Have more than thou showest,

Speak less than thou knowest,

Lend less than thou owest,

Ride more than thou goest,

Learn more than thou trowest,

Set less than thou throwest;

Leave thy drink and thy whore,

And keep in-a-door,

And thou shalt have more

Than two tens to a score.King Lear, Act 1, Scene 4

My grandmother was a great woman. My mother died when I was 4 years old from kidney failure associated with lupus and my father left soon after for Vietnam to work for what became known in later years as Air America. No, he wasn’t a spy; he kept the electronics working. My sister and I moved to my dad’s mother and step-father’s farm in Arkansas and stayed there until I was 10 years old. Granny was the head of our family and everyone knew it and accepted it – including granddaddy – because, for lack of a better term, she was a badass. This woman kicked a ne’er do well husband out and divorced him – in the south, in the early 1950s when such things were hard to do – and raised 3 sons on her own. They were poor, living for a while in an old, abandoned store thanks to a kind-hearted man – or a besotted one depending on which brother is telling the story – but she held it together, kept everyone fed and clothed, working wherever and whenever she could. She later married the man I knew as Granddaddy and they owned a cafe and a gas station in addition to raising Angus cattle on a 100 acre farm. She was involved in all of the businesses and also managed to raise a garden every year, made sure the cow got milked (yes, I can milk a cow), the butter churned, the corn shucked, peas shelled and the canning done. All while raising me and my sister along with the two daughters she had with Granddaddy.

She was the most amazing woman I’ve ever known and I think of her often. She wasn’t highly educated but she was a font of wisdom, most of it a function of hard earned experience. She didn’t read about the Great Depression, she lived it (my Dad was her first born in 1935) and she taught me more about money and economics than I could ever learn from a book. She taught me to be skeptical, to be wary of things that sounded too good to be true. She taught me to dream but not take flights of fancy. She taught me to work hard and save, how to be frugal but not miserly. She taught me that quality was more important than quantity. And she taught me to ask questions.

One of her favorite sayings was that God gave us one mouth and two ears for a reason and we ought to use them in those proportions. When us kids did something wrong, we didn’t get a lecture, we got interrogated. She’d ask a question and then sit and wait for you to answer – and she had the patience of Job. She could sit there for what seemed like an hour, letting the silence overwhelm you until you had to talk. And you better be truthful because she always knew – somehow – when you were fibbing and believe me when I say she had no problem with corporal punishment. At the end of one of those sessions she would have, after only a handful of questions, learned all she needed to know.

And that is why I spend most of my time asking questions. It makes me think about the things I know or think I know and the things I don’t know and the things I can’t know and must wait for the future to reveal. It isn’t usually an exercise that yields clear answers because most of the questions involve the future which, despite much effort on the part of economists and weathermen, is still quite unknowable. But asking questions and listening to a variety of opinions is still the best way I know of getting at the truth. Thanks Granny.

Markets have been unsettled over the last couple of months as we near a Fed easing cycle. The yield curve is normalizing – long term rates rising above short term – and the fear of recession is palpable. The uncertainty is hitting markets, first at the beginning of August and now again at the beginning of September. This post-COVID recovery is vastly different than any in recent memory – and I’m old so recent memory for me goes back a ways – so the uncertainty seems greater today than in the past. And that means we need to ask more questions. Here’s what I’ve been thinking about lately:

