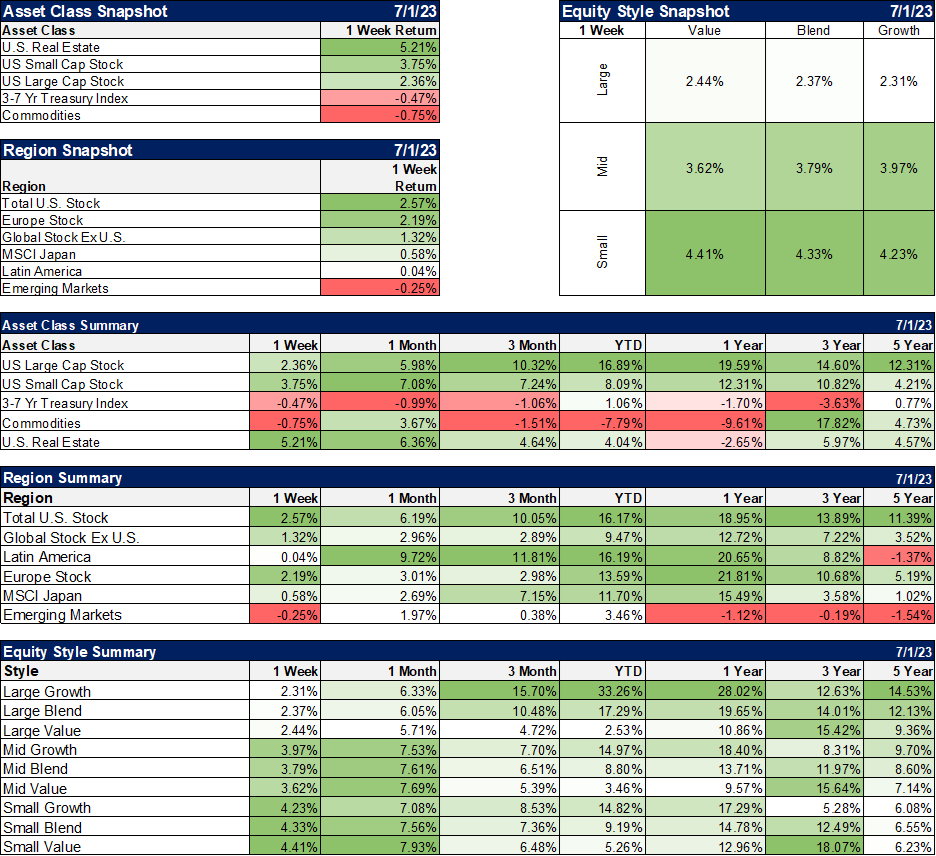

The first half of the year is over and despite a few bank failures and three more rate hikes by the Fed, stocks and bonds both managed to produce gains in the first six months of 2023. Growth stocks were the big winners as the market for most of the first half was trying to price in rate cuts before the end of the year. Lower rates are seen as positive for high-multiple growth stocks and with a dash of artificial intelligence thrown in, tech stocks crushed the competition. June saw the 10-year Treasury yield rise back to within a few basis points of its year-end rate though and other parts of the market caught up some.

