As is my custom, I’ll be taking a break from these weekly updates for the rest of the year. That doesn’t mean I’ll be loafing my way to year end though. I’ll probably do some short posts as things come up before year end but my main focus will be on the 2026 outlook that we’ll publish in a couple of weeks. This week will just be a short update on how markets have performed year-to-date.

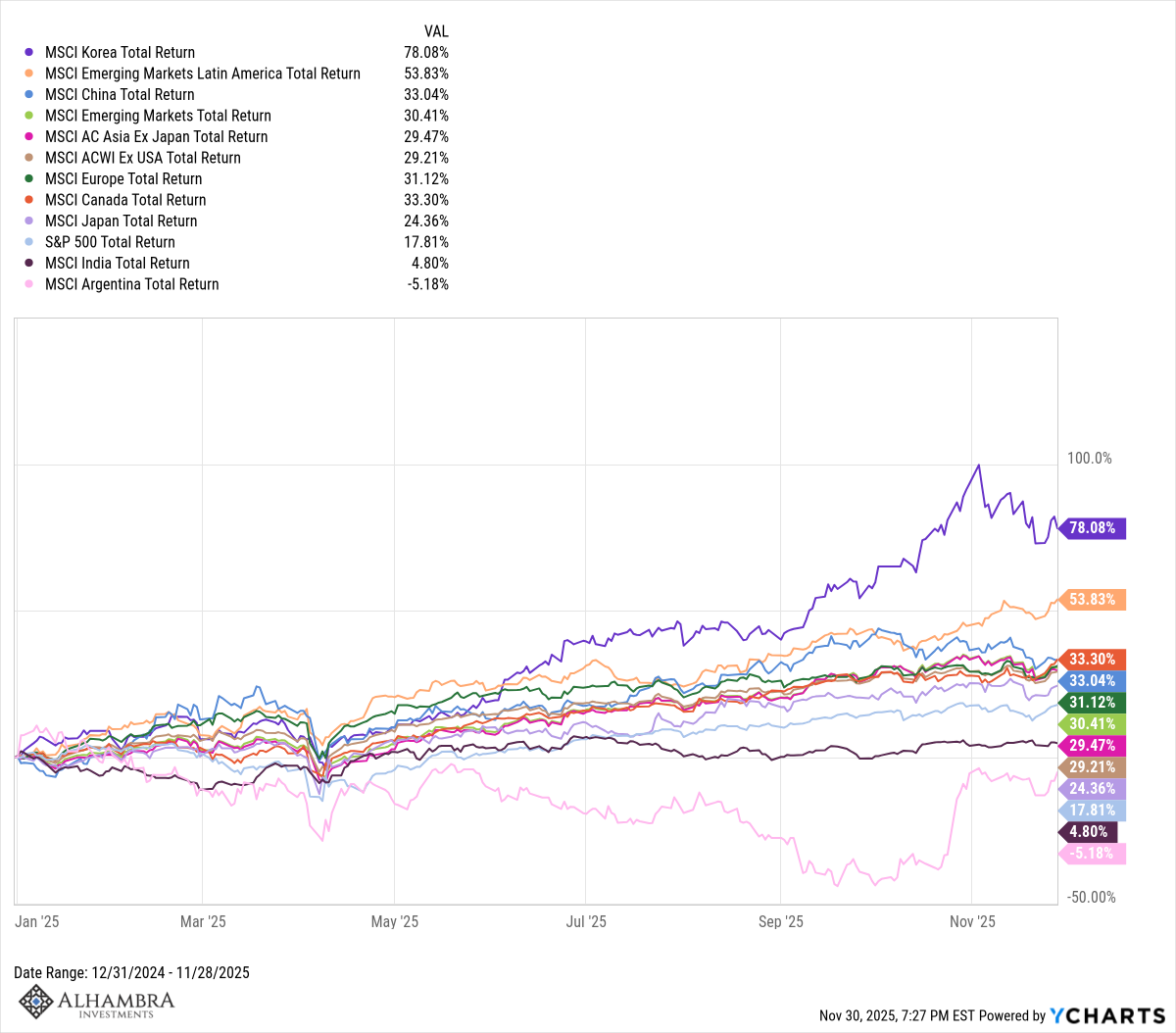

International markets have been the stars so far this year:

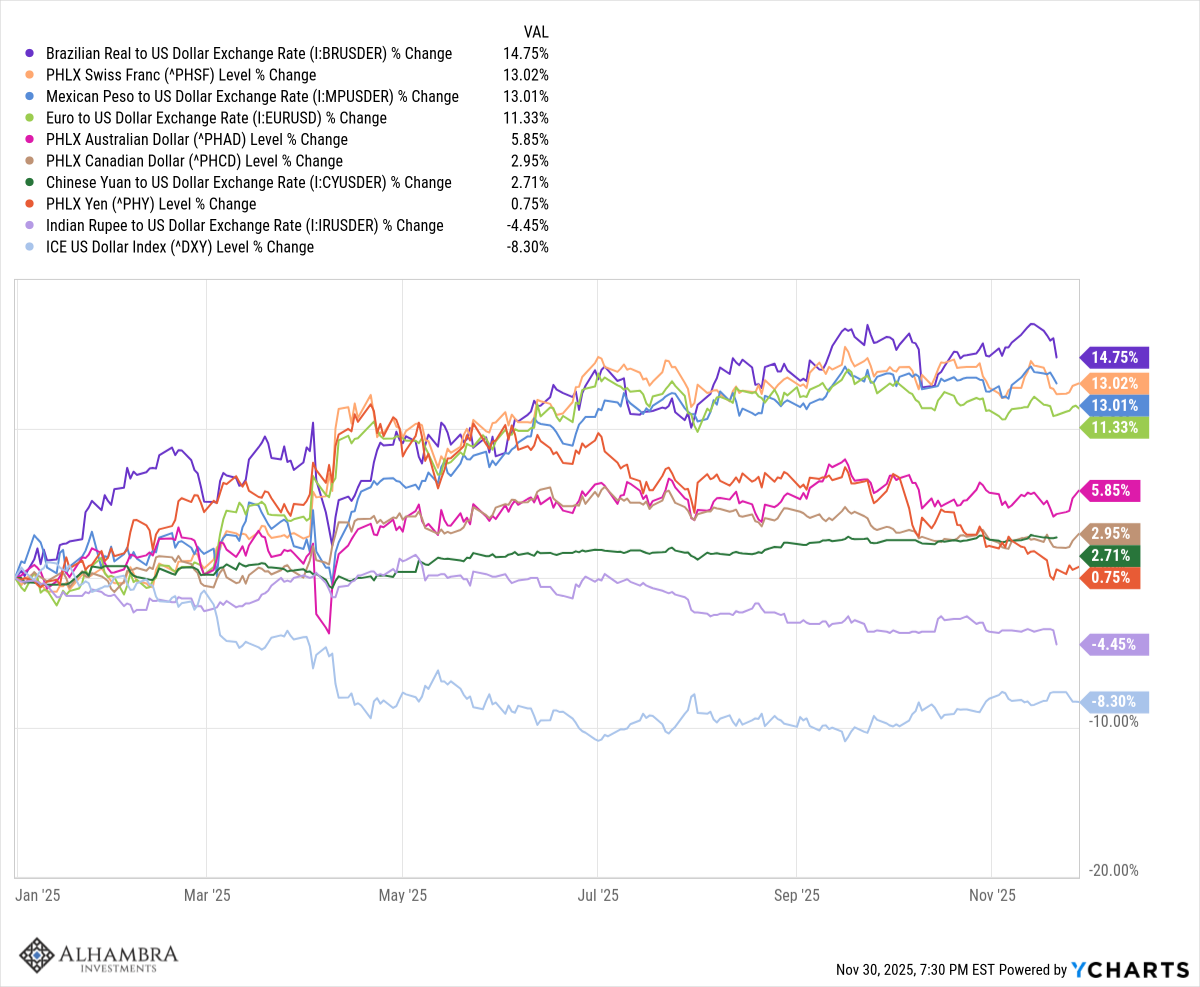

Thanks in part to a weakening dollar:

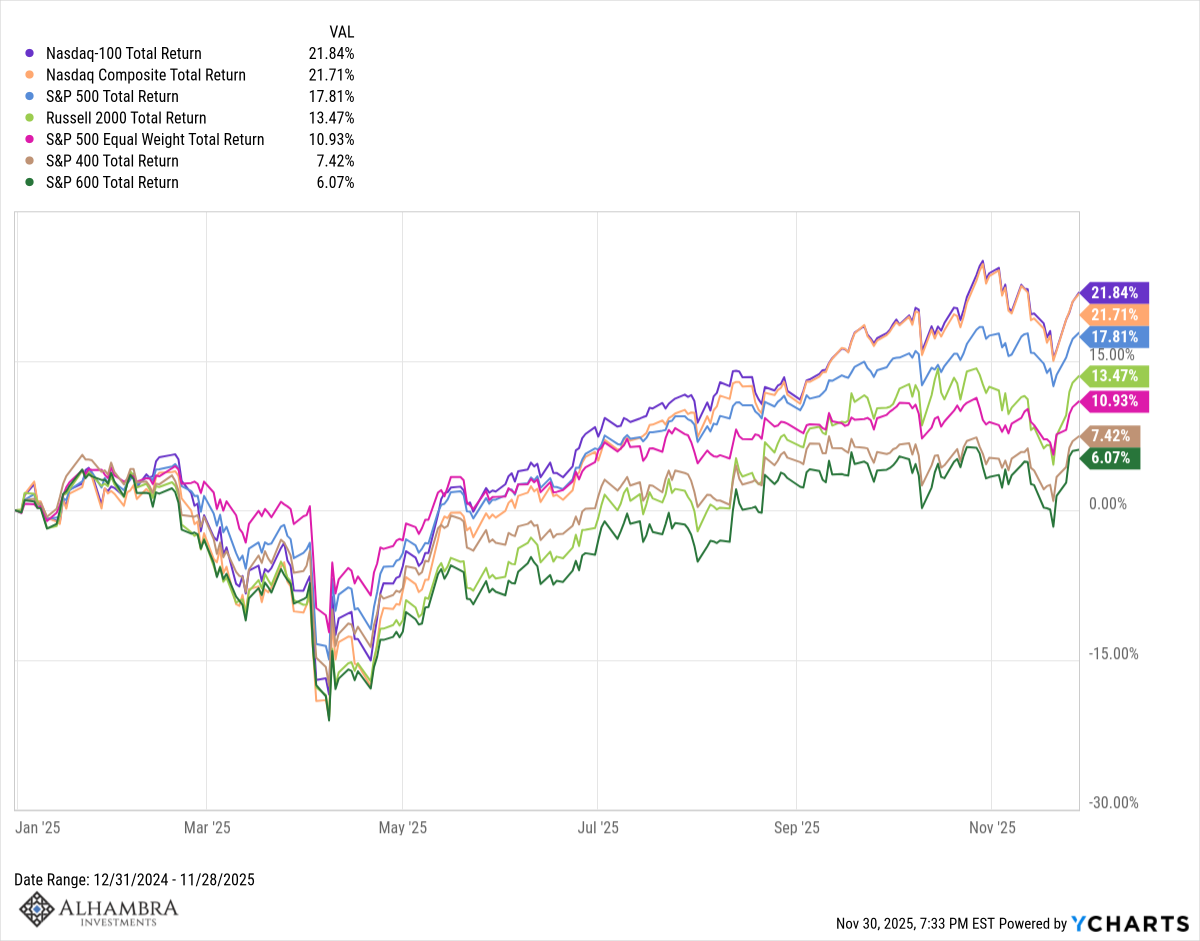

Within the US, large cap stocks have been the leaders again, with the tech-heavy NASDAQ leading the way:

