesn’t say but that is apparently what they thought:

My colleagues and I judged at the outset that these pandemic-related factors would not be persistent and, thus, that the sudden rise in inflation was likely to pass through fairly quickly without the need for a monetary policy response.

He takes pains to point out that inflation was a global phenomenon and so, again, it wasn’t their fault:

High rates of inflation were a global phenomenon, reflecting common experiences: rapid increases in the demand for goods, strained supply chains, tight labor markets, and sharp hikes in commodity prices.

He praises himself and his colleagues for being so brave:

The FOMC did not flinch from carrying out our responsibilities, and our actions forcefully demonstrated our commitment to restoring price stability. We raised our policy rate by 425 basis points in 2022 and another 100 basis points in 2023. We have held our policy rate at its current restrictive level since July 2023.

Somebody get these guys a Medal of Freedom for goodness sakes. The Fed bravely raised interest rates and the inflation rate came down. This would be a good time to remember that correlation is not causation.

The summer of 2022 proved to be the peak of inflation. The 4-1/2 percentage point decline in inflation from its peak two years ago has occurred in a context of low unemployment—a welcome and historically unusual result.

The Fed started hiking the Fed Funds rate in March of 2022 all the way from 0-0.25% to 0.25% – 0.50%. The inflation rate magically peaked just 3 months later in June of 2022. Man, that monetary policy is some powerful stuff.

Or maybe there were some other things going on that played a role in reducing inflation:

Pandemic-related distortions to supply and demand, as well as severe shocks to energy and commodity markets, were important drivers of high inflation, and their reversal has been a key part of the story of its decline. The unwinding of these factors took much longer than expected but ultimately played a large role in the subsequent disinflation.

What role did the Fed play?

Our restrictive monetary policy contributed to a moderation in aggregate demand, which combined with improvements in aggregate supply to reduce inflationary pressures while allowing growth to continue at a healthy pace.

Moderation in aggregate demand is Fedspeak for soft landing which is only possible, according to Powell, because the Fed kept inflation expectations anchored:

Disinflation while preserving labor market strength is only possible with anchored inflation expectations, which reflect the public’s confidence that the central bank will bring about 2 percent inflation over time. That confidence has been built over decades and reinforced by our actions.

So the most important impact of the Fed’s rate hiking campaign was to keep inflation expectations under control? When inflation expectations aren’t correlated – at all – with future inflation? Yeah, that sounds about right.

I didn’t watch Powell’s speech at Jackson Hole. I don’t usually watch his press conferences after FOMC meetings either. It isn’t personal; I have nothing against Jerome Powell. As I’ve gotten older though, I’ve come to realize that what the Fed is doing or saying or not doing or not saying doesn’t really have any lasting impact. The Fed is a follower, always behind the market. The Fed started hiking rates in March of 2022 but the market started hiking rates a full year earlier. The 2-year Treasury note yield rose from a low of 0.105% in February of 2021 to 2.28% by the time the Fed got around to raising the – irrelevant – Fed Funds rate. Was the Fed late? What difference does it make? I guess the Fed does have more control over very short term rates but even the 3-month T-bill rate rose before the Fed hiked.

