As is my usual practice, this will be my last commentary for the year barring big news (and most “news” isn’t, especially that of the market variety). While I won’t be writing for the next month, that doesn’t mean I won’t be working. I use the month of December to catch up on my research reading (books and academic papers) and to think about the big picture. I will also be researching and writing a long form piece on the current state of the markets and the things I think may be important for the next year. This year will be particularly challenging because of the return of the Trump administration (part 2), which is looking quite a bit different than the first version. Here’s a few of the things I’ll be contemplating during December:

- Will Trump really raise tariffs as high as he said during the campaign? If so, will they be phased in or implemented all at once? How will other countries respond? Will high tariffs be inflationary? What US companies/industries will get exemptions? Will companies really move production back to the US or just to countries that avoid Trump’s ire?

- Will a new Trump administration really cut government spending? What exactly is the goal in this regard? Scott Bessent has previously said he’d like to get the deficit down to 3% of GDP over the next four years. That’s about half the current deficit and would require cuts of nearly $1 trillion from the budget to get there in one year. Done over time is easier but still not easy. If Nominal GDP continues to grow at around 5% (the long-term average) for the next four years and the dollar amount of the deficit ($1.8 trillion in 2024) stays the same, the deficit would still be 5% of NGDP. Getting to 3% would require cutting the deficit by an additional $800 billion. Even if we assume a higher growth rate – which could be from inflation or real growth – deep cuts would be required. You can’t grow your way out of this hole; getting from a 6% deficit to a 3% deficit will require some combination of faster growth, higher tax revenue, and spending cuts. The problem is that generating higher revenue (higher taxes of some sort) and cutting government spending, would both tend to reduce NGDP growth, not enhance it, at least in the short term. You can’t make this up with tariffs either. A 10% universal tariff would likely raise less than $200 billion a year and that assumes no negative impact on growth (which is probably unrealistic). A 20% universal tariff could conceivably raise more, but we don’t know what the Laffer curve for tariffs looks like; it could raise less than expected. There are some advantages to consumption taxes (which is what tariffs are) over income taxes but there’s also a lot more uncertainty about the impact of tariffs.

- Will the inflation rate continue to fall? The progress on inflation has stalled over the last few months even as growth has remained around the long-term trend. Most of the slowing in nominal GDP (as inflation slowed) has come from the housing sector but lower interest rates could change that quickly. Lower rates would likely increase economic activity, not just in housing but in durable goods as well. For the last two years, growth has depended largely on growth in the service sector but if the goods side of the economy starts to recover, growth could surprise to the upside and it probably wouldn’t all be in the form of better real growth; inflation would likely rise as well. Or, higher tariffs and spending cuts could reduce growth and push inflation lower, something almost no one is expecting.

- Will the Fed continue to cut interest rates? Currently the highest probability outcome by the end of 2025 is for three more 0.25% rate cuts in the Fed Funds rate to a range of 3.75 – 4%. Predicting Fed policy a year ahead is incredibly difficult so this doesn’t mean all that much; the probability for that level of rates is just 28.6%. How will the Fed respond to changes in economic policy by the Trump administration? That isn’t to say that the Fed will be politically motivated; monetary policy always acts to offset fiscal policy. If the Fed perceives the Trump team’s set of economic policies as changing expected NGDP growth, for better or worse, they will have to respond.

- Will AI investments start to pay off? Will the capital spending continue? Which companies/industries are the most likely to benefit from the implementation of AI (rather than the companies like Nvidia who provided the infrastructure)?

- What are the consequences to Pharma companies if RFK, Jr. is confirmed by Congress to run HHS? What about other healthcare companies such as UNH or CVS?

- How will the media streaming industry consolidate? These companies’ stocks are universally hated so the prices are cheap but most of them lack the scale to succeed. Consolidation seems the most likely outcome but who are the buyers and who are the sellers?

- What policies will the Trump administration use to increase crude oil and natural gas output as they promised during the campaign? Higher production and lower prices could be very beneficial, not only to US consumers, but geopolitically as well. Lower oil prices are already having a negative impact on the Russian economy; have you seen the Ruble lately? How would even lower prices affect Russia’s ability to conduct war in Ukraine? It could also prove beneficial to the US in the Middle East; Saudi Arabia needs $100 oil to balance its budget and other oil producing countries need higher prices too. But US energy producers are focused on returning capital to shareholders and have little incentive to raise production if prices keep falling. Is there some policy that could encourage them to produce more and protect them from lower prices?

