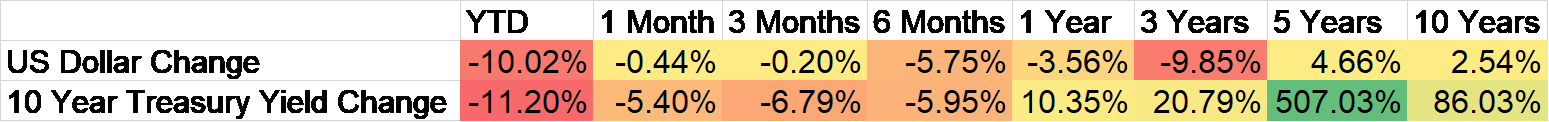

With the dollar index and interest rates in downtrends, it seems the US economy is slowing absolutely and relative to the rest of the world. The slowdown, so far, doesn’t look that severe and we are likely to get a rate cut from the Fed this week. Last September, the Fed surprised the market with a 50 basis point cut and then followed that up with two more cuts before the election. There was – and is – a lot of speculation that the move was politically motivated but I don’t see it that way – and neither does the market. The economy was slowing before that cut; that’s why the 10-year rate had fallen over 100 basis points from April to September. Long-term interest rates started to rise almost immediately after the September cut and ultimately moved up about 120 basis points by the end of the year. Rising long-term rates is an indication that nominal growth expectations are rising – which is exactly what you should want after a rate cut. If they had cut and long-term rates continued to fall, that would have been the market saying “you didn’t do enough”.

So, it will be interesting to see how long-term rates move after the FOMC meeting tomorrow. President Trump wants lower long-term rates but cutting short-term interest rates is no guarantee he’ll get his wish. And whether he knows it or not, it isn’t what he – or investors – should want.

Environment

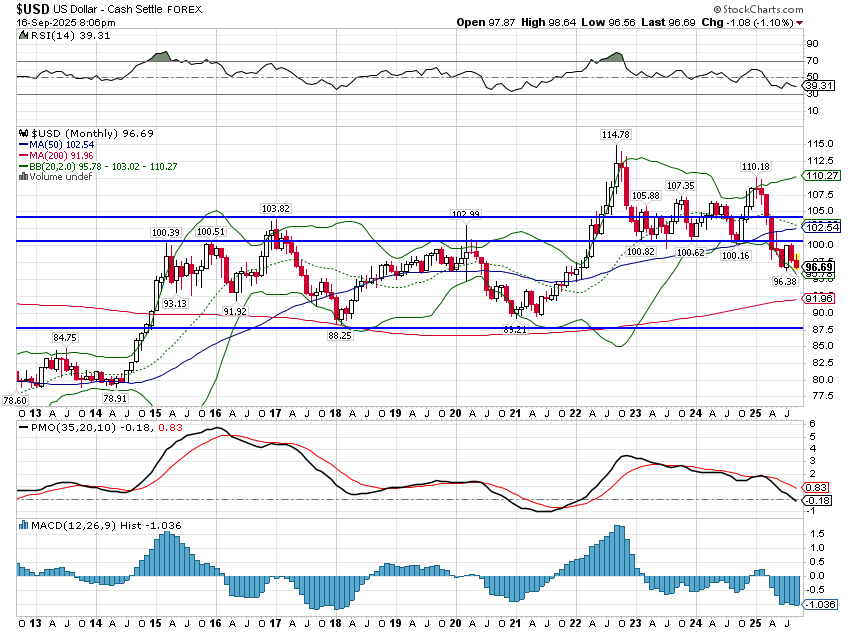

The dollar closed at its low for the year today (9-16-25) although it is still above the intraday low set in early July. It’s down over 1% in the last week. I’ve been posting the weekly chart for the last three years but I had to shift to the monthly to show the relevant technical levels. It’s pretty obvious that the next support level is around 90 and maybe a skosh lower. That has been our first major target – in what we expect to be a long and deep slide for the buck – since the downtrend started in late 2022. It will not go there in a straight line – there will be rallies too – but the technicals are pretty clear. The dollar index is in an intermediate and short-term downtrend that is looking pretty determined to turn into a long-term downtrend. That could reverse but I think it would take a major change in economic policy that just doesn’t look to be in the cards right now.

