The latest government shutdown ended last week, after a mere four days, but that was apparently enough to prevent the Bureau of Labor Statistics from releasing the January employment report. It will be released this week instead (2/11) but I’d prefer if they waited about six months. These reports are one of the most anticipated by Wall Street and are often market moving but their accuracy leaves a lot to be desired. Over the full history of the release, the average revision from the initial report to the last monthly revision has been about 55,000 jobs while the annual benchmark revisions adjust the annual total by about 275,000 jobs.

Since COVID, with survey response rates falling and the birth/death model affected by the virus, the average monthly revision has jumped to over 100,000. Annual revisions have gotten larger as well with the last two years coming in at 598k and 911k. Maybe the BLS should just give up and let the private sector do the job. ADP didn’t have any problems releasing its report on time and it showed the economy added 22,000 jobs in January. That continues a trend of weaker numbers that started in the middle of last year. The most positive development in the report was that most of the gains came from small and medium sized businesses who have been much more affected by the tariff chaos than larger establishments. On the other hand, manufacturing employment fell again, down now 11 months in a row.

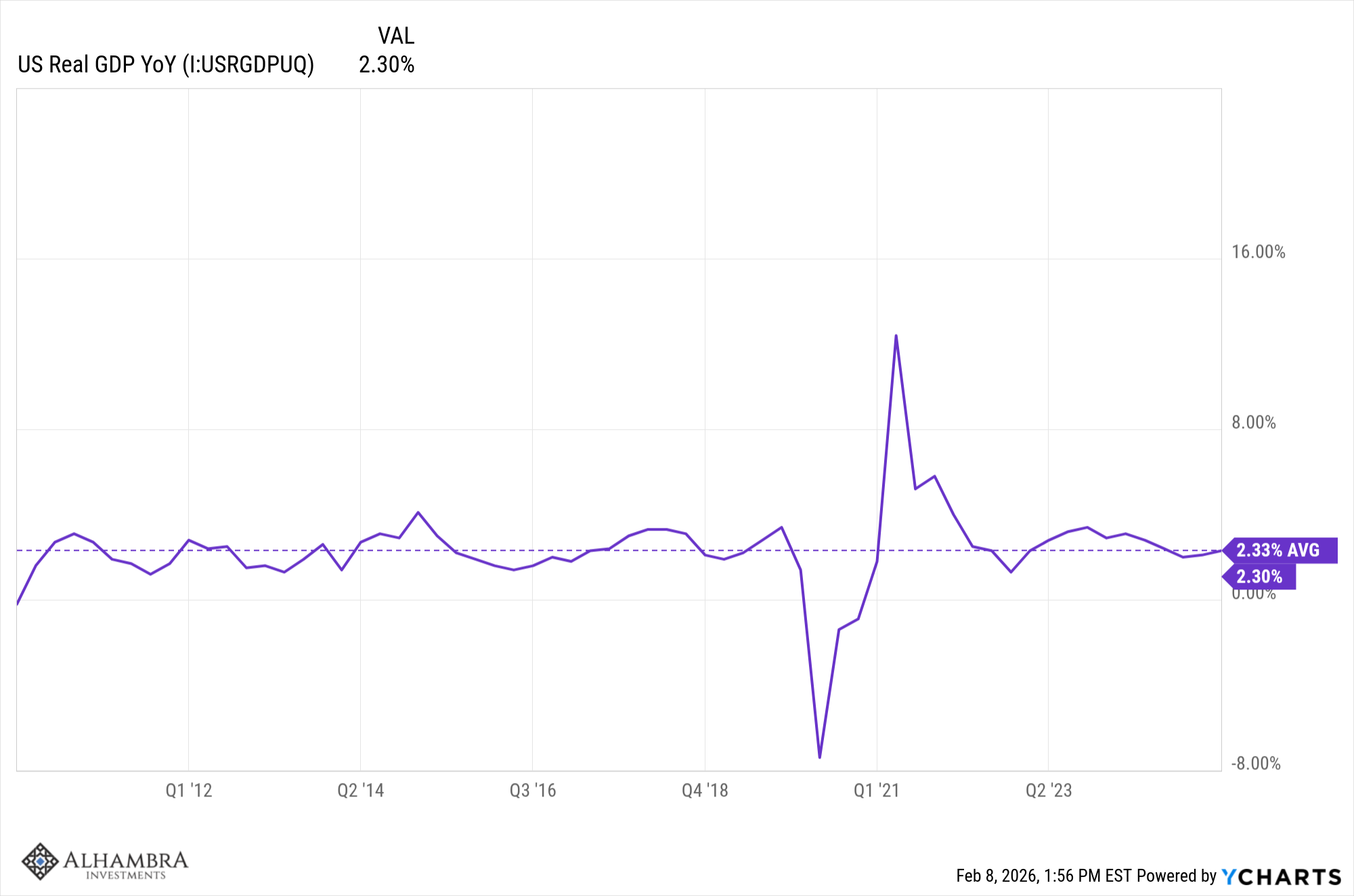

Much of the economic data released over the last month is from a few months ago (because of the previous government shutdown) and so doesn’t provide us with much useful information. We have had some “soft” data – surveys on manufacturing and services for instance – that may be pointing to a pick up in economic activity but overall, the economy is growing right at the post 2008 financial crisis rate of 2.3%. We did have some acceleration in GDP growth in Q2 and Q3 of last year but those numbers – like Q1 – were distorted by tariff issues. Even with that acceleration, the year-over-year change in real GDP at the end of Q3 2025 was 2.3%, slightly below the average since 2010 of 2.33%.

The most recent reading of the Chicago Fed National Activity Index shows the same thing with the November reading at -0.04; a reading of zero indicates trend growth.