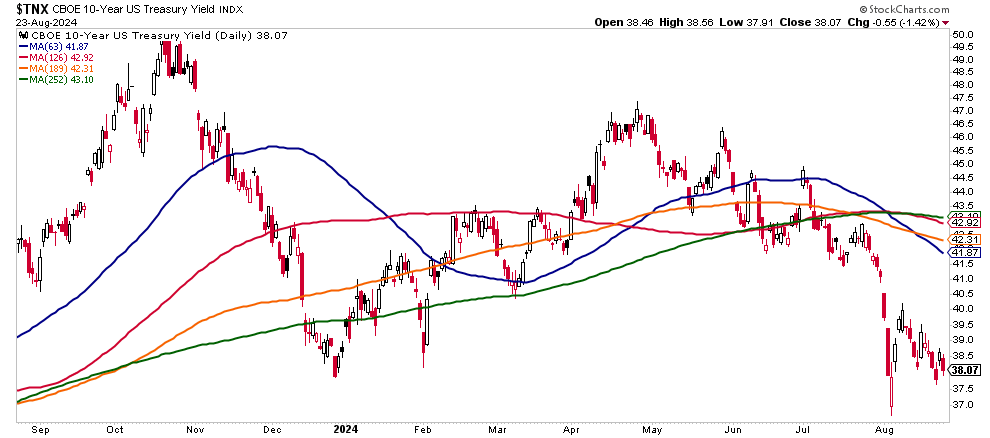

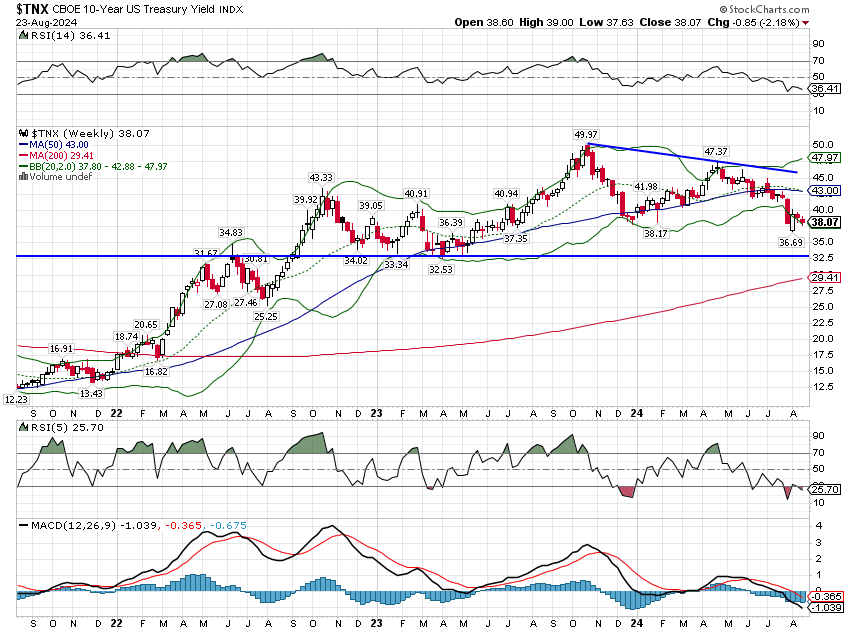

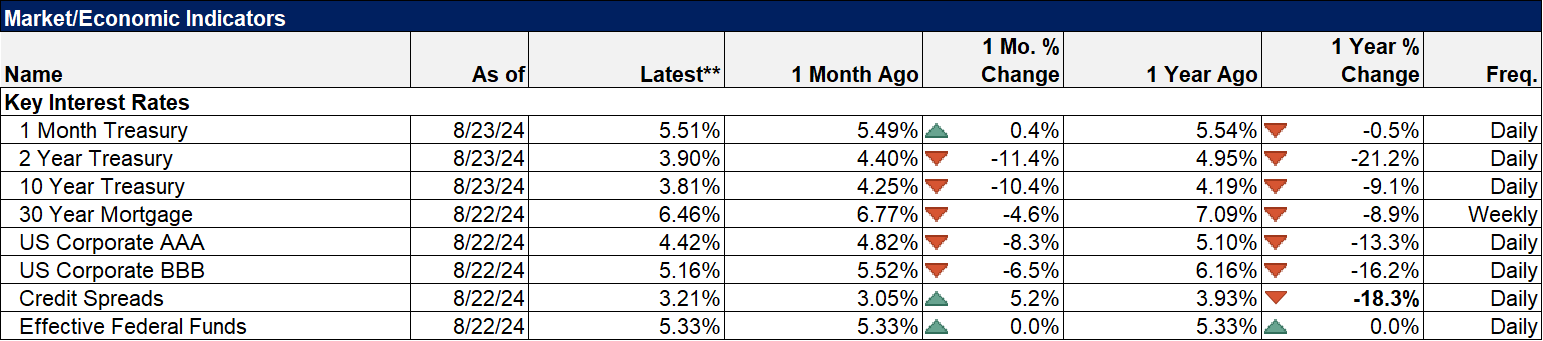

And now that the Fed has finally decided to cut rates, they are merely following the market again. The 2-year note yield peaked in early October last year at 5.26% and closed last week at 3.92%. The 3-month T-bill rate also peaked last October at 5.35% and today is at 5.0%. The market has already taken the action the Fed promised might come next month. Gee thanks, Jerome.