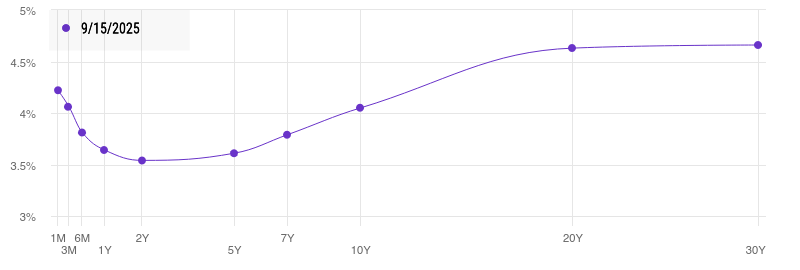

Currency movements are mostly about changes in relative growth expectations and that seems to apply here, where the US economy is expected to continue slowing while the rest of the world is not. We see this in the expectations for interest rates via the yield curve. For instance, the US yield curve is inverted at the front end with the 3-month Tbill yielding 4.06% while the 2-year is yielding 3.54%; the market is expecting the Fed to cut rates and keep doing so for a while. In Europe, on the other hand, the yield curve is not inverted at the front end (see chart at ECB: https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/euro_area_yield_curves/html/index.en.html); the market does not expect further rate cuts. Rates are higher in the US than Europe but today’s rates aren’t what moves markets.

