Markets were rather volatile last week. That’s a wild understatement and what passes for sarcasm in the investment business. Stocks started the week waiting with bated (baited?) breath for the inflation reports of the week. It isn’t surprising that the market is focused firmly on the rearview mirror for clues about the future since Jerome Powell has made it plain that is his plan, goofy as it is. Stocks were down slightly Monday and Tuesday fearing the worst and hoping for the best I guess.

A hotter-than-expected PPI didn’t change things much on Wednesday because through hundreds of speeches about inflation over the summer, no one at the Fed has mentioned PPI. Apparently, inflation at the wholesale level is irrelevant.

But Thursday, well, now that’s a different story. Things were looking up pre-market based on rumors that the UK Chancellor of the Exchequer was on the ropes and the PM would be rolling back her tax cut plan. Why did that push US futures higher? Um. Yeah, I don’t know either.

Maybe fiscal responsibility turned into a positive for markets? I’m not sure and I’m certainly not against a little sanity in budgeting, but merely canceling some of the tax cuts will not come close to closing the UK deficit. They aren’t balancing a budget any time soon across the pond.

The positive reaction may have been hope that the UK pension funds that were blowing up a couple of weeks ago would be saved with lower rates. But the BOE’s been buying bonds for two weeks giving those funds a chance to reduce their risk and I can’t imagine they’ve been sitting around doing nothing. When your central bank offers to bail you out of a mess of your own making you don’t have to be wise to take it, just interested in self-preservation.

I could say something here about global interconnectedness and all that but the truth is that people are just afraid – because that’s been the prevailing mood all year – that a calamity in some country somewhere will trigger the global meltdown all the economic permabears have been warning about…since I still had hair. The UK pension mess was just the latest iteration.

So, anyway, the CPI came out Thursday morning hotter than expected and faster than I could get my toast done, the Dow futures went from up 300 to down 500. The S&P 500 opened down 2.5% but that turned out to be the low of the day. By the close, the S&P 500 was up 5.1% from the low and 2.5% for the day, a mirror of the early morning plunge. Huh? With a hotter-than-expected CPI? Remember my commentary from a few weeks ago titled Peak Pessimism? Once everyone who wants to sell has sold, everyone who wants to hedge has hedged, there’s no one left to push things down so any nudge higher can turn into a stampede. And that’s exactly what happened Thursday.

Unfortunately, we got the opposite Friday, based on even thinner news than the CPI report because stampedes can happen in any direction. The market was trading higher until the release of the University of Michigan consumer sentiment survey at 10 AM. The headline from the survey wasn’t disturbing at all, overall Sentiment and Current Conditions both rising while Expectations only fell modestly. But the U of Michigan also reports on inflation expectations and the 1 year forward rose from 4.7% to 5.1%. The 5-year forward average was 2.9%, the exact average since December 1990 but no one noticed that apparently.

Six months ago I doubt the market would have reacted to this number at all but at the June FOMC post-meeting press conference, Jerome Powell happened to mention that it played a role in their decision to hike 75 basis points rather than 50 as had been expected. It apparently shocked him so much that he leaked a story to the WSJ two days before the meeting that a 75 basis point hike was likely.

I do wonder sometimes if Jerome Powell does everything in life based on feelings and hunches and stuff. If he had taken even a moment to review the data from this survey a couple of things would be obvious. First of all, the respondents to the poll are not that bad at figuring out the direction of future inflation and second, they are absolutely awful at figuring out the magnitude. Since December of 1990, the average difference between the respondents’ one-year-ahead inflation expectation and the year-over-year change in CPI is 5.1%. Yes, you read that right. They consistently overestimated inflation through much of the decade prior to COVID and have consistently underestimated it since the spring of 2021. By the way, this measure of inflation expectations peaked in March at 5.4% so the trend is down if only slightly.

In any case, by the end of Friday’s trading, the market had taken back almost all of Thursday’s gain and stocks closed the week down about 1.5%. All based on nothing. The CPI report contained exactly zero surprises other than that inflation wasn’t as bad as the market feared and prepared for. The reason CPI was a whole 0.1% higher – it is amazing how much markets can move on something so slight – than expected was the difference between goods and services which are moving in opposite directions. Goods prices were generally well behaved, mostly flat but quite a few categories down. Services prices, on the other hand, were almost all higher and some by substantial amounts.

I don’t find that timing difference odd in the least. I’ve been saying for a year now that the goods economy would slow back down to trend while the service side would recover up to trend. The result is the zero growth we saw in the first half of the year and that may be the course until the goods and service economies get back to their old trends or start new ones. So with goods slowing and services still accelerating (did you hear the airlines on their earnings calls last week? business is booming with no let up in sight) is it really surprising that the price trends reflect that growth rate difference?