I wouldn’t say that the Fed is completely irrelevant but it certainly gets more attention than it warrants. There’s a lot going on in the world and the level of short-term interest rates just isn’t that powerful a tool. The transmission mechanism isn’t nearly as direct as it once was when lending into the economy was primarily a function carried out by banks. That started to change way back in the 80s with the emergence of the junk bond market and in the post financial crisis world, almost all the risky lending in the economy has migrated to private credit channels. The banks participate in that market through partnerships with private funds but the funding is mostly independent of the banking system. Changing the Fed Funds rate – the overnight rate for lending reserves between banks – doesn’t have much impact.

Did higher interest rates impact the economy over the last couple of years? The biggest impact, by far in my opinion, has been on housing market activity but I think it is noteworthy that prices have continued to rise. Did the Fed’s rate hikes reduce the demand for housing? Maybe but they also affected supply (mortgage lock in effect) so if the goal was to stop prices from rising, it appears to be a bust. There are some negative effects on the economy from reduced housing activity primarily in durable goods orders. But real personal consumption of durable goods (inflation-adjusted) are up 2.9% over the last year so it isn’t much of an impact. Think about what might happen to those orders if mortgage rates continue to fall and housing market activity picks up.

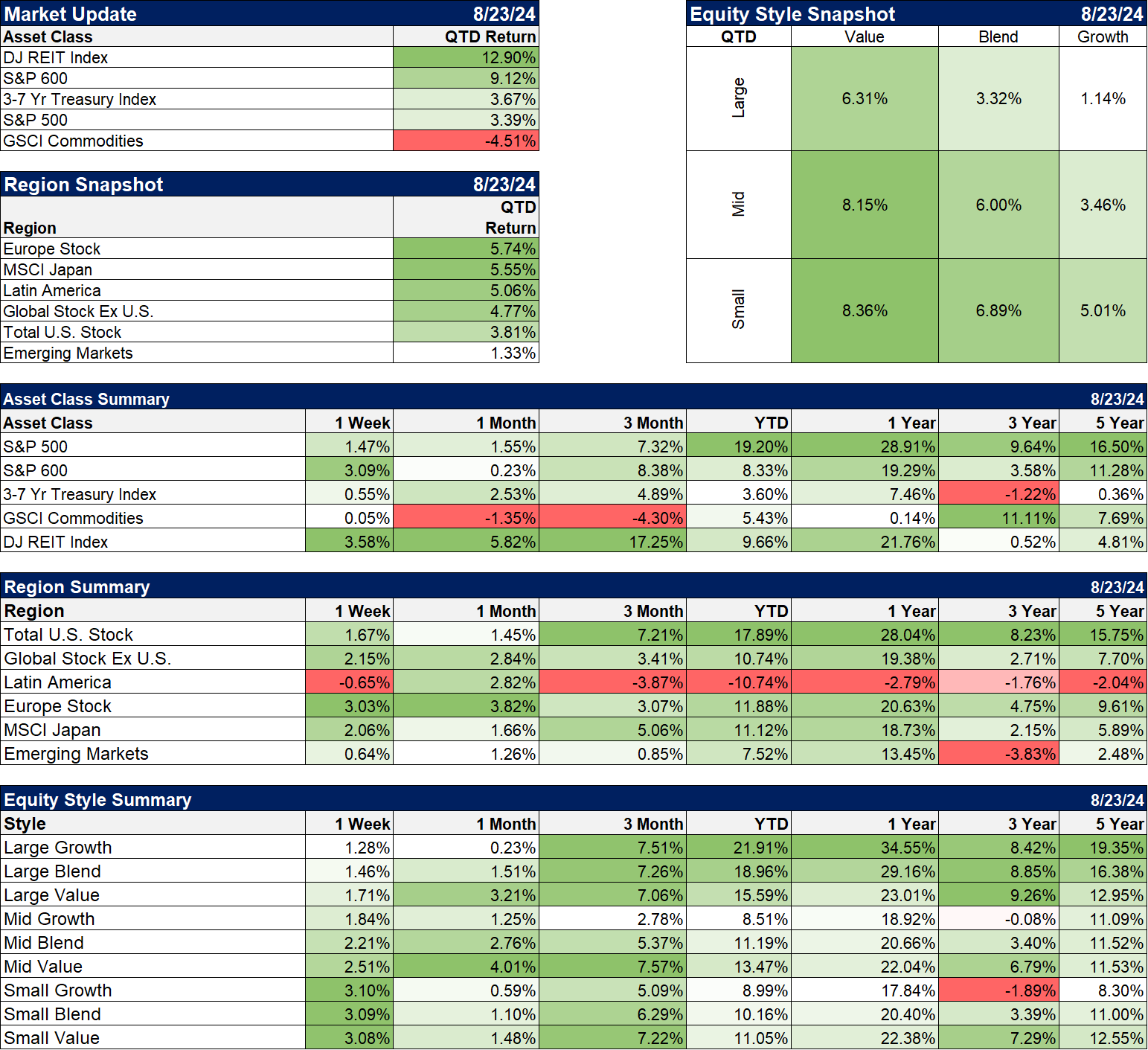

What’s important for investors isn’t what the Fed may or may not do. The movement of the markets is much more timely and impactful than anything the Fed does. Right now the market is saying that the US economy is slowing some, not just outright but also relative to the rest of the world. You can see that in the movement of market determined interest rates and the dollar, both of which are in short-term downtrends. Will that stop before we get to recession? I have no idea. Neither does Jerome Powell or anyone else. My guess is yes and I have my reasons but it’s just a guess and I’m sure you have one too. For some, that guess is a function of their own experience, for some it is a function of their political beliefs and for some, to paraphrase Keynes, it is a function of their devotion to some defunct economist (maybe even Keynes). Your beliefs and $2.95 will get you a tall latte at Starbucks but not much else. I have no idea what the coffee will cost next year but I doubt it will have much to do with the Fed Funds rate.