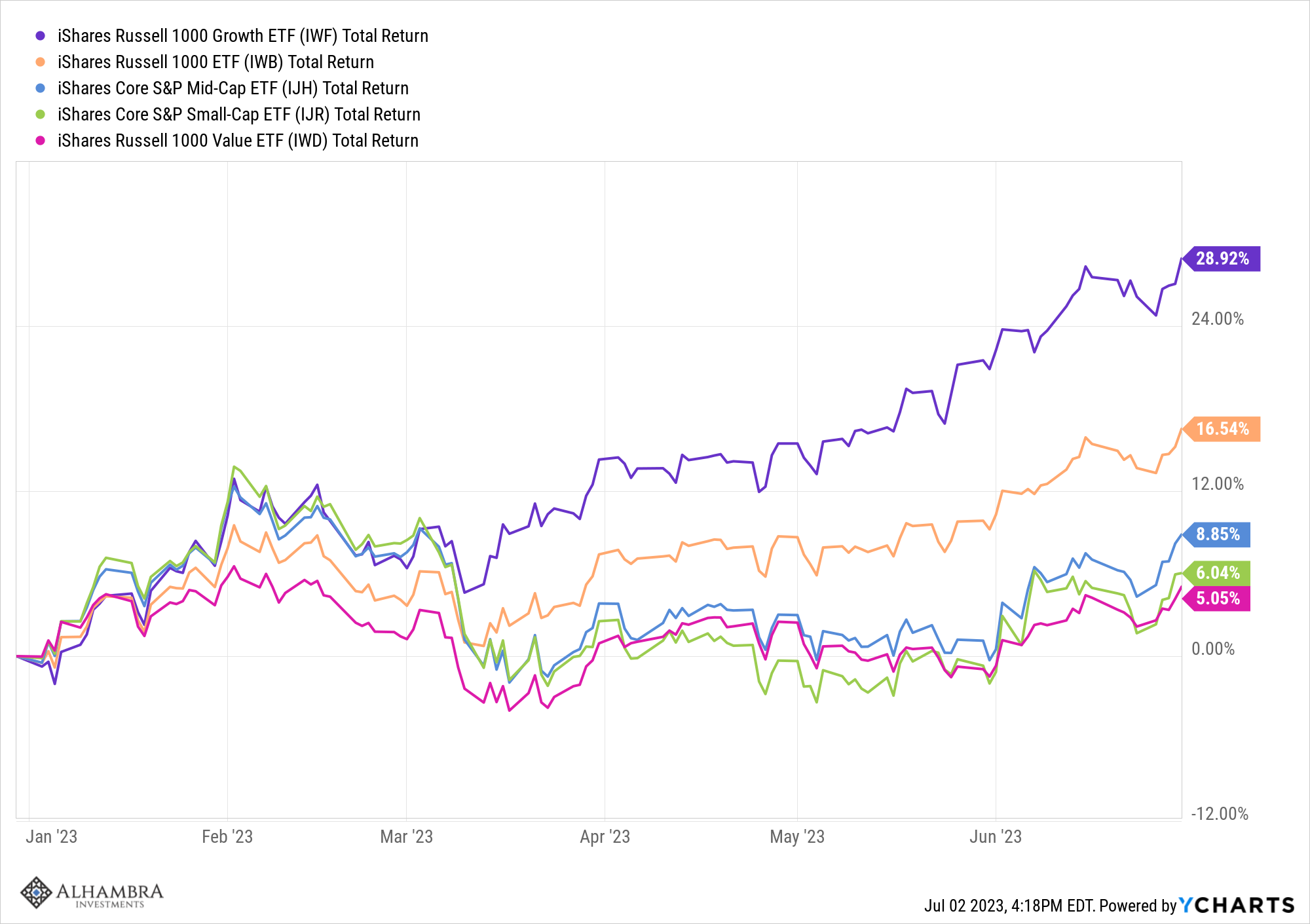

Still, the gap between large-cap growth and large-cap value over the six-month period was one of the largest on record. The Russell 1000 growth index rose nearly 29% in the first half versus a respectable but terrible in comparison 5% by the Russell 1000 value index. When we compare the overall large-cap indexes to the rest of the market, it is obvious that the gains were very concentrated in large-cap growth.