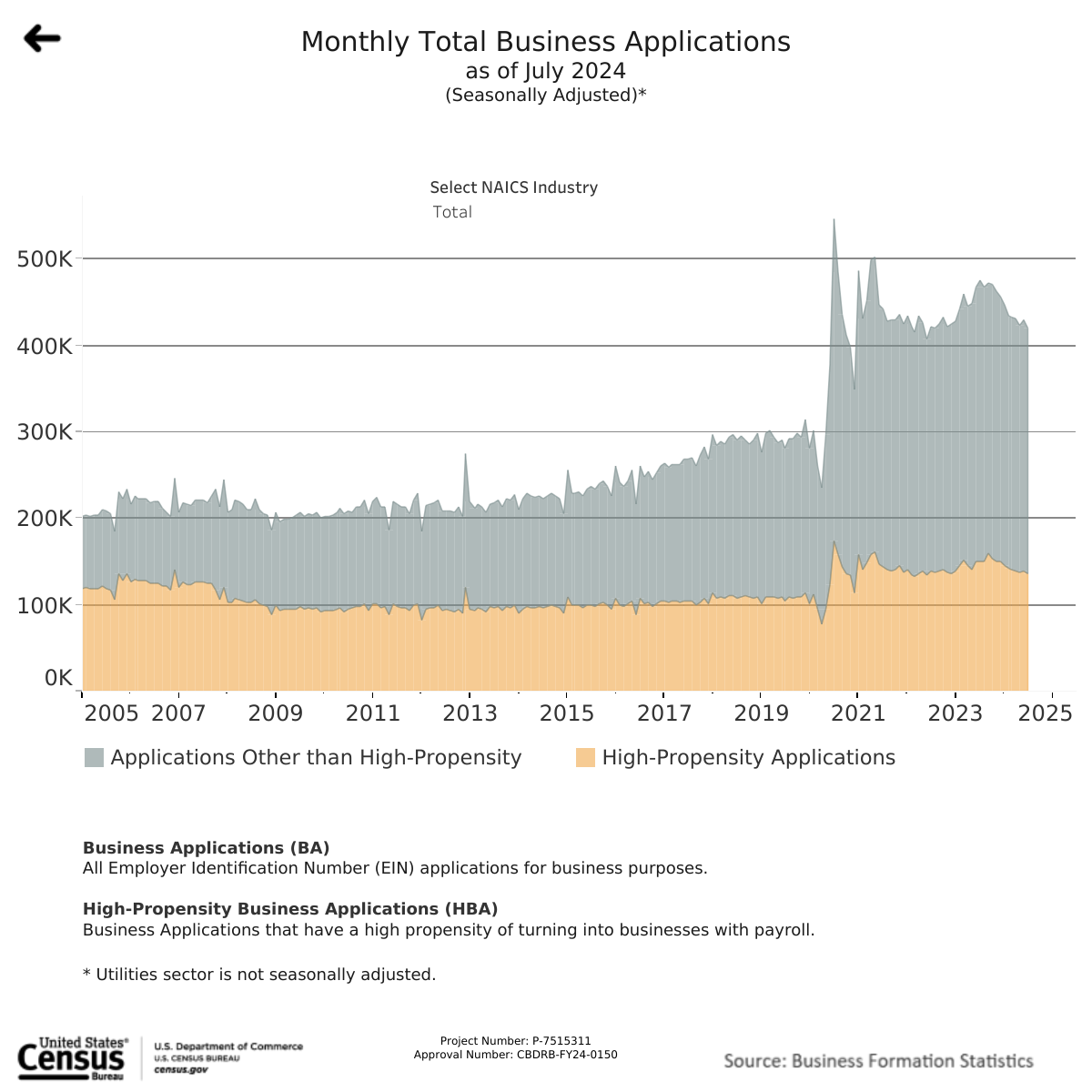

- Did COVID cause a structural change to the economy? There is no denying that the post-COVID economy has changed from the one that preceded it. Most people point to the size and persistence of the fiscal response to COVID and that is certainly true but could there be some other explanation? Why for, instance, has new business formation been so robust in this period? Are people more willing to take chances today than they were prior to COVID? Maybe COVID taught us – or reminded us – that our lives are a lot more fragile than we thought. If the entire world seems risky, maybe the risk of starting and running a business pales in comparison. Or maybe COVID just pushed forward a trend that was already in place (gig work, independent contractor, etc.). But these aren’t all just one person companies; there’s a big jump in “High Propensity Applications” – those who expect to hire employees other than the founders – too. Knowing this, do we put the same trust in an indicator like weekly jobless claims? Has the margin of error for the monthly employment numbers changed? Are job openings as relevant as they were prior to COVID?

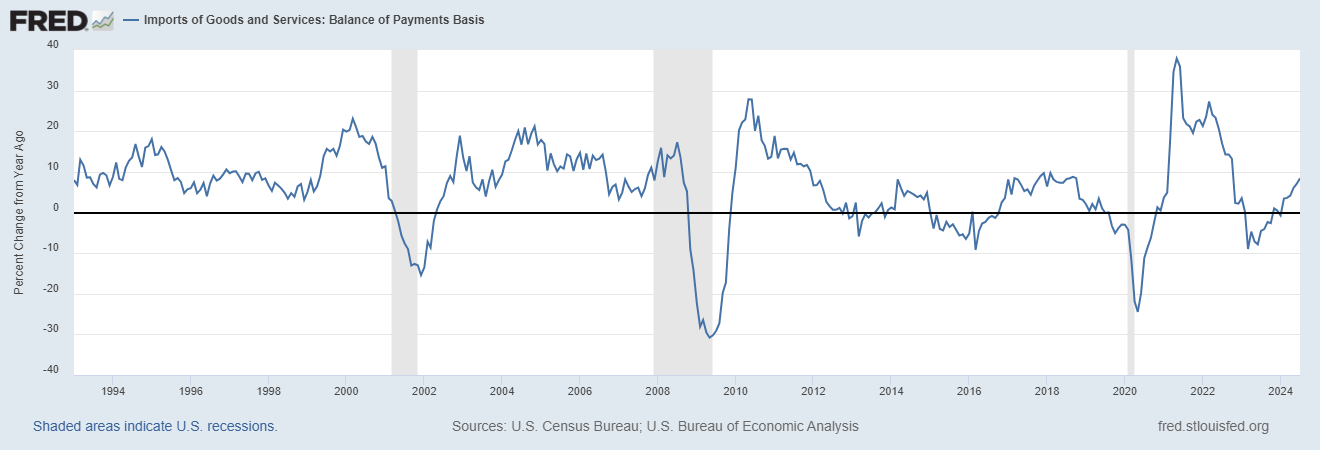

- I’ve seen a number of economic series recently that look as they would coming out of recession rather than nearing a new one. Just last week we got a trade report that showed rising exports and imports with imports rising faster, widening the trade deficit (tariffs aren’t “working”). Imports are correlated with US growth, falling before or in recession and rising rapidly as we exit recession. Which is exactly what it looks like right now. Did we have a recession in 2023 and no one recognized it?

