This is not just an artwork; it represents a cultural phenomenon that bridges the worlds of art, memes, and the cryptocurrency community. I believe this piece will inspire more thought and discussion in the future and will become a part of history. I am honored to be the proud owner of this iconic work and look forward to it sparking further inspiration and impact for art enthusiasts around the world.

– Justin Sun, Chinese crypto bro, who paid $6.2 million for “Comedian” by Maurizio Cattelan which consists of a banana duct taped to a wall, a certificate of authenticity and a 14-page installation manual.

“Oh my God! Thank you so much Mr. Saylor.”

– Hailey Welch, The Hawk Tuah Girl, thanking Michael Saylor, CEO of Microstrategy, for convincing her to buy Bitcoin. If you don’t know who she is, Google her; this is a family publication.

MicroStrategy is poised to become the Standard Oil of the digital age. Let’s take a closer look at how Michael @saylor is refining new Bitcoin financial products in the same way John D. Rockefeller did with petroleum, when few understood the practical uses of crude oil.

– From an X post by some crypto evangelist I’ve never heard of expounding on the genius of Michael Saylor and his Microstrategy/Bitcoin perpetual motion machine

$1.8 billion and $6.4 billion

– Total assets of the Daily Target 2X Long Microstrategy ETF and the 2X long Nvidia ETF. Single stock ETFs are ones that invest (I don’t know how to sneer with a keyboard but I would if I could) in one stock with leverage. Some are inverse versions which short a stock with leverage.

$95 billion, $467 million, -$407 million, -$5.26 billion, -17%

– Market cap, annual revenue, net income, free cash flow and return on equity of Microstrategy

It’s really simple. Game theory says the world will adopt Bitcoin as the unit of account. It’s better money than dollars, euros, or yen. It can’t be confiscated or debased. Either you get on the train now, and you get rich or you miss out and work for a Bitcoiner. It’s entirely up to you.

– From an X post by another crypto evangelist, this one an alleged PhD from Stanford (I don’t care enough to check), which may prove the old joke that PhD stands for Piled Higher and Deeper

US Blue Chip Bond Issuance Reaches Second Highest Level Ever

- Companies have sold $1.4 trillion this year, surpassing 2021

- Finance chiefs want to issue debt now while markets are hot

– Headline from Bloomberg

I could go on and on and on but hopefully you catch my drift. We are in the midst of one of those periodic eruptions of irrationality that brings forth all manner of con men, flim-flam artists and fraudsters, determined to separate fools from their money as quickly as possible,

lest reality close the window of opportunity. New financial products are always a feature of these periods and today we have them by the bucket(shop) full. In today’s wild west of finance, even conservative investors can get taken. Fintechs like Synapse wrote software that allowed companies like Yotta to offer banking services to individuals even though they lacked a banking license. Yotta’s hook was a monthly lottery that paid the winner extra interest. No, I’m not kidding. Many of these companies marketed themselves as banks and claimed that deposits were covered by FDIC. In actuality, all they did was make deposits on your behalf at FDIC insured banks. Unfortunately, their accounting systems were the digital equivalent of an abacus and some notes scribbled on an old grocery bag. The banks don’t have the money and the fintech “banks” can’t figure out which sock drawer they put it in so “depositors” can’t access their money. But it was new and shiny and got you away from the big bad old banks who screwed things up so badly back in ’08 so people bought it and overlooked the fact that maybe banks are regulated for a reason.

Crypto land is your entree to the world of DeFi – decentralized finance – where you can earn rates that put those FDIC boys to shame and be even more confused about where your money went. You can “stake” your crypto – which amounts to lending it to someone you don’t know to do something you don’t understand – and earn rewards of up to 20% a year, the rate depending, as far as I can tell, only on your gullibility. You can also just buy the most ridiculous crypto coin you can find and it will surely rise. DOGE, the original meme coin, was created by someone as a joke to prove that people would buy anything as long as it was crypto and succeeded beyond his wildest dreams. Today DOGE coin has a $61 billion market cap and the richest man in the world as its promoter. It has no purpose and no utility which makes it the perfect crypto project. The latest version of this insanity is the Peanut the Squirrel coin which is a tribute to, obviously, Peanut the Squirrel. Peanut (or Pnut to those in the know) was rescued from a Manhattan street in 2017 by a kind New Yorker and seven years later was seized and euthanized by the New York State Department of Environmental Conservation; apparently the environments they preserve do not include squirrels. PNUT is now worth $1.2 billion which would buy a lot of acorns. I cannot believe I am spending part of my Sunday writing about a financial product based on a martyred squirrel but that’s where we are in the world of finance today.

