Every time we hear, watch, or read the news, we are reminded that liberty is a rare commodity in this world.

– Ronald Reagan

It is foolish and wrong to mourn the men who died. Rather we should thank God such men lived.

– George S. Patton

In the End, we will remember not the words of our enemies, but the silence of our friends.

– Martin Luther King

There is nothing wrong with America that cannot be cured with what is right in America.

– Bill Clinton

Patriotism is supporting your country all the time, and your government when it deserves it.

– Mark Twain

Today is Memorial Day, when we honor the men and women who died while serving in the US military. I would add that we should also remember and honor the families of those who died in such circumstances. They have suffered more than those of us who never experienced such loss and deserve our gratitude, our support, and our tribute.

I chose the quotes above for my own reasons. You may not agree with all of them but to me, they represent the universality of the pride we all feel for our country.

________________________________________________________________________________

One is rarely surprised when expecting the least from our elected officials – although rock bottom does seem to get lower every year – so I don’t expect much to come of this. We will not be balancing the budget this year. We won’t be cutting or raising taxes, getting rid of any regulations, or passing out fewer subsidies to favored industries. But I don’t think we’ll be defaulting either.

– Me, one week ago

And so we have a deal. Or at least President Biden and Speaker McCarthy have a deal. I don’t know if they have the votes to get this passed but I doubt they would have announced anything without counting noses and yeses. So, I assume they’ll pass something and end this latest episode of The Debt Ceiling as all the previous ones ended – with an agreement that accomplishes exactly nothing.

I haven’t read the entire bill and have no intention of doing so because it amounts to a hill of beans. It doesn’t mandate any meaningful spending cuts, it doesn’t close any tax loopholes, it doesn’t reduce the deficit, it doesn’t reduce regulation and it doesn’t reduce any subsidies. About the only thing it does that might impact the economy in any significant way is to end the moratorium on student loan repayments…one month sooner than previously scheduled. Ok, never mind. What it does is yield headlines like this:

McCarthy Won the Debt-Limit Deal. Biden Did, Too.

Assuming the deal passes, how will it impact markets? I am reminded of the old Wall Street adage to “buy the rumor, sell the news”. The odds of an actual default were miniscule and a resolution with little substance was the most likely and obvious outcome, evidenced by the fact that even I figured it out. But is that why the stock market is up 3.7% in the last month? If it is, then one might expect some selling on the news of a deal.

But was the prospect of a debt ceiling compromise really the driving factor for stocks over the last month (or quarter or YTD for that matter)? I have my doubts since I don’t think anyone really treated the idea of an actual default as a serious possibility. It isn’t a popular idea these days but I think we ought to consider the possibility that it is the fundamentals that are moving the market.

The economy continues to show remarkable resiliency. Economic growth is not great but it is better than expected, an outcome accomplished for most by merely staying positive. Q1 GDP growth was upgraded last week on the second estimate to 1.3% and that, if anything, understates the strength. Inventories shaved 2.1% off that total last quarter. The inventory correction is largely over though so inventories may well prove a positive in coming quarters.

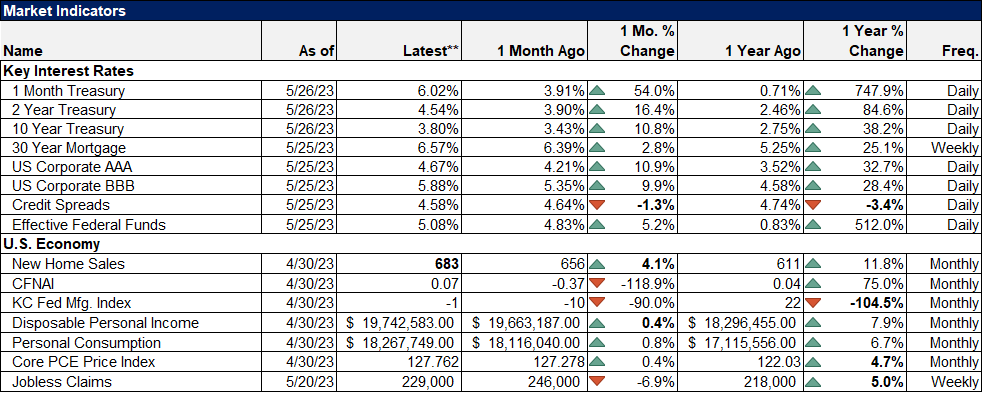

A broader measure of economic growth, the Chicago Fed National Activity Index, was released last week that confirms that the trend of Q1 is continuing into Q2. The reading for April was 0.07, a considerable improvement from March’s -0.37. The recent low was in November 2022 at -0.56 and we’ve seen a choppy improvement since then. A reading of zero indicates growth at trend, which today is right around 2%, while a 3-month average of -0.75 indicates recession.

