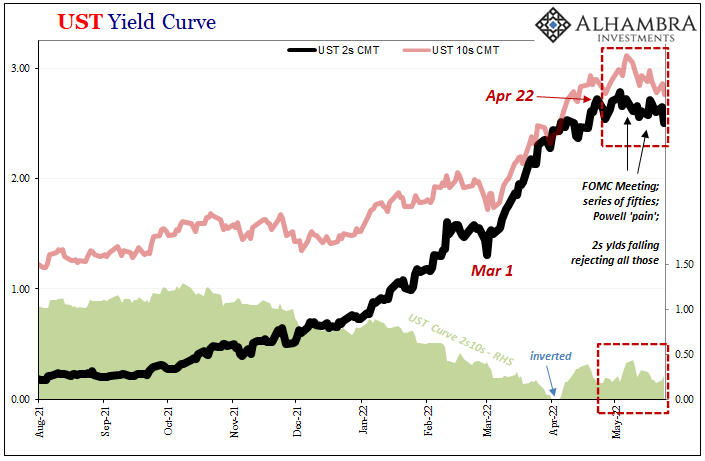

The 2-year Treasury right now is the key point, the spot on the yield curve which is influenced mostly by potential alternative rates including those offered by the Federal Reserve. Because of this, the market for the 2s is looking forward at what those alternate rates are likely to be, then pricing yields accordingly.

Since the FOMC sets those alternative rates, most of the time – like the whites and reds in eurodollar futures – the 2s simply project forward policymakers’ intended rate path. If officials say they are going to aggressively raise their policy rates, that’s where prices in the 2s are going to begin.

However, there comes a time when it just isn’t so simple as Fed says, market does. Even short-term maturities like the 2-year note are going to face complications, including those which might be priced into the back end of the yield curve. Inversion there, as it is now, indicates a strong emerging consensus about all manner of eventual negative outcomes only starting with recession.

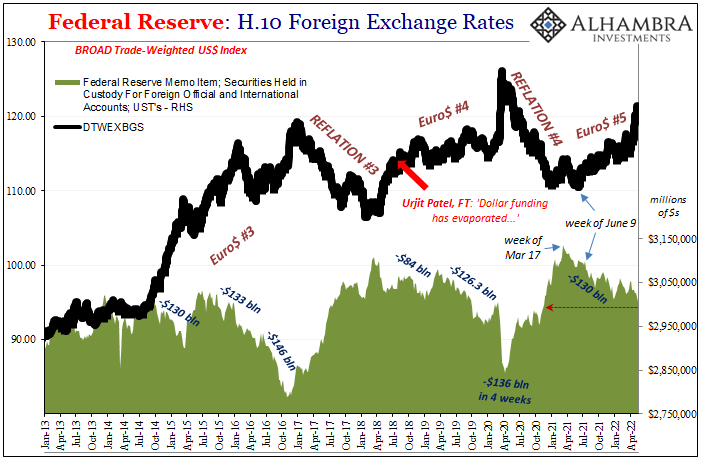

It’s not what the Fed thinks it will do up front, it’s what the market believes the Fed will be able to do given the tendency of Fed policymakers to be surprised by all sorts of downside developments, including seriously deflationary money their models never, ever see coming.

So, the 2s are for all intents and purposes the pivot between the back end where growth/inflation expectations trade independent of the Fed’s projections and policies, and faith across the market in the ability of the Fed to actually carry out its planned path and purposes. Those two competing views collide right here on the curve.

Should the 2-year yield ditch the Fed path to instead begin trading more aligned with the farther out notes and bonds, the 7s or 10s, that’s a troublesome sign for whatever is bothering the far end is no longer being fretted over as some distant future concern. When the short-term notes like the 2s stop worrying about the Fed’s rate hikes and start pricing something else, the problem must be a more immediate one.