The “art” at the top of the article is called “Comedian” and it was originally installed at Art Basel in Miami in 2019. There were originally three of them (hey, bananas come in bunches, why waste them as food?), two of which sold for $120,000 – $150,000 at the show. The third was sold for a higher, undisclosed amount and donated to the Guggenheim. With the Sotheby’s auction last week one of the original buyers realized a return of 50 times their original investment or a cool 120%/year for the last five years. The banana for the auctioned piece was distributed by Dole and purchased at a fruit stand on the Upper East Side of NYC owned by a Bangladeshi immigrant who had no comment. The buyer of the “art” was a Chinese crypto “entrepreneur” who is currently under investigation by the SEC (of course he is). He has an alleged net worth of $1.2 billion and owns a bunch of crypto projects, the most recognizable of which is the old Bit Torrent, the file sharing software that enabled millions of people to steal the intellectual property of artists. The irony may have escaped Justin Sun. Bit Torrent now has a coin because, well, just because.*

Microstrategy is putatively a software company but it styles itself now as:

…the world’s first and largest Bitcoin Treasury Company. We are a publicly traded company that has adopted Bitcoin as our primary treasury reserve asset. By using proceeds from equity and debt financings, as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital.

Michael Saylor is the chairman of the company and has transformed it into a crypto darling by selling new MSTR stock and debt (recently convertible bonds which are potentially dilutive to shareholders) and using the proceeds to buy Bitcoin. He has so far put the company $4 billion in debt to fund the purchase of 331,200 bitcoins with a value of roughly $32 billion. He recently claimed the company was making “$500 million a day” although that surely has nothing to do with their software business. Despite the claim on the website about using “cash flows from our operations” to purchase Bitcoin, the trailing 12-month cash flow from operations is -$34.5 million. Return on assets, return on equity, and return on invested capital are all negative. Here’s something to ponder if you are considering an investment:

Accounting and Auditing Enforcement Release No. 1352 / December 14, 2000

The Securities and Exchange Commission filed today a settled civil injunctive action against MicroStrategy Inc.’s top three officers: Michael Saylor (co-founder and chief executive officer), Sanjeev Bansal (co-founder and chief operating officer) and Mark Lynch (former chief financial officer). The complaint alleges that from the time of its initial public offering in June 1998 through March 2000, MicroStrategy, a Vienna, Virginia-based software company whose securities are listed on NASDAQ, materially overstated its revenues and earnings from the sales of software and information services contrary to Generally Accepted Accounting Principles. The company’s public financial reports during this time showed positive net income. In fact, the Commission alleged, MicroStrategy should have reported net losses from 1997 through the present.

Without admitting or denying the Commission’s allegations, the defendants consented to the entry of a final judgment permanently enjoining each of them from violating the antifraud and record-keeping provisions of the federal securities laws (Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934 and Rules 10b-5 and 13b2-1 thereunder), ordering them to pay disgorgement totaling $10 million (Saylor — $8,280,000, Bansal — $1,630,000, Lynch — $138,000) and ordering each to pay a $350,000 civil penalty. Lynch, the former chief financial officer, also consented to the entry of an administrative order pursuant to Commission Rule 102(e)(3) based on the entry of an injunction, barring Lynch from practicing before the Commission as an accountant, with a right to reapply after three years.

Saylor controls the company through his ownership of B shares which have 10 votes to 1 for class A shares. It is a bit murky but it appears he owns 9.9% of the company but has majority voting control. One thing that isn’t murky is the insider selling of the stock which totals 843,878 shares over the last year which would net nearly $120 million if they got the average price of $139.55. Through salary and options the CEO made $19 million in 2021 and another $20 million in 2022. He fell on hard times in 2023, raking in a mere $8 million. For running a money losing software company. With the stock price up a bit this year (+567%), I’m guessing Phong Q. Le is having a pretty good 2024. Not bad work if you can get it.

