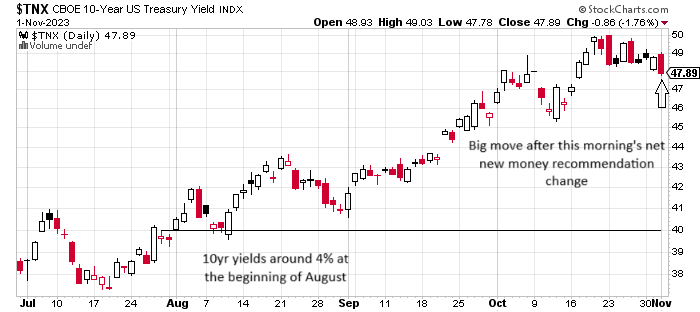

In August the Treasury Borrowing Advisory Committee (TBAC) told the market they were raising the net new money issuance recommendation for Q32023 from the initial guess of $733B to over $1T. They also announced a recommendation of $852B of net new money for Q42023. That spooked the bond market and 10-year yields jumped from 4% at the beginning of August to over 5% at one point in October. There’s been a lot of chatter at the Treasury Department about why bond yields have spiked and supply/demand dynamics causing investors to demand a higher term premium is thought to be one of the main culprits.

So, it won’t surprise anyone, that this morning they back tracked. The gist of what they said was: Upon further review, revenues will probably be higher because Q3 growth was so strong. We therefore are only recommending net new money of $776B for Q4 ($76B less).

So dealers had to go inventory hunting to fill their expected customer demand for Treasuries. The result, bond yields dropped 8 bps today, a pretty big move for one day.

Stay In Touch