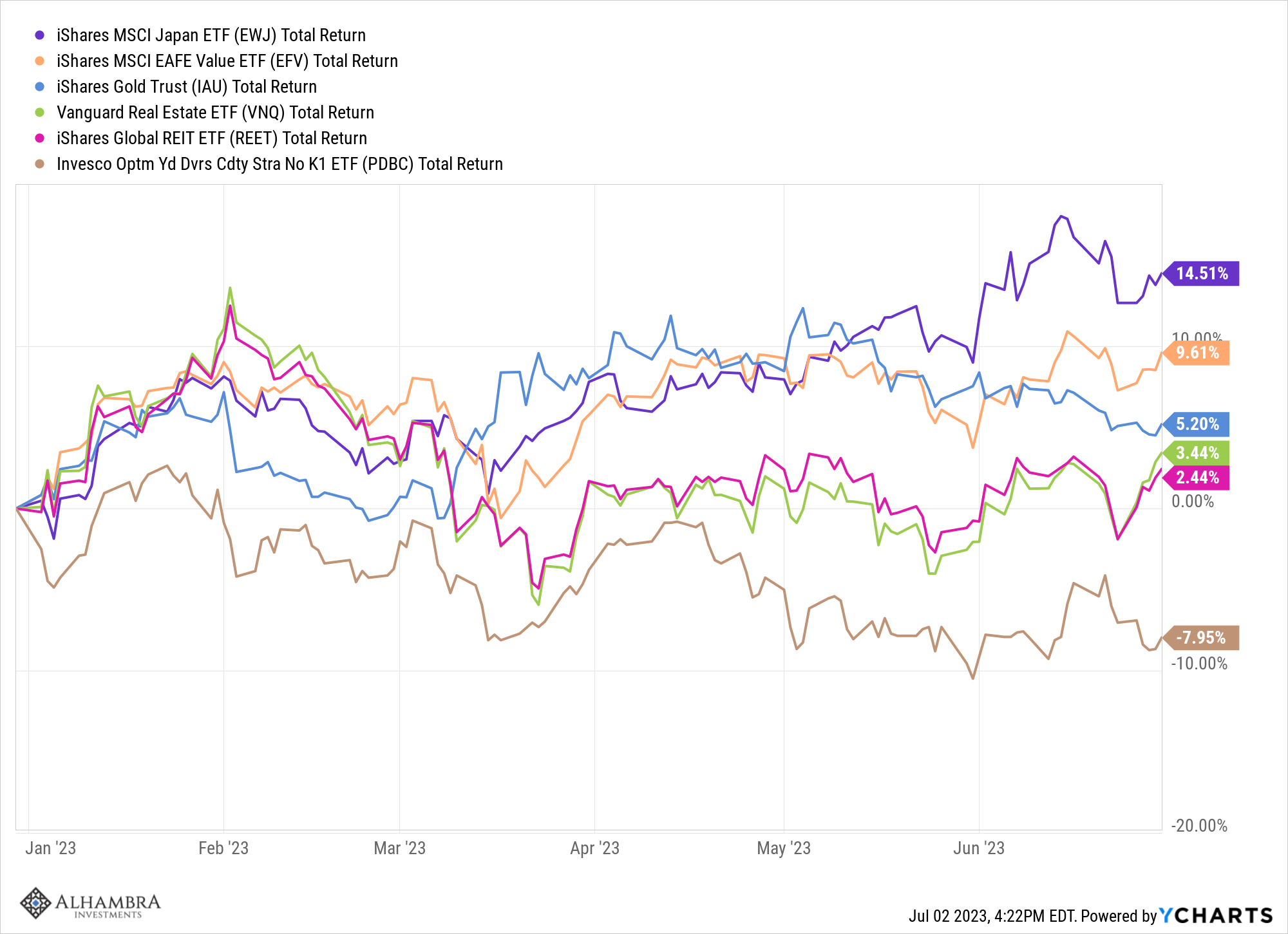

Other asset classes also produced solid returns but pale in comparison to the mighty US large-cap growth stocks. International markets performed well with Japan leading the way. US and global real estate were higher despite extraordinarily negative sentiment. Gold rose by a bit over 5%. Of the major risk asset classes we follow, only general commodities were down (-8%).

For bonds, gains were concentrated in the riskier parts of the market. Long-term Treasuries outperformed all other durations of government bonds. In corporates, junk bonds were the best performers. Intermediate municipal bonds outperformed comparable Treasuries by a good margin even on a pre-tax basis. Regardless, the returns on bonds and cash were still pretty low in the first half of the year and pulled down the performance of moderate diversified portfolios.

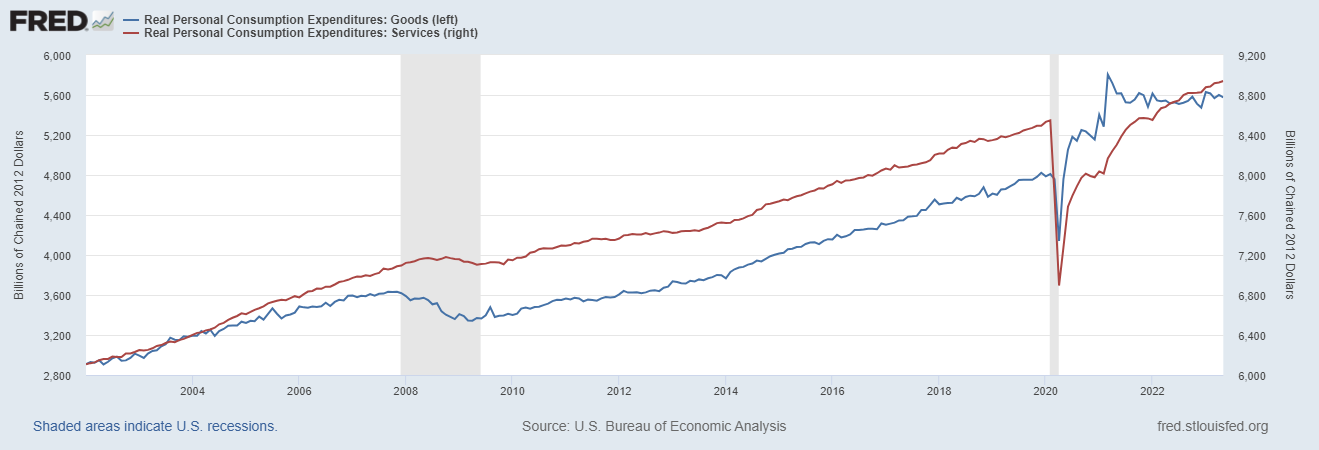

I expect the second half to correct some – maybe all – of the large-cap growth outperformance of the first half. Interest rates appear poised to move higher as the economy continues to provide positive surprises. The economy slowed over the last year but didn’t enter recession because the services side of the economy continued to recover even as the goods side of the economy took a rest.

The inventory issues that plagued the economy last year also appear to be well on the way to being resolved so if goods consumption growth starts to rise again, so will production (and imports). There are some preliminary signs that may be happening already. Consumers certainly have the wherewithal to fund more consumption. They remain flush with cash after the surge in savings during COVID and real disposable personal income is up 4% over the last year.