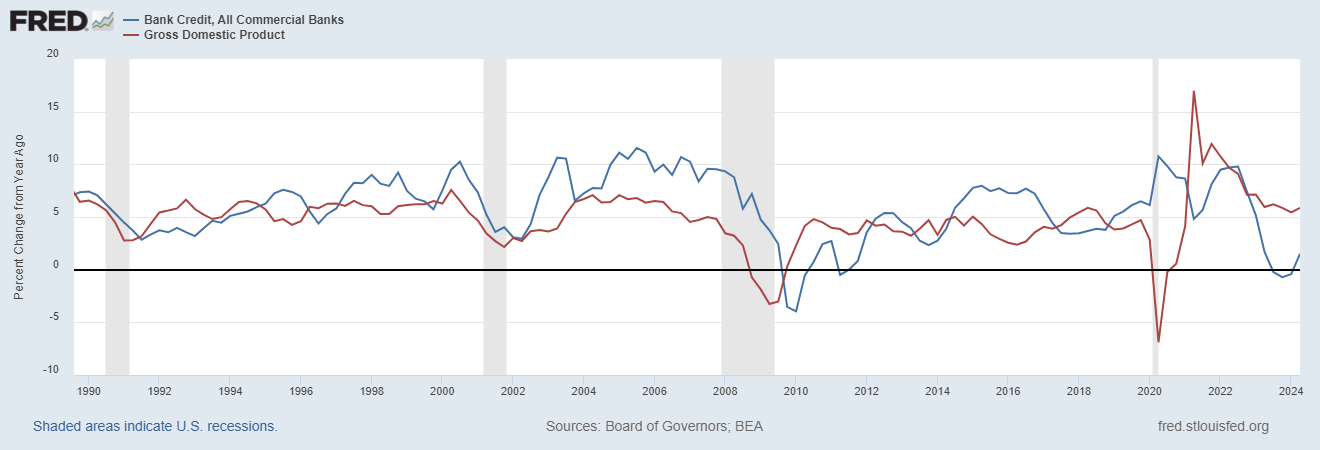

- Another series that looks post-recession is Bank Credit (all commercial banks) which also falls in recession and rises as recession ends. It is highly correlated with Nominal GDP growth (real growth + inflation) and is now turning higher. Is the economy about to reaccelerate? With so much of the lending in the economy now coming from private credit – non bank – sources, is bank credit as reliable an indicator as it was pre-COVID?

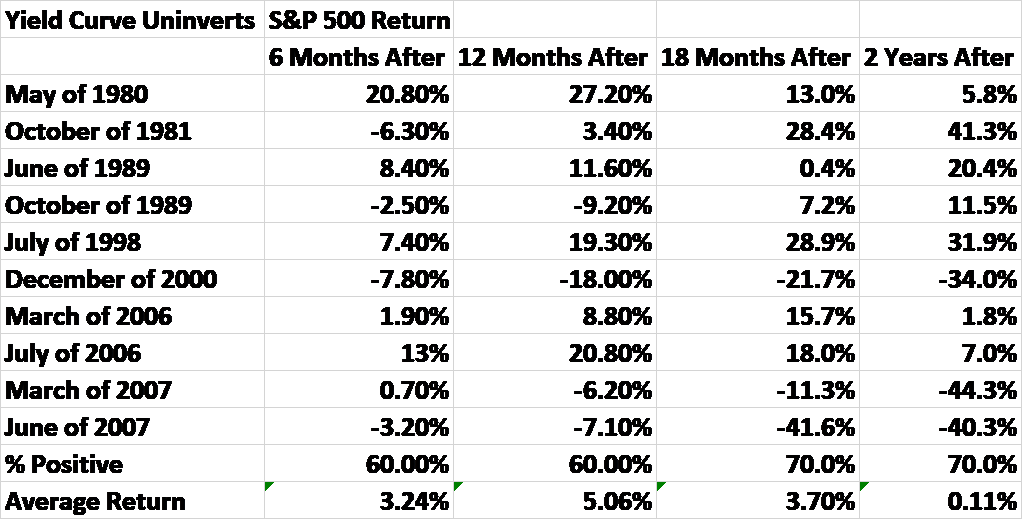

- There’s a lot of talk about the recent normalization of the 10/2 yield curve but most of the narrative is about the odds of and timing of a recession. If we’re looking at this as investors, is that the right question to ask? Shouldn’t we be asking how the markets perform when the curve goes from negative to positive? The term spread has moved from negative to positive 10 times since the 1980 recession. The reason there are so many instances of this is because the curve tends to invert, normalize, re-invert, normalize, etc. You can’t just assume that the most recent normalization is the last one. Anyway, of the 10 times the curve has normalized, returns for the S&P 500 are higher 60-70% of the time depending on time frame. The average returns in the next 6, 12, 18 and 24 months are all positive but not exactly inspiring. The good news is that bear market-sized losses tend to be 18 to 24 months after the normalization of the curve. Which means we probably have time to think and observe before making any big decisions. That is much more valuable information for an investor than “when does the recession start”.