Today’s Treasury trading is, therefore, of potentially huge concern given how the 2-year note yield dropped by just over 10 bps all in a single day. A big move, this brings the rate down to just a touch below 2.50% for the first time since mid-April.

Following the past month when the 2s seem to have been ignoring the Fed’s increasingly loud (shrill) bluster about inflation and pain, there is now a substantial and heightened possibility the short run notes (never mind bills) are, in fact, rejecting rate hikes altogether. The most aggressive FOMC stance since 1994, yet the market isn’t going along any longer.

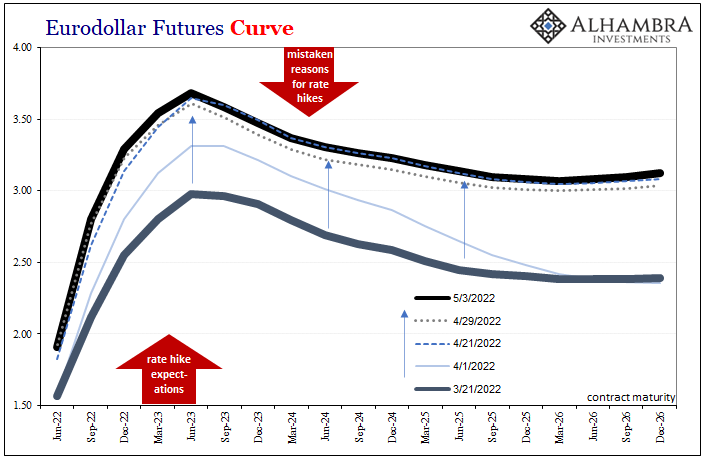

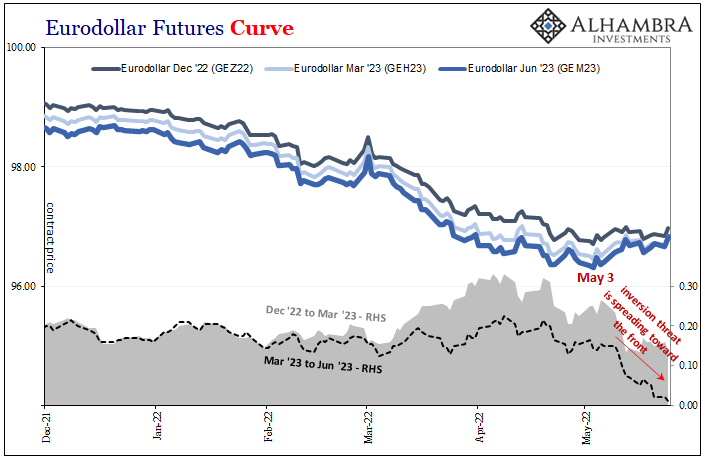

The “market” also includes eurodollar futures. It’s not just the 2-year Treasury starting to challenge rate hikes, the eurodollar futures curve likewise have tipped in that same Fed-defying direction.

This other curve has been heavily inverted in its back end, though its inversion had already cut deep into the reds. In more normal times (these times just aren’t normal, and what’s abnormal isn’t inflation), the front contract packs, whites and reds, would be just like the 2-year UST note all about the Fed’s rate hike path.

Red is Fed; or was.

When the eurodollar reds turned against the FOMC a few months ago, that was already a key warning which has only been validated by both further trading across markets (including, as you know, the spike in the US$) as well as recent global data (and not just Xi Jinping’s).