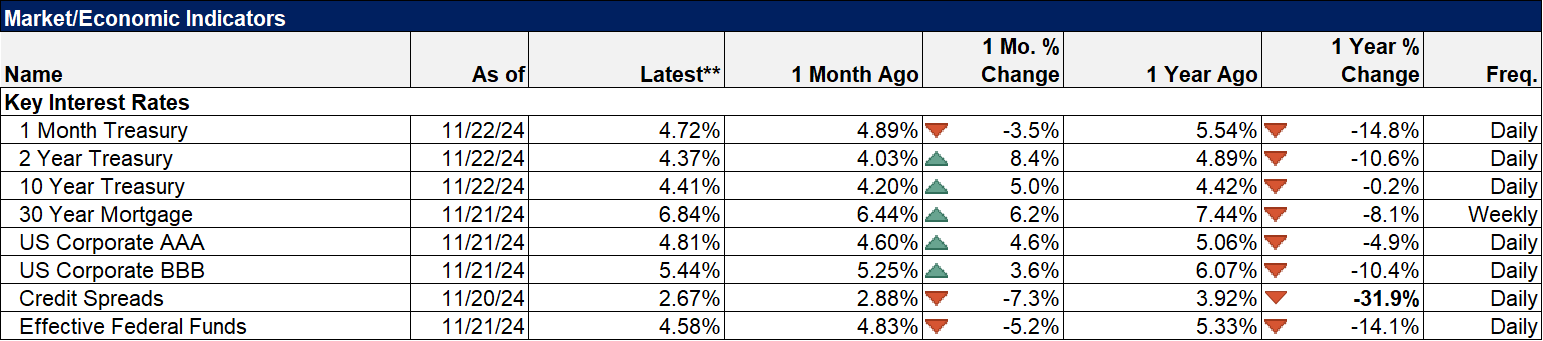

Meanwhile, the S&P 500 is trading at 25 times this year’s earnings and 21 times next year’s estimate with expected long-term earnings growth of 12-14% (depending on whose estimates you use). The top 10 holdings (out of 503) represent 35% of the index while a third of the index is in the tech sector. The Shiller P/E is nearing the dot com peak and expected returns over the next 10 years are solidly in the low single digits (or negative depending on how you calculate such things). US stocks are so beloved that they make up 2/3 of the global stock indexes while representing 25% of global GDP. Median house prices are roughly 6 times median household income when the historical average is 3 to 4 times. Gold is about $100 from its all-time high which it set last month. From 1980 to 2004 copper traded between (roughly) $0.50 and $1.50. In May of this year, it set an all-time record of $5.20 although it has recently fallen back to $4.10. Corporate bond spreads are at all-time tights versus Treasuries while private credit is in the midst of a boom. Private equity has LBOd so much of America that Blackstone, with billions still to invest, is buying a sandwich shop (Jersey Mike’s, a fine sub but $8 billion??). And the Fed thinks they need to ease monetary policy?

We are living through one of the greatest speculative periods in history. While it really got going in the aftermath of 2008 with QE, I would actually date it to the late 90s during the dot com boom. The rise in asset prices has been relentless since the Fed bailed out LTCM in 1998, even if it has been interrupted temporarily several times (2000-2003 dot com/Worldcom/Enron bust, 2008 financial crisis, and COVID). From that day forward everyone has been operating on the assumption that no matter what happens the Fed will always bail out the system, they will always find a way to inject new money into the economy and cover our mistakes. And if not the Federal Reserve then someone in government will come to your rescue because they are deathly afraid the entire edifice will collapse if they allow any significant failure. That was confirmed again just last year with the bailout of depositors at Silicon Valley Banks and several others. Looking at asset prices, common sense tells us that the last 25 years is inflation, in the old sense of devaluing of our money, even if it isn’t obvious in the aggregate economic data. It only becomes obvious with the perspective of 25 years or so.