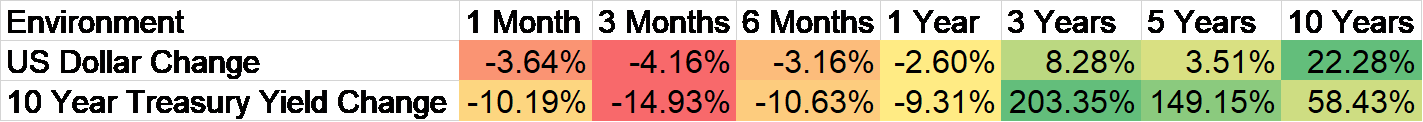

Environment

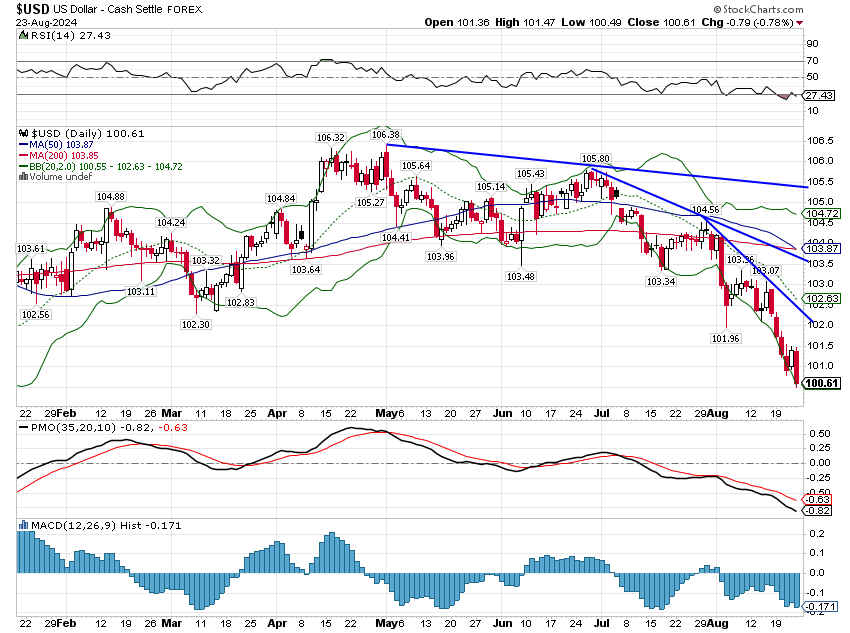

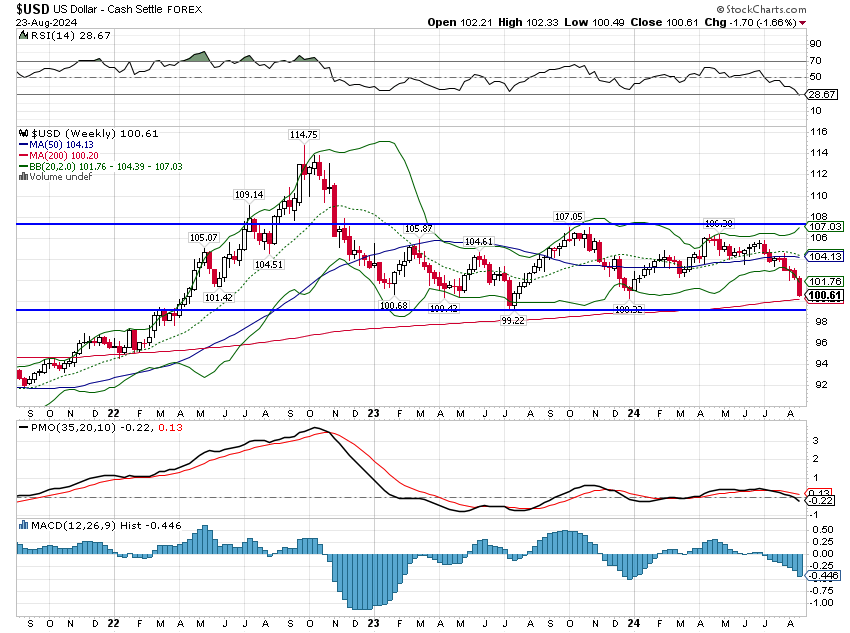

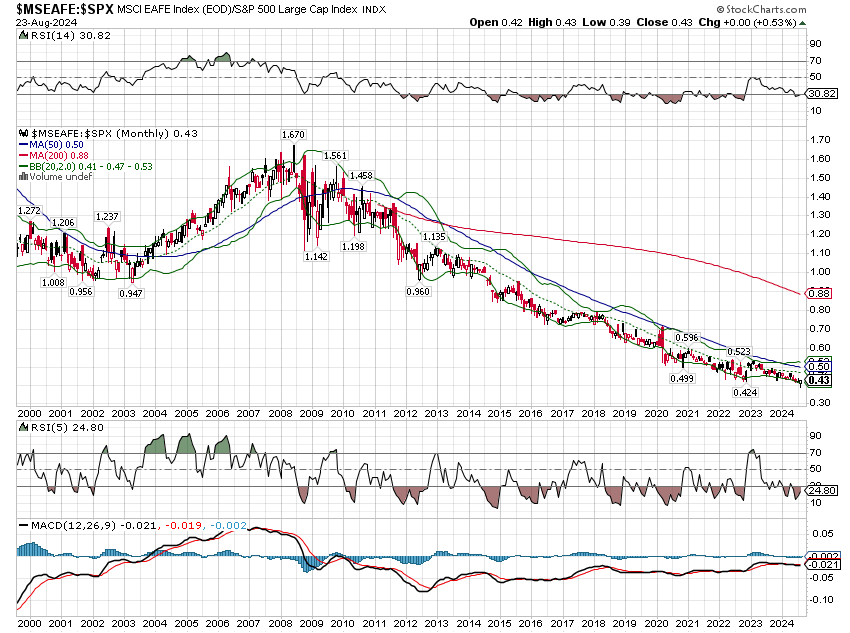

The dollar remains in a short-term downtrend that has now accelerated to near the bottom of the intermediate-term trend. We’ve approached this 100 level several times over the last couple of years and the buck turned around each time. Will it this time? I don’t know but experience says the more times you test a level, the more likely you are to break it. Really short term, it probably makes sense to expect some kind of bounce but an accelerating downtrend like this usually continues. A short-term bounce would likely cause a correction in non-US stocks, which, as you can see below, have been outperforming this quarter.

