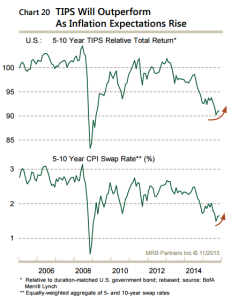

TIPS

About the Author: Marcelo Perez

Marcelo is the Head of Operations at Alhambra Investments, a fee-only Investment Advisory firm doing business since 2006. Alhambra Investments specializes in all-weather, highly diversified, multiple asset class portfolios. Give us a call today at 1-888-777-0970 or via email at [email protected] and we’d be happy to arrange for one of our investment professionals to discuss your situation with you – completely complimentary. Let’s start the conversation today.

Stay In Touch