Despite the loss of manufacturing jobs in the ADP report, the recent manufacturing survey data has looked a little better. The January Empire State and Philly Fed surveys both moved back into positive territory at 7.7 (up from -3.7) and 12.6 (up from -8.8), while new orders also expanded for both (6.6 and 14.4 respectively). I won’t get excited about these until we get more than one or two positive months in a row. Both of these reports have been positive for 5 of the last 12 months and both were mostly negative before that all the way back to 2022. The Dallas Fed survey also turned positive in January while Richmond improved but stayed negative and KC stayed at zero. If this is a nascent manufacturing expansion, it’s a decidedly uneven one.

The ISM surveys – manufacturing and services – were also positive. The manufacturing version moved up to 52.6 – over 50 denotes expansion – but don’t get too excited yet. Last January and February were also above 50 but they were the only readings over 50 for the entire year. For that matter, there have only been 4 readings in expansion since November of 2022. The services version continued to show expansion at 53.8 but the record for services is the opposite of manufacturing – only 4 readings below 50 since December of 2022.

There is other positive data but as I said above it is from several months ago:

- Advance durable goods orders were up 5.3% in November and 14.7% year-over-year; ex-transportation (Boeing) orders were up 0.5% in November and 8% year-over-year. The December report was delayed like the employment report.

- Core capital goods orders rose 0.7% in November and 5.3% year-over-year

- Retail sales rose 0.6% in November and 3.3% year-over-year; adjusted for inflation sales were up a more modest 0.4%

- Real personal consumption expenditures were up 2.6% as of November

- Inflation is still above the Fed’s target but doesn’t seem to be getting worse. Core CPI is up 2.6% year-over-year in December while core PPI was up 3.3%. The latter, by the way, has been in an uptrend since bottoming in July of 2023. If that continues, it will be addressed through prices, margins, or cost cutting. Given the AI boom, the latter would likely be through lower headcount.

- Unemployment claims ticked higher last week to 231k but that is still well below anything that is associated with recession

- The unemployment rate is up to 4.4% but that is still very low

There are, as always, areas that aren’t doing so well:

- Disposable personal income was up 0.3% in November and 3.8% year-over-year but inflation reduces those to 0.1% and 1% respectively; the savings rate continued to fall, down to 3.5% versus 4.9% a year ago

- Light vehicle sales fell to a 14.9 million annual rate in January, down from a nearly 18 million annual rate last March (-16.5%)