- Will corporate earnings rise fast enough to justify current valuations? Are valuations, outside of the large tech companies, really that challenging? What sectors will produce the highest earnings growth over the next year? The lowest? Any that will see earnings shrink?

- Can small and mid cap stocks continue to outperform large caps as they have over the last year (R2000 +48.02% vs S&P 500 +44.5%)?

- Will the dollar rise or fall? Or continue to trade in the range it’s been in for the last two years? The Trump administration wants to raise tariffs, make sure the dollar remains the world’s reserve currency, but also believe the dollar is overvalued. J.D. Vance has talked openly of wanting a lower value for the dollar as an assist to US exporters. Can they raise tariffs, threaten the “BRICS” with tariffs if they even think about using anything other dollars, and devalue the buck, all at the same time? I have no idea but I don’t envy the next Treasury Secretary who has to come up with a solution to this three body problem.

- How will China respond to even higher tariffs from the Trump administration? Could their response include invading Taiwan?

- Will the Chinese let the Renminbi (Yuan) float? If they do, how much will it fall and what will the Trump administration do in response?

- Will Europe’s economy continue to contract? Can the rest of Europe grow if Germany doesn’t?

- Will the Trump administration carry out their mass deportation threat? If so, what are the implications for the labor markets and inflation?

- How will crypto regulation evolve when the President has a vested interest in crypto investments? The crypto ecosphere is riddled with fraud and the annual losses to such activity run into the billions. That probably won’t get better without better enforcement of current securities laws or new regulation aimed directly at crypto. That doesn’t seem likely to come from the new administration. The crypto market has been the wild west of the financial world since it started and that isn’t going to change under the Trump administration. Don’t be surprised though if you start to see a lot VC-funded crypto dreams come crashing down over the next couple of years. It’s getting late in this game.

- Will someone, anyone, come up with a use case for crypto technology that is actually economically beneficial to anyone other than the people running the scheme?

- Will Japan be the beneficiary of Trump’s increased tariffs on China? Will the Yen rise from the dead? If it does, what are the implications to our markets as Japanese investors repatriate their investments? Will hedge funds unwind the Yen carry trades as they did in July? That produced a nearly 10% correction in the S&P 500 over the summer. If the Yen gets into a sustained uptrend what are the implications for non-Japanese markets? What are the implications for Japanese stocks?

- Will the Trump administration enact any policies that will benefit Javier Milei and Argentina? Milei has gone out of his way to flatter the former/future President. Will he get anything in return?

- Will S&P 500 value continue to outperform S&P 500 growth as it has over the last 4 years? This large cap value trend is unique to the S&P 500 formulations. Russell 1000 value and growth have performed almost the same over the last three years and growth has outperformed over the last 4 years. Small and mid cap value have both strongly outperformed their growth peers. What is the driving force behind small and value outperformance? Can it continue?

- Can gold continue to rise? Already near an all-time high and having outperformed the S&P 500 this century, can it keep going up? What does that say about future inflation, if anything?

- What will become of the antitrust investigations started by the Biden administration? Will we see more M&A activity? Cui bono?

- Who will Trump choose to succeed Jerome Powell?????

This is a time of great change and uncertainty. I warned before the election that one party control was the worst outcome – and it didn’t matter much which party – because it creates massive uncertainty. The party in control wants to do big things and those take time and require negotiation even within one party. The incoming Trump administration is, if anything, more ambitious than most new administrations. What can they do and how fast can they do it? Is anyone thinking about how all the new policies will interact? What are the unintended consequences? How will our allies and enemies respond? Will Donald Trump be able to complete an entire term (he would be 82 in four years)? Will he suffer from age-related reduced capacity as Biden did? How will the razor thin margin in the House affect Republican plans? Uncertainty around future tax policy has an impact today; companies delay investments until they know how policies will change. How will that impact growth over the next 6 or 9 months or year?

