Note: I wrote most of this commentary prior to the US strike on Iran and I decided to go ahead with it anyway. I don’t know any more than you do about what is going on in the Middle East and trying to predict what will happen in the coming days and weeks is a fool’s errand. We have a strategic allocation to commodities in our portfolios exactly because we can’t predict things like this. Futures markets are not open yet as I write this so I don’t know how things will open, but oil up and stocks down seems both too obvious and still likely. How big the effect and how long it lasts is unanswerable but history would favor not big and not long.

President Trump in a Truth Social post after the Fed’s meeting last week

Too late Powell complains about costs…but he could do the biggest and best job for our country by helping to lower Interest Rates and, if he reduced them to the number they should be, 1% to 2%, that numbskull would be saving the United States of America up to $1 trillion per year….He’s a dumb guy, and an obvious Trump hater, who should have never been there, I listened to someone that I shouldn’t have listened to, and Biden shouldn’t have reappointed him….If he was concerned about Inflation or anything else, then all he has to do is bring the Rate down, so we can benefit on Interest Costs, and raise it in the future when and if these “other elements” happen (which I doubt they will!)…. I don’t know why the Board doesn’t override this Total and Complete Moron! Maybe, just maybe, I’ll have to change my mind about firing him? But regardless, his Term ends shortly!

Fed Governor Waller says central bank could cut rates as early as July

Federal Reserve Governor Christopher Waller said Friday that he doesn’t expect tariffs to boost inflation significantly so policymakers should be looking to lower interest rates as early as next month.

In a CNBC interview, the central banker said he and his colleagues should move slowly but start to ease as inflation is not posing a major economic threat, which he expects to continue.

“I think we’re in the position that we could do this as early as July,” Waller said during a “Squawk Box” interview with CNBC’s Steve Liesman. “That would be my view, whether the committee would go along with it or not.”The comments come two days after the Federal Open Market Committee voted to keep its key interest rate steady, the fourth straight hold following the last cut in December.

President Donald Trump, who nominated Waller as a governor during his first term in office, has been hectoring the Fed to lower interest rates to reduce borrowing costs on the $36 trillion national debt.

In his remarks, Waller said he thinks the Fed should cut to avoid a potential slowdown in the labor market.

“If you’re starting to worry about the downside risk [to the] labor market, move now, don’t wait,” he said. “Why do we want to wait until we actually see a crash before we start cutting rates? So I’m all in favor of saying maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait till the job market tanks before we start cutting the policy rate.”

