The Wall Street Journal published an article last week about the concentration of the S&P 500 and why you shouldn’t worry about it. The gist of the article is that the index has been more concentrated in the past and calamity didn’t ensue so it must be okay now. The author, Jason Zweig, is one of my favorite financial writers so it stings a bit when he says:

Countless financial advisers and asset managers are saying the S&P 500 is “excessively concentrated,” “presents elevated risks to investors,” “is broken”, and is “not safe!”

He intimates that my and others’ concerns about the index are driven by marketing rather than investment purposes. That is certainly true of some in our business, like the doom and gloom crowd who want you to believe they can get you out at the top and back in at the bottom, which they reckon is a long way down from here and also from wherever the index was a year ago or 3 years ago or, in some cases 15 years ago. Permabears are always going to find something to point to that seems very negative and requires you to hire them.

But I think in most cases, the analyses of the S&P 500’s concentration risk come from genuine concern. Zweig didn’t link to any of my articles about the subject but he did link to articles by Morgan Stanley and Rockefeller Capital which were not written by those firms’ marketing departments. I’m sure they wrote about what they see as a genuine risk in “the market” if it is defined as the S&P 500. That’s the way I see it too; buying a highly valued, concentrated portfolio of stocks is riskier than owning a more diversified, less concentrated portfolio. My concern with this dismissal of that risk, by Mr. Zweig and plenty of other investors, is that I worry they want to do the easy thing – just buy the S&P – because it’s been working. At least until recently.

