Fears over machines aren’t anything new. The Terminator franchise got started in the eighties and was hardly original back then. In gross economic terms, it may seem like the robot invasion is a 21st century phenomenon. It isn’t. One need only go back to Alberta of all places and learn about the Canadian Clifford Hugh Douglas.

Douglas preached something called social credit not too much unlike the idea behind universal basic income. It was a way to redistribute wealth back to workers who were going to be displaced by mechanization, raw human toil converted to literal machinery. Not only had automation been one chief cause of the Great Depression, Douglas reasoned, it would be the key reason why it would be permanent. Otherwise, without the means to pay the surely growing ranks of unemployed and underemployed it was said income inequality would become so severe that society itself was in danger of breaking down.

This belief easily spread so far and wide that in 1935 the Alberta Social Credit Party handily won a majority government in the province during that party’s very first election. As a political organization, it wasn’t even six months old and already running things.

Imagine that, widespread fear of the robot takeover during a period when economic growth just seemed to have disappeared, leaving the electorate desperately searching for increasingly bizarre “answers” from outside the “respectable” class who had none to give. Why not fear the machines? By 1935, two and three years of worldwide “recovery” and the whole damn system still appeared to be broken to the point of unfixable.

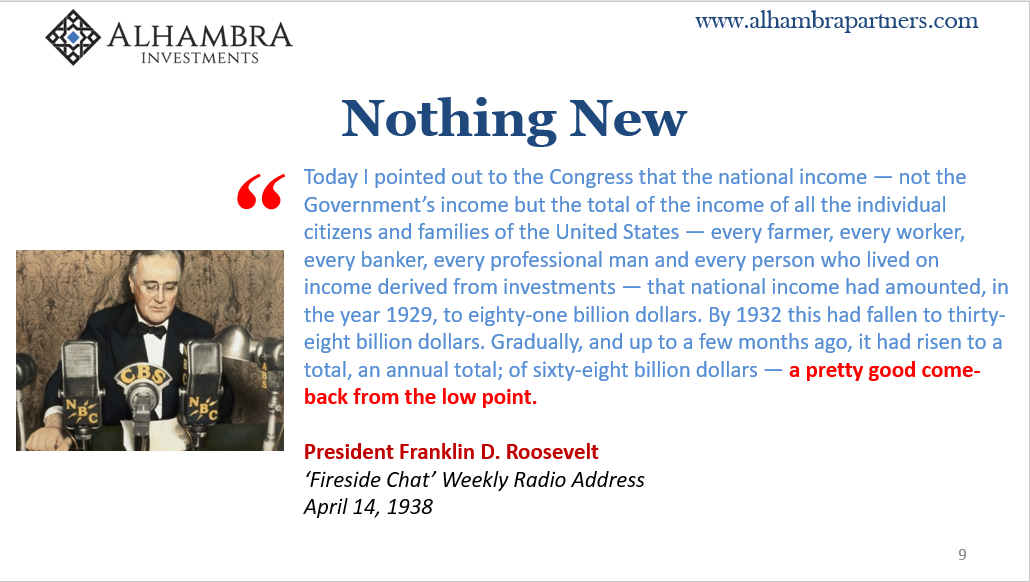

Alvin Hansen a few years later coined the term “secular stagnation” as at least a more realistic way to characterize the situation, much closer to reality than FDR’s “a pretty good come-back.” Though eight and a half decades separate us, the modern world can relate. Even secular stagnation has made its reappearance.

Where today we might depart is from the schedule for the machine takeover. It’s not actually happening; or, it’s not happening all that quickly. Ever since around, I don’t know, 2008, the demand for not just machines but more importantly the “mother machines” has essentially flat-lined.

These sound like something from those futuristic James Cameron movies, machines that make other machines, and they aren’t all that far removed. The modern industrial economy requires very purposeful devices that are then used to create the physical apparatuses which then run the mass productions.

Working backward, if there isn’t much demand for that which is mass produced, there must not be much demand for the machinery to do the mass producing and, therefore, not as much of a necessity to be birthing their mothers.