S&P 500 earnings have also been better than expected and while there has been a lot of reporting on the small year-over-year decline (currently about 2%), there has been almost none on the sequential gains. With 95% of the companies in the index reporting, operating earnings are up about 5% from Q4 ’22 and 13% from Q2 ’22. That is now 3 consecutive quarters of sequential improvement. Even more impressive is the improvement in margins, up nearly a full percent quarter over quarter.

Predicting the short-term direction of the stock market is a mug’s game and one I don’t play. I don’t know what the market will do now assuming the debt ceiling melodrama is over. There is a din of hype around artificial intelligence that is hard to ignore despite there being little substance to it at this point. Over a quarter of companies in the S&P 500 mentioned AI on their quarterly conference calls and I’d be shocked if a quarter of those have any idea what the term even means. AI is improving rapidly but this is early times and its ultimate impact is still a big unknown. So, yes, looking at stocks like Nvidia makes me think sentiment might just be a tad too bullish right now. A correction of some sort would not be surprising at all.

Markets have, in recent weeks, started to price in another rate hike and pushed rate cuts out to near the end of the year. With inflation proving stubborn and economic growth barely affected by rate hikes (other than the real estate slowdown), the risk for investors is that rates have higher to go. All else equal, higher rates mean lower valuations. Earnings can continue to grow, even in recession, if nominal GDP continues to grow. NGDP growth never turned negative in the 70s and earnings grew from $5.73 to $15 during the decade despite 3 recessions. By contrast, earnings only grew to $22.49 in the next 10 years with only one recession.

So, the question for investors is whether earnings growth will be sufficient to offset lower valuations. There are too many unknowns to produce a confident answer but that probably wouldn’t prevent AI from providing one. And it would probably be as accurate as most of the research produced by Wall Street.

Environment

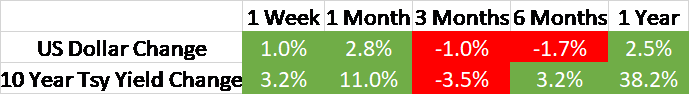

The dollar rose last week to the 104/105 area we identified last week as a short-term objective. The trend is still neutral but it would not take much to change that to an uptrend.

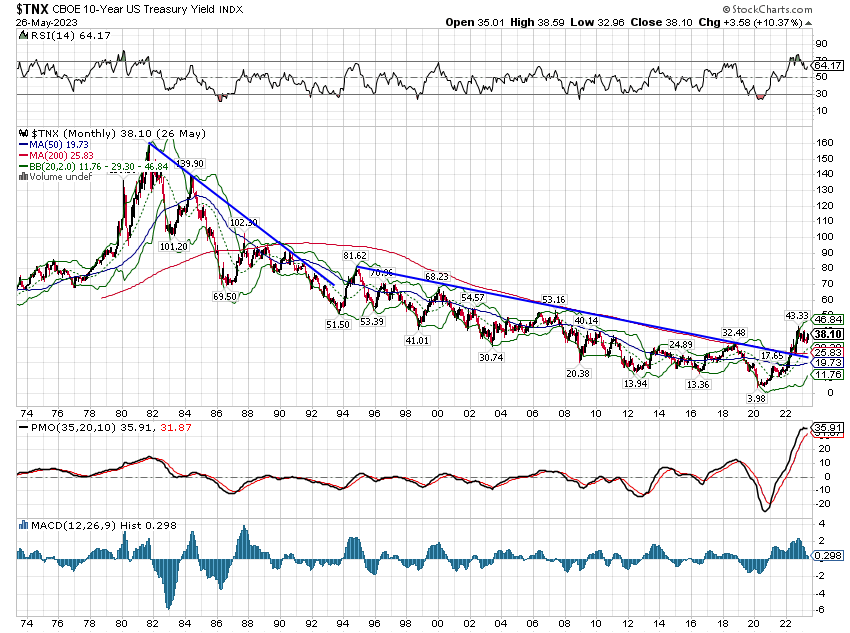

The 10-year Treasury yield is still in a short-term downtrend but it is near the top of a declining downtrend line. Shorter term rates are still trending sideways with the exception of the 1-month TBill which broke out above 6% last week on debt ceiling fears. Assuming the debt ceiling deal struck by McCarthy and Biden over the weekend actually gets passed by Congress, we would expect Tbill rates to fall some. How much? That depends on how much they were actually up because of debt ceiling fears. My suspicion is not as much as most people think.