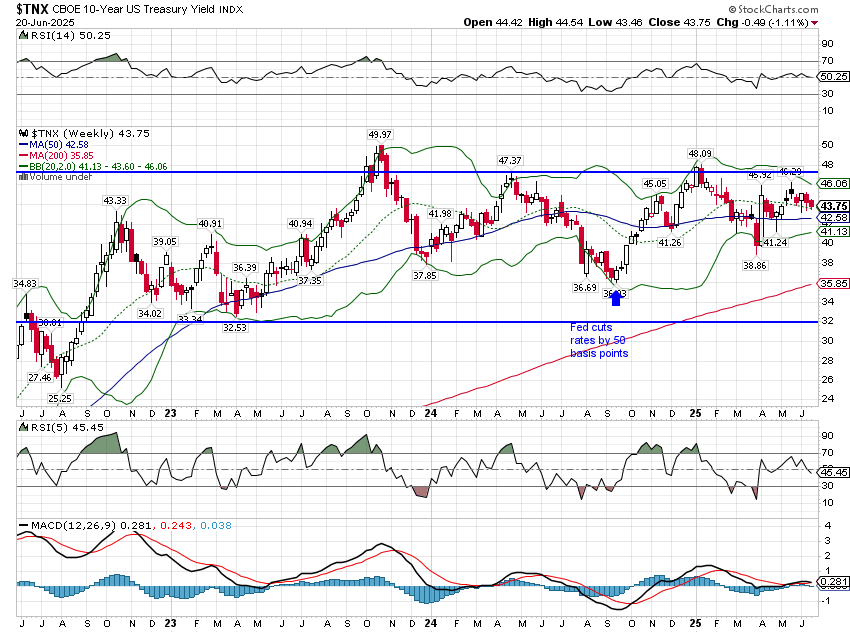

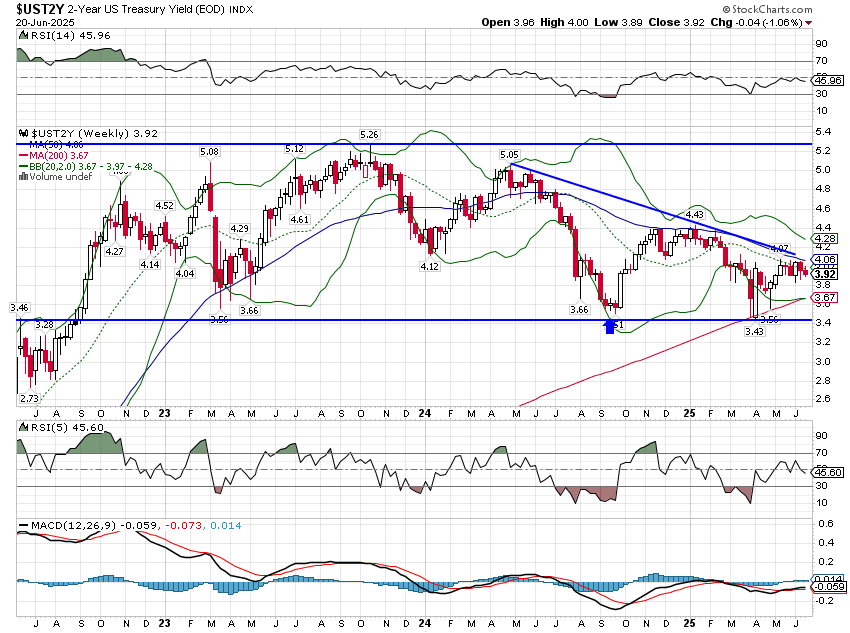

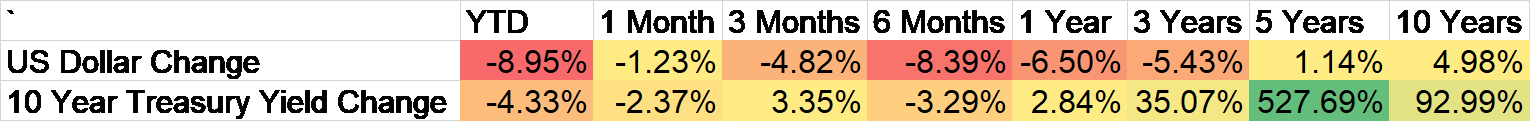

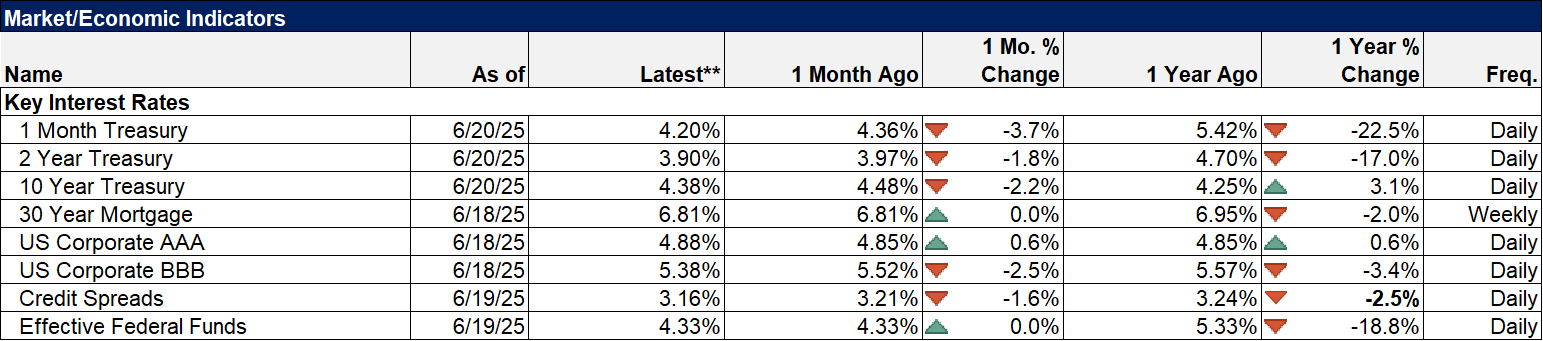

I’m not sure I’ve ever seen a statement so worthy of the phrase “careful what you wish for, you might get it good and hard” than the President’s latest broadside against Jerome Powell. Forget for a moment the odd capitalizations, run-on sentences, and childish name calling – Dignity, thy name is not Trump – and focus on what he’s saying. He apparently believes that the Chairman of the Federal Reserve sets interest rates all by himself, not noticing or caring that the vote to keep rates steady was unanimous, 12-0, including the Trump appointed Governor Waller. Does he also believe the Fed controls all interest rates, that the Fed Chair has control over long-term rates too? One need only remember what happened to long-term interest rates when the Fed started cutting rates in September to see that isn’t true.

I suppose he might also mean that he wants to finance all new US debt at the short end of the curve but there isn’t even any assurance that the market would abide that. The 2-year Treasury note yield is also higher since the first Fed rate cut of this cycle.

Long-term and short-term rates had been falling prior to the Fed’s September rate cut, an indication markets were starting to price in a slowing of NGDP growth. A quick look at real yields shows that real growth expectations were falling too; the 10-year TIPS yield had fallen 70 basis points from April to September. If the Fed had cut in September and those rates kept falling it would have been a signal that they had not done enough to alleviate growth concerns. Instead, the market conclusion was that the Fed’s cuts were sufficient, at least for then, and since rates are still higher today, for now as well. In short, the market doesn’t presently indicate any need for lower rates and a Fed cut now might well prove counterproductive by raising long-term rates further.