I don’t know when, how or why this era will end. But history tells us it will and it won’t be kind to those who overextended themselves. Today is a time for conservative investing, a time to be more concerned about potential losses rather than dreaming of big gains. It is a time to apply the rigors of TradFi, traditional finance techniques sneered at by the crypto bros but that have stood the test of time. Right now MSTR is a master of the universe despite a dismal track record of running their actual business. Taking on debt to buy a speculative asset with no known use beyond gambling is not a sustainable business model. My guess is that the top in the stock will come when they announce the inevitable name change to something that includes the word Bitcoin. Meanwhile, the new Trump administration is talking about a Strategic Bitcoin Reserve, to which I can only ask reserve for what? For what goal will this reserve be established? Or does no one in the new administration know the definition of “strategic”?

In the short term, sentiment is getting rather frothy even in the more traditional parts of the market while the non-traditional parts have lost their collective minds. That doesn’t mean you need to sell everything and go to all cash. But acting a little more conservatively, spending the time to investigate that new financial product thoroughly before investing and being just a little cynical does seem a prudent course of action. The wolves of DeFi and AI and fintech are at your door. Don’t be a sheep.

*I actually think Comedian is great art although I wouldn’t pay $6.2 million for it. It is very much in the vein of Marcel Duchamp’s Fountain and holds much the same meaning. It is amazing to me that artists such as Maurizio Cattelan can ridicule and mock their patrons and get away with it. Do art collectors not understand they are the butt of the joke or do they get it but think the artist wasn’t thinking of them?

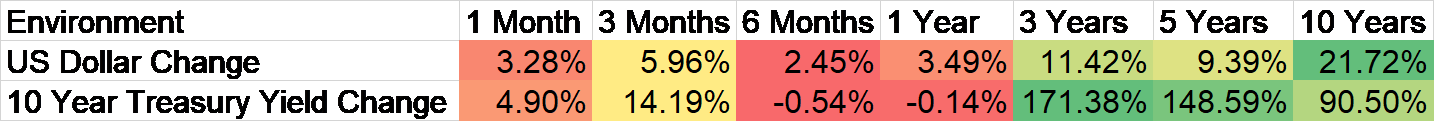

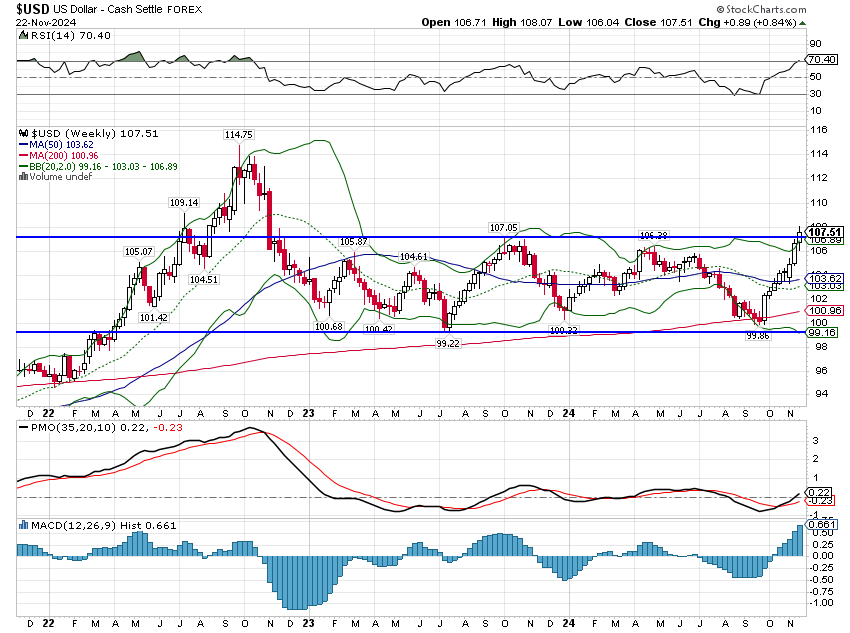

Environment

The dollar index broke out of its extended two-year trading range last week. I generally only act on month end changes so there’s nothing to do immediately but if this sticks there are some potential changes to your asset allocation that might make sense. If the breakout holds, I’ll cover some of that at the end of the month.