Will the economic/inflation data support higher rates from here? The data has certainly been better over the last couple of weeks but real growth is right around trend of about 2%. Inflation has not come down as rapidly as the Fed – or anyone else – would like but the next couple of months may prove a turning point in the rent category. Overall, I see little reason to expect a big move in rates either way.

The dynamics for the dollar are a bit different but not much. The global economy is slowing and the US is no exception. If there is little change in relative growth expectations there shouldn’t be much change in currency values either. We may be entering a period of calm for currency markets.

Markets

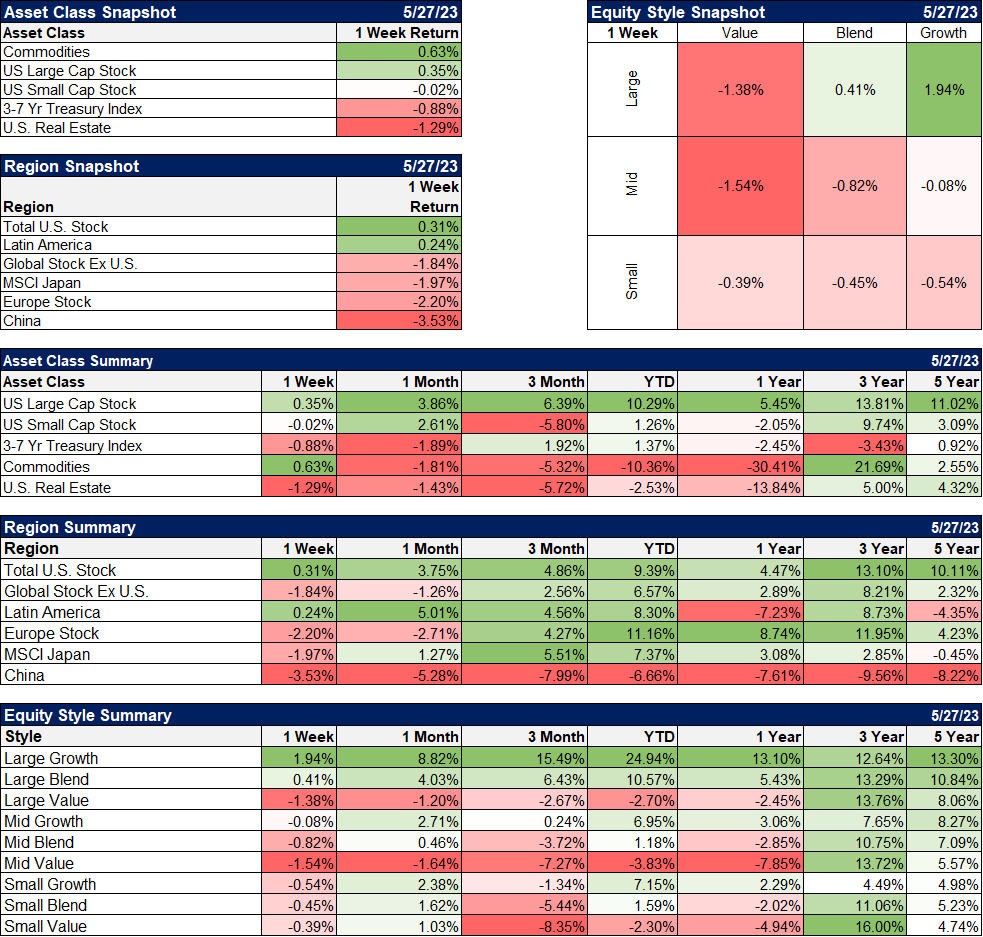

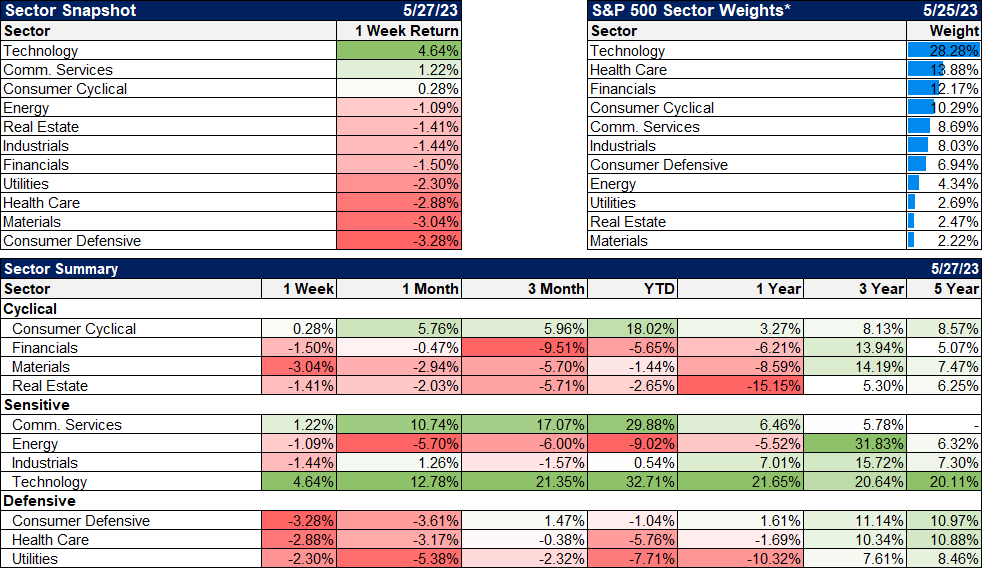

Large-cap growth stocks continue to defy gravity. Growth is the only style part of the US stock market higher this year. When interest rates were zero one could maybe justify paying very high multiples for growth but with rates where they are today, one has to assume a very high rate of earnings growth to justify current multiples. Can AI really accelerate growth enough to justify today’s tech sector multiples? I have my doubts but apparently no one else does. There are reasonably priced stocks in the tech sector and growth more generally but the ones getting the most attention aren’t among them.

Commodities had a good week but that was almost entirely due to crude oil. More economically sensitive commodities like copper, platinum, and palladium were down as were the ag commodities.

Real estate had another down week with rates higher. Sentiment on real estate is as bad as I’ve ever seen and we are starting to see deep value and distressed investors (such as Oaktree Capital) enter the sector. They might be a tad early but I don’t think they’ll be wrong.