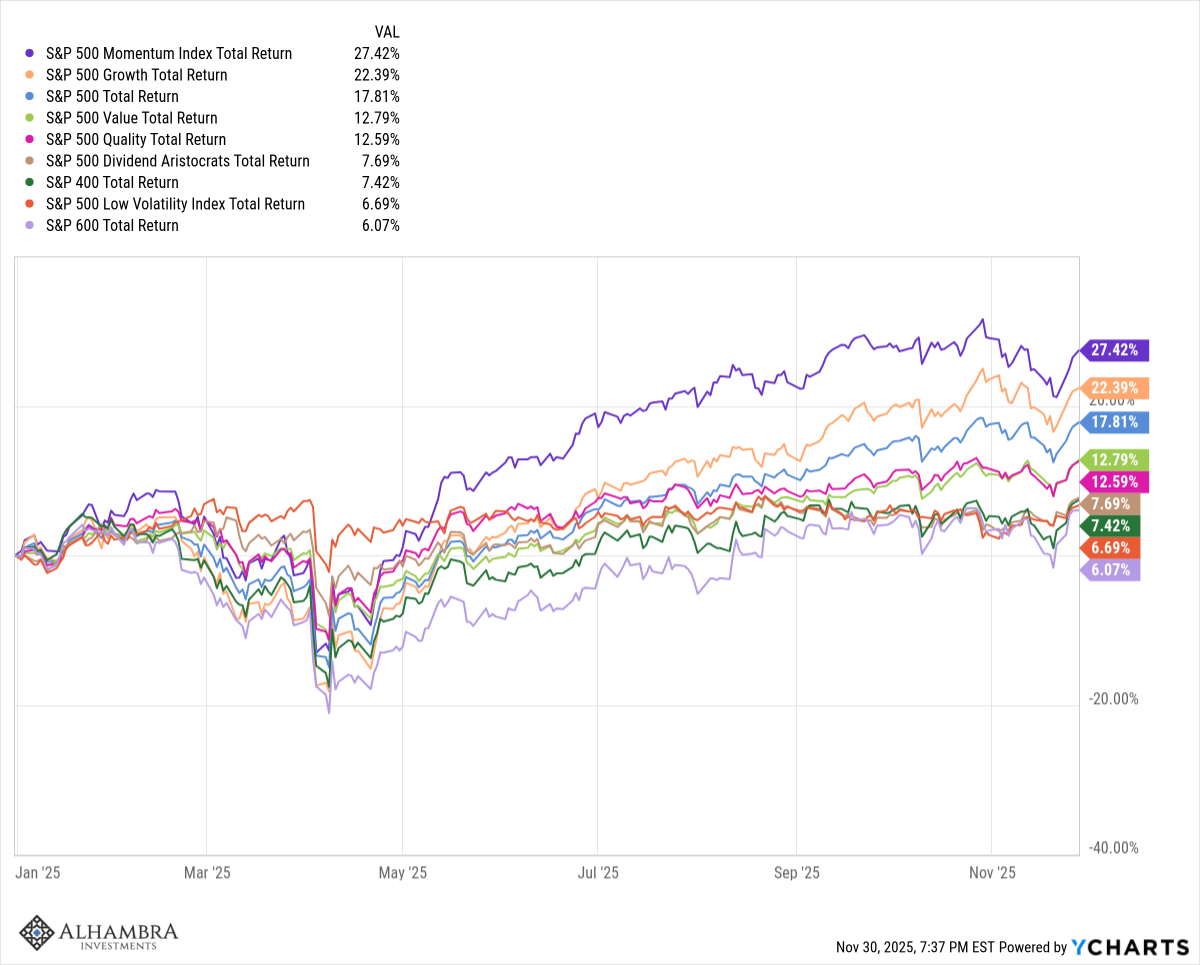

Momentum and growth have beaten the pants off everything else. Value had another tough year in the US:

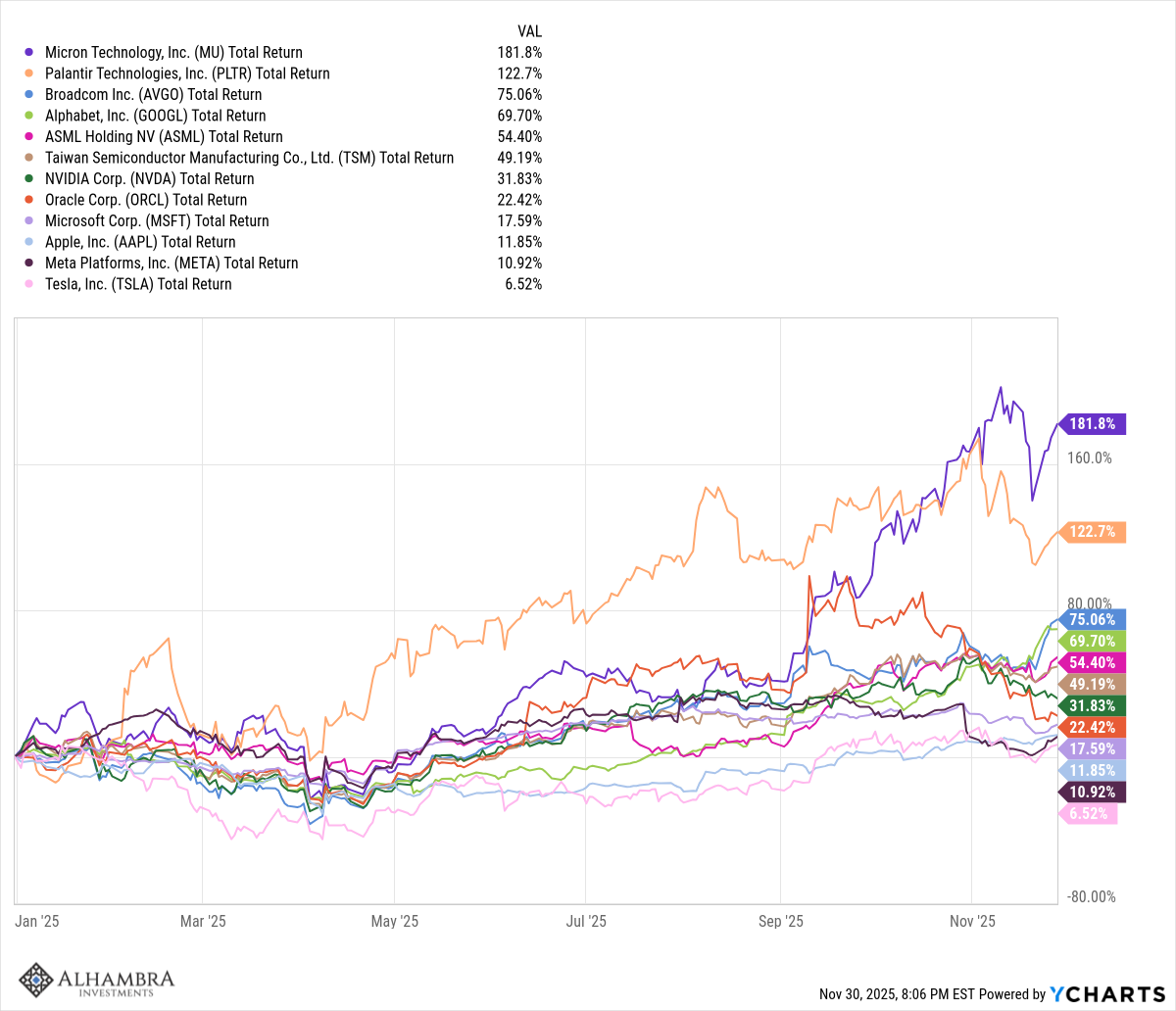

More specifically it has been AI stocks leading the market. The biggest winners this year might not be what you expect, with Nvidia, Meat, Tesla, Apple, and Oracle actually lagging the big winners by a considerable margin.