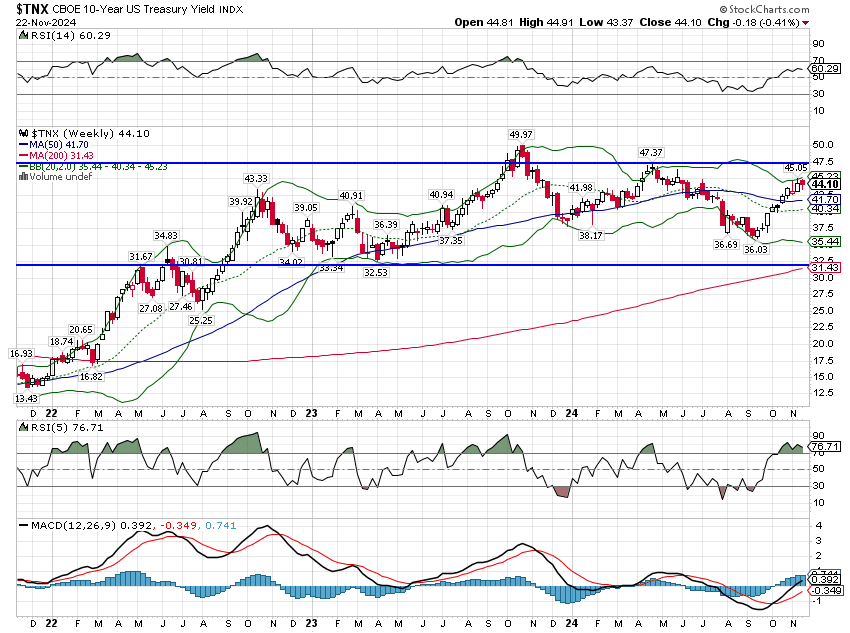

Interestingly, the 10-year Treasury yield did not break out which makes a little wary of being aggressive on the dollar change. Rates were down a couple of basis points on the week.