Politicians, like most people, act in their own best interests, which may or may not coincide with the interests of the country. A more politically-controlled monetary authority would conduct monetary policy to satisfy political constituencies, to achieve political ends which may or may not be in the public’s best interest. Of course, there’s scant evidence the committee of 12, the FOMC, can determine what’s in the nation’s best interest and implement a policy that achieves it either but I want to believe they are doing their best. I am not much of a Jerome Powell fan but I don’t think he has some hidden, anti-Trump agenda. I have an idea how he feels about President Trump – I don’t imagine he will invite him to his retirement party – but I’m pretty sure he doesn’t take that into account when he leads the FOMC in their regular policy meetings. Which brings me to Governor Waller, who seems to have found some new insight that he believes would allow the Fed to cut rates as soon as next month. Governor Waller may be an honorable man too but doing a public interview in support of President Trump’s desires when he is one of three people currently considered a likely replacement for Powell (along with Bessent and former Fed Governor Warsh) is unseemly at a minimum. To the extent he is seen as doing Trump’s bidding, he lessens the market’s trust in the Fed and the FOMC.

Personally, I can envision a world where monetary “policy” is decided entirely by the market and leaves politicians to deal with the consequences of their choices but we don’t live in that world right now. By the way, the recently passed GENIUS Act – which, based on my observations of the characters leading the crypto movement, might be the biggest misnomer in the history of Congressional acronyms – could be a step in that direction but I’ll leave that for another day. Unfortunately, we’re stuck with the system we have which means that the people running monetary policy need to be independent minded, of the highest character and have a firm understanding of how their actions affect markets and the economy. The number of people who fit that description in the current Trump administration is shockingly small.