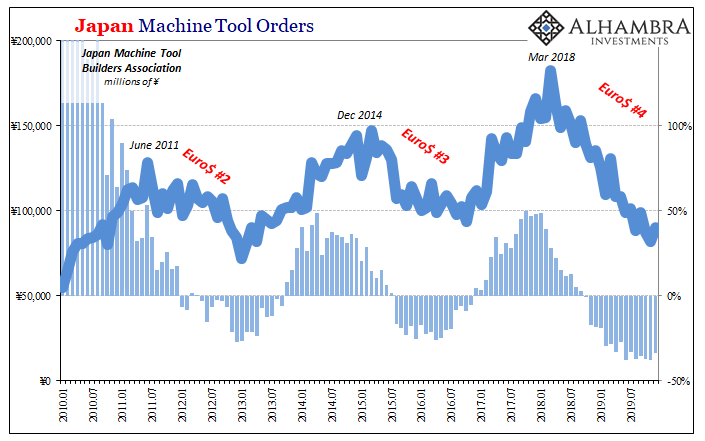

The Japan Machine Tool Builders Association (JMTBA) has kept track of Japan’s enlarged share of this space since 1963. One of the essential components of the previously legendary Japan Inc. was its efficient and creative uses for, and ways to manufacture, mother machines and therefore new orders for them were an important clue as to the health of the overall system as well as Japan’s standing in it.

Not just the Japanese economy, either. Most of these first-line robots are made to be exported. For all of 2018, for example, the JMTBA data says that of the ¥1.8 trillion total orders placed ¥1.07 trillion were for those whose destination was outside of Japan. This is a deep proxy for the core of the global economy.

What the trade group’s data tells us about today is that despite nearly eleven years of “recovery”, machinery orders have been at recent peaks barely more than when the Great “Recession” began the process of unmaking the globalized economy. And that was before this latest “unexpected” “transitory” interruption that showed up in all sorts of data and market prices two years ago.

According to their most recent figures, machinery orders in December 2019 totaled ¥90 billion. They had been ¥132 billion in May 2008 at the prior peak.

The data also tells us that orders in the final month of 2019 were down by a third from the previous December. Not only has there been very little growth during the so-called recovery, what growth there may have been is increasingly being undone – again. This time around, Euro$ #4, the setbacks are becoming even more extreme than the last one – which was a little more extreme than the one before.

Japan’s machinery orders data matches up very closely with the intermittent eurodollar squeezes (global dollar shortages) that have periodically popped up during the last decade. There may be no better global proxy for these.

The means for interrupting recovery is therefore pretty clear; dollars become scarce and industry begins to pull back – in output as well as key inputs – and then keeps going until, for whatever reasons, the squeeze ends and the economy can breathe again if only minimally for a few more years (reflation).

Mother machines go dark as the global economy increasingly does. As a result, fewer mother machines. As a further consequence, synchronized industry and thus the overall economy.