The question for investors is how the Fed will respond to an economy that seems impervious to their rate hikes. If the economy continues to perform well and inflation continues to moderate, then markets are probably going to like that environment a lot. And I don’t think it would be confined to growth stocks since the value indexes hold more companies sensitive to economic growth. But if the economy continues to surprise to the upside and inflation doesn’t moderate? Well, that isn’t on anyone’s radar right now and it would not be a positive surprise for markets. I never try to predict these things because I’m not any good at it (nor is anyone else) so I can’t say which way things will go but I sure don’t see any indication the economy is slowing. As for inflation, the headline numbers have come down but I find it quite worrisome that the core really hasn’t. If the headline starts to rise again – and all we need for that is for crude oil to start rising again – then all bets are off.

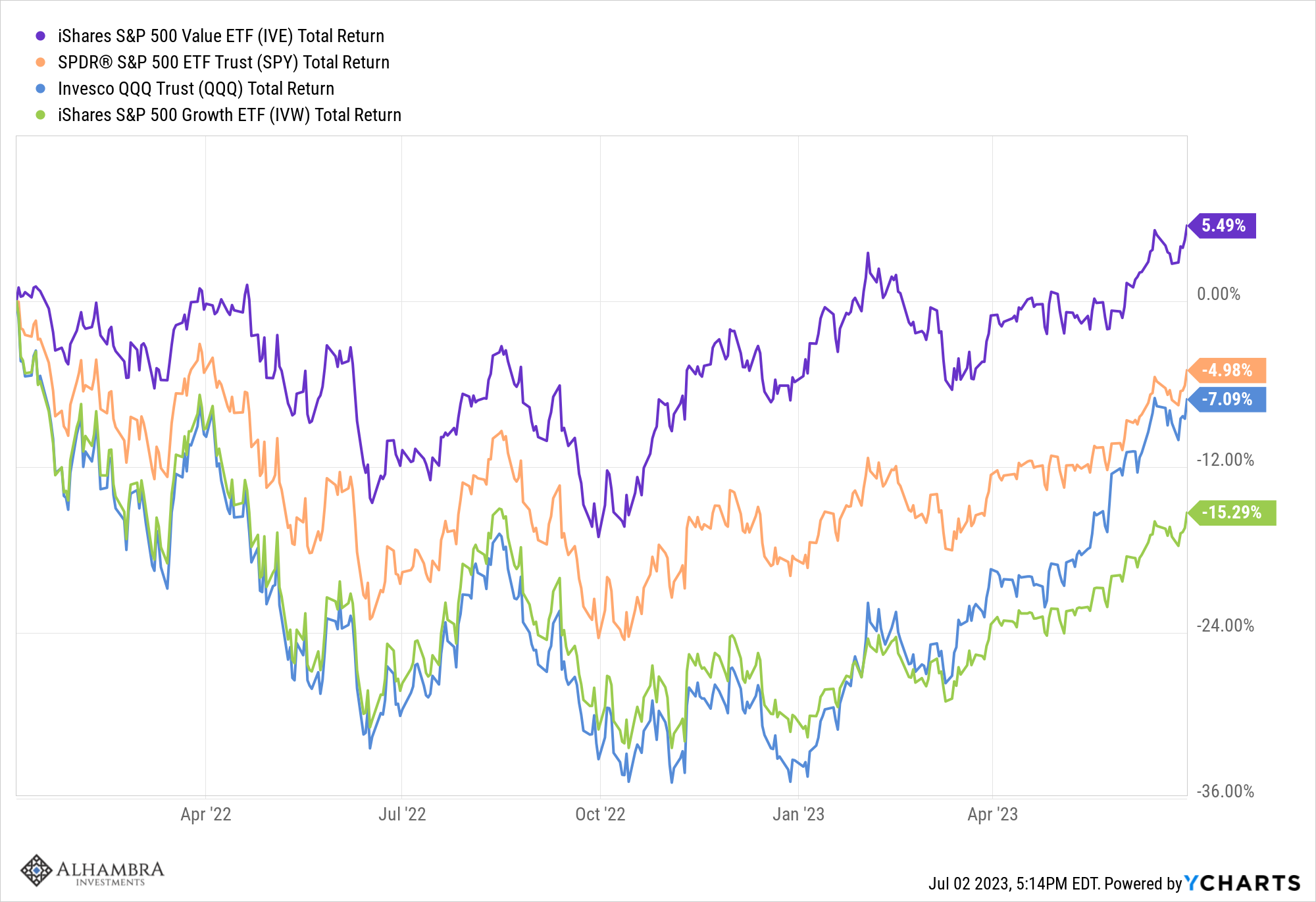

If you didn’t own growth stocks in the first half, your returns were still pretty good. No, they weren’t what they could have been if you had bought the NASDAQ late last year. It would be wise to remember though that if you bought QQQ or SPY or IVW (S&P 500 growth) at the beginning of 2022 you’d still be down even after that great first half. But if you bought just the value half of the S&P 500 you’re up. That’s a pretty solid argument for a strategic allocation that has a bit of both. Perspective matters.