Technology and communications (which is mostly tech too) were the biggest winners for the week as they have been for almost all of this year. Cyclical stocks have also done well this year and were up slightly last week too. Only 4 of the 11 sectors in the S&P 500 are up on the year and one of those – industrials – less than 1%.

Market/Economic Indicators

Credit spreads improved last week and continue to trade less than the long-term average and below the levels of a year ago. There is no stress in credit right now.

The CFNAI came in at 0.07 for April, an indication that growth is still right around trend. It should be noted though that last month was revised significantly lower and the 3-month average is now -0.22. A reading of -0.75 is generally evidence of recession so we aren’t there yet but we are in uncomfortable territory.

As I said last week, the debt ceiling drama is about politics, not economics. The real threat of the deficits and debt is long term and it is economic. Government spending may show up as GDP growth in the short term but the book about successful industrial policy is a pamphlet. Or maybe a memo. The debt incurred to fund such policies, like the CHIPs Act, are a drag on future growth. Interest expense takes up a larger and larger portion of the budget and ultimately affects more essential spending. Interest expense in the US is now $1 trillion per year which is starting to sound like real money.

This debt ceiling drama isn’t meant to address this long-term issue but eventually, we’ll have to do so. Doing so means hard choices on taxing and spending or inflation. Since we’re talking about politicians, I think you know which one they’ll choose. How the debt is inflated away is probably less important right now than just knowing that is the likely outcome. If higher inflation is part of our future, you have to start thinking today about how to address that in your investments. Over the last 30 years, interest rates fell along with inflation and investors could forego protection from rising prices. The next 30 years will likely prove a lot different.

Joe Calhoun

Stay In Touch