I’ve said several times over the last year that the rally in gold could be telling us something about the future movement of the dollar. That appears to be true today, but don’t take that to mean I was somehow prescient. I was just pointing out a possibility but markets are often wrong and the outcome could have gone the other way with the dollar rallying and gold coming back down. What will be more interesting is to see what gold does now. If it has been anticipating this breakdown, will it now continue to rally? If the dollar downtrend continues and especially if it further accelerates, you’re going to hear lots of talking heads touting gold. In the combination of falling dollar/falling rates, gold does perform well but foreign stocks are the big winners and I expect no one to be talking about that.

Rates are also in an accelerating downtrend but, like the dollar, the longer-term trend is still neutral. Jerome Powell believes now is the time to cut rates and after as much as promising to do so at Jackson Hole, he’ll almost certainly follow through. But that doesn’t matter because the Fed is always a follower and the market has already cut rates. What matters to other markets is what rates do from here. If we get some stronger economic data – and I think we’re likely to as mortgage rates come back down – a series of rate cuts may not to be priced out of the market.

Markets

If last quarter was from Venus, this quarter is from…Pluto. Everything that didn’t work last quarter has this quarter although it has come with some extreme volatility. REITs, small cap stocks, and everything value is working like a charm for now but no long-term trends have changed. This is, for now, just a case of the laggards getting too far behind and playing catchup. Falling dollar environments haven’t historically been great for small company stocks or REITs or even value. But then growth stocks outperformed in a rising dollar environment which isn’t historically normal either. This cycle has been abnormal in so many ways it wouldn’t surprise me in the least to see it just continue to defy history.

If we assume the dollar will continue to fall though, I think the place to focus is on international, non-US stocks. They have underperformed for a long time – see the three-year track record below – and no one is expecting them to do well. That’s the contrarian play that no one is expecting and there is already a nascent move in that direction this quarter. But the long term trend is obvious and hasn’t changed yet so patience is required.

The other noteworthy item in this quarter to date is the outperformance of intermediate-term Treasuries which have outperformed the S&P 500 QTD. Bonds are very well loved right now and I suspect this trend won’t continue much longer. Or maybe I just hope it doesn’t because of what that would say about the economy.