Environment

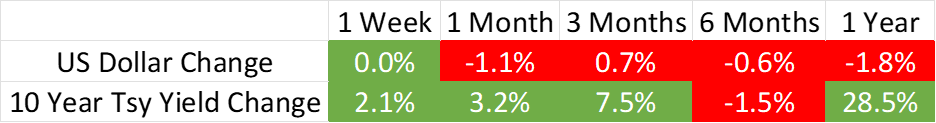

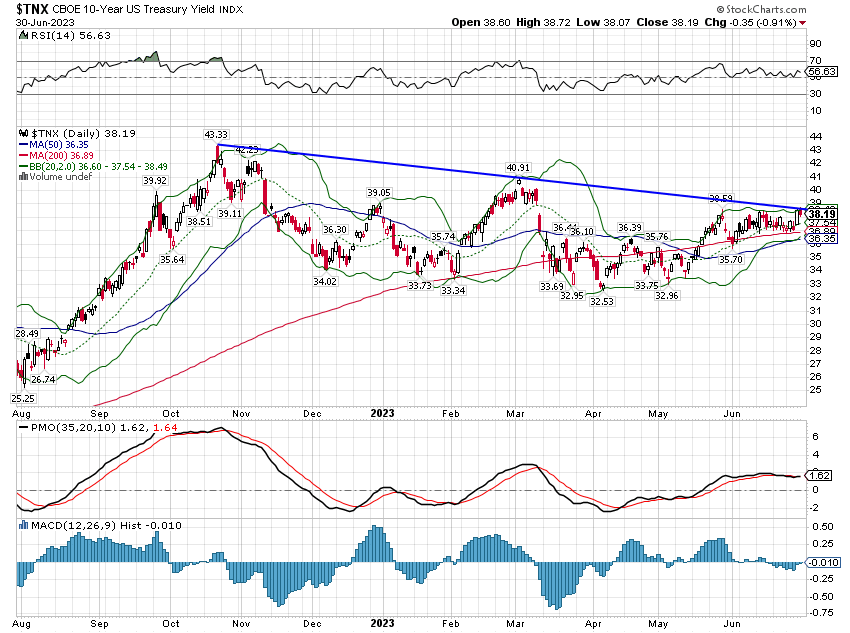

So close! The 10-year Treasury yield came very close to breaking out of its short-term downtrend last week but a bond rally Friday kept it just under the downtrend line. On an intermediate-term basis, the trend is still up so not much has changed this year. For the first half of the year, it was the belly of the curve that performed the worst. The longest and shortest-dated Treasuries were the best performers. Over the last year, the only winners are on the short end.

| Year to Date Total Returns (Daily) | 3 Month Total Returns (Daily) | 6 Month Total Returns (Daily) | 1 Year Total Returns (Daily) | |