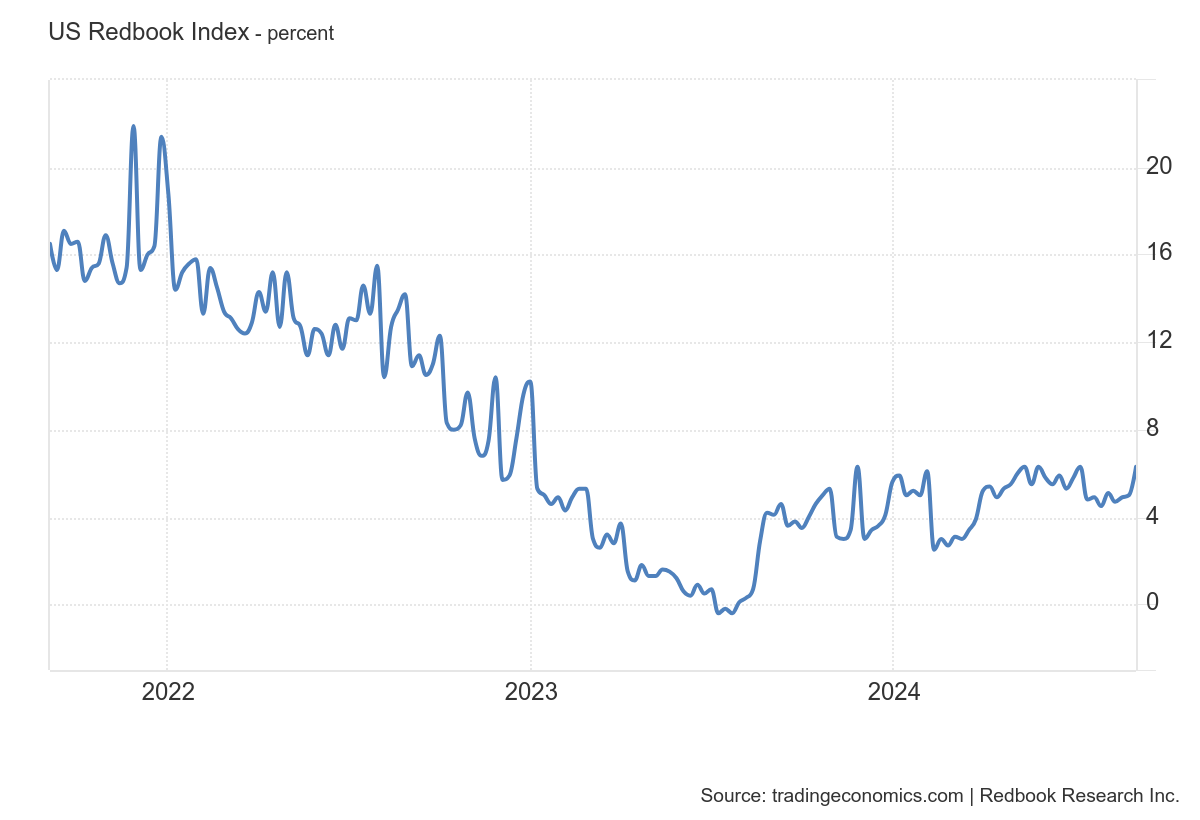

- There’s been a lot of angst recently about consumption and specifically retail sales. A number of companies have blamed less than expected sales trends on a weak economy but is that really why their sales are disappointing? Maybe Dollar General and Dollar Tree are just getting their butts kicked by Walmart. Real retail sales have been somewhat disappointing over the last year, down 0.4%, but there are indications that the trend is already reversing. Real retail sales over the last 3 months are up 1%. And year-over-year, same store sales are trending higher again. The reduction in growth from 2022 to mid 2023 looks steep and it is but that’s just coming off the huge COVID recovery. The current year-over-year change is, however, at the top end of the pre-COVID trend.

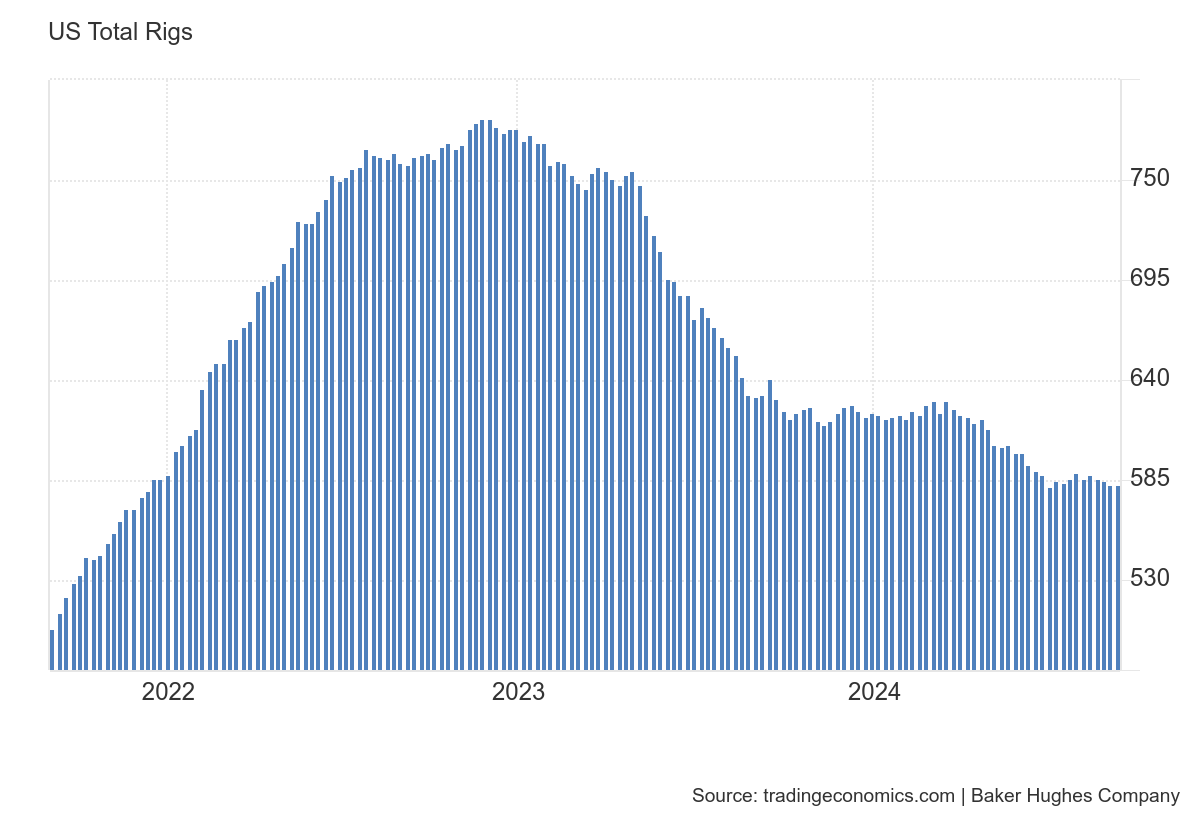

- Crude oil prices are down nearly 23% over the last year and gasoline prices are down nearly 28%. Will that be positive or negative for economic growth? Until the fracking revolution, a drop like that was obviously positive but with the US now the world’s biggest producer of crude oil, is that still true? The number of active drilling rigs is down 25% from the recent peak in December of 2022 so maybe companies have already anticipated this drop in price. Crude oil futures, by the way, are still in backwardation (near term prices higher than further out) so this drop in price doesn’t appear to be demand driven.