I don’t know the answers to most of these questions and some of them are unanswerable but I think we need to contemplate them nonetheless. Even if this exercise yields just one insight that gives us an advantage over the crowd, it will be well worth the time and effort.

Here’s hoping you have a great holiday season. I look forward to corresponding again next year.

Joe Calhoun

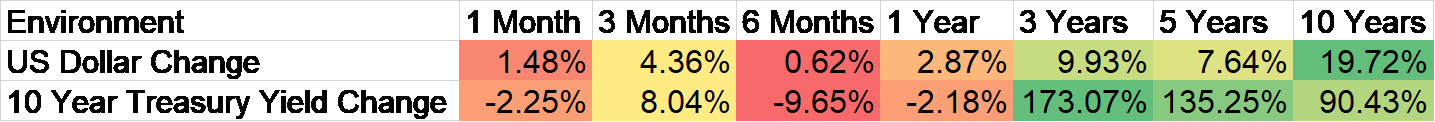

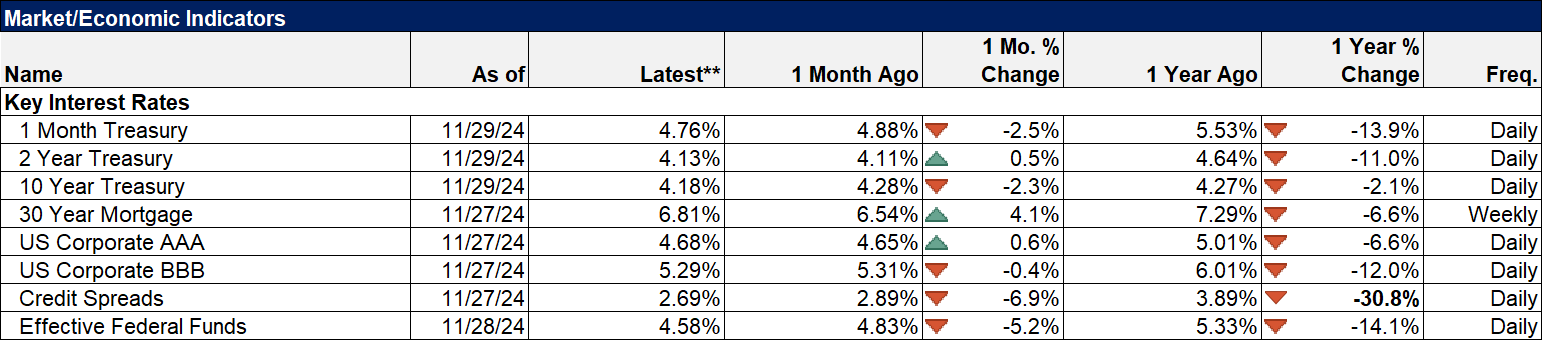

Environment

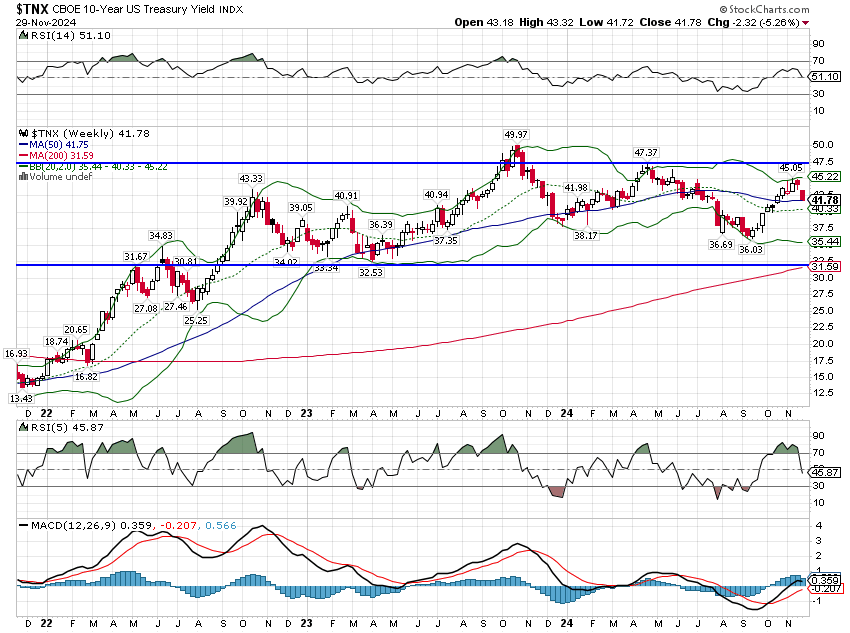

10-year Treasury yields ended the week down 23 basis points and about 11 basis points for the month. The surge in rates based on the idea that the new Trump administration’s policies would cause either higher inflation (if you don’t like him) or higher real growth (if you do like him) proved ephemeral because no one really knows what’s going to happen at this point. The Republican majority in the House is likely to be very small – and maybe existent only for a short time – and getting anything passed is going to require the legislative equivalent of herding cats. Uncertainty regarding future economic policy is off the charts right now and that isn’t an environment conducive to making long-term corporate investment plans. About the only thing companies feel comfortable predicting is that tariffs will rise so importing more now makes some sense.