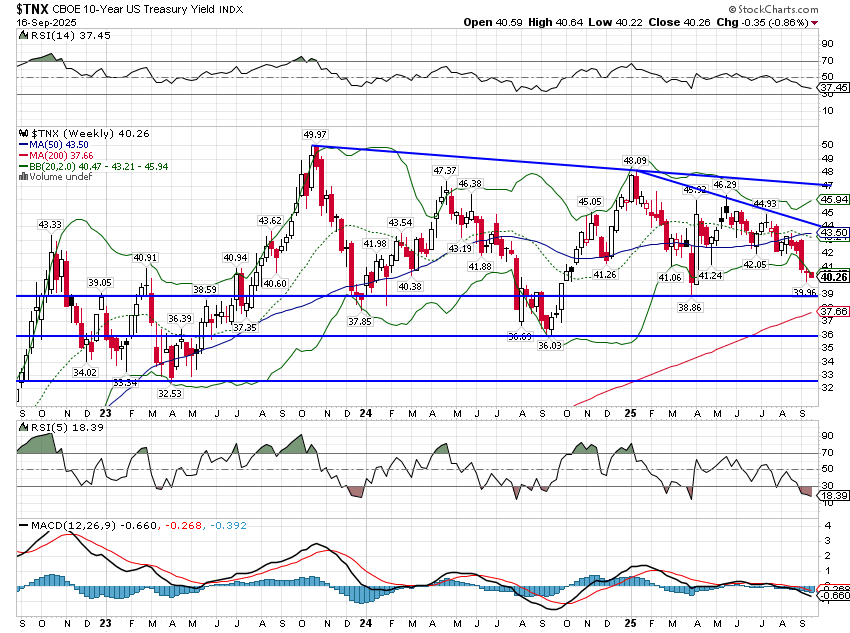

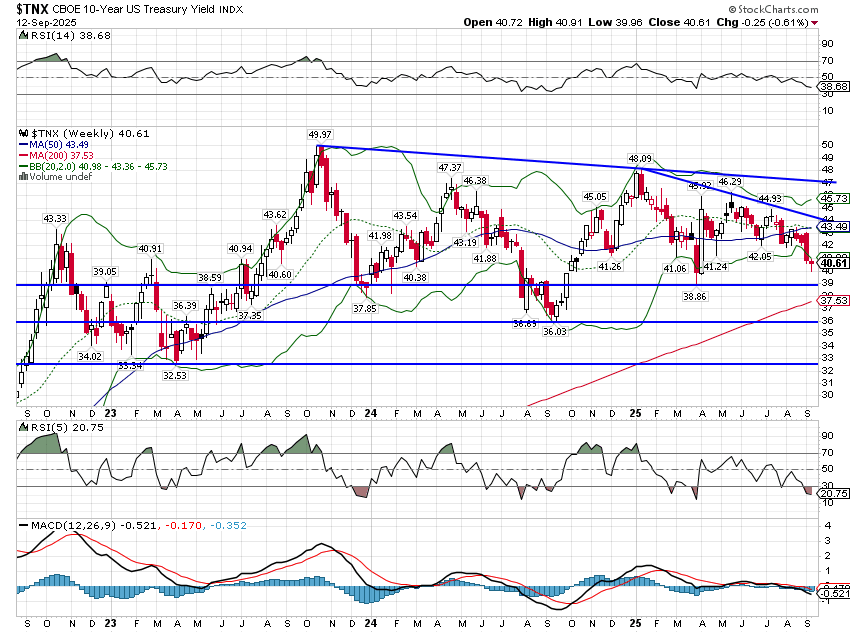

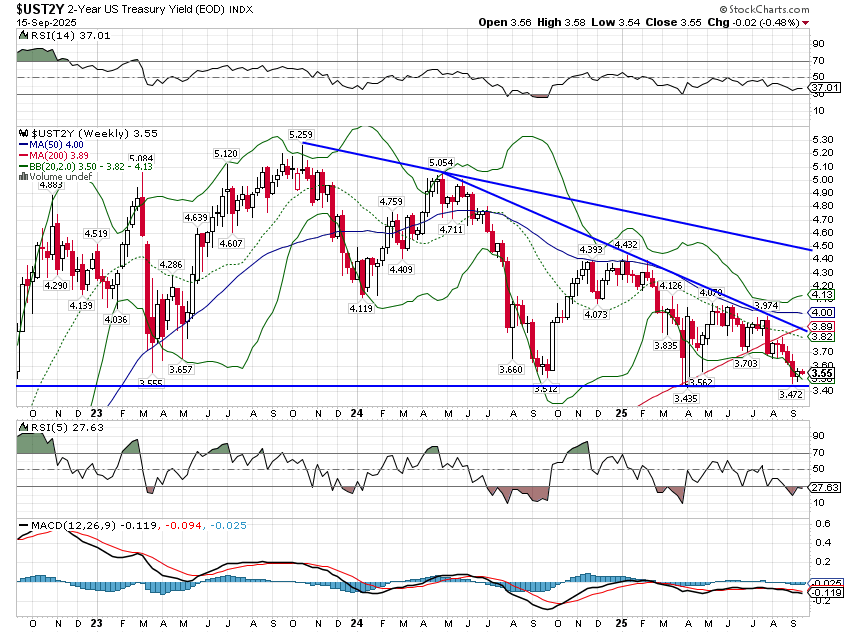

Rates on the long end of the yield curve have been falling recently and both the 10-year and 2-year note yields are close to slipping below long-term support.

Remember the 10-year nominal yield is a good proxy for nominal GDP growth so a slip below 4% starts to look a little dicey for the economy. My guess on real growth and inflation right now is roughly 1.5% on the former and 2.5% on the latter for the near future. That comes from the trend of big picture indicators like the CFNAI showing growth slightly below trend and the trend of the incoming inflation data. Both of those can change quickly of course, but that looks to be a reasonable expectation right now. So, a 4% 10-year makes perfect sense (1.5% + 2.5%). But if the yield moves much lower, it better be because inflation is falling because once you get real growth down to about 1% it is hard to stay out of recession. As you can see, we’ve been here before recently – rates fell as low as 3.6% before the Fed cut last September – so it doesn’t have to mean recession; it just makes it more likely.

The 10-year yield, like the dollar, is in an intermediate and short-term downtrend.

The 2-year has stabilized over the last week but the trend is obviously down. SOFR futures currently has rates falling to about 3% in March of ’27 so the market isn’t anticipating a deep recession, at least right now. If that is correct, the 2-year yield probably has a bit more to fall but not a lot.

