Everybody loves dividend stocks. Some prefer stocks with high dividend yields and some prefer stocks of companies that have grown their dividends consistently, but dividends are an essential component of many (we think it should be all) investors’ portfolios. The two methodologies produce quite different portfolios but over the long run, they both perform very well on a total return basis.

For retirees, high-dividend stocks can be an important source of income while also offering appreciation potential. For the not-yet-retired, dividend growth companies are a conservative method of choosing high-quality companies. Earnings aren’t always what they seem and are routinely “managed” by companies to smooth out quarter-to-quarter fluctuations. There is often a wide gap between “reported earnings”, which have to conform to the accounting rules, and “operating earnings” which are often referred to, at least around here, as “earnings before all the bad stuff”. Earnings can be manipulated but dividends are paid in cold, hard cash.

There are a wide range of dividend ETFs and mutual funds out there, generally falling into the two categories mentioned above – high dividend and dividend growth. At Alhambra, we use both depending on the client and the economic environment. We also run an individual stock portfolio that combines high yield with dividend growth. For an uncertain economic environment, we will generally choose high dividend funds as they hold more defensive types of stocks: utilities, healthcare, financials, energy, and industrials. During periods when growth is expected to accelerate – such as coming out of recession – we will generally favor dividend growth stocks.

Over the long term, through all economic environments, dividend yield is actually the more important factor; higher-yielding stocks have produced better returns than dividend growth and the broader market. Considering that since 1926, dividends have accounted for nearly 40% of the total return of the S&P 500, that shouldn’t be that surprising. Of course, high-dividend stocks don’t outperform across all shorter time frames but no stock-picking methodology does.

So, yes, there are good reasons to like dividend stocks but in 2023 dividend investors are likely wondering why they bothered. The Dividend Select ETF (DVY*) is down 4.97% this year while the S&P 500 is up 17.5% (including, ironically, dividends). Dividend growth has done better at +4.3% but even that pales next to the large-cap growth stocks; the NASDAQ 100 is up 40% YTD. It is an enormous performance gap and I imagine dividend investors are sorely tempted to abandon the strategy and go for the growth. We think that would be a big mistake.

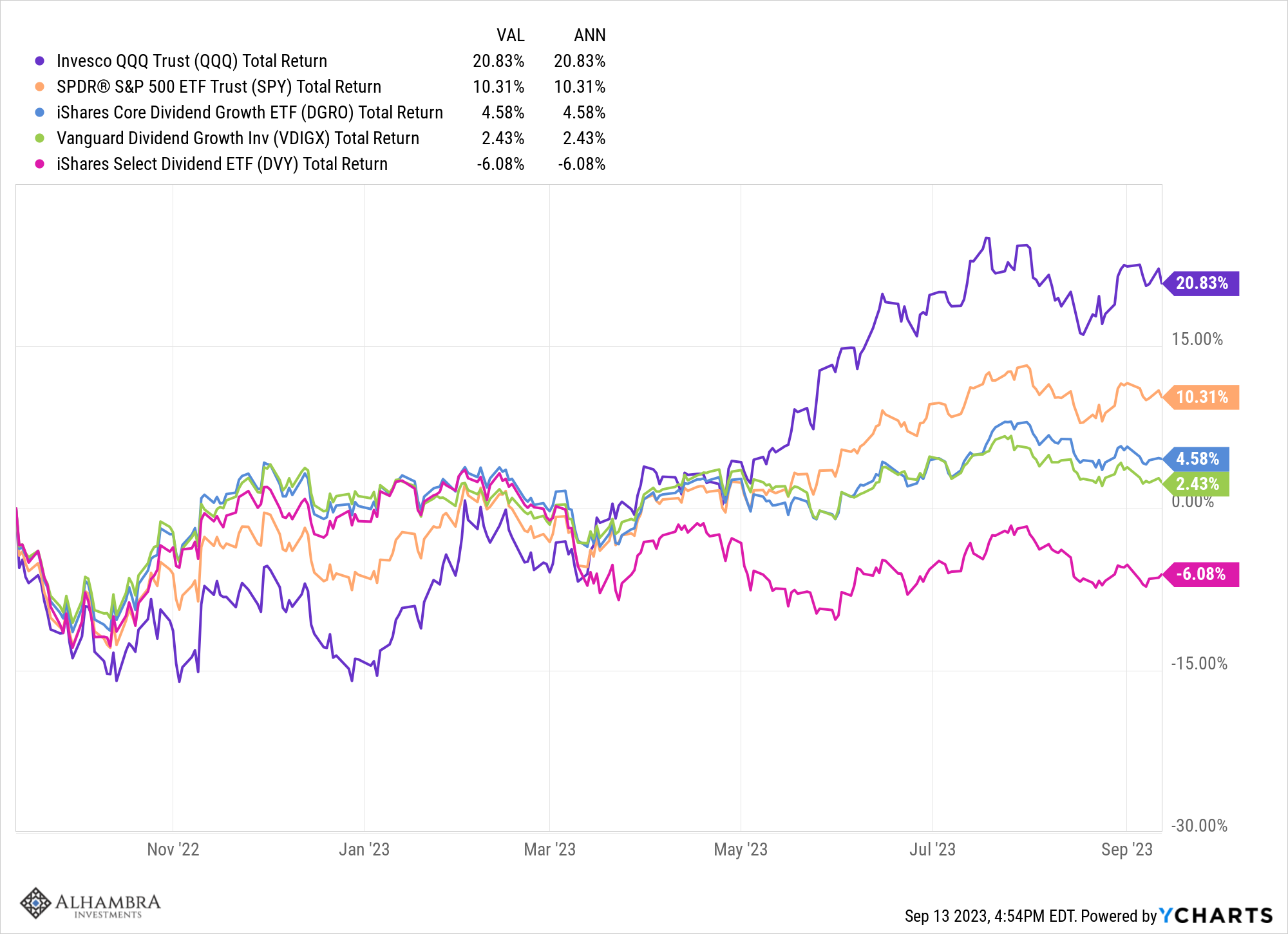

It is true that the S&P 500 and the NASDAQ 100 have dramatically outperformed both dividend growth and high dividend YTD and over the last year. This shows the performance of DVY (Select Dividend), DGRO* (Core Dividend Growth), VDIGX* (Vanguard Dividend Growth), SPY* (S&P 500), and QQQ (NASDAQ 100) over the last year:

*Alhambra or its clients hold positions in these securities.