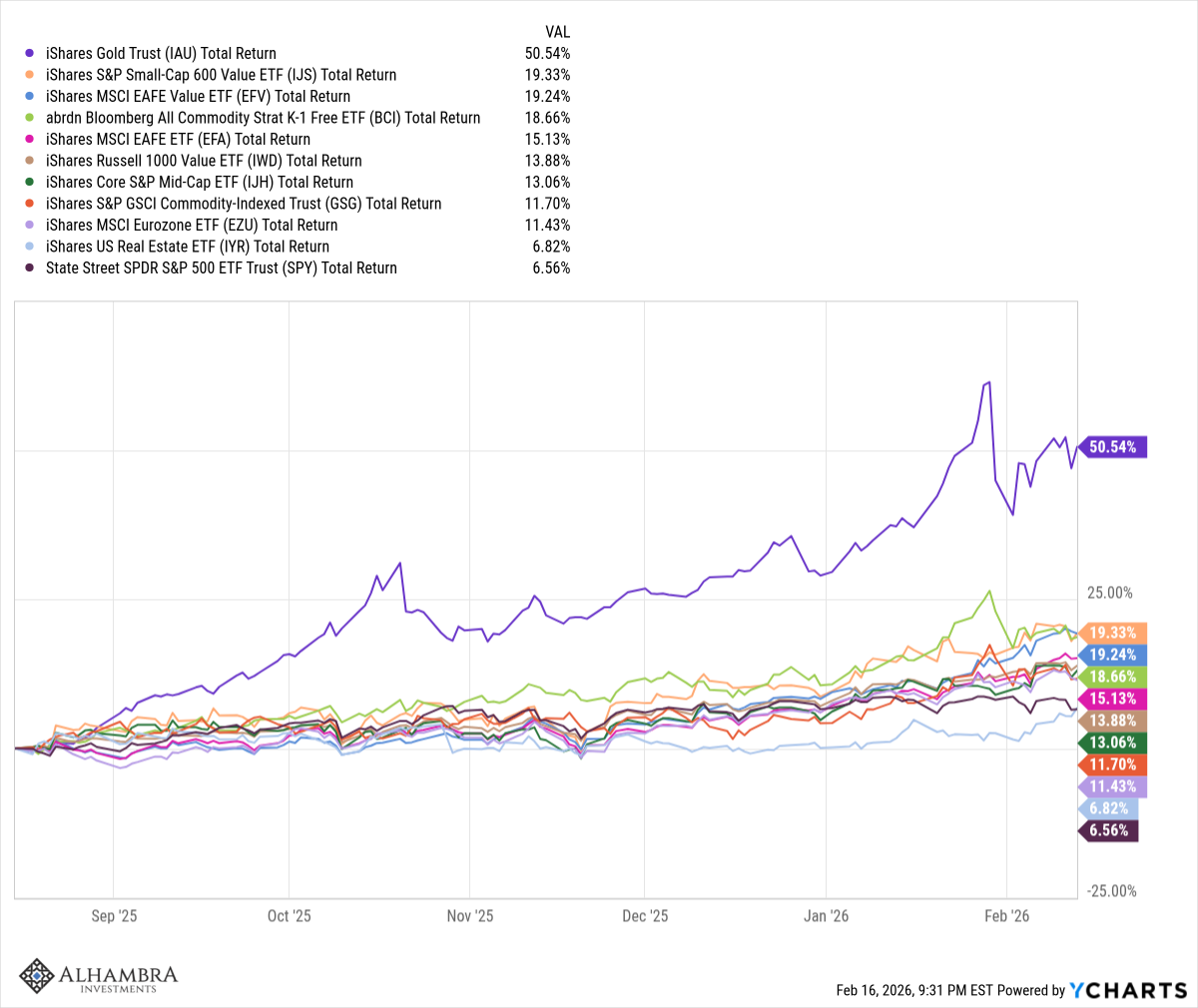

Over the last six months, the S&P 500 ranks at the bottom of my above chart of random asset returns, most of which are just other equity index ETFs. US small cap value, international value, international core, US large cap value, midcaps, European stocks, and even REITs have all beaten the S&P 500. If you change the time frame to a year, the index climbs all the way to 8th place (out of 11). Of course, this is a short period of time and may not mean anything but it could also be the beginning of a longer period of underperformance. If it is, it certainly won’t be the first time; this has happened before. The last time the S&P 500 was so concentrated in the technology sector was during the dot com boom back at the turn of the century. In 2000, technology had grown to over a third of the index and the result was severe underperformance in the ensuing period.