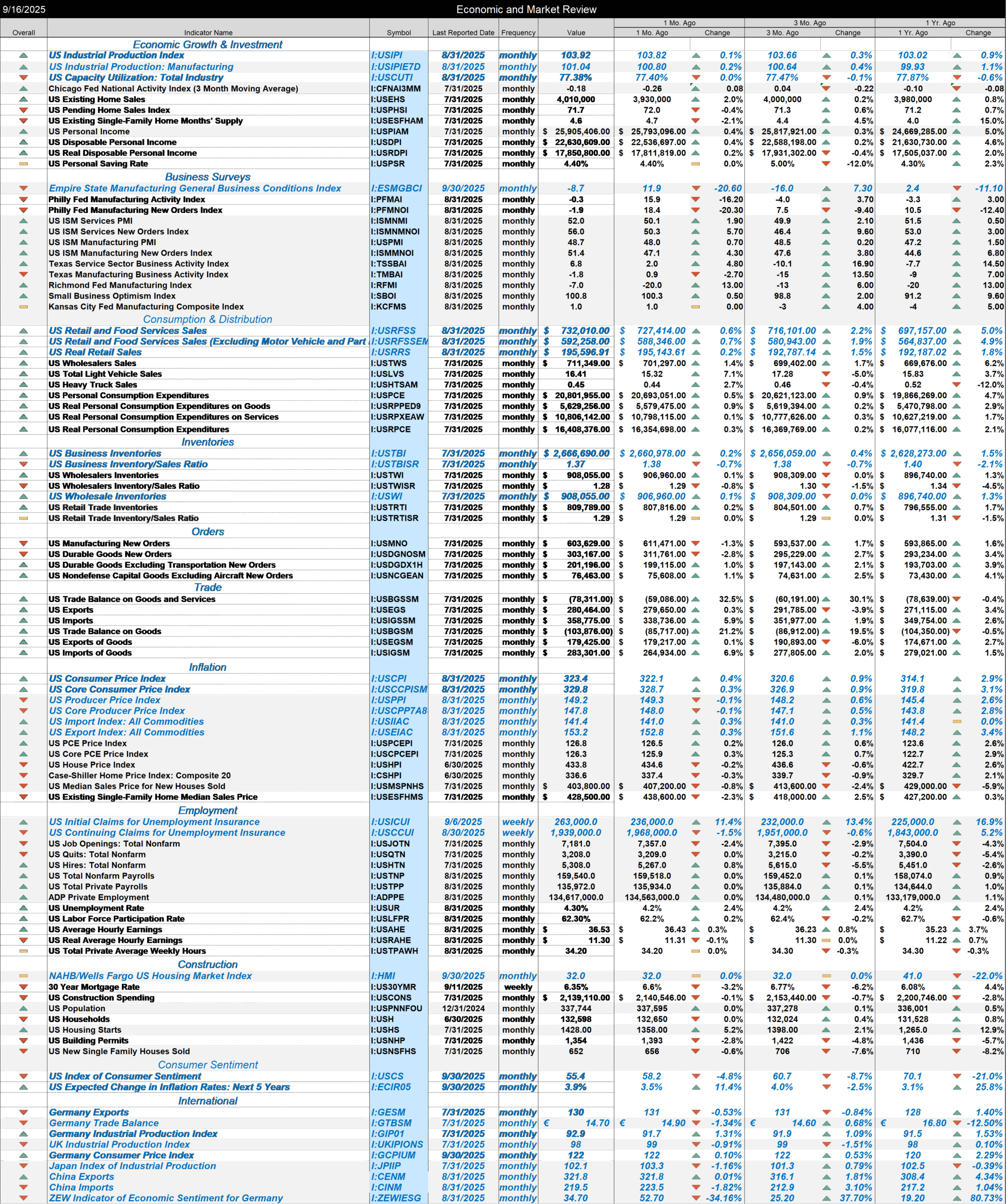

Economy/Market Indicators

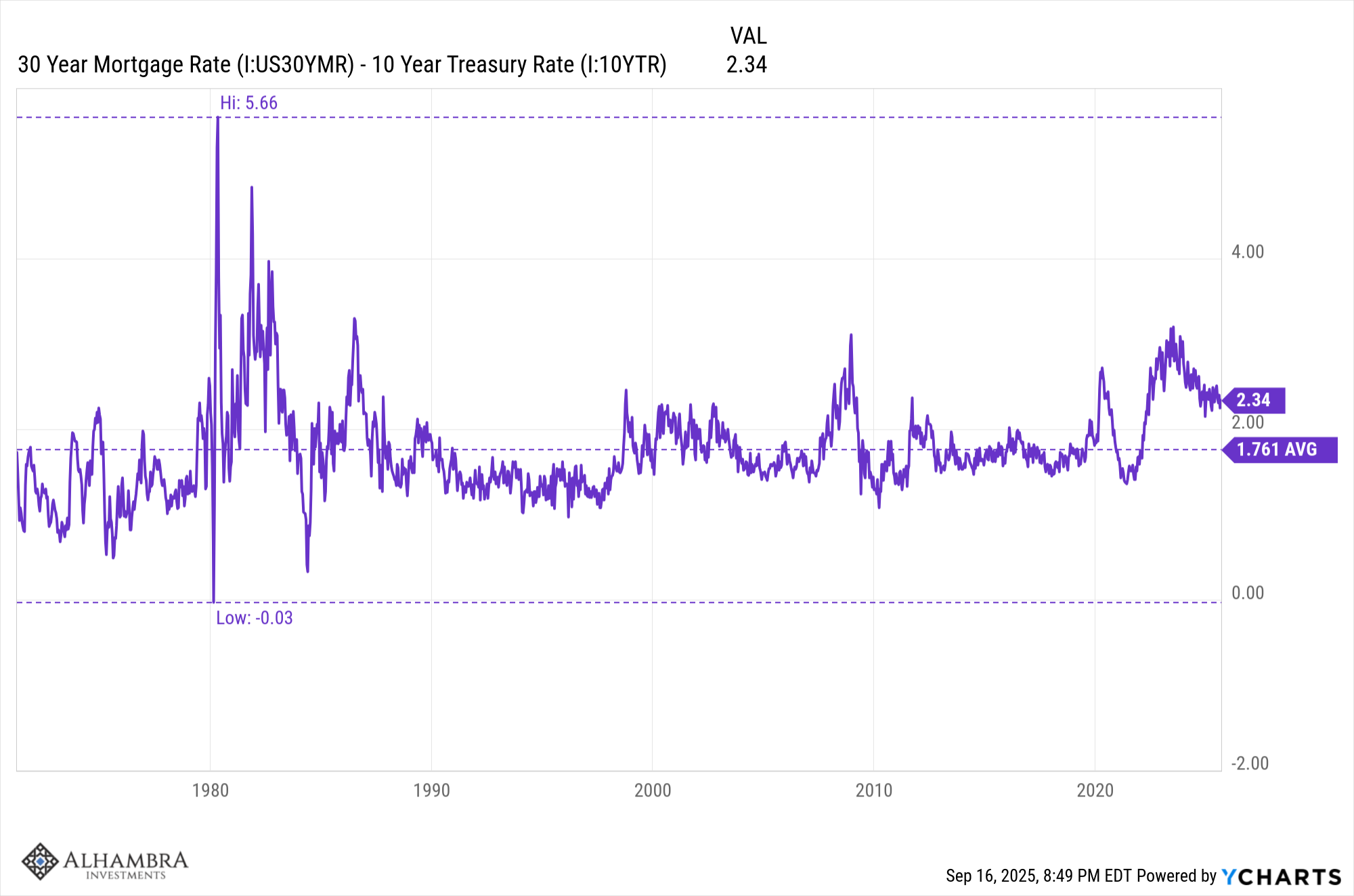

Mortgage rates continue to fall but the spread to the 10-year is still wider than the average at 2.34%. If rates get below 6% I would expect housing activity to pick up but only if it falls because the spread closes. If it falls because the economy continues to get worse, the economy will take precedence over rates.