Markets

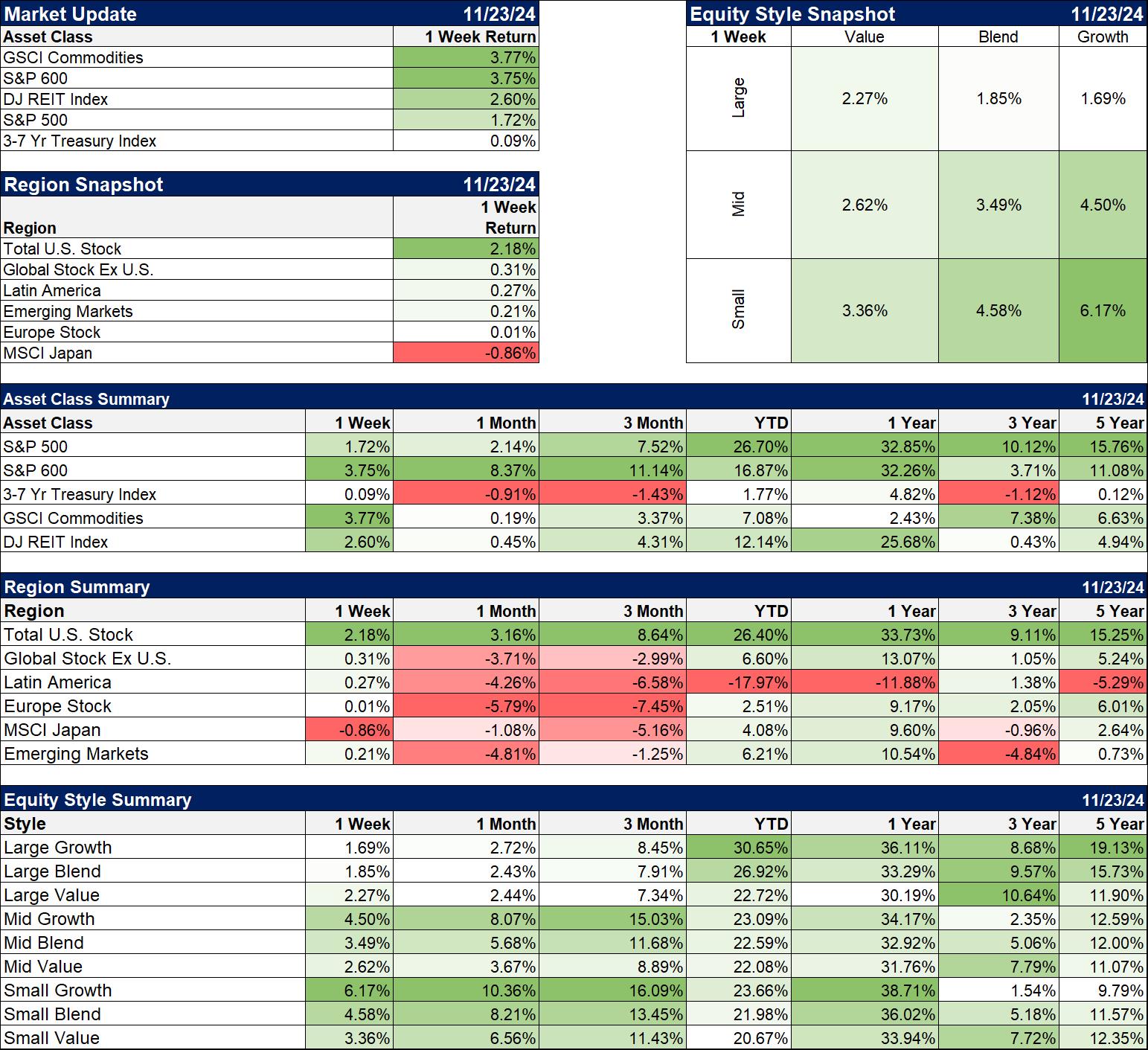

Commodities led the way last week on the back of a 6.5% rally in crude oil and a monster rally of 16.4% in natural gas but the rally was pretty broad based. Gold recovered most of its recent losses, up 5.5% for the week.

Small-cap stocks continue to outpace large company stocks. While small and midcap value have been outperforming growth for the last three years (and most of the last five), growth was the stronger performer last week by a good margin. Value tends to do better in a rising dollar environment so this may be nothing more than a short-term phenomenon.

REITs also did better last week after being on their heels since the election. Rates eased a bit last week which surely helped but REITs also tend to do well in a strong dollar environment.

International stocks continue to struggle with the higher dollar.