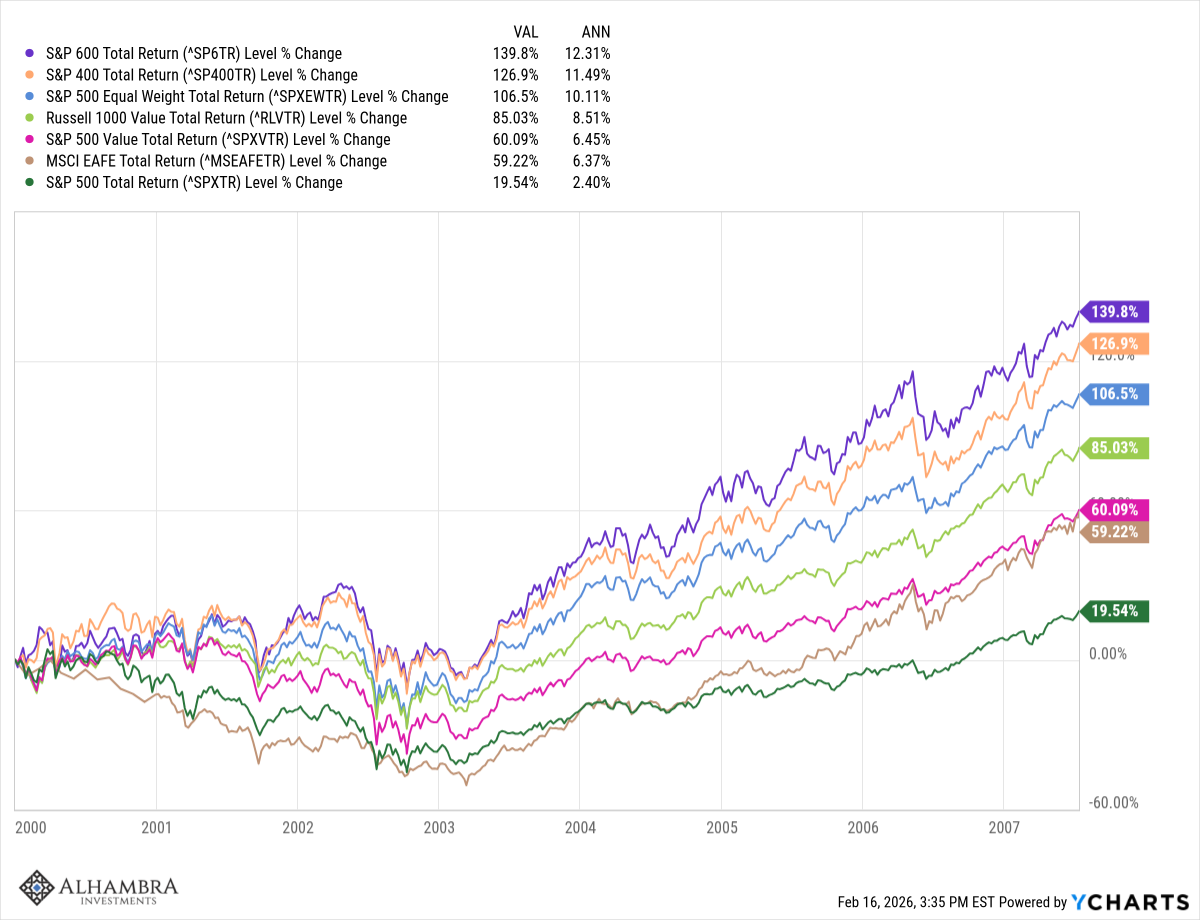

From the beginning of 2000 to the peak of the next market cycle, in mid-July of 2007, the S&P 500 total return averaged just 2.4% annually. That’s a total return of just 19.5% over a 7.5 year period. Mr. Zweig thinks you should just ride that out because, you know, the index does fine over the long term. The fact is that there were plenty of other stock market indexes that provided much better returns during that period. Small cap stocks, the equal weight S&P 500, large cap value stocks, and foreign stocks all outperformed the S&P 500 during that period and some of them by very large margins.

We can’t know the future but we have to be clear eyed about the present. The S&P 500 is concentrated in the technology and communications sectors. As constructed, it is expensive at about 24.5 times full-year 2026 estimates. That is well above the five-year average of 20, the ten-year average of 18.8 and way above the 25-year average of 16.3. Concentrated and expensive and I’d say riskier than it would be with less concentration and a cheaper multiple. It is possible that the optimism embedded in the index today is justified. There is also some chance that it isn’t, that AI takes longer than expected to deliver its miracles. Since we don’t know which way things will come out, the logical thing to do is to spread our bets – diversify.

We don’t own the S&P 500 in our portfolios and haven’t for some time. That doesn’t mean that we don’t own technology stocks because we do; we just don’t have nearly 40% of our large cap exposure in 10 stocks. We have found alternative indexes that provide us with large cap exposure in a more diversified way. We also own small and midcap stocks as well as international stocks. They have all outperformed the S&P 500 over the last 3 and 6-month periods and all but one have outperformed over the last year. The international index we own has outperformed the S&P 500 over the last three years.