From a higher level, the market volatility last week was a vivid demonstration of the consequences of reduced liquidity. Now, that isn’t necessarily some problem the Fed or anyone else need respond to. It is a natural consequence of a bear market and investors’ risk aversion. In a way, a lack of liquidity is exactly what a bear market is all about. Fewer people are willing to risk buying a market that is still falling and those still holding aren’t willing to risk selling a market that is already down quite a bit. The result is less urgency by either to transact. This is why the biggest one-day rallies in the history of the stock market have almost all come during bear markets; low liquidity means big market moves.

There are situations where the Fed can and should take action though, and I wonder if we might be nearing just such a time. With all the stock volatility it may have escaped your notice but Thursday, the 10-year Treasury note traded in a range of 24 basis points, from 4.08% at the high all the way down to 3.84% at the low. That doesn’t sound like much but with rates at only 4%, that’s a range of 6% on the day. That was a greater range, percentage-wise, than stocks that day. And that has been the case throughout much of this year by the way; bond volatility this year is history-making.

Why might that be a problem for the Fed to solve? In two words, quantitative tightening. I don’t believe QE or QT has much influence over inflation. You can slice and dice the inflation data however you want and there is no correlation. QE and QT do affect liquidity though and most directly in the Treasury market – with knock-on effects in other markets. There is no doubt the public – and a lot of economists – believe that QE and QT directly affect inflation. Reality disagrees.

We didn’t get inflation after doing QE from 2008 to 2014. Indeed, inflation spent most of that period below the Fed’s target of 2%. We did get inflation after reintroducing QE during COVID but the key difference was fiscal, not monetary policy. You can easily see that in M2 money supply, which barely budged in the earlier period, soared during COVID. QE alone is nothing more than an asset swap, Treasuries for reserves. QE combined with fiscal policy that puts cash directly in people’s hands is a helicopter of a different color. The effect is just a bit different, as we’re finding out.

Through QE the Fed is always a ready, price-insensitive buyer. Today, with QT, a continuing budget deficit, and smaller trade deficits, there is increased supply and buyers are very price sensitive. It is ironic, at least to me, that the Fed was a buyer of Treasuries when inflation was low and everyone was willing to own bonds and a seller now when no one really wants them. It is the Fed’s job to provide liquidity when others won’t and they’ve spent a decade doing the opposite, adding liquidity when it is abundant and withdrawing it when it’s scarce.

The Fed’s balance sheet has ballooned before, during the Great Depression and during WWII. The balance sheet peaked at 23% of GDP during the late 1930s. It rose to 25% of GDP in the first iterations of QE up to 2014. It fell back to about 17% in 2019 but soared to around 35% of GDP by the first quarter of this year. The size of the balance sheet is larger today than it was in the 1940s but the Fed has dealt with this before.

Does shrinking the balance sheet affect inflation? The experience after WWII would seem to indicate the answer is no. In fact, the evidence seems to show that interest rates don’t have much impact either. Right after the war, the Treasury was still directing the Fed to peg the entire yield curve so interest rates didn’t really move. But inflation sure did. From 18% in 1946 to -2.1% in 1949 and back up to 6% in 1951. The balance sheet during that time fell as a % of GDP but not because the Fed was selling assets from its balance sheet. They just let the balance sheet shrink naturally over time. It took until the early 1980s for the balance sheet to shrink back to the ratio to GDP that prevailed prior to the Depression. Inflation moved around a lot in those years but I don’t think anyone believes the balance sheet had anything at all to do with it.

I’m not suggesting that the Fed should restart QE but I am suggesting that maybe trying to shrink the balance sheet while also raising interest rates is just a bit too much for the market and the economy to take. Maybe the Fed should be more concerned with its original mission – lender of last resort or “liquidity provider” – than some of the new ones politicians keep assigning them. If QT doesn’t affect inflation – and it doesn’t appear to – why do it right now? Why complicate an already tense situation? Why do it at all? Why not follow a model that obviously worked before and let the run off happen naturally? This Fed, more than any other in my lifetime, seems obsessed with doing things quickly. Slow down.

Environment

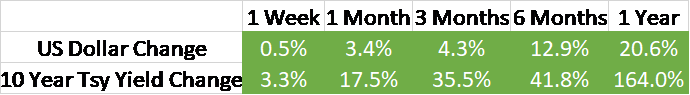

The trend for the 10-year Treasury rate and the US Dollar is still higher but the rate of change on both is starting to slow. The dollar’s rise this year is a function of higher rates, specifically higher real rates. The rise in the 10-year TIPS yield is even more dramatic than the nominal 10-year, rising from -1.04% on December 31 and closing last week at 1.59%. Interestingly, as the nominal 10-year yield was hitting a new high last week, the 10-year TIPS yield was actually down by 3 bps.