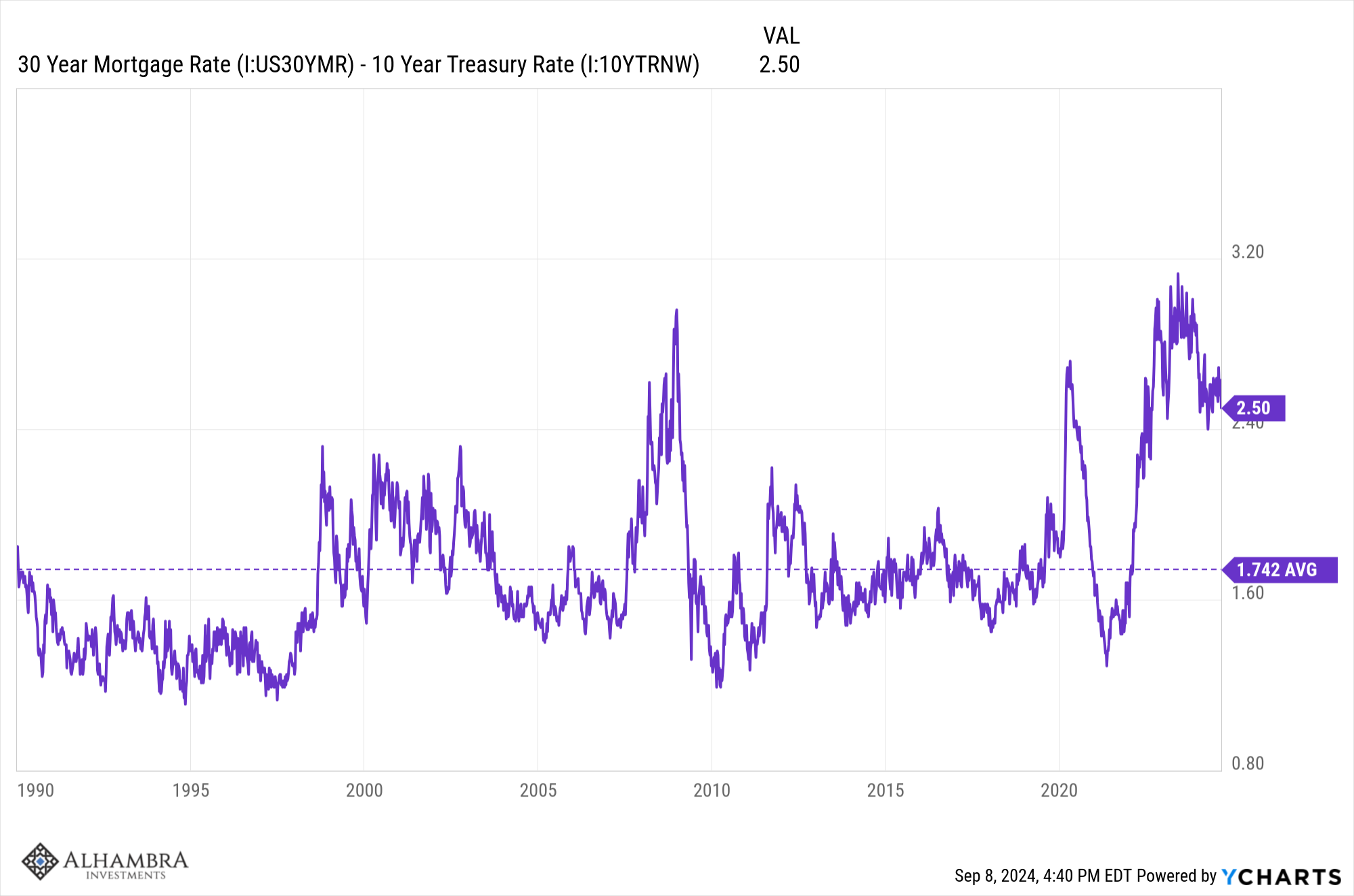

- Mortgage rates have fallen recently and there has been an increase in mortgage activity but the housing market is still struggling a bit. We only have data from July and rates have fallen more since then so we’ll get a better view of things when August data is released. Mortgage rates are still elevated relative to the 10-year Treasury note as well, although it has come down some. When will that gap close and what will spur it? If the spread were at the average now, the 30-year mortgage rate would be about 5.4% so closing the spread should have a big impact on housing which, in turn, would likely have a big impact on the economy as well.

- I don’t see much reason to worry about an imminent recession right now. The economy has slowed some but frankly it isn’t significant at this point. Based on the big picture indicators I use, the economy is growing right around trend right now (about 2%) which isn’t great but certainly isn’t recessionary either. Economic growth is driven by work force growth and productivity growth. Work force growth has been accelerating due to immigration. Foreign born work force level grew at 1.6% pace from 2010 to 2019 but since April of 2020 that has accelerated to 5.4%. Productivity growth in the post-COVID era has been disappointing so far. Is AI the answer that gets us to a new, higher level of real growth?