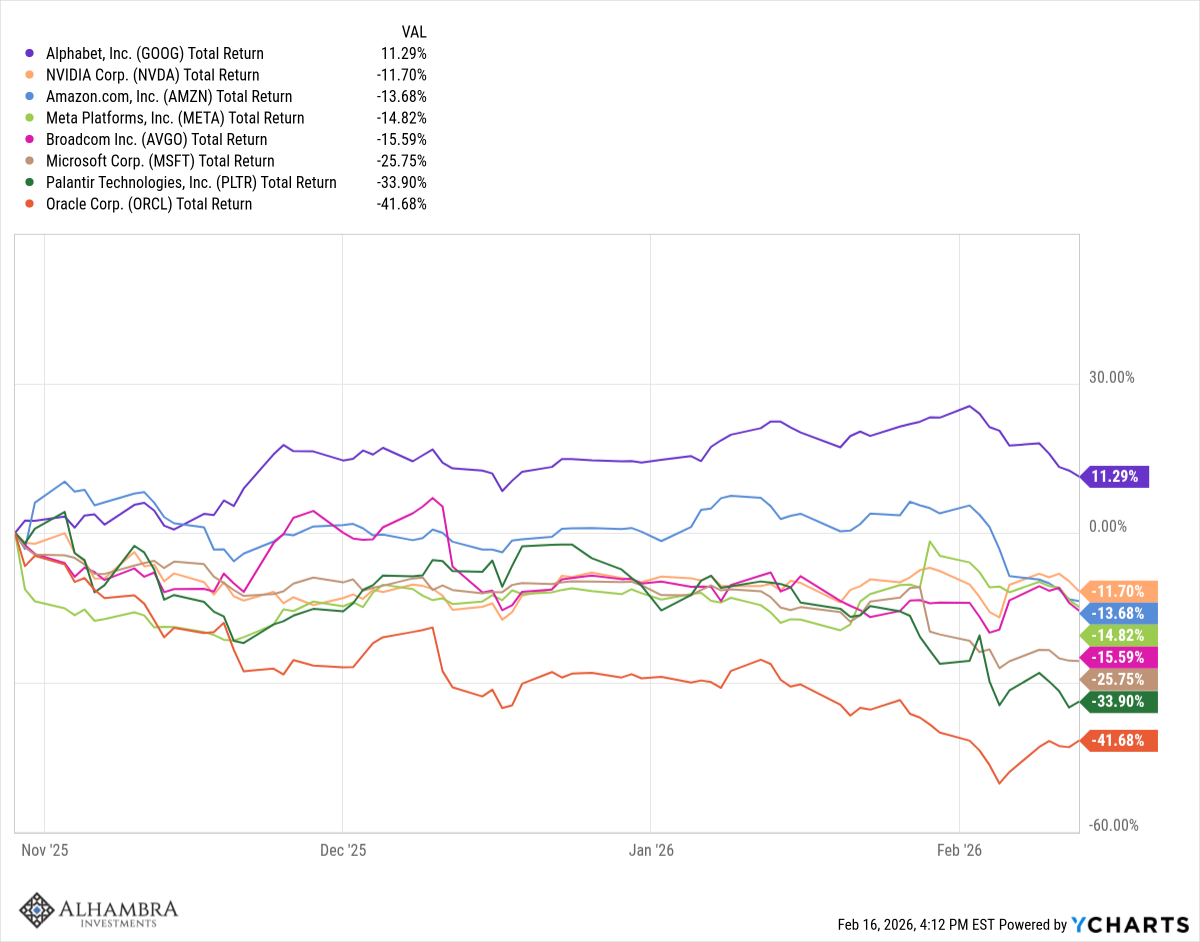

The most recent bout of S&P 500 underperformance dates from October 29th last year when the index was just a bit above where it is now. What stalled the index? Tech stocks stopped going up. Of Microsoft, Nvidia, Amazon, Meta, Broadcom, Palantir, Oracle, and Google, only the last one is up since October 29th.

These aren’t the only stocks being affected by AI fears. Over the last couple of weeks, we’ve seen several sectors take hits on fears about how AI will affect their business. Software stocks have been particularly hard hit with Intuit, Salesforce, Service Now, Adobe, and Autodesk all down significantly from their highs. Apparently no one will buy software ever again because AI will just let them develop everything in house. Insurance brokerage stocks such as AJ Gallagher, Brown & Brown, Willis Towers Watson, and AON were all hit because an online insurance shopping platform released a new app. Data companies like MSCI and S&P Global were knocked down because…well I’m not sure exactly why except they seem vulnerable somehow because…you know…AI.

In a sign that this may all be jumping the shark a bit, trucking stocks were hit hard last Thursday, with C. H. Robinson down nearly 25% at one point during the trading session, when a company called Algorhythm Holdings, which in a prior incarnation made karaoke machines, released a white paper which claimed that its SemiCab AI unit could boost freight volumes for customers by 300% “without a corresponding increase in operational headcount”. This is a penny stock company with a market cap of about $12 million, whose press release knocked billions off the value of trucking stocks. The irony is that these trucking companies would be the beneficiaries of such an app if it really exists. AI trading bots aren’t big on logic I guess.

With some softer economic readings last week—retail sales came in weak, existing home sales disappointed—it’s tempting to layer an economic slowdown narrative on top of the AI fear trade. And the 10-year Treasury yield has fallen about 25 basis points since February 3rd, lending some superficial support to that story. But we haven’t really seen slowdown fears emerge in the market yet. The 10-year Treasury yield is down from its recent high but rates were lower when stocks peaked in October. TIPS yields have moved a little too but both are still in the same range they’ve been in for at least the last three years. Credit spreads have widened a little but are still very tight – 130 basis points tighter than three years ago.

The story that’s getting a bit buried here is that earnings season showed that growth has broadened beyond the tech sector. Overall, Q4 earnings are up over 13% – the fifth consecutive quarter of double digit earnings growth – while revenue growth is running at over 9%. And it isn’t just tech anymore. 9 of 11 sectors are reporting earnings growth, up from 6 last quarter. Ironically, the sector with the worst recent stock performance was the one with the best earnings growth (technology) while one of the best performing sectors was one of the two with earnings down (energy). Stock prices aren’t much interested in the present.

So, is the stock market peaking? Well, if you define the stock market as the S&P 500 it may be, although I’m more than a little skeptical. AI is a wonderful tool and it may well impact a lot of industries. And some of those, like SAAS companies, may well need to adjust their business models while some are rendered obsolete. But many will be enhanced by AI themselves and come out winners.

I would also note that while LLMs may be able to do a lot of the things humans can do, in the end it is still just aping human language. And like the karaoke machines once produced by Algorhythm Holdings (a clever nod to their music past, I must say) AI is only as good as its user. Have you ever been to Karaoke night? Imagine software written with the same level of skill as the average Karaoke singer.

Maybe I’m wrong and Jason Zweig is right that the S&P 500 today, with nearly 8% of the index in Nvidia, is just as safe as it was in 1932 when AT&T was nearly 13% of the index. Sure, Nvidia is in a highly competitive industry and AT&T was a protected monopoly in 1932 but that probably doesn’t matter. Right? But just in case it does, what are the three most important words in investing? Diversify, diversify, diversify.

Joe Calhoun

Stay In Touch