Speaking Volumes Rather Than Fast Rate Hikes

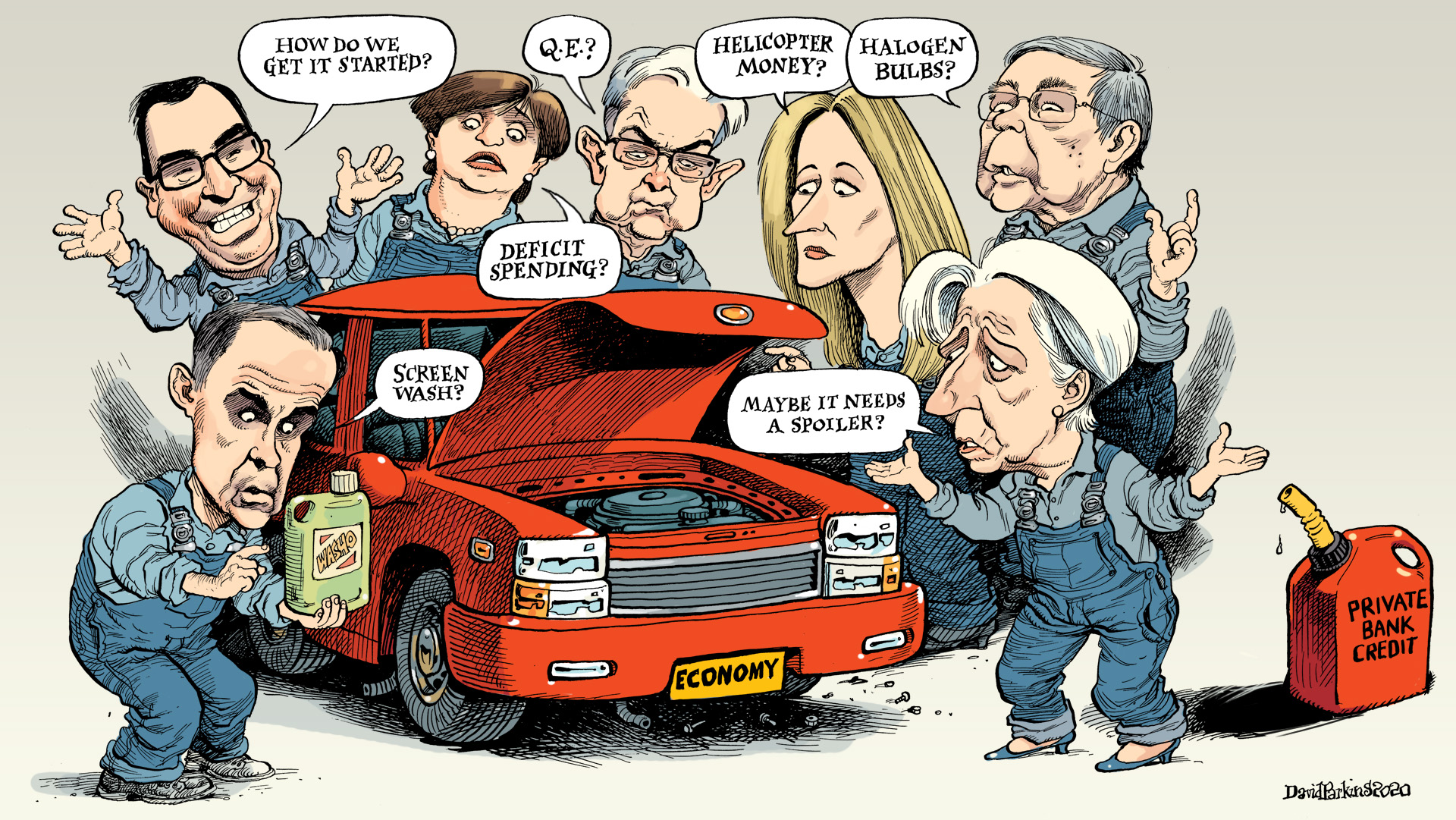

The price illusion. It is causing enormous confusion and difficulty, making the global economy out to be something it really isn’t. In fact, the whole situation is being viewed backward. What’s presumed from this is a red-hot economy causing consumer prices to skyrocket. In such a scenario, central banks might need to rush their rate hikes to cool it down [...]

Stay In Touch