Economy/Economic Data

- The inflation reports last week were not that great with core CPI and PPI both near 3%. I suspect that will matter more to the FOMC than most expect. If so, it will show up in the dot plot and the press conference. I do not expect the Fed to signal an aggressive rate cutting cycle.

- The import and export prices released this week were both benign, particularly import prices which are flat over the last year. That doesn’t mean foreign exporters are eating the tariffs – import prices are pre-tariff so they would have to fall to indicate that – but it may well mean they are foregoing price hikes that would have happened without the tariffs. Not a great result but maybe a bit better than expected by all the folks who are waiting for tariffs to show up in inflation.

- The Empire State manufacturing survey fell back into negative territory after poking into positive territory for a couple of months. The index has been mostly negative since the beginning of 2022 so it isn’t new but it isn’t positive either.

- Retail sales were pretty strong but real retail sales have been stalled for over 4 years. The August numbers were no higher than June of 2021. They have recently picked up some but that may well be from front running of tariffs.

- Total business inventory/sales ratio has been falling since peaking in March of ’23 at 1.43 and now stands at 1.37. It has been much lower in the past (1.25 – 1.30) and I expect it to fall further as companies work off inventories to avoid tariffs as much as possible.

- Initial jobless claims jumped 27k last week but all of that was in Texas and the state’s labor office is now saying the jump was due to fraudulent attempts to collect benefits. We’ll get another read Thursday. Even if the jump in claims was real, the current level is still low compared to history. Claims are not yet a problem even if they are – may be – going in the wrong direction.

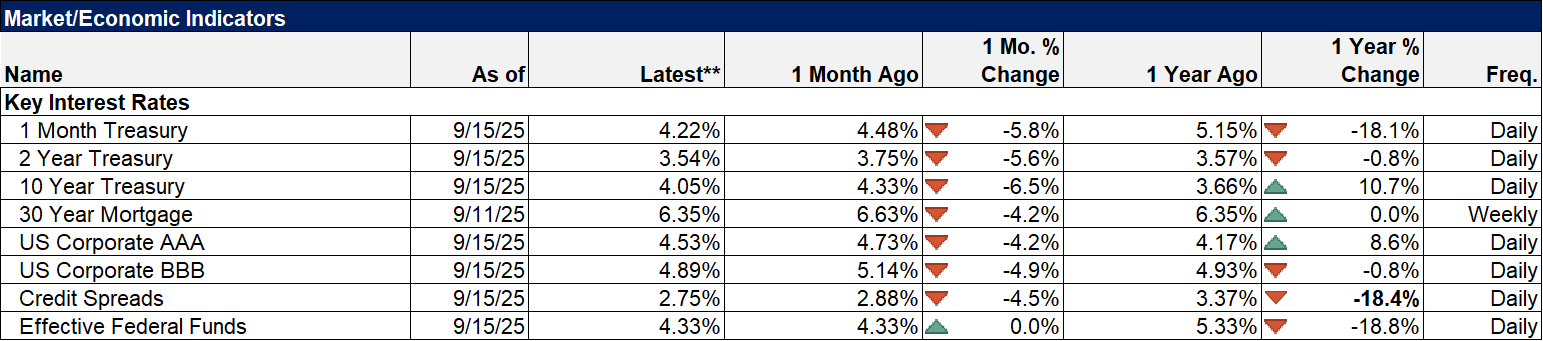

If you look over that entire chart of data below you’ll find an economy that is still growing but not at a very rapid pace. There really isn’t anything surprising: housing is the most obvious negative but it isn’t terrible, real disposable personal income is positive but up only 2%, about 0.5% below the long-term average, all of the regional fed manufacturing surveys have improved over the last year except Empire but there’s no manufacturing boom, the year-over-year change in consumption is positive but below the long-term average, inflation is higher than the target and employment growth has slowed to a crawl. That adds up to a slow economy but not one in recession.

Latest reports in blue.

Stay In Touch