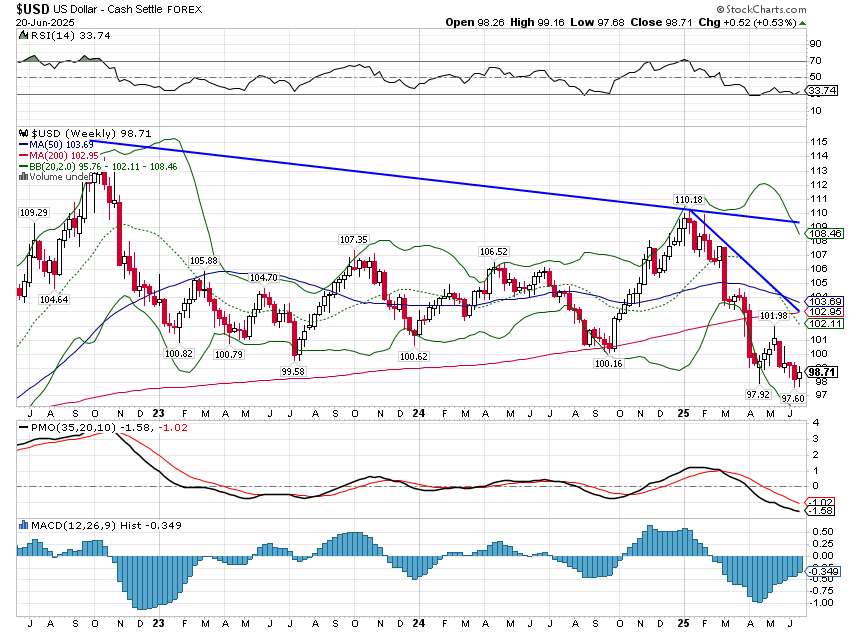

President Trump has a habit of misdirection though, so I’m not sure we should take his comments about Powell at face value. He says lower rates would save us money on interest costs but rates are not terribly high now and his Treasury Secretary is already issuing a lot of short-term paper. Before he had to sit atop the Treasury Department, Secretary Bessent was quick to criticize his predecessor, Janet Yellen, for issuing at the short end, saying it was an attempt to provide political support to Biden prior to the election. Now that he’s in charge he’s doing the same thing, for the same reason Yellen did it – that’s where the demand is. You can try to sell 30-year bonds when the market is demanding Tbills but you aren’t going to like the outcome. So what might President Trump really be after? My guess is a weaker dollar, because he believes it will rid him of his pet peeve – trade deficits. He’s wrong but, if he’s proven nothing else during his time in the public eye, it is that his Ahab-like obsession with bi-lateral trade deficits is impervious to both theory and evidence. Call me Ishmael.

Should we worry about the President being able to influence monetary policy? The only modern example we have of Presidential control of monetary policy argues, emphatically, yes. Recep Erdogan, President of Turkey, once said that interest rates out of his control was “the mother of all evil” and that “the central bank can’t take this independence and set aside the signals given by the president.” He has also referred to rate hikes as “treason”. After his election in 2018 he said in an interview with Bloomberg that he intended to take greater control of the economy, including de facto control over monetary policy, and reduce interest rates. He believed that lower interest rates would stimulate domestic investment and support export-oriented sectors while a cheaper Lira would attract foreign investment and boost growth. Sound familiar?

With the usual caution that correlation is not causation, this is the Turkish Lira during Erdogan’s rule.

A currency down nearly 90s% is inflation in its purist form. Inflation was over 15% when he was elected in June of 2018 but it rose a bit as the Lira fell, peaking in October of 2022 at a mere 85.5%. Today, two years after starting a rate hiking campaign, inflation is down to just 39%. So much for the Erdogan theory of monetary economics.