I don’t spend a lot of time thinking too much about the things everyone else is worrying about. As an old market pro once told me, those things are already well worried. I spend my time exploring and thinking about the things that most aren’t. As Yogi Berra once said, you can observe a lot by just watching.

By the way, the King Lear quote above is from the Fool character. The Fool is the only one who can tell the King the truth but he can only do so by disguising it as humor or sarcasm. One can’t help but wish our modern leaders had the wisdom to hire one rather than act like one.

Environment

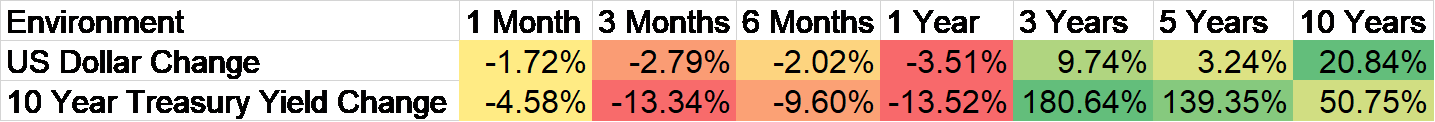

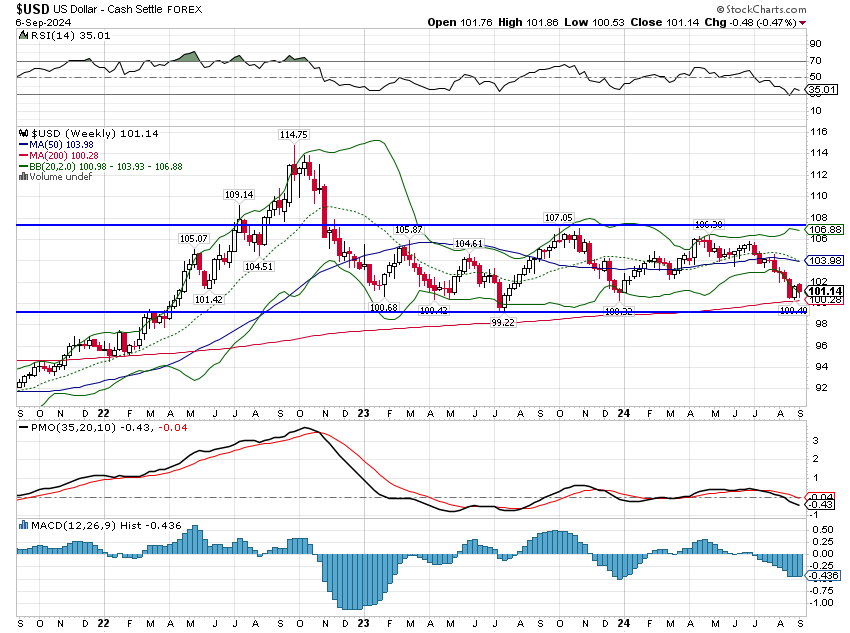

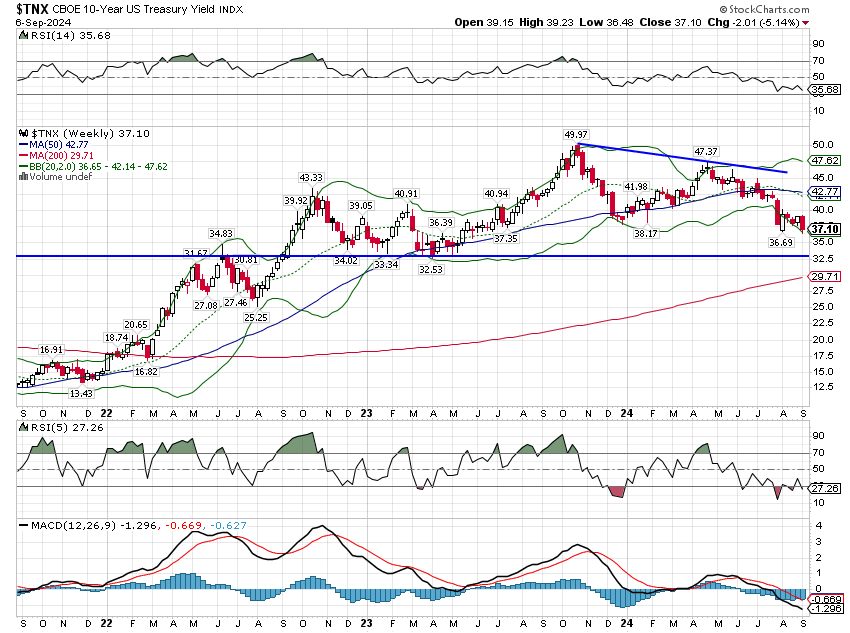

Interest rates and the dollar were down last week, the 10-year yield by 20 basis points and the dollar by about 0.5%. No trends have changed with both in a short-term downtrend but still above the bottom of their long trading ranges.

