This is one of those cases when Inigo Montoya, the lovable if fictional rapscallion from the movie The Princess Bride, would pop into the scene to devastatingly deliver his now famous rebuke. Last week, China’s one-man Dear Leader said that the country was going to start up its own version of Build Back Better. Immediately cheered by the entire Western media, every single news story contained the same phrase.

“All out.”

Cue Mr. Montoya’s wry witticism.

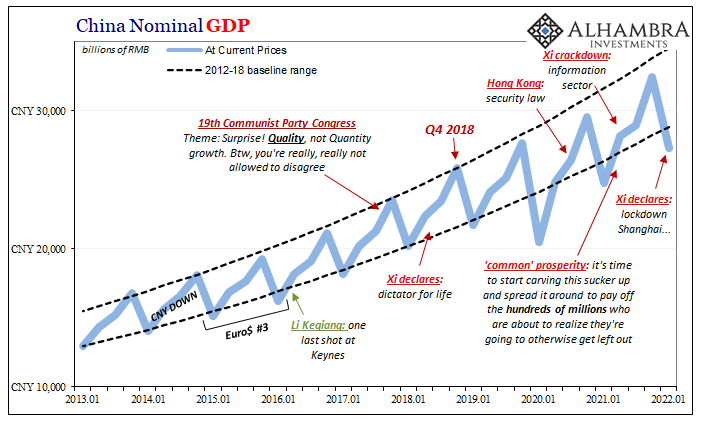

Did anyone actually hear what Emperor Xi said? On this side of the ocean, it is being made to sound as if President Biden’s dead infrastructure deal has instead been breathed new life by…the guy deliberately dressing himself like Mao Zedong (see: below). Seriously, everything about the man is designed to send a message.

What message?

While Xi referenced the Chinese economy’s recent stumble, to put it mildly, what he really said was very different than what’s been reported. “Somehow”, and we all know how, the mainstream media translated his formal Chinese into Western Keynesian rather than plain English.

But one example:

Yeah, that’s not what he said. In the face of “extreme conditions” all this new planned “infrastructure” will be highly focus on internal security. Supercomputing and AI. For the sake of China’s economy? Come on, man.Mao Zedong Xi Jinping last week blurted it out:

We must strengthen the construction of national-security-related infrastructure to improve our capacity to deal with extreme conditions.

All you need is one more translation: the Chinese Communist Party understands that locking down whole megalopolises is risky but has concluded it necessary business, so in order to achieve the same dystopian goal of crushing all dissent only without the very public pitchfork provoking jailing of entire cities it will be necessary to spend a lot more on far less high-profile authoritarian capacities.

Paging Mr. Orwell.

And if it helps “stimulate” an increasingly dire economic situation, so much the better in a two-birds-with-one-stone sort of way. At the very least, the parrots in the West will actually sing its praises on that account (if not the other, too).

Talk about forest for the trees. The translation wasn’t screwed up much closer to the message’s source:

Even the usual Communism-is-science pabulum opening went noticably absent from this weekend’s press release announcing some truly awful economic updates over there; the typical Xi-is-awesome-no-matter-what-troubling-numbers-follow was omitted in favor of only a half-hearted reassurance placed awkwardly at the statement’s end:

However, it should also be noted that the fundamentals of China’s long-term economic growth have not changed. Especially recently, relevant departments have further coordinated epidemic prevention and control, logistics smoothness and supply, and stepped up [sic] various policies such as helping enterprises and bailouts, which is conducive to stabilizing the confidence of market players…With the effective control of the epidemic and the emergence of policy effects, corporate expectations are expected to gradually improve.