Interest rates are still in the long-term trading range they’ve been in for two years and the election didn’t change that one bit.

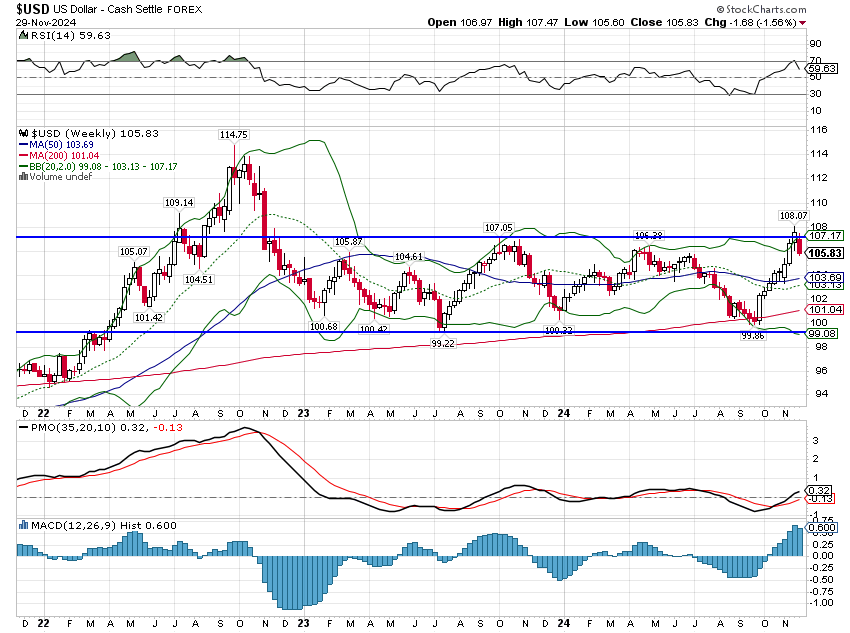

The dollar fell back into its previous range, down 1.5% last week. The breakout from last week may well prove to be false and to be frank I’m not surprised. The overwhelming bullish attitude on the dollar since the election on the “certainty” that Trump would impose high tariffs and the “certainty” that it meant a stronger dollar was too extreme to hold. It may be that all of that proves true but it isn’t as easy as it sounds to determine the impact of any tariffs or threatened tariffs of an administration that isn’t even in office yet. We’ll see how this plays out but I’d be shocked if it played out in textbook fashion. Markets don’t read textbooks.

As I said in last week’s commentary, we generally don’t make tactical changes based on mid-month moves and this shows why. There are all kinds of things that can happen in a day or a week – or even a month for that matter – that are nothing more than noise.