I would posit though that if real yields are peaking – and the 10-year TIPS yield is essentially unchanged for the last 3 weeks – then the dollar may also be peaking. The dollar is sensitive to real rate changes as is gold. The dollar tends to rise – and gold fall – when real rates are rising. And despite the hoopla last week of closing above 4% for the first time this year, the nominal 10-year yield is only up 5 basis points since September 27th.

The bear market in stocks this year has been driven by rising rates and the rising dollar (related obviously). We got a demonstration last week of what happens when you get a little relief from either. Thursday stocks rallied strongly as rates and the dollar both reversed intraday. With market positioning overwhelmingly bearish it didn’t take much of a push for stocks to move from -2% to +2% over the course of a day.

In past inflationary episodes, during the 60s and 70s, stocks made their lows near the peak in the year-over-year change in inflation. In the 1969/70 recession, the YOY change in the CPI peaked at 6.4% in February of 1970, stocks hit their lows in June and the recession ended in November. In the 1973/74 recession, CPI peaked in November 1974 and stocks hit their lows in September 1974, just before the peak. In the short 1980 recession, CPI peaked in April of 1980 the same month the stock market made its low. CPI peaked this cycle – so far – in June of this year.

Markets

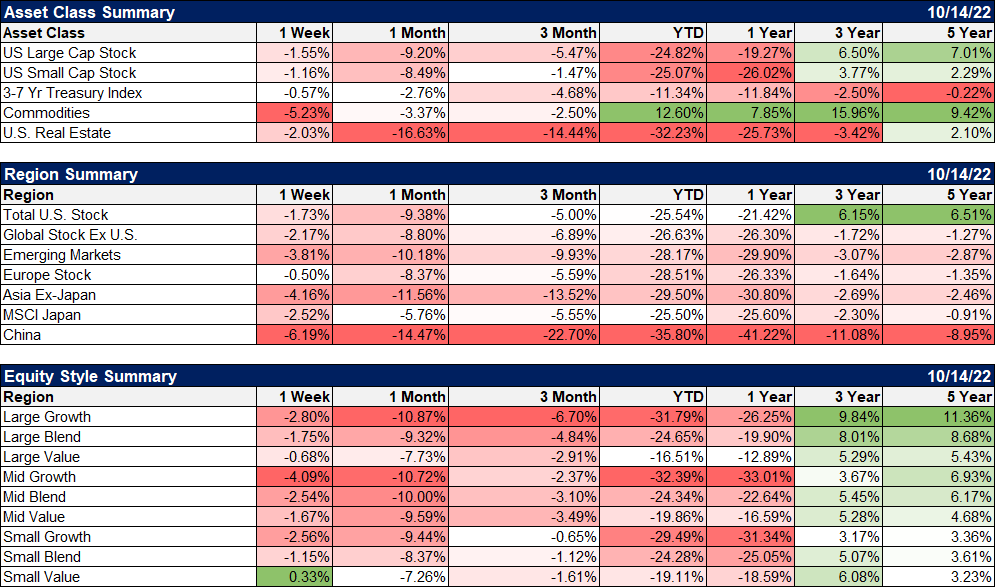

It was a wild week for stocks with the S&P surging on Thursday and giving almost all the gain back on Friday, all driven by the change in rates and the dollar. Commodities were down on the week as crude oil fell 7.5%. There were a few commodities higher, like copper, but in general, commodity prices continue to moderate. I don’t think that will last though; I think commodities are likely in a secular uptrend, not cyclical.

Bonds and real estate were both down last week with rates higher. REITs are, by far, the worst-performing asset class in our universe this year, down over 32%. REITs have historically performed well in inflationary environments and they are a permanent part of our strategic allocation. We believe we have entered a structurally higher inflation – and interest rate – environment. Not necessarily a 1970s level of inflation but higher than we’ve experienced in the recent past. We think inflation could be sustained at 3-5% for a period of time measured in years (and maybe decades). (BTW, we will make a research paper available this week that lays out our reasoning.) I am confident REITs will perform well under those conditions.

Real estate performs well in an inflationary environment because landlords have pricing power; rents rise. That should continue to be true in the US where housing vacancy rates are still at or near all-time lows. While I expected a transition period as interest rates rose I have to admit that I didn’t foresee anything like the downdraft we’ve had this year. Payouts and yields have risen this year through a mix of falling stock prices and rising dividends. And if inflation proves sticky, it will likely mean a steady rise in dividends in the coming years. I think that’s a trend we’re going to want to participate in. Are we through the transition yet? That probably depends on how high interest rates ultimately rise but I would expect REITs to outperform when rates start to pull back.