The US is not Turkey but the President installing a toady as Chair of the Federal Reserve isn’t going to inspire confidence. On the other hand, he’d probably have to replace the entire board to get what he wants so we probably won’t have an outcome like Turkey (whose problems were and are a lot deeper than lousy monetary policy). But even if Trump or a future President gains only partial control over monetary policy, the outcome will likely be the same directionally.

In the meantime, meaning until next May when Powell’s term ends, monetary policy will be conducted as it has for years, by following the market. The Fed will lower – or raise – rates long after the market has already done so; they are essentially irrelevant. We should hope they remain so.

Environment

Israel and Iran are going at it every day and all the dollar could manage was a measly 0.5% gain on the week. Nevertheless, I do still expect a rally though as sentiment has just gotten too bearish; is there anyone who likes the dollar right now? On the other hand, I think the longer term trend is changing and any rally will be limited. President Trump is doing everything in his power to weaken the dollar and eventually he will succeed.

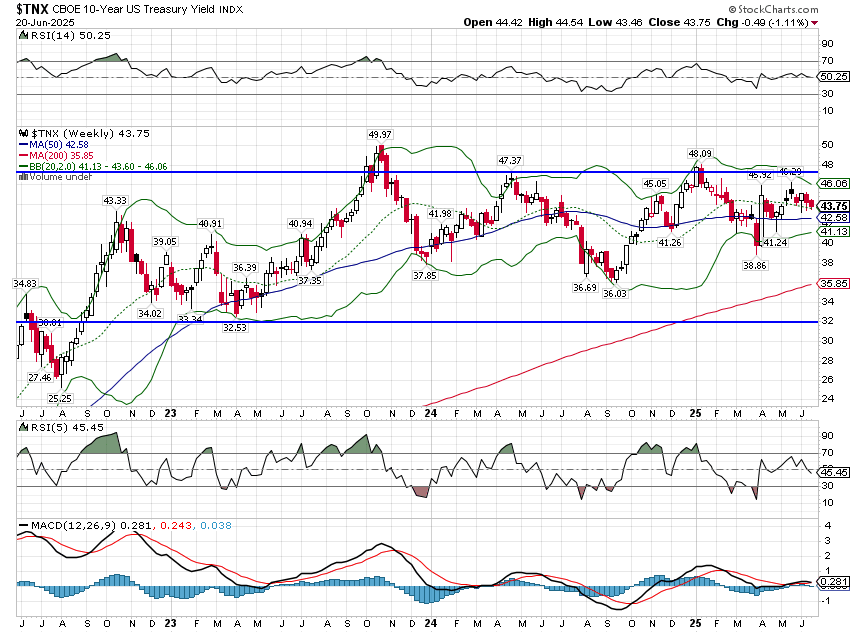

Along with Israel/Iran, the economic data has recently trended in the less-than-expected direction and bonds managed a gain but it wasn’t very impressive; the 10-year Treasury yield is still – still! – in the same range its been in for going on 3 years. Are bonds also anticipating a weaker dollar and the inflationary implications of that? 10-year inflation breakevens are up 16 basis points since mid-April and that’s in the wrong direction but it’s also too small a move to draw any conclusions.

Markets

Stocks were down last week but diversified investors benefitted from a rise in commodity prices and a small gain in bonds. You see a similar benefit in the 5-year numbers where commodities are the best performing asset class. Over the last year, the multi-asset class portfolio has benefitted from exposure to REITs which have handily beaten the S&P 500. If you can’t predict the future – and no one can – a diversified portfolio is your best defense – and offense.

It is also interesting that while everyone waits on large cap value to outperform, small and midcap value are already in the lead over the last five years and not by an inconsiderable margin.

The outperformance of international stock markets this year has been well reported but I wonder if most investors understand how well non-US markets have performed in recent years. The 1, 3, and 5-year returns for Global Stocks ex-US are less than the S&P 500 but far from bad at 13.8%, 13% and 9.3% respectively.