| TLT | 4.73% | -1.01% | 4.73% | -7.83% |

| BIL | 2.25% | 1.18% | 2.25% | 3.56% |

| TIP | 2.05% | -0.98% | 2.05% | -1.55% |

| IEF | 1.97% | -1.34% | 1.97% | -3.28% |

| STIP | 1.70% | -0.21% | 1.70% | 0.15% |

| VGIT | 1.35% | -1.14% | 1.35% | -1.97% |

| IEI | 1.18% | -1.09% | 1.18% | -1.65% |

| SHY | 0.97% | -0.51% | 0.97% | 0.05% |

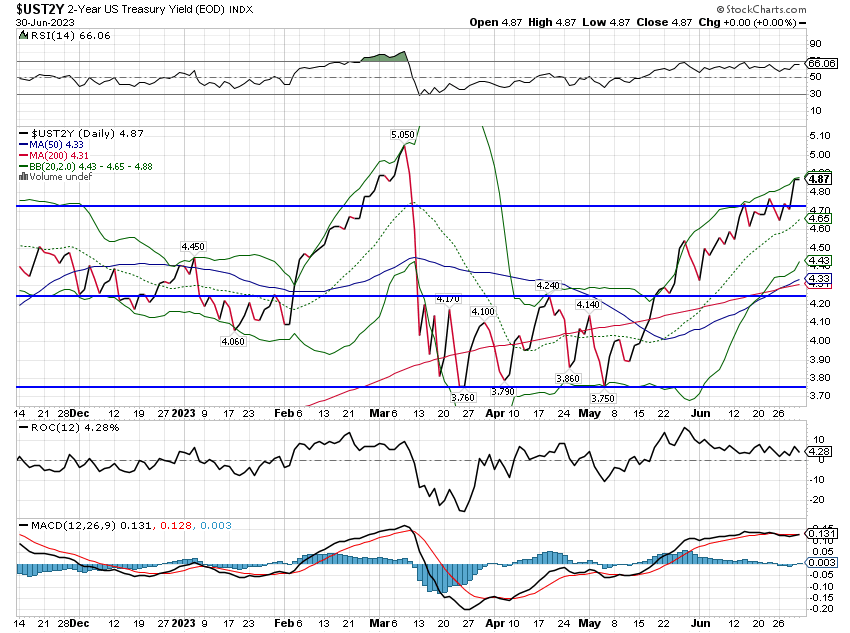

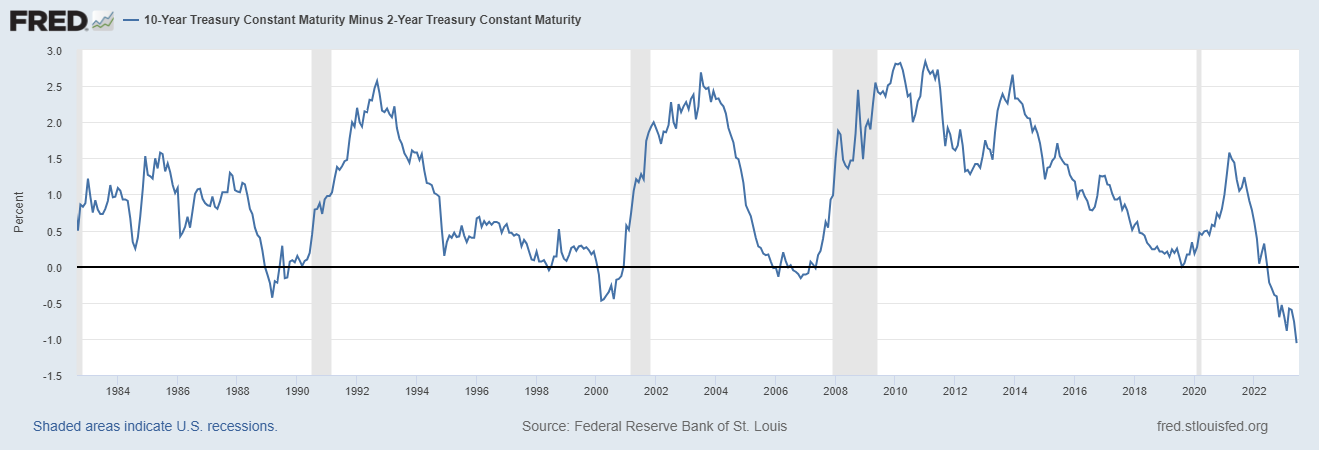

The 2-year Treasury yield was higher last week and by more than the 10-year so the yield curve pushed to within 1 basis point of its low for this cycle. In the last 4 cycles, the 10/2 curve turned positive before the start of the recession so we could still be quite a ways from that.

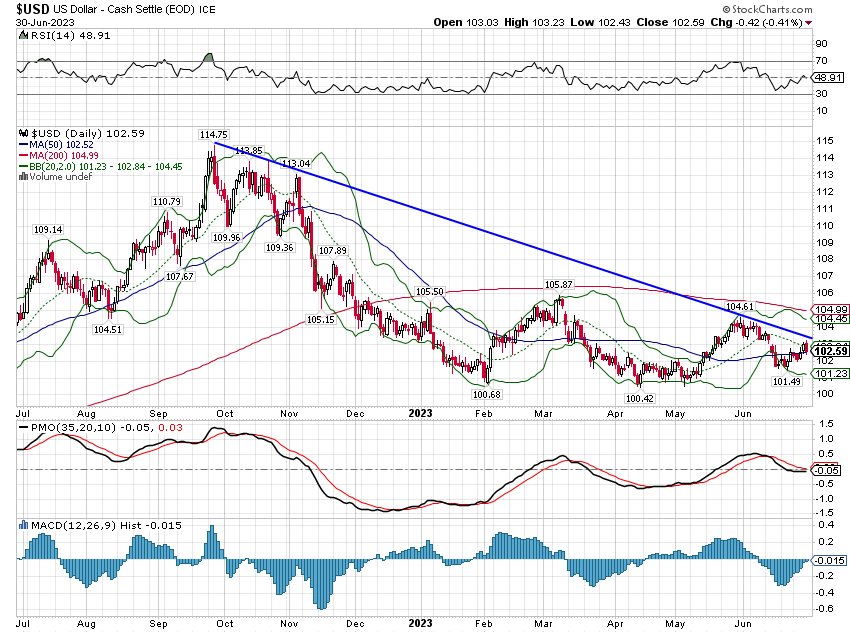

The dollar also remains in a short-term downtrend but is basically unchanged since March. I am a bit surprised the dollar didn’t act better with rates rising last week.