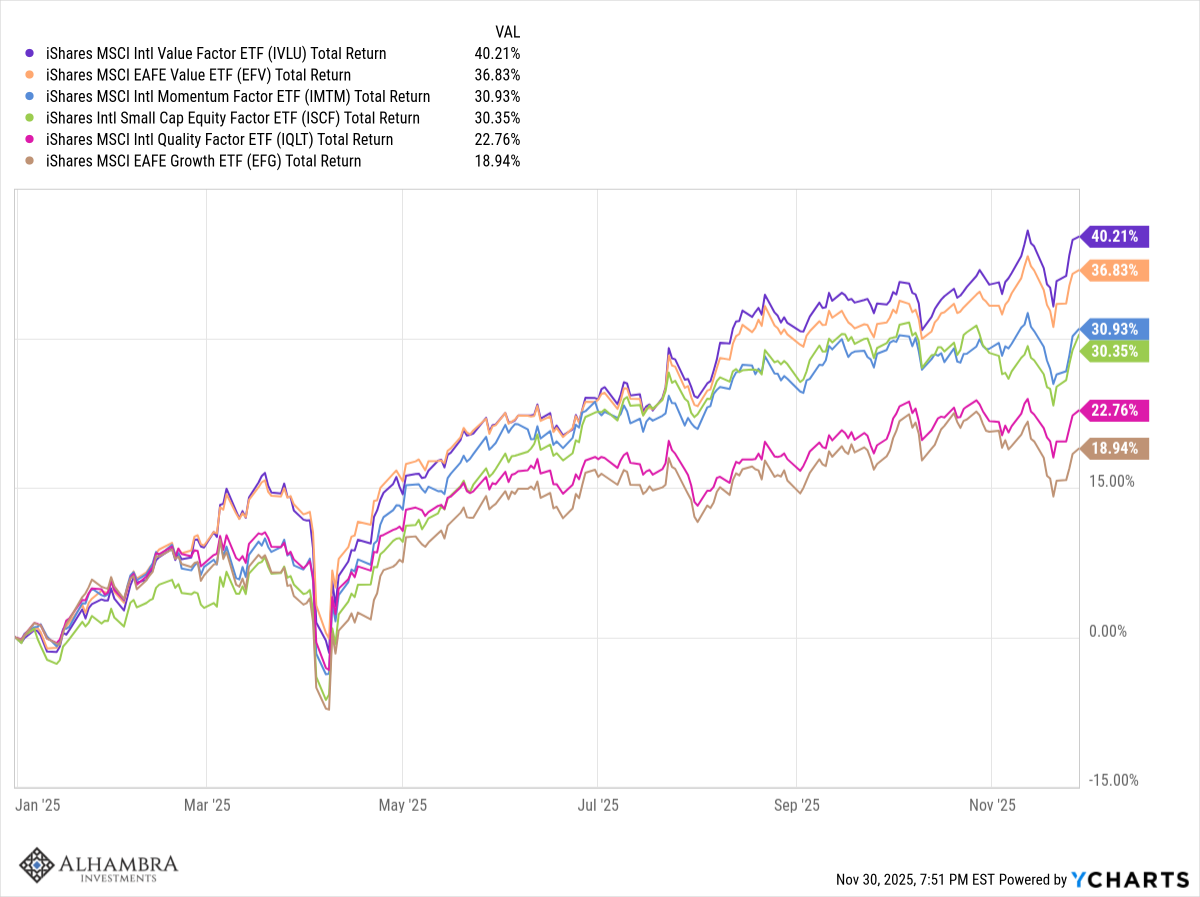

Outside the US, the factor outcome has been nearly the reverse of the US with value leading and growth lagging. Small caps are also having a great year, up over 30% but momentum has worked even better than in the US.