Sectors

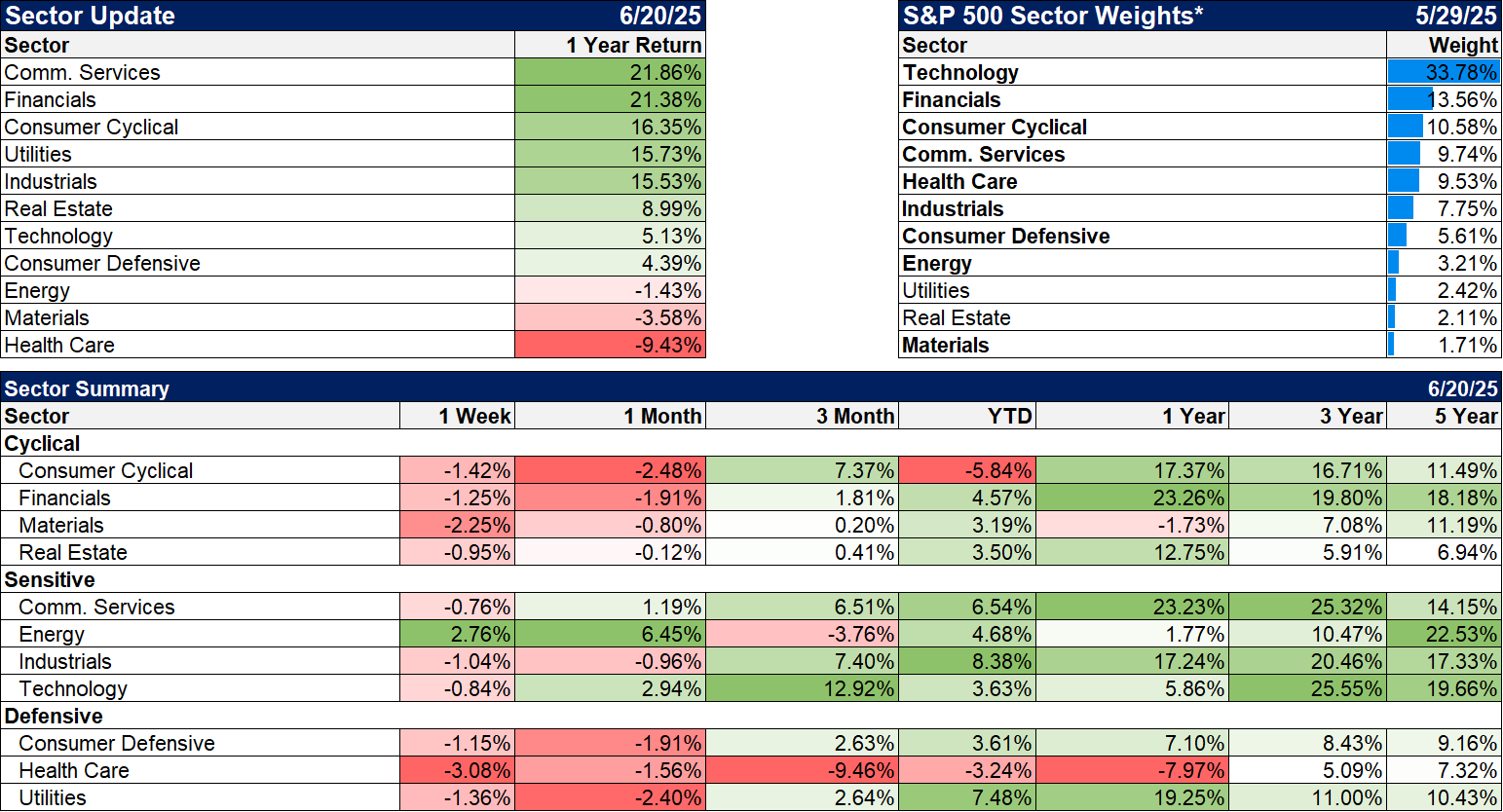

Everyone continues to talk about the tech sector but it has lagged badly over the last year. Communications services leads the way and it has a technology tilt with Meta and Google as its two largest holdings but the rest of the top 5 isn’t tech at all.