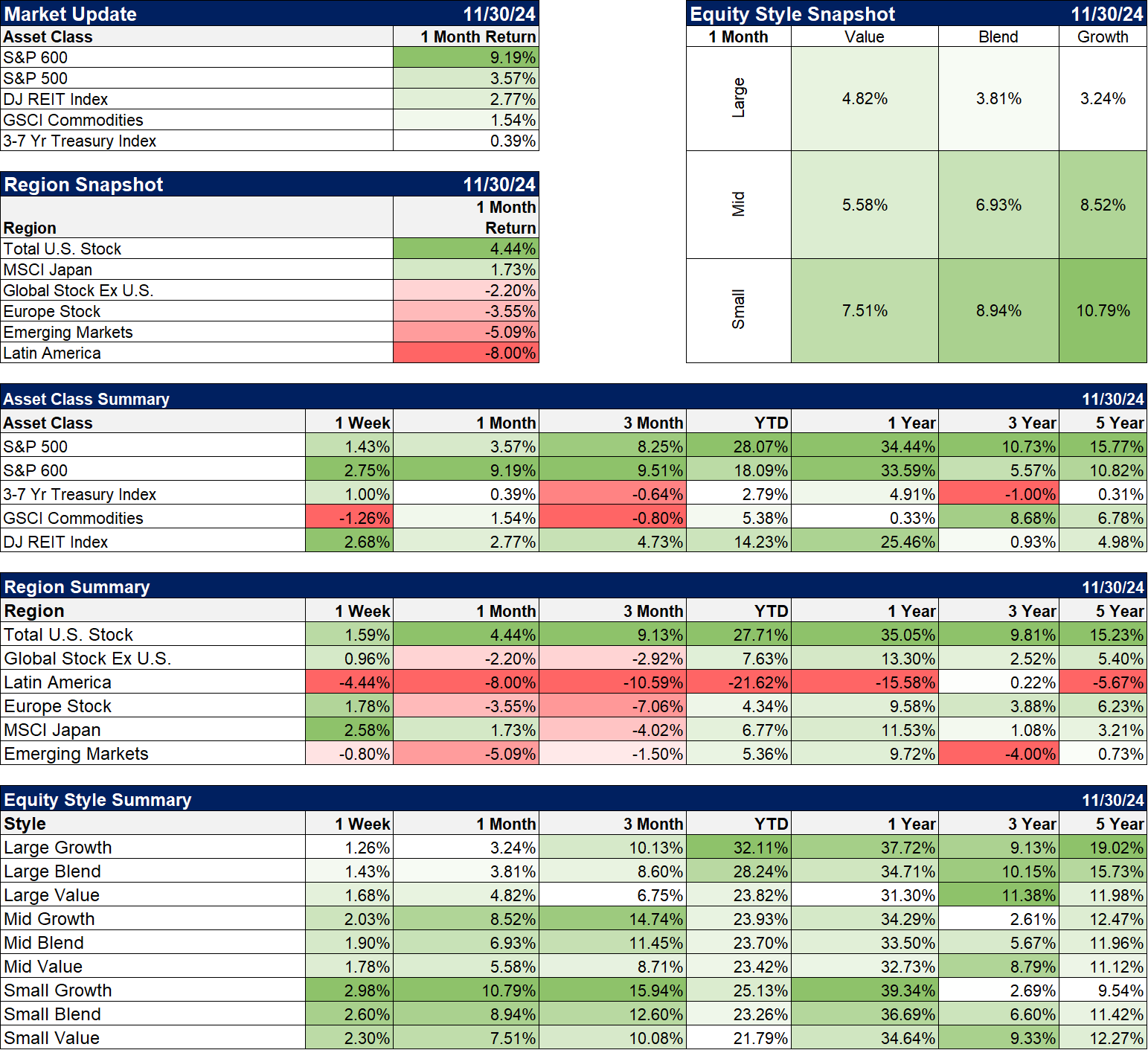

Markets

Small and mid-cap stocks were the big winners in the month of November while non-US stocks were the big losers. These moves were predicated on the idea that the new administration’s economic policies will be positive for the domestic economy and negative for the rest of the world. I am more than a tad skeptical of that conclusion but as a holder of more US small and midcaps than non-US stocks, I’m not unhappy with the result. Whether it will last is the more important question and it may be that these stocks were poised to outperform anyway and just needed a catalyst.