Markets

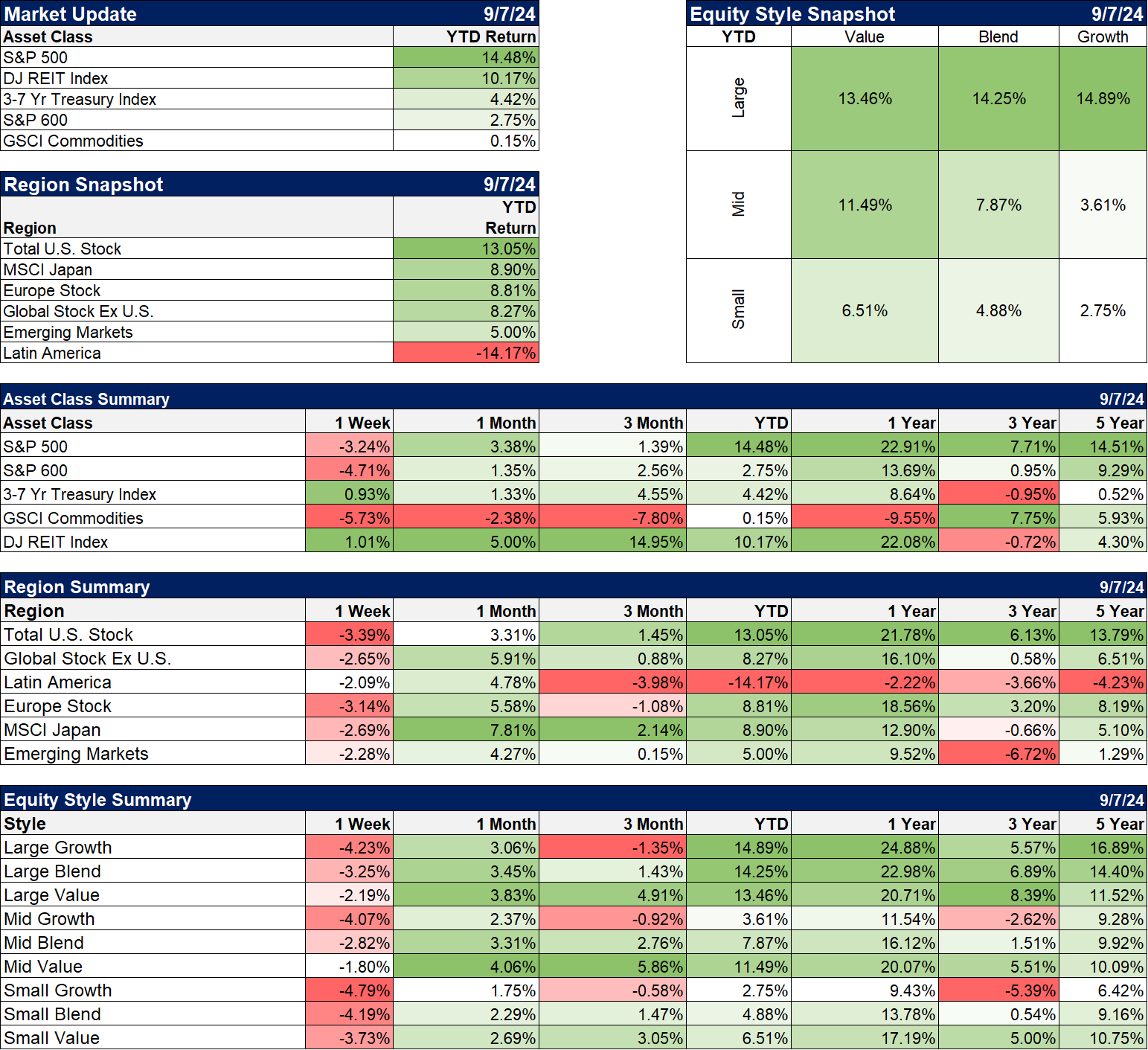

It was a rough week for markets with stocks and commodities both taking a hit. The S&P 500 was down a little over 4% while small caps lost a bit over 5%. Commodities were down 4.5%. The bright spots were bonds and REITs both driven by the 20 basis point drop in the 10-year yield. Non-US stocks and value outperformed for the week.

The outperformance of value over growth for the last three years has extended with LC value outperforming LC growth by nearly 3%/year over that time. The spread in mid and small caps is even wider. Midcap value has outperformed midcap growth +5.5% to -2.6% and small cap value outperforming +5% to -5.4%. I keep hearing that investors are waiting for value to start outperforming and I wonder what markets they are talking about.

I would note however, that all stocks are expensive relative to history. Small cap value is the cheapest of the bunch at about 14 times next year’s earnings and that is cheap relative to the 29 times for the S&P 500 growth index. But when value is really cheap, it trades for single digit multiples so it isn’t outright cheap. That may not matter if earnings growth is robust enough but we don’t have much evidence of that just yet.

The real cheap area is non-US value where the EAFE value index trades for just 10 times next year’s earnings. European value stocks are even cheaper but there aren’t any ETFs for it that I know of. One other note: when I look at the largest regional and single country ETFs I see a lot of currency hedged versions at the top of the list. Maybe it’s time to take the currency risk.