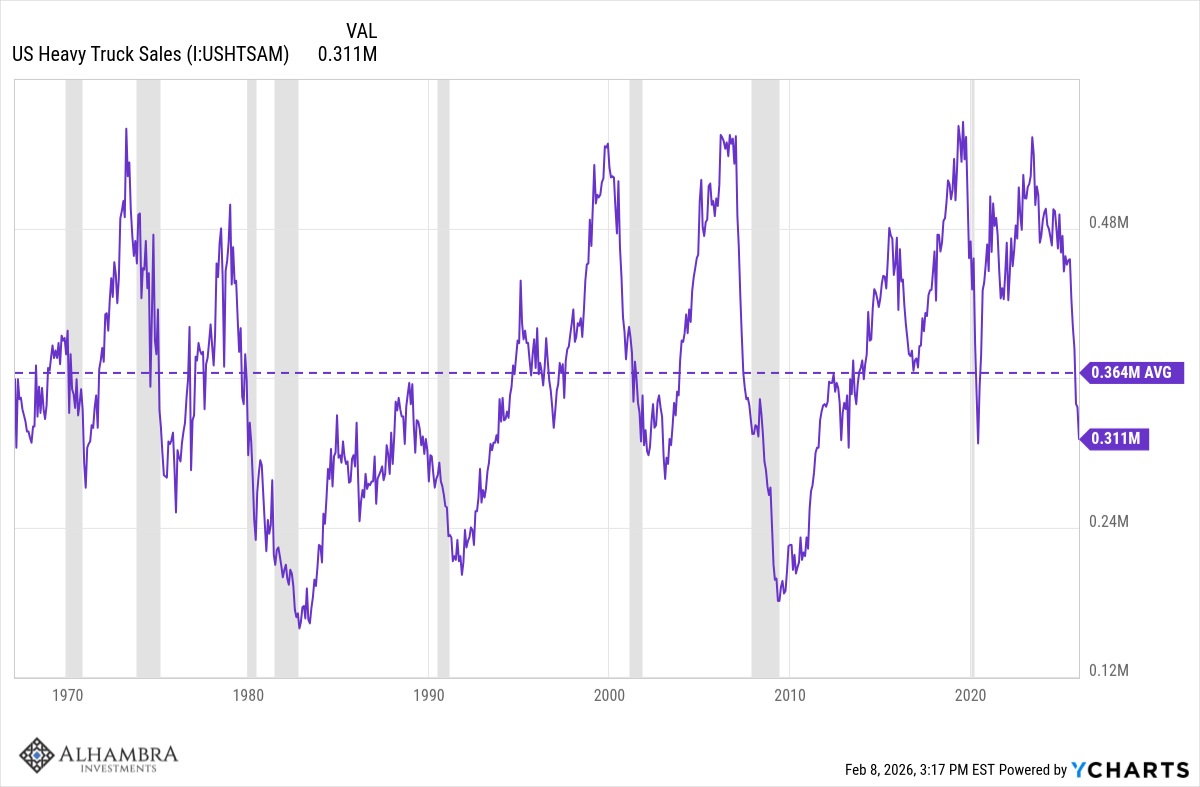

- Heavy truck sales fell 30% year-over-year in December; a reliable recession indicator that is now well below the long-term average

- Construction spending is down 1% year-over-year (October numbers) and manufacturing construction is down nearly 11% since its peak in June of 2024

- Housing starts are down 7.8% year-over-year; sales are up 18.7% off a low base

- Building permits are down 1.1% in the last year (as of October)

The biggest negative of all for the economy is consumer confidence and consumer sentiment (which are produced by different sources). The Conference Board released its latest report on Consumer Confidence last week. The overall index, the Present Situation index and the Expectations Index all fell sharply. The Expectations Index, at 65.1, is well below the 80 level that has historically signaled a recession.

“Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened,” said Dana M Peterson, Chief Economist, The Conference Board. “All five components of the Index deteriorated, driving the overall Index to its lowest level since May 2014 (82.2)—surpassing its COVID-19 pandemic depths.”

Consumers’ write-in responses on factors affecting the economy continued to skew towards pessimism. References to prices and inflation, oil and gas prices, and food and grocery prices remained elevated. Mentions of tariffs and trade, politics, and the labor market also rose in January, and references to health/insurance and war edged higher.

I wrote about the University of Michigan’s Consumer Sentiment survey in last month’s economic update and we’ve had one update since that showed some small improvements. Emphasis on small.

From an investor’s viewpoint, buying stocks when consumer confidence/sentiment is low is a contrarian play that usually pays off. The problem, of course, is that we have to figure out what “low” is and that has become more difficult in recent years. The Conference Board survey suffers from the same political bias malady as the University of Michigan sentiment poll. Republicans think the economy is great and getting better; Democrats think it stinks and is getting more foul by the day. Independents are a tad cheerier than the Democrats. This partisan split has gotten a lot worse in recent years so past readings may not be much guide to the future. Furthermore, the measures of stock market sentiment I follow are a lot more mixed than these two, more general readings.

What can we deduce from all this noise? Well, if you take consumer confidence/sentiment as being only about the economy then maybe sentiment is negative enough to be a contrarian and look for improvement. As for stocks, I wouldn’t make any big bets either way.