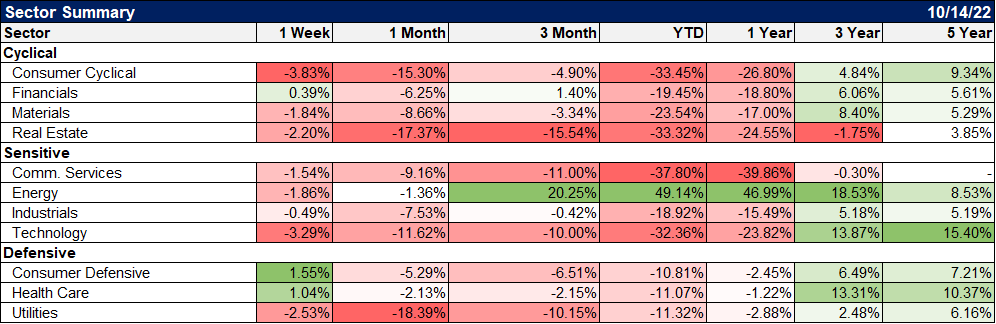

Financial, defensive, and health care outperformed last week. The financials are particularly interesting as multiple banks reported rising net interest margins – in several cases very large rises – in their earnings reports.

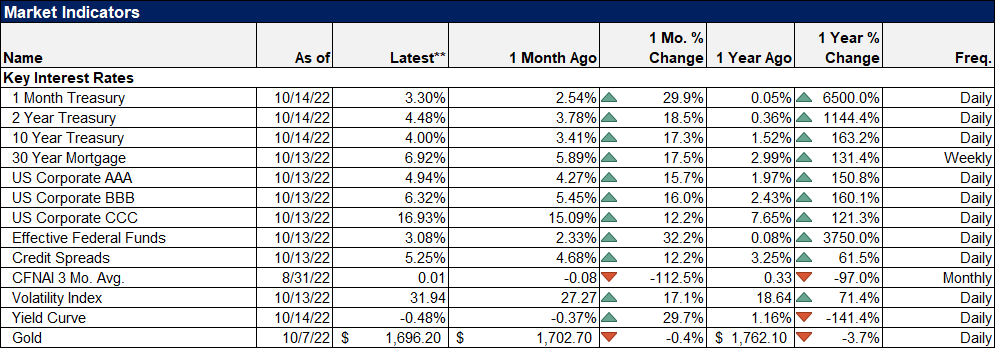

The very short end of the rates curve is rising pretty rapidly now, faster than longer maturities. If the Fed does indeed hike 75 basis points at the November meeting, we may finally invert the 10-year/3-month portion of the curve. While the 10-year/2-year curve has provided multiple false signals in the past, I only know of one time since 1962 that the 10-year/3-month curve has inverted and we avoided recession (1966). Lead time to recession is highly variable though with the longest I know of being 19 months (inverted Feb ’06, recession Dec ’07) from inversion to the onset of recession. The last four recessions saw lead times of 14, 8, 19, and 9 months from inversion to recession (average of 12.5 months).

Volatility is the inverse of liquidity. When there is ample liquidity there is little volatility and when there is none we get lots of it. Stocks have been more volatile this year but despite the large drawdown in the S&P 500, the Volatility Index itself (VIX) has been surprisingly tame. The intraday high of the year was 38.94 way back in January when the bear market was just getting started. Most corrections/bear markets see at least one spike above 40 before finding a bottom.

The MOVE index – the volatility index of the bond market – on the other hand, has nearly doubled this year. At 152.9, it is above the highs of the COVID crisis and consistent with the peak at the end of the 2000-2003 bear market. It is still well less than the 2008 peak over 250; we have a bit of a liquidity problem but nothing on the order of 2008.

Monetary tightening episodes are all characterized by reduced liquidity – that’s what a tightening cycle is all about – so this isn’t unusual. But it is getting to be extreme and whipsaw markets like we saw last week will probably continue until we achieve some stability in the bond market. I can’t tell you when that will happen but Janet Yellen just last week expressed her concern about bond market liquidity. Are we about to get a pause in QT? I don’t know but regardless of how it might affect the stock market, it is the right thing to do. Long and variable lags in monetary policy mean that the Fed doesn’t know the impact of its rate hikes yet. But the impact of QT is pretty obvious.

Joe Calhoun

Stay In Touch