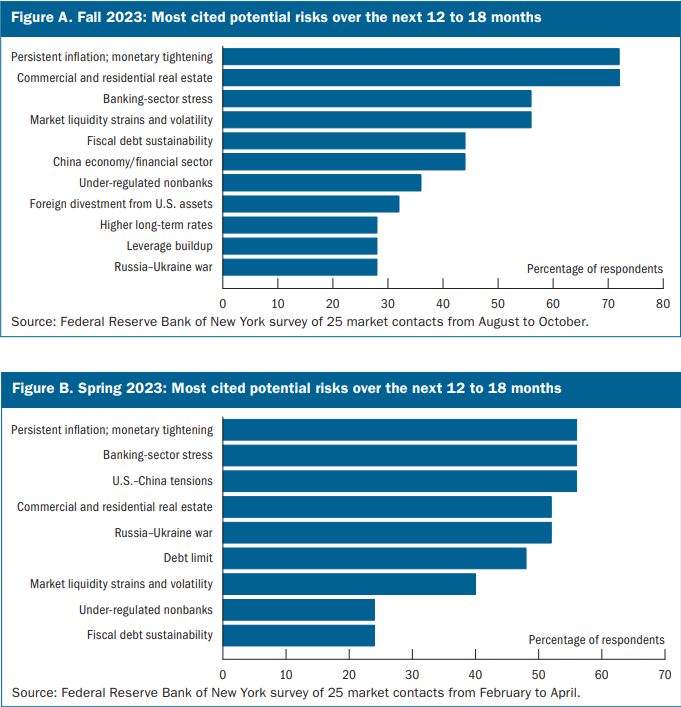

Here is a brief summary of what is of concern to domestic and international policymakers, academics, community groups, and others. We might call these “known risks.”

Persistent inflation and monetary tightening

- Persistent or reaccelerating inflationary pressures

- Resilient economic outlook leading to further monetary policy tightening

- Volatile market conditions

- Entrenched expectations of higher inflation leading to higher realized inflation leading to even more restrictive monetary policy

- Induces and even exacerbates recession

Commercial real estate

- Potential trigger for systemic stress

- Higher interest rates

- Declining property prices

- Structural shifts in demand for office space may prompt large realized losses

- Small and regional domestic bank vulnerability

- Tighter bank lending conditions

Reemergence of banking-sector stress

- Renewed deposit outflows

- Uninsured deposits

- Losses on CRE exposures

- Market liquidity strains and volatility

- Vulnerabilities among highly levered NBFIs

Weakness in the Chinese economy and financial sector

- Capital flight

- Stronger U.S. dollar

- Downward pressure on Chinese assets and other Asian markets

- Alongside weakness in Europe, increased likelihood of a global recession

- Increased foreign exchange market volatility

- Implementation of capital controls

Fiscal debt sustainability

- Treasury market volatility

- Treasury market liquidity strain

- Higher long-term interest rates and bond term premia

- Increases in sovereign bond issuance

Stay In Touch