Interest Rates

The 10-year Treasury rate is up 2.7 basis points over the last month and sits right around the long-term average. Move along, nothing to see here.

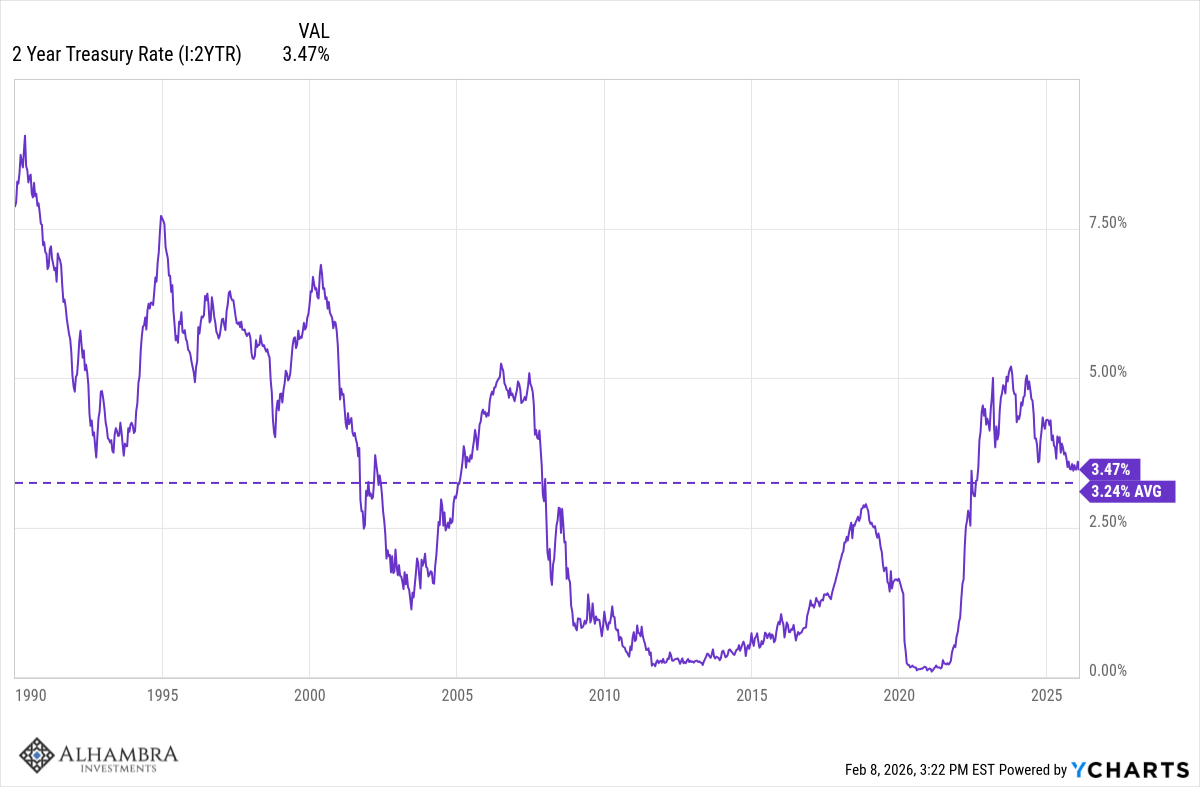

The 2-Year Treasury rate is unchanged over the last month and also right around its long-term average.