Sectors

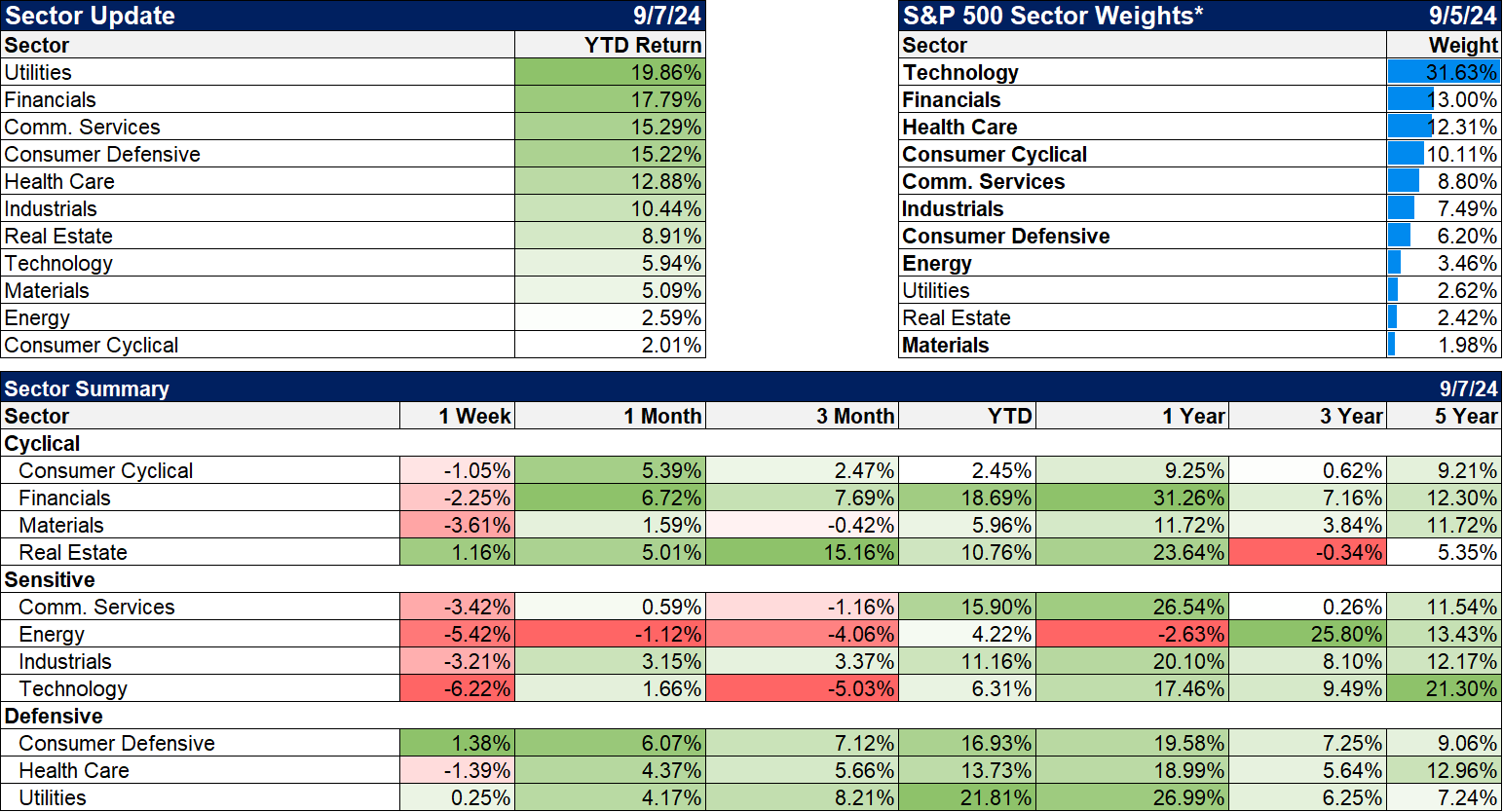

The only sectors up last week were REITs and consumer defensive (staples). Those two are also leading the pack over the last 3 months with REITs up over 15%.

Market/Economic Indicators

- Manufacturing PMIs still around the 47 area indicating contraction. That is far from new or interesting at this point.

- Construction spending was down 0.3% but it’s up nearly 7% year over year so a rest isn’t a surprise.

- Job openings were down but still above the pre-COVID level. Quits were up a little but not significant.

- Services PMIs were mixed with S&P at 55.7 and ISM at 51.5.

- Payrolls grew in August +142k but the last 2 months were revised down. Participation rate was unchanged, average hourly earnings up a little hotter than expected 0.4%. I find it hard to get too excited by any payroll report and this one was more boring than usual.

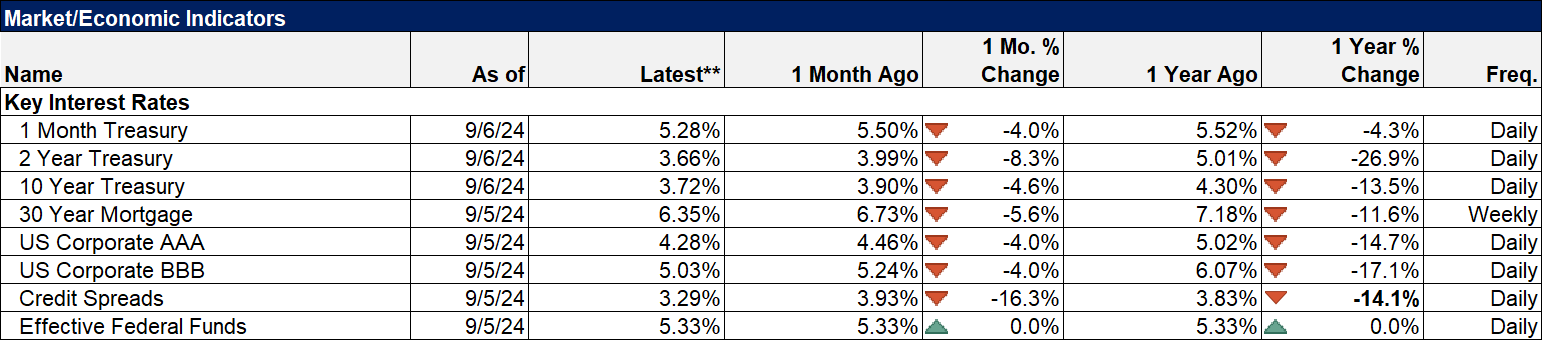

Credit spreads rose a bit last week which isn’t surprising if people are worried about recession. But the current level is still right near the lows for this cycle and it is down 14% over the last year. The most important downtrend in the chart below is mortgage rates, down nearly 12% over the last year and down about 0.4% in the last month.

Joe Calhoun

Stay In Touch