While everyone is focused on stocks, I suspect the more interesting developments may come in the bond market. Intermediate-term Treasuries have a barely positive return over the last five years and that is quite unique in history. The last two five-year calendar periods (2018-2022 and 2019-2023) produced returns in Intermediate-term Treasuries of 0.2% and 0.8%. Since 1930 the only worse five-year period was the 0.3% return from 1955-1959. The latest 10-year period had a return of 1.4%/year which, again, is the worst 10-year track record since the 1940s/50s. Notably, this earlier periods was one where interest rates were capped and inflation was relatively high. To achieve more average returns, rates probably need to get a little higher; the arithmetic average 5-year return since 1930 is 5.1% and the 10-year is 5.2% while current 5-year Treasury yield is 4.11%. One thing to note is that the financial repression of the 1940s/50s would be only possible again if the Fed/Treasury accord of 1951 is revoked. Prior to that accord, the Fed and Treasury coordinated to keep real interest rates negative so the large debt incurred during WWII could be paid off more easily. I doubt such an arrangement could be forged today.

Also of note is that the other asset classes with low 5-year returns are commodities and REITs, both of which would respond favorably to negative real rates. Just some food for thought.

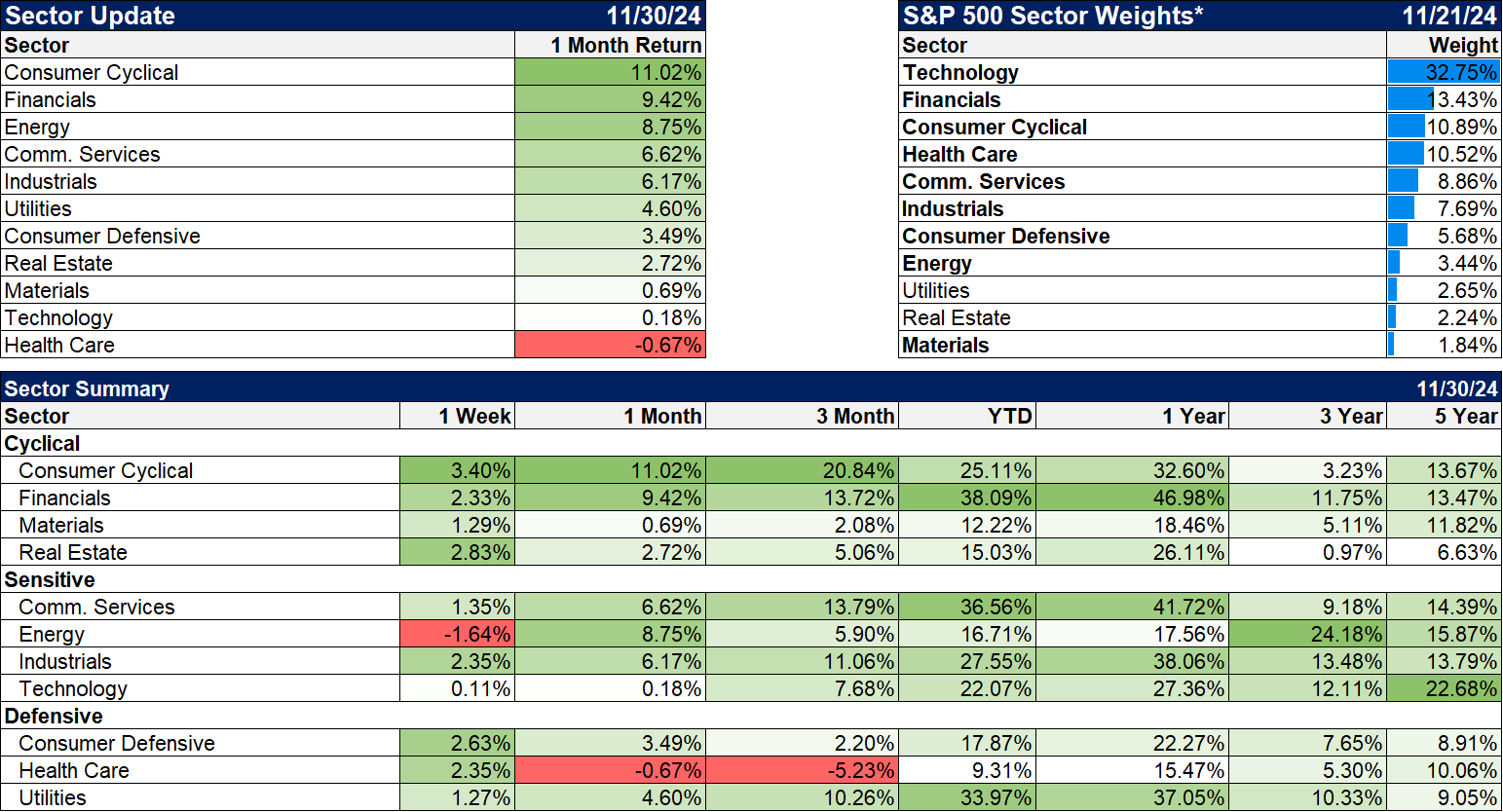

Sectors

The best sector returns over the last month do, at first blush, appear to be election related. Consumer cyclicals (consumer discretionary) was led by Tesla, financials rallied on the prospect of an easier regulatory environment, energy rose for the same reason. The worst returns were led by healthcare which is also seemingly election related. As with most trades predicated on some potential Trump policy, I would be very careful about chasing these.