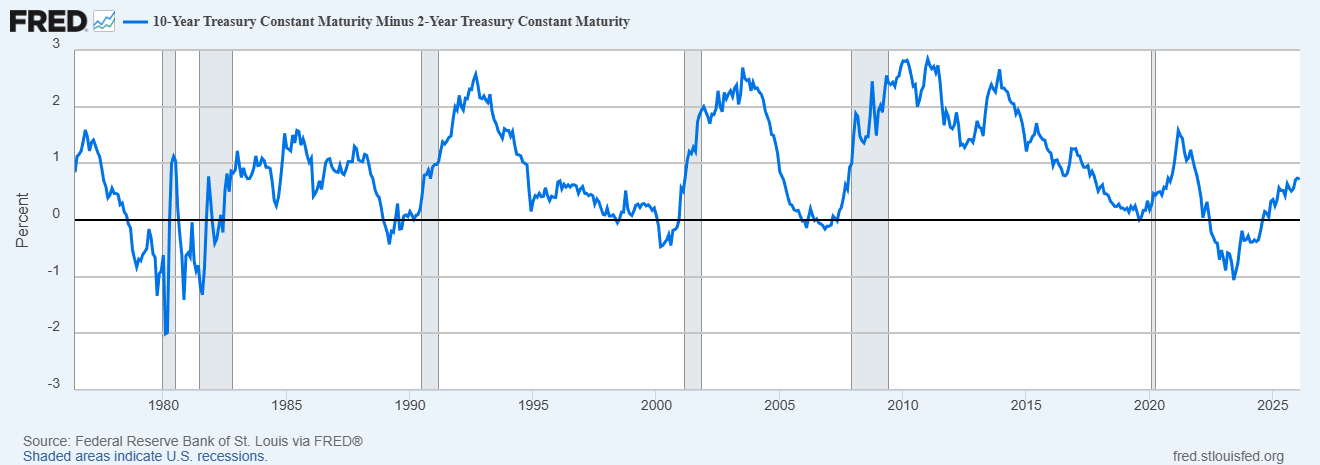

The yield curve is also basically unchanged since my last report.

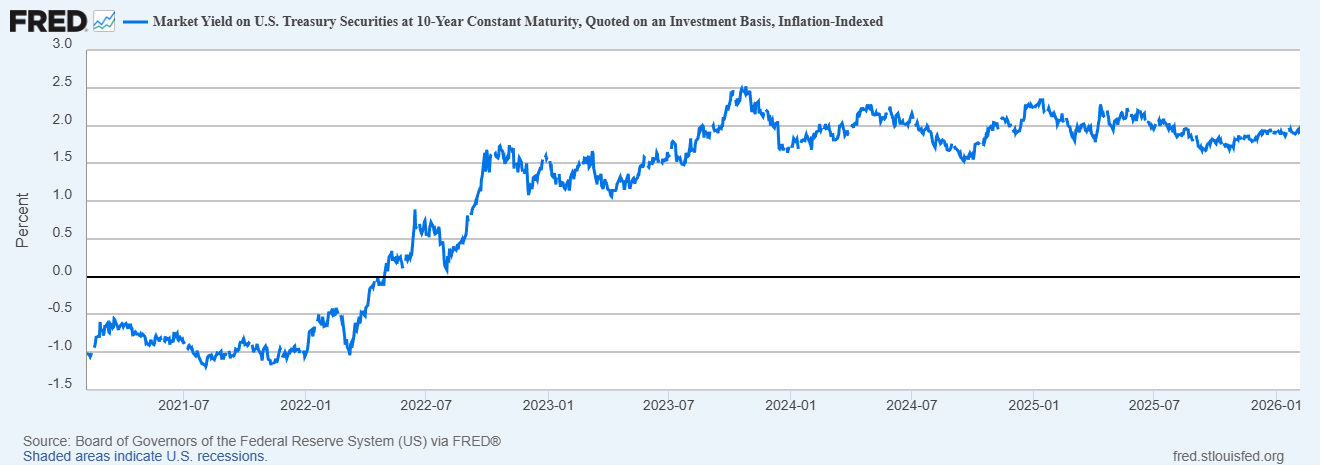

The 10-year TIPS yield is down 2 basis points over the last month and unchanged since August of 2023.