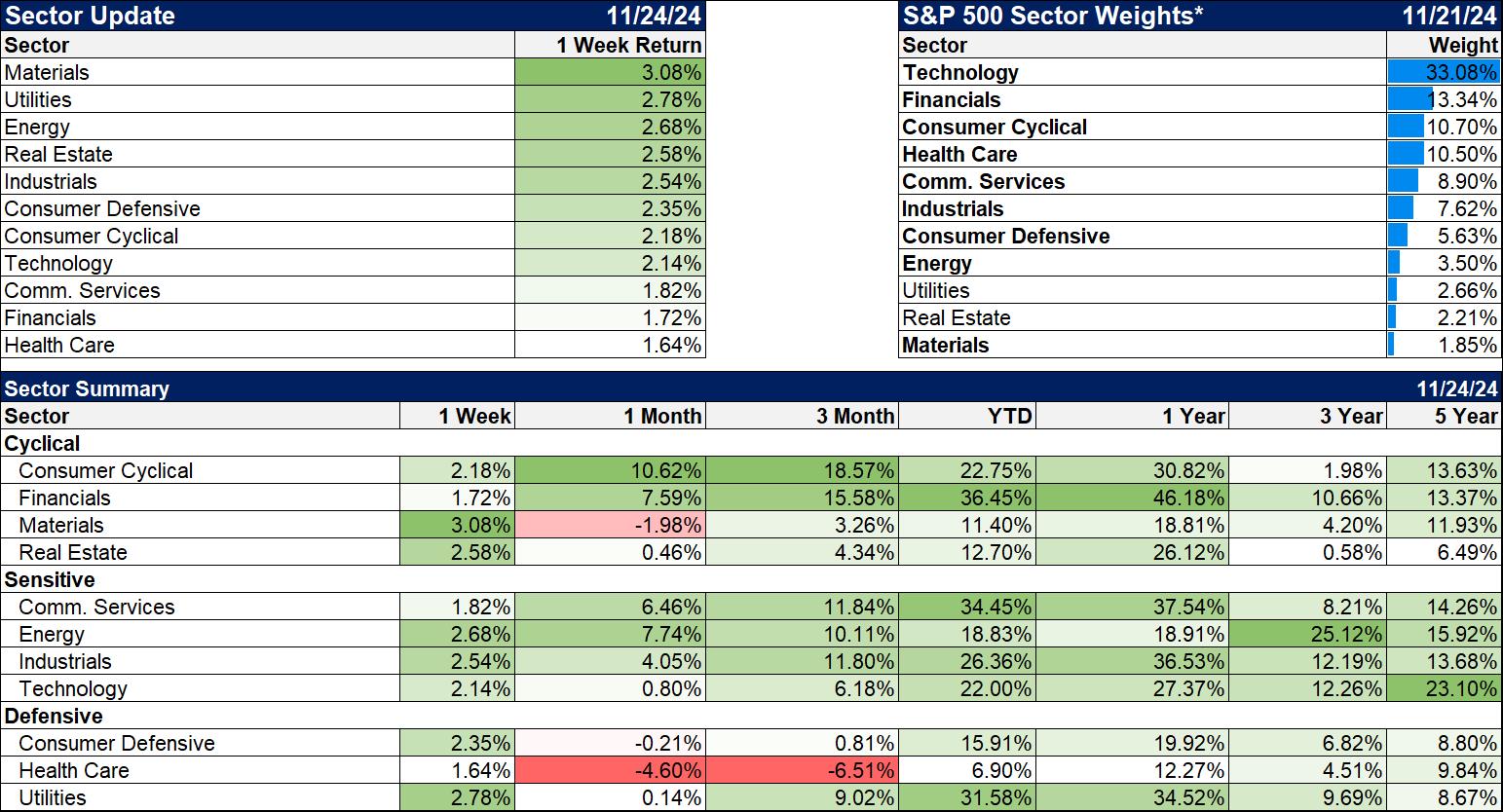

Sectors

The best performing sectors this year are financials and communication services with utilities not far behind. The laggard is healthcare which is in the midst of an RFK, Jr. hangover. With strong revenue and profit growth it makes sense to at least take a look at the sector.

Economy/Market Indicators

Mortgage rates remain elevated and the reprieve of September is long gone. I see little reason to expect much of a housing activity rebound without lower rates. Residential investment seems likely to remain a drag on GDP growth.

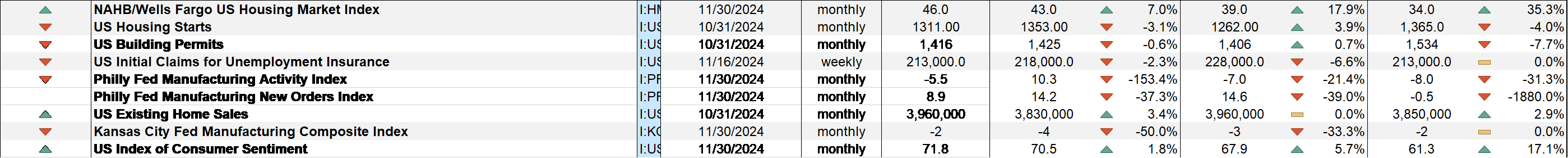

Economy/Economic Data

- Housing market index, a sentiment survey of homebuilders, improved some but remains below 50.

- Housing starts and permits were both down and show no signs of recovery

- The Phill Fed fell back into negative territory but the forward looking parts of the report were actually very positive.

- Existing home sales rose in October but that is based closings; the deals were struck in September when rates were closer to 6%.

- Consumer sentiment improved modestly. Next month will be interesting as Republicans turn positive and Democrats turn negative. In the past Democrats haven’t been as partisan but that may have changed.

Joe Calhoun

Stay In Touch