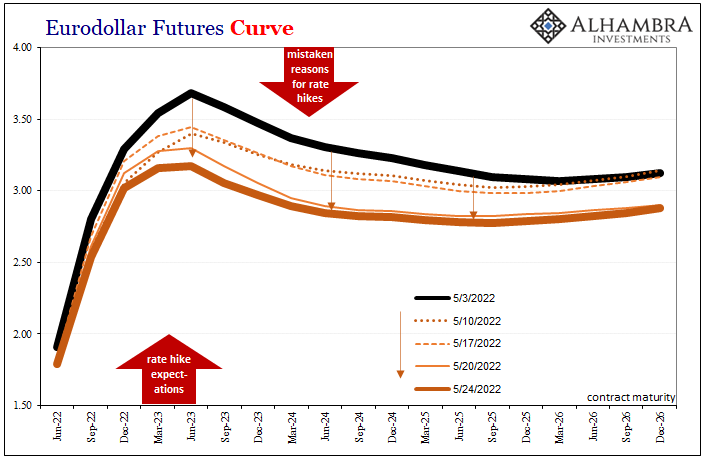

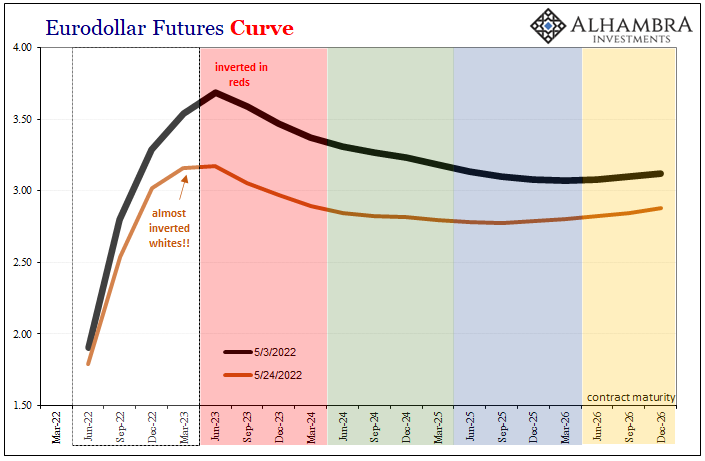

Over the past few weeks, the curve has flattened even more, and further toward the front such that some of the whites now threaten inversion. After trading today, the calendar spread between the March 2023 contract and the June 2023 was basically a blip (above). Even the spread between the December 2022 and March 2023 has dropped considerably (also above).

If Jay loses the whites, too…

In other words, eurodollar futures are corroborating the rejection move in the 2-year Treasury. Again, whites – even more than reds – are supposed to be all Fed all the time. Bad news, obviously, for Jay Powell and his inflation-is-the-biggest-risk rationale with so much of the overall market now shifted to being more worried about the deflationary scenarios driving each back-end inversion.

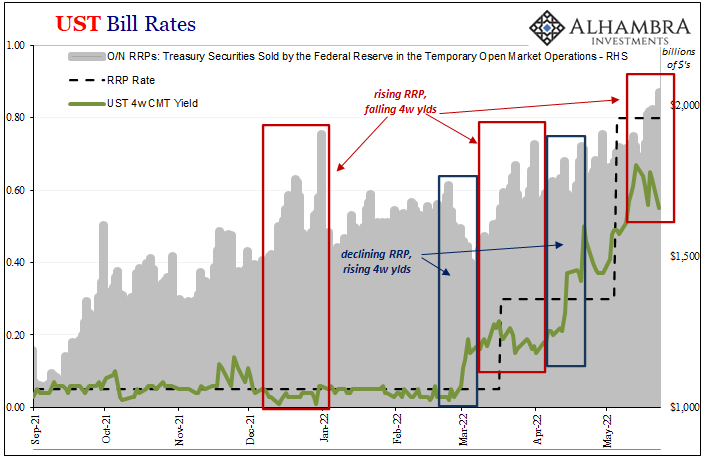

To put it bluntly, combined eurodollar futures and short-term Treasuries, what’s being indicated is the point at which the FOMC is forced to stop hiking must be fast approaching the here and now (as always, officials won’t end the rate hikes voluntarily); the short run view. After all, T-bills and all that for collateral problems.

The more 2s yields drop, the further up the curve into the whites the eurodollar futures inversion spreads, the more you know what’s going wrong has turned into (more of) an immediate problem.

Landmine at last?

Stay In Touch