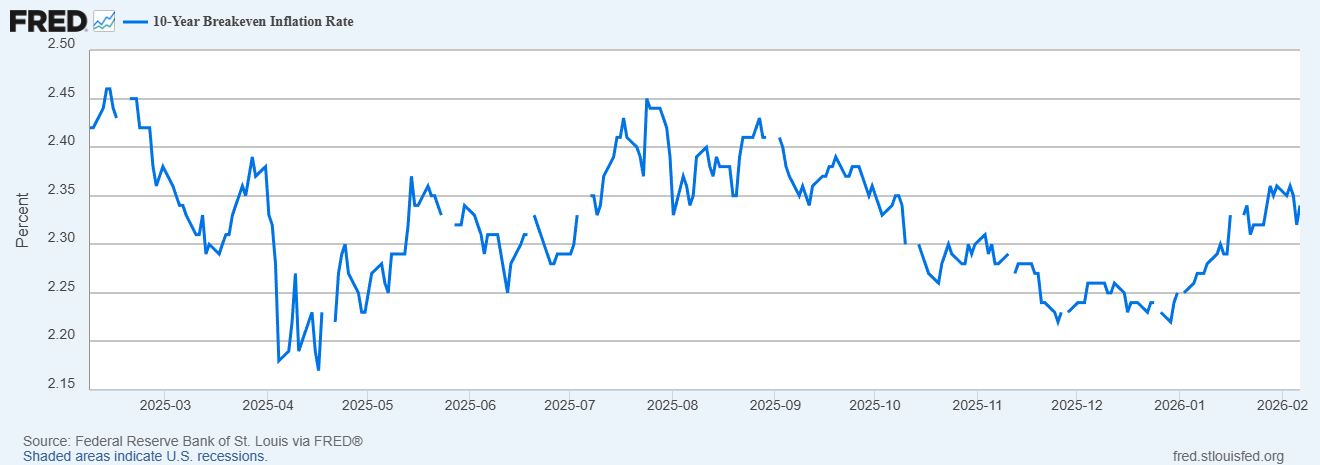

The most significant change in the interest rate complex – and it isn’t very significant – is in the 10-year breakeven inflation rate, up 7 basis points over the last month and 9 YTD.

The interest rate complex is signaling that not much has changed in the aggregate. The AI boom is being offset by negatives in other parts of the economy.

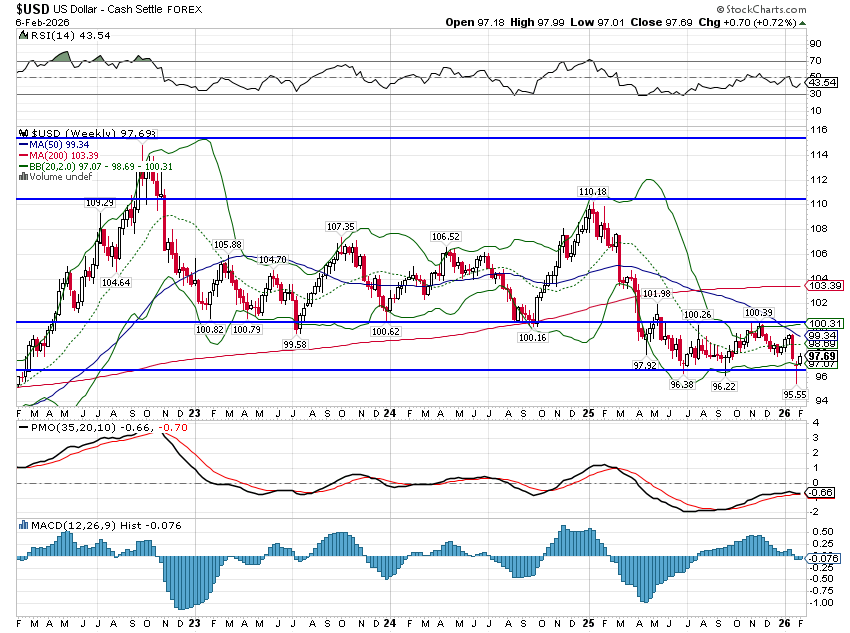

The Dollar

The dollar is down 0.9% over the last month and continues below the range that persisted from mid-2022 until April of last year (with the reciprocal tariff announcement). The drop in the dollar is the most significant development of the second Trump term and has long-term negative implications for US growth and inflation. I expect this trend to continue with next support around 90. Currency trends tend to be persistent so a long-term target around 80 seems reasonable.

I’ve said many times that investors shouldn’t try to predict the course of the economy and nothing I’ve seen from the folks who try to do so makes me think I need to change my mind. That doesn’t mean you shouldn’t think about the future but how you do so matters. Investors need to think in terms of a range of possible outcomes and focus on probabilities. And more than anything, when thinking about the future economy one needs to think about time. In general, we tend to think events will happen faster than they actually do; we have an optimism bias. And that is especially true when it comes to technological advancement, which seems pertinent at the moment. The promise of the dot com boom took way longer than anyone thought in 1999 but the future eventually arrived (even if some of us aren’t too happy about it). AI has a lot of promise too and while it may seem like things are going at warp speed right now, I suspect this boom – assuming it actually happens – will not arrive on the currently expected schedule either.

All we can really do with any degree of accuracy is to describe the current state of the economy and markets. Given the lack of real time economic data, even that is not as easy as it sounds. Right now, despite all the changes wrought in the first year of Trump 2.0, the economy has barely budged from its long-term trends. For now I see no reason to expect that to change.

Joe Calhoun

Stay In Touch