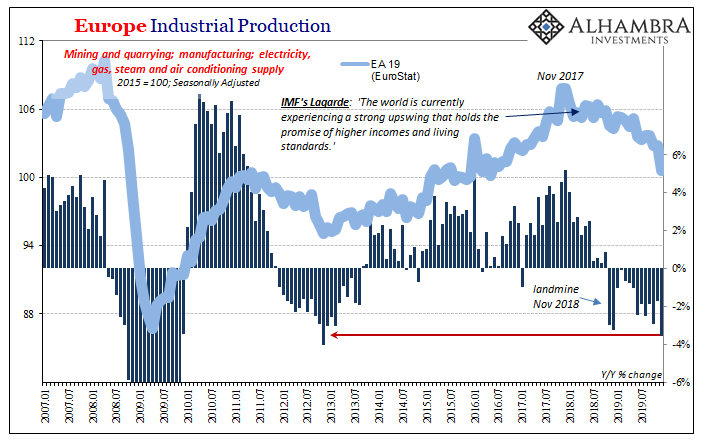

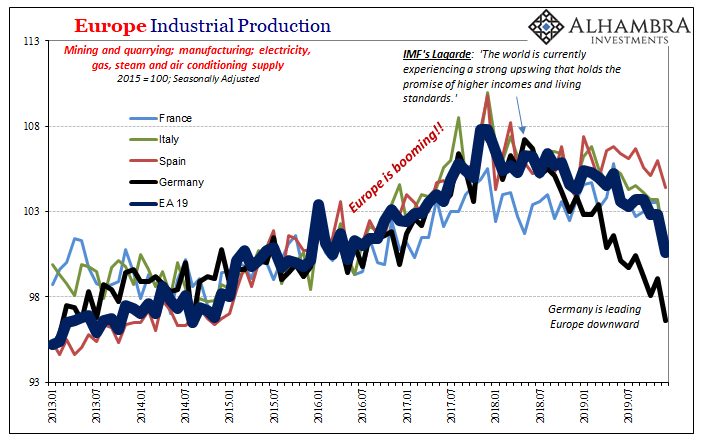

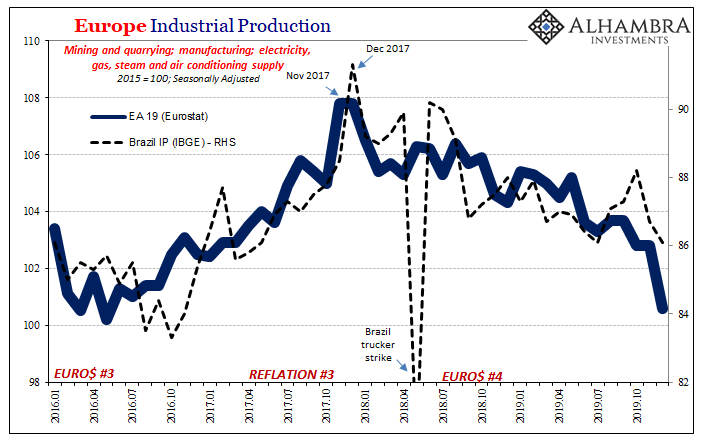

Given all this, maybe Europe’s recent lurch downward shouldn’t have been all that surprising. It obviously was if only because the public had been handed the usual shiny QE distraction, the renewed puppet show to take everyone’s eyes off the realness of the real economy. Sentiment has been higher but actual conditions, industry in particular, is increasingly lower.

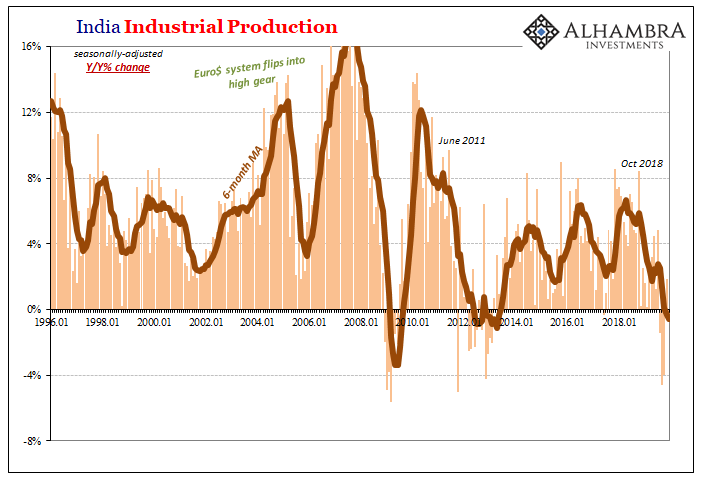

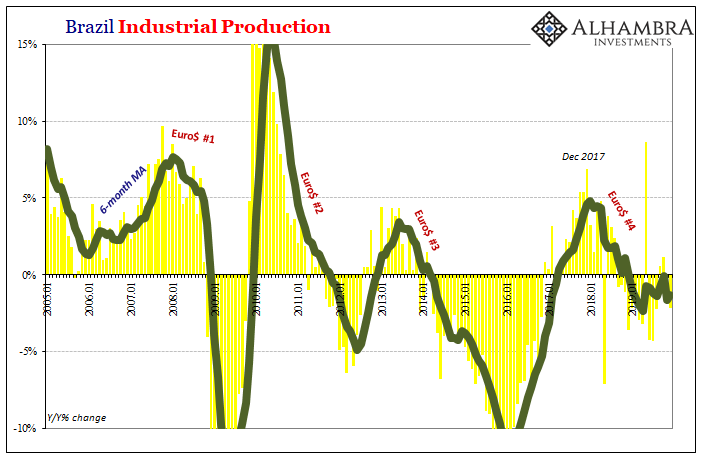

European IP came out bad but the place is far from alone in its struggle. I added a few others to the list yesterday, filling out more within the catalog of unrelenting downside synchronicity. I’ll add a few more today (India, Brazil) to further emphasize just how much 2019 ended the wrong way.

Social credit like secular stagnation faded in the forties and fifties because actually robust economic growth finally reappeared. The once-feared machines by then had been welcomed first into the factories and then invited right into the homes of the new modern upwardly mobile lifestyle. The two things, real economic growth and robots, actually go together.

In that way, the lack of machines is actually what’s making a statement now and the robots really are speaking to us humans, just not at all in the way it’s been commonly transcribed.

Stay In Touch