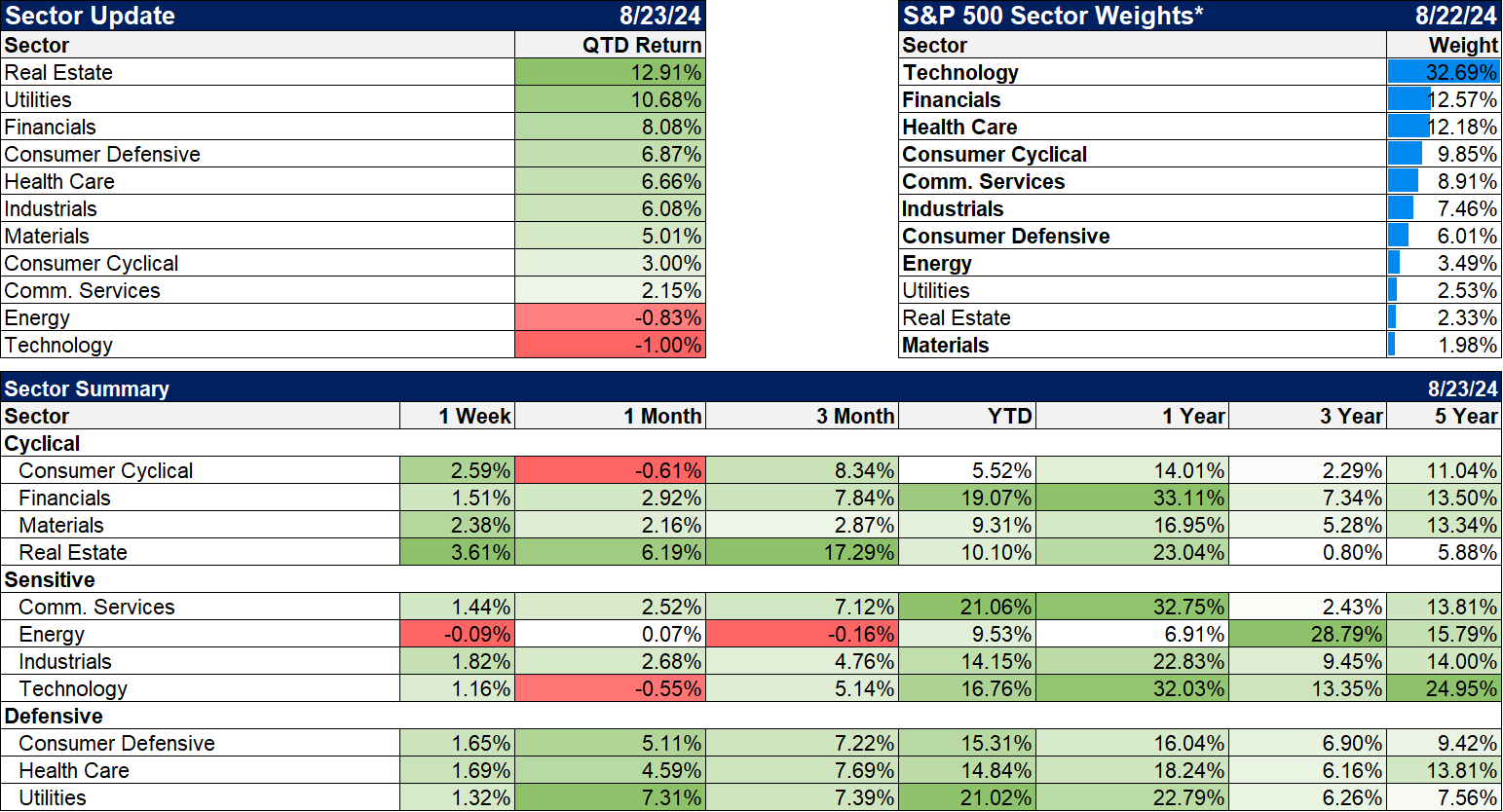

Sectors

Real estate, utilities, and financials all benefit from lower rates so it isn’t surprising to see them at the top of the sector ranking for this quarter. But they will only outperform with falling rates until falling rates turns into fear of recession. Utilities would normally be defensive and continue to perform well even if recession is feared but in this case I think valuations have outrun reality. The utility sector currently sports a very non-utility like P/E of 18 because of the recent run up based on AI fever.

Market/Economic Indicators

It was a light week for economic data with the most anticipated release being the preliminary annual revision of non-farm payrolls. This is a report that only econ nerds paid any attention to until, well, now. This preliminary report will be followed by the actual annual revision in January of next year. The only thing this report should be used for is to disabuse anyone of the notion that the monthly payroll figures mean anything. The preliminary revision was lower by 818,000 jobs from April 2023 to March 2024. This is somewhat larger than normal but we’ve had big revisions before and we’ll have them again. Prior to the revision, the monthly average was 234k and after it drops to about 166k. That isn’t great but its more than enough to absorb the rise in the labor force over that time which was about 100k/month.

Other data from last week:

Chicago Fed National Activity Index: fell to -0.34 (0 is trend growth) from -0.09. 3 month average is -0.06 and far from the -0.75 that indicates recession

Initial jobless claims: 232k up a couple of thousand from last week. The scare of a few weeks ago when it hit 250k was overblown and just normal volatility.

S&P Global US PMIs: Composite 54.1, manufacturing 48.0, services 55.2. Manufacturing was a little light but these don’t change anything.

Existing home sales: Up 1.3% in from June.

KC Fed Mfg. index: +6 from -12; composite improved to -3 from -13

New home sales: Up 10.6% from June and better than expected. Up 5.6% over the last year but these are still low levels. Inventory came down a little.

This week will be a tad more intense with reports on:

- Durable goods orders

- Case-Shiller home prices

- Several regional Fed surveys

- 2nd estimate of Q2 GDP

- Personal income and spending

- PCE price index (Fed’s favored inflation gauge)

Anything that upsets the soft landing scenario will not be welcomed by risk markets. Sentiment isn’t ebullient yet but it is nowhere near as dire as it was a few weeks ago when allegedly serious people were talking about an emergency, inter-meeting, Fed rate cut. From a sentiment standpoint, the environment isn’t cheery enough to call for a correction nor dour enough to warrant aggressive buying.

Credit spreads have narrowed back to almost where they were prior to the correction. Even the peak during the correction of 3.93% is well below the long-term average of 5.3%.

Stay In Touch