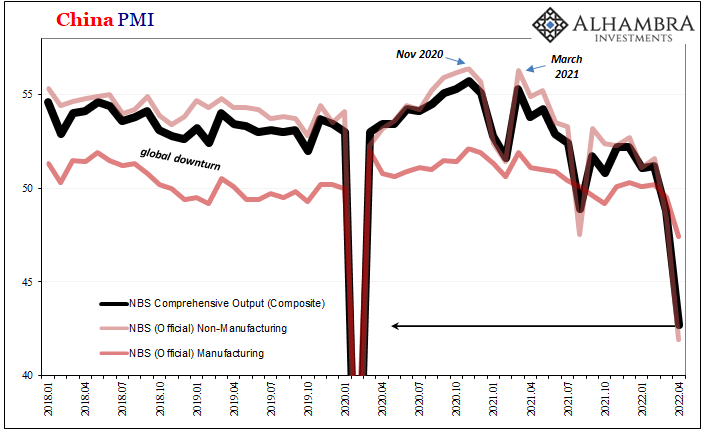

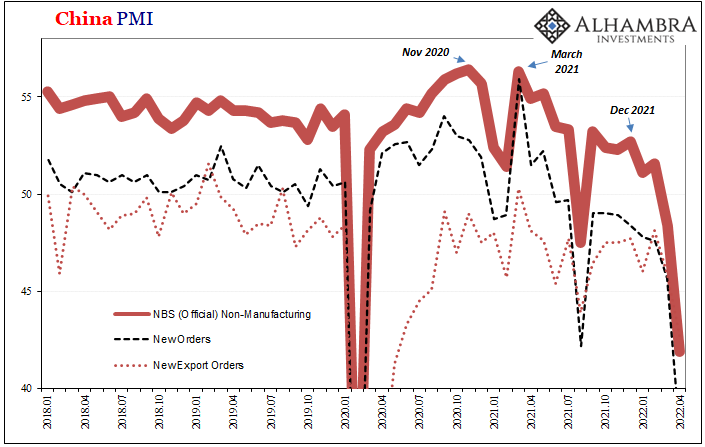

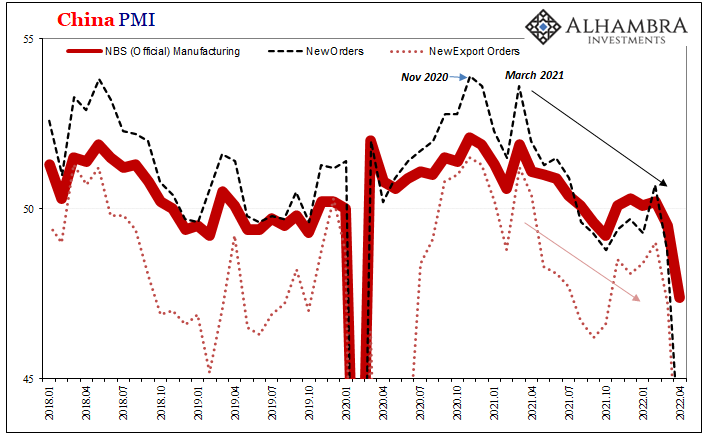

All three PMIs compiled by China’s National Bureau of Statistics crashed. Manufacturing sunk to 47.4 in April 2022 from 49.5 in March, two points below expectations set by analysts who already saw the news of Shanghai being shanghaied and Beijing sitting in Xi’s crosshairs. New Orders collapsed to 42.6, down 6.2 pts while exports orders dropped to 41.6 from 47.2 (because this is all about China’s lockdowns?)

NBS’s Non-manufacturing index reached 41.9 in April following an-already historically-low 48.4. New orders here plunged to 37.4. Full stop.

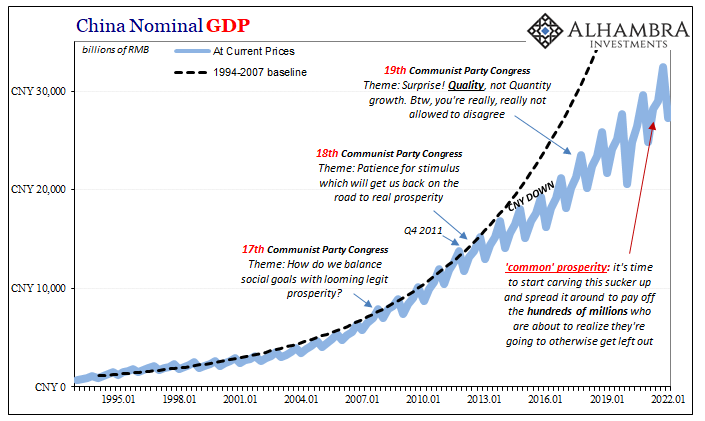

As I keep writing and saying, lockdowns aren’t the story here; they may explain the depths but don’t describe the direction which goes back more than a year now. Rather than corona, Euro$ #5.