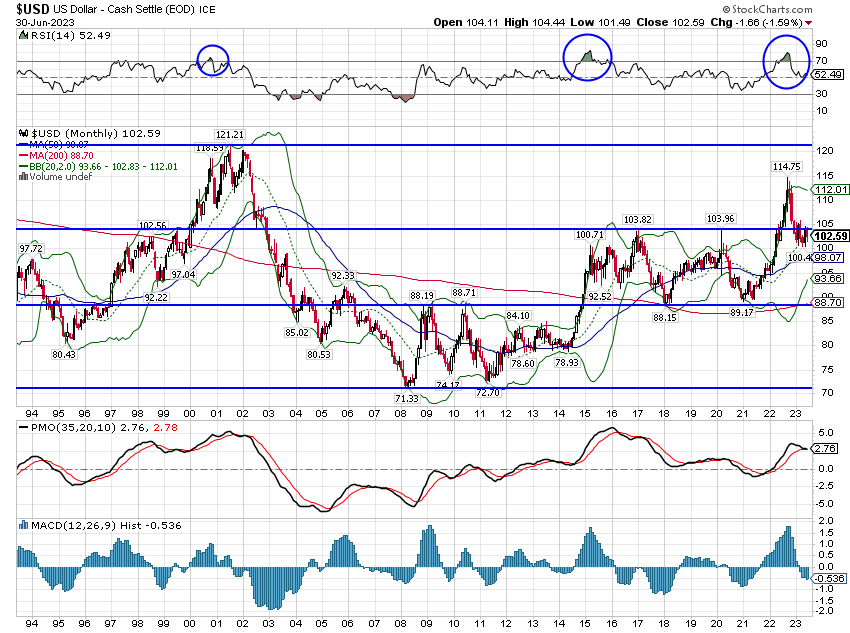

The intermediate-term dollar trend, as with the 10-year Treasury yield, is still up. Longer term, I expect the dollar to trend toward the bottom end of that middle band (see below) over the next couple of years. If that’s correct it will have big implications for asset allocation. Falling dollar environments favor value over growth, international over US, and shorter duration over longer duration bonds (because of generally higher inflation).

Markets

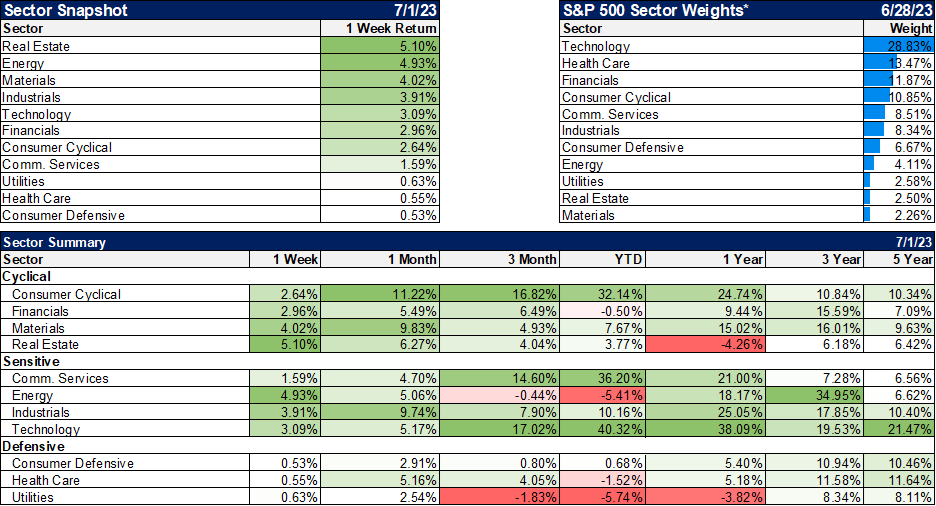

I’ve written twice in recent weeks about the negativity around real estate stocks and it didn’t take much in the way of good news to push them higher. The news was that SL Green sold an interest in one of their NYC buildings at a $2 billion valuation which was obviously higher than the value the stock price was placing on it. In other words, maybe NYC commercial real estate isn’t dead yet and smart operators like SLG will find a way to get through this. SLG was up nearly 29% last week and other office REITs performed well too. I do think you need to be very choosy if you want to own individual names in this space. While I think companies are going to push hard to get employees back in the office, that doesn’t mean they’ll be taking the same footprint as before. Work schedules are still going to be more flexible than they were pre-COVID. Some of the office REITs with heavy exposure in places like Chicago and San Francisco are going to have a tougher time because those cities have problems beyond just the pace of return to office. Be careful out there.

Small-cap stocks have been the other big laggards in the first half but they made up a lot of ground last week. It was just one week though and there is still plenty of room for small cap to play catch up. Small caps are still a lot cheaper than large caps. S&P 600 trades for 12 times next year’s estimate while S&P 500 goes for 19 times.