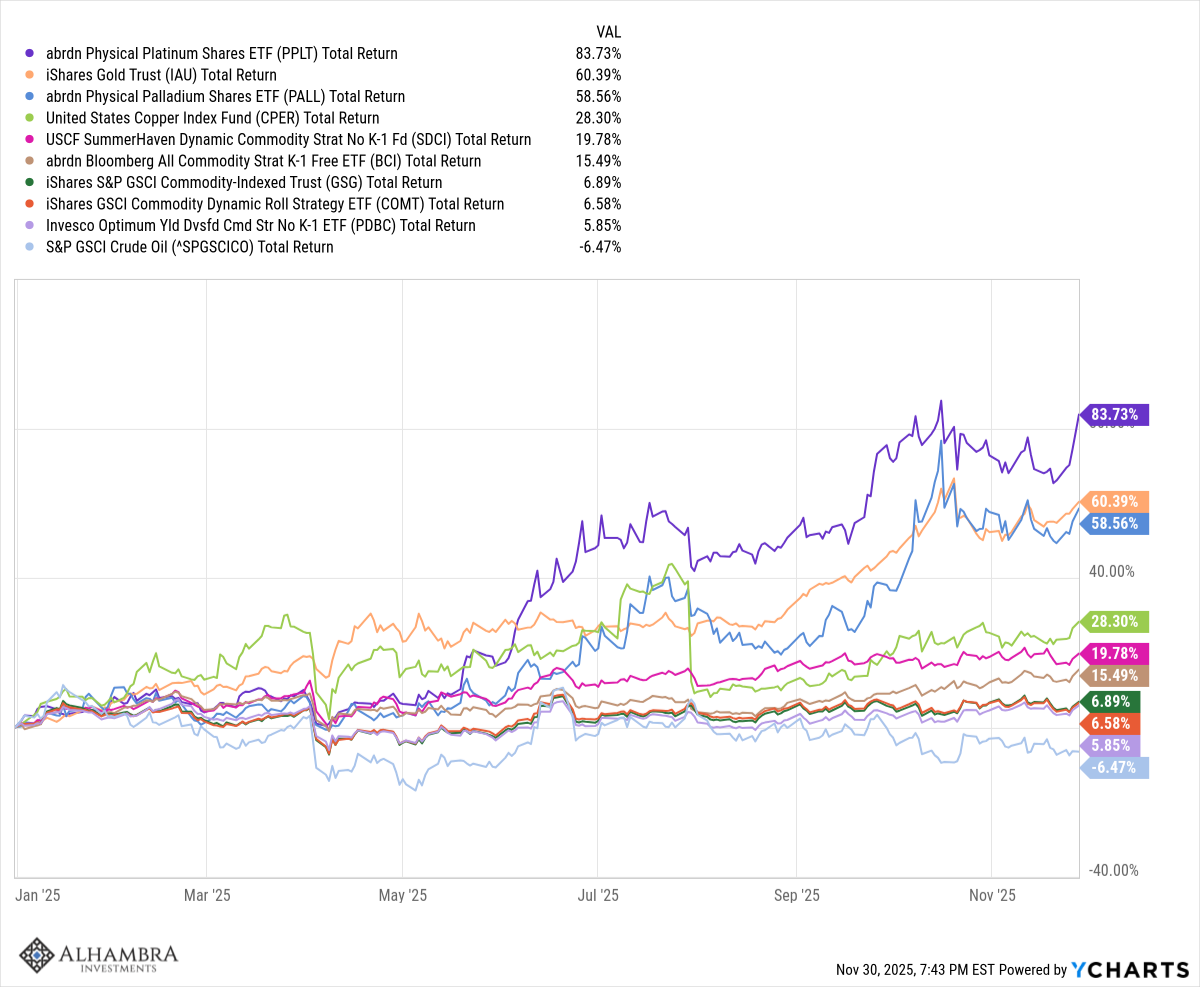

Commodities have had a good year but platinum, palladium, gold, and copper have had great years. Crude oil is lower for the year:

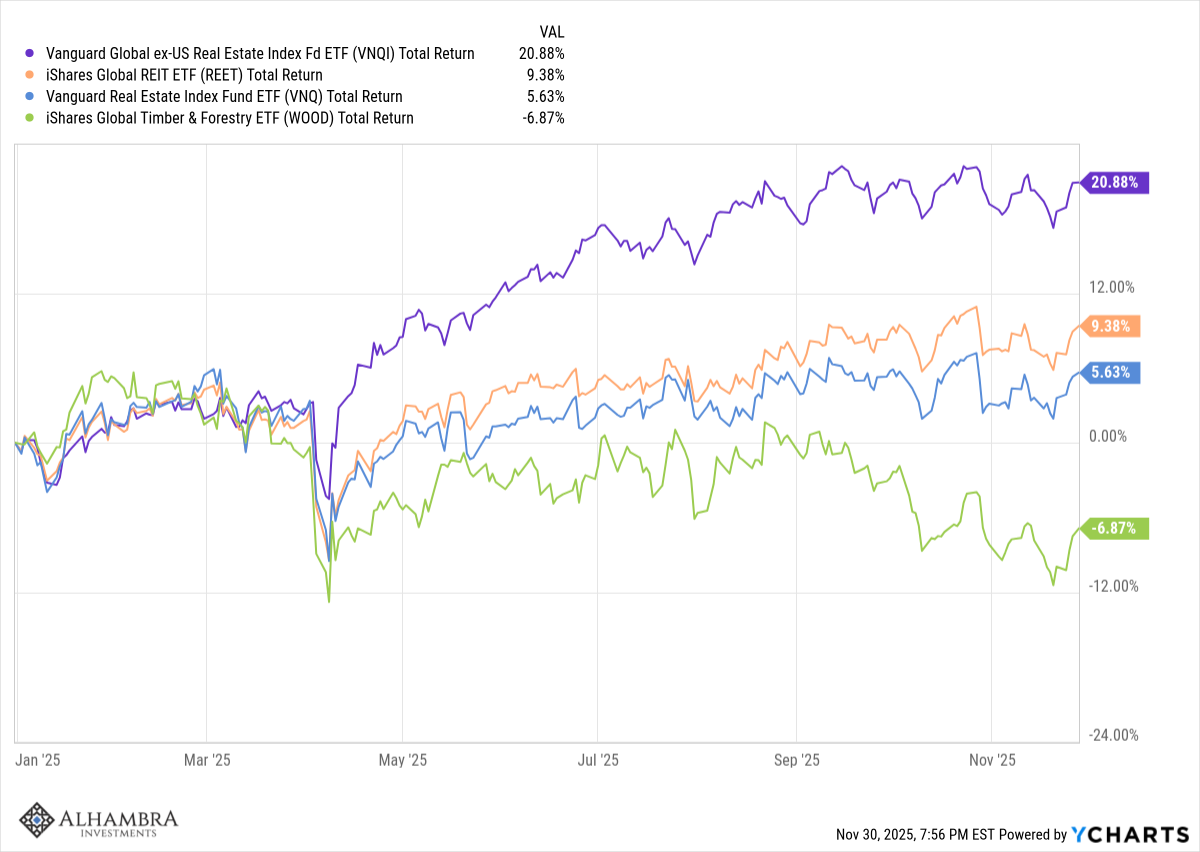

In real estate, like stocks, it is international that has been leading:

Bonds have had a good year with the intermediate part of the curve from 3 to 10 years performing the best:

The results so far this year, considering the drastic change in economic policies – and the erratic path to the current policy mix – are nothing short of extraordinary. And we still have a month to go.

Here’s wishing all of you – clients, long time regular readers and newcomers – a Happy Holiday season. Try not to spend too much of it worrying about markets or politics and economic policy. That’s our job.

Joe Calhoun

Stay In Touch