Because of this, China’s economic disaster is just far further along compared to elsewhere around the world. These things, however, are synchronized, so elsewhere around the world is already questionably with weakness increasingly showing up outside of China rather than data/prices more consistent with inflation.

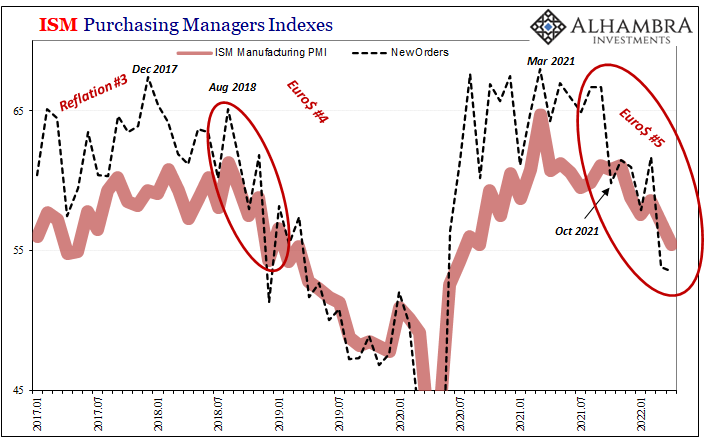

Today the US ISM reported another drop in its own manufacturing index. This one fell to 55.4 in April, down from 57.1 in March. More concerning than its continued decline is the larger one in new orders; that component had been down big in March, then failing to rebound in April (from 53.8 to now 53.5).

Domestic manufacturing, according to the ISM (S&P Global’s PMI went in a different direction), has run afoul of fewer positive orders since, yep, last October.

Put these indications together and China’s Zero-COVID stance clarifies only the distance between them. The arrival of Euro$ #5 is how both (plus Europe) are heading in the same direction if at variable speeds and timing.

Again.

For China specifically, it has been the direction of the economy which precipitated the lockdowns. Being forced into such blunt, open political and social methodology is what’s driving “infrastructure.”

Rather than some “all out” desire to gain control over a sputtering disaster of an economy, the sputtering disaster of an economy has convinced the guy wearing the Mao suit to spend whatever it takes to keep going Mao. And he has rarely (if ever) been shy as to his intentions.

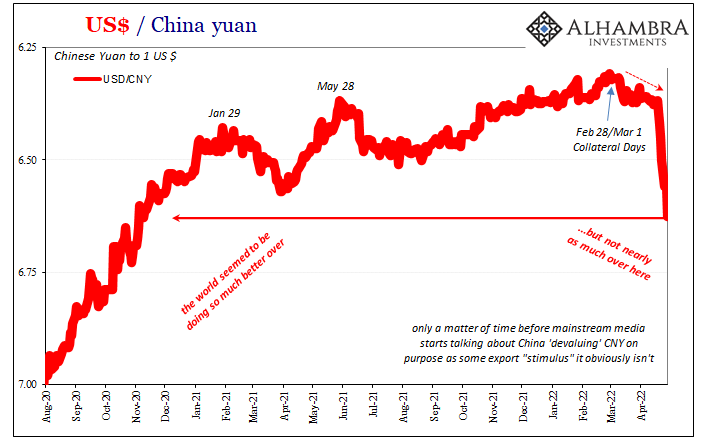

The global economy is going to do what it’s going to do, and that means the Communists are going to respond as Communists rather than Keynesians. Therefore, take away what might be left of China’s export “dollars” and suddenly CNY is the biggest Euro$ #5 out there.

Yuan, at least, that has actually been “all out.”

Stay In Touch