Economy/Market Indicators

Mortgage rates moved higher over the last month but that is already moderating as other rates come back down.

Economy/Data Releases

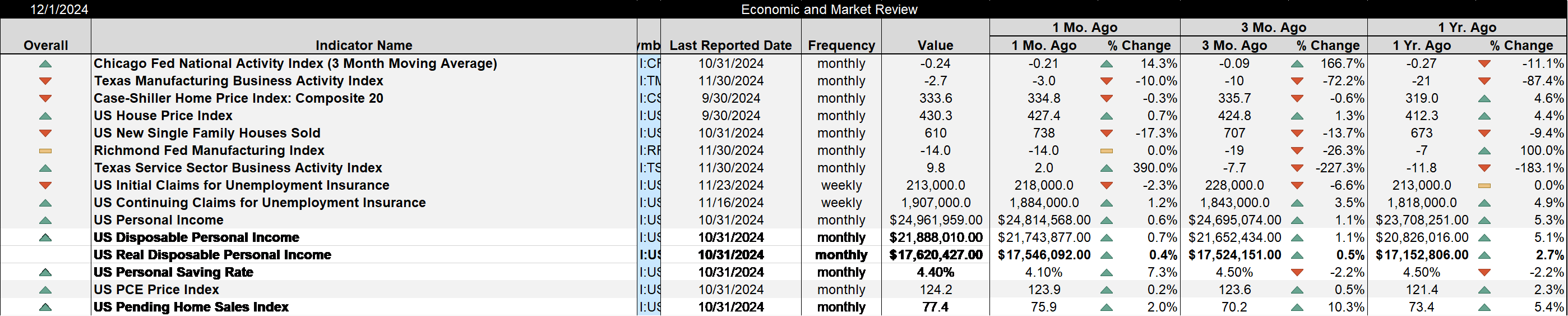

- The monthly Chicago Fed National Activity Index fell to -0.40 in October and the 3 month average fell to -0.24. That indicates an economy growing less than trend (below zero) but it isn’t recessionary yet (-0.75 is considered recessionary). This level isn’t out of the ordinary for the last couple of years but it does conflict somewhat with other data. Still, it isn’t positive and that’s the point. This bears watching closely over the next few months.

- The Dallas Fed reading was a slight improvement from last month and a big improvement from a year ago. Still below zero though so still not great.

- Home prices have been moderating with the last two Case Shiller readings coming with a minus sign. Year over year change has now fallen from 7.5% in March 2024 to 4.6% in February.

- New home sales fell 17% month to month which was likely driven by rising mortgage rates.

- Dallas Fed services index rose to 9.8 from 2.0, the second consecutive positive reading after more than 2 years of negatives. Revenues, hours worked, employment and capex were all up and input costs fell.

- Jobless claims continue at low levels but continuing claims continue to rise, up about 5% year over year.

- Personal income and spending were both better than expected while the savings rate fell.

- PCE prices were up 0.2% on the month and 2.3% year over year. My guess is that will be as good as it gets on the year over year trend.

- Pending home sales surprised to the upside.

Stay In Touch