Contrarian bets are starting to pay off as REITs have performed well over the last year (note: the sector fund used for these calculations is not the DJ REIT index used above). Health care, the other poor performer over the last 3 and 5 years is still in the dumps.

Economy/Market Indicators

High yield spreads have been coming down but have barely budged over the last month and are still higher than the February lows for this business cycle. Have the trend for spreads changed? Not yet, but I’m worried.

Economy/Economic Data

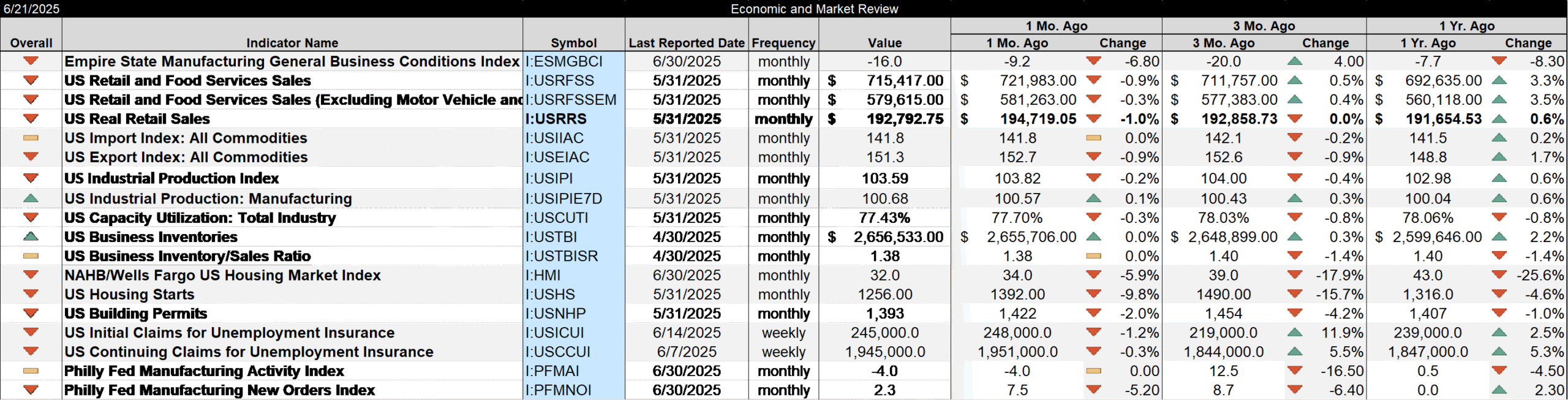

The theme this week is “less than expected”:

- Empire State survey was expected to improve but fell instead to -16; new orders and shipments down, supply availability worse, labor edged higher

- Retail sales -0.9% vs expectations of -0.7%, ex-autos -0.3% vs expected +0.1%, ex-autos ex-gas -0.1%

- Industrial production also less than expected -0.2%, manufacturing also less than expected but up 0.1%

- Housing market index less than expected at 32 vs expected 36. Either way it’s awful

- Export prices down 0.9%, import prices flat

- Housing starts and permits both less than expected at 1.26 million and 1.39 million respectively, -9.8% and -2%

- Jobless claims 245k as expected; continuing claims down a bit from last week but sitting near a three year high.

- Fed meeting – no real news except lowered this year’s growth expectation to 1.4% from 1.7% in March

- Philly Fed less than expected at -4 vs expected -1, business conditions fell from 47.2 to 18.3, capex 27 to 14.5, employment 16.5 to -9.8, new orders 7.5 to 2.3 but good news prices paid 59.8 to 41.4

Stay In Touch