Bonds and commodities were both down modestly on the week. In commodities, crude oil was higher (+2.4%) for a change while natural gas was down (-1.6%) slightly. Other than crude and a small gain in precious metals, it was a lousy week though. Agriculture was down hard with Wheat and Corn both down double digits. Industrial metals were also down but more modestly. Just in case you needed a reminder, commodities are volatile. It goes to show too how dependent the indexes are on energy and crude oil specifically.

Commodities are still the only major asset class we track that is down for the year. As for crude, WTIC is still in a mild contango (spot cheaper than contracts for delivery in the future) which tells us that the market is pretty well supplied right now but price action tells us the market is pretty well balanced. Prices have oscillated around this $70 level since early May. Which way it goes from here is anyone’s guess, especially considering the situation in Russia.

Value stocks outperformed last week very slightly but growth is still leading over the YTD and 1-year time frames. Value maintains its lead over the 3-year period. We continue to favor value, especially small cap and international. The difference in performance in small cap isn’t nearly as wide as it is in large-cap, about 2% favoring growth over the last year. But over 3 years, value has outperformed growth by nearly 28%. Small cap value has outperformed large cap growth too, by an even wider margin over the last 3 years. And it is still a lot cheaper.

Energy had a big up week on the back of a small gain in crude oil but the stocks have gone nowhere this year. The positive sentiment on energy stocks has waned considerably over the last year. Everyone wanted these stocks when Russia invaded Ukraine but after that surge, the stocks have essentially gone nowhere. Now that everyone is enamored of artificial intelligence stocks they might be worth a look again. These are generally pretty cheap stocks with high dividends, stock buybacks in place, and solid balance sheets. They aren’t as fun as AI stocks to talk about at parties but other than that they’ve got a lot going for them.

Economic/Market Indicators

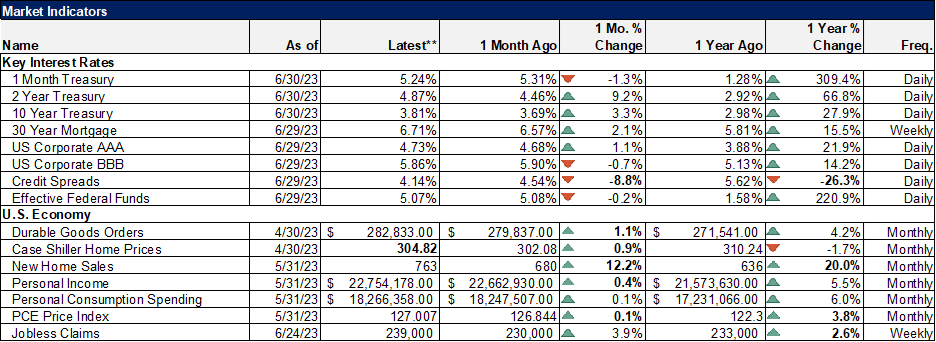

Credit spreads continue to narrow and are now back to near 4%. Just an FYI, narrowing credit spreads is not what you see just prior to recession.

The economic data was again better than expected last week. I’m sure the economic bears out there found some nits to pick but the economic news was pretty darn good. Durable goods orders were up when they were expected to be down and that is true even if you strip out transportation orders which have been ripping higher on Boeing demand. Durable goods orders ex-transportation are now up 5 of the last 6 months after being up none of the previous six months.

The Conference Board’s Consumer Confidence index jumped to 109.7 from 102.5 and versus expectations of 103. Every part of the survey improved including expectations which jumped from 71.5 to 79.3, just below the 80 level associated with recession in the next 12 months. That report was seemingly confirmed by the University of Michigan’s Consumer Sentiment poll which also improved and at 64.4 is well above last year’s low of 50. More importantly, inflation expectations fell considerably.

Personal income and spending also improved although spending was flat after adjusting for the 0.1% increase in the PCE price index. Real disposable personal income rose another 0.3% and is up 4% year-over-year.

The economy appears to me to be reaccelerating after production slowed to correct an inventory problem. Retail inventories ex-autos (where inventories are still way below the pre-COVID levels) are down 6 of the last 8 months and wholesale inventories are down 4 of the last 6. The inventory correction may have run its course. If so – and that better-than-expected durable goods report may be an indication it has – then growth may be about to improve.

There have been widespread expectations for recession for the last year and right now the last thing anyone expects is for the economy to accelerate. About the only thing less expected would be for inflation to stop improving but if demand for goods improves and companies retain pricing power that may be just what we get. The Fed Funds futures markets have priced out any rate cuts until early next year and that has been widely reported. But the market has only priced in one more rate hike, at the July meeting, and that may be where consensus turns out to be wrong.

Joe Calhoun

Stay In Touch