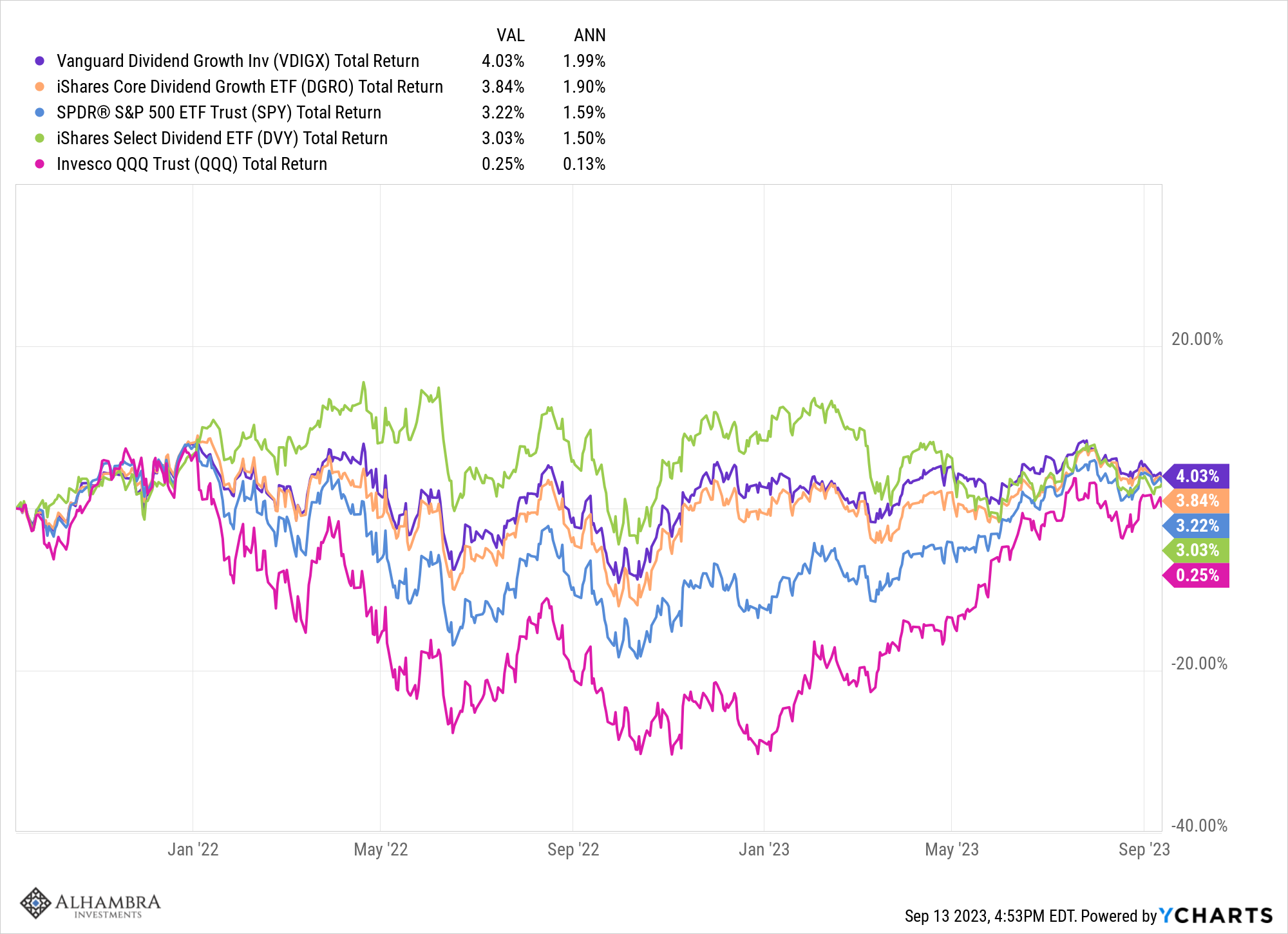

NASDAQ has doubled the performance of the S&P 500 while also outperforming the dividend ETFs over the last year. But it might be important to note that this period starts near the bottom of last year’s bear market. If we change the measurement period to two years, closer to the top before the bear market, we get a different picture:

Now the NASDAQ return drops to last place and the dividend growth funds jump to the top of the list. While the dividend funds and the NASDAQ end up in about the same place, the journey was dramatically different. The NASDAQ fell more than 30% at it’s low point while Vanguard Dividend Growth (VDIGX) and Select Dividend (DVY) both fell less than 10%. So, ask yourself, could you have just held on to QQQ when it was down 20%? or 25%? or 30%? The answer is hard to know without living through it because we know now that it recovered, but after over 30 years in this business, I can tell you that the answer for most people is no. Here’s another thing to think about; none of these has provided much in the way of returns for 2 solid years. Believe it or not, that isn’t that long or that unusual and if you want to invest in stocks, you better get used to it; in nearly a quarter of the two-year periods since 1928, the S&P 500 had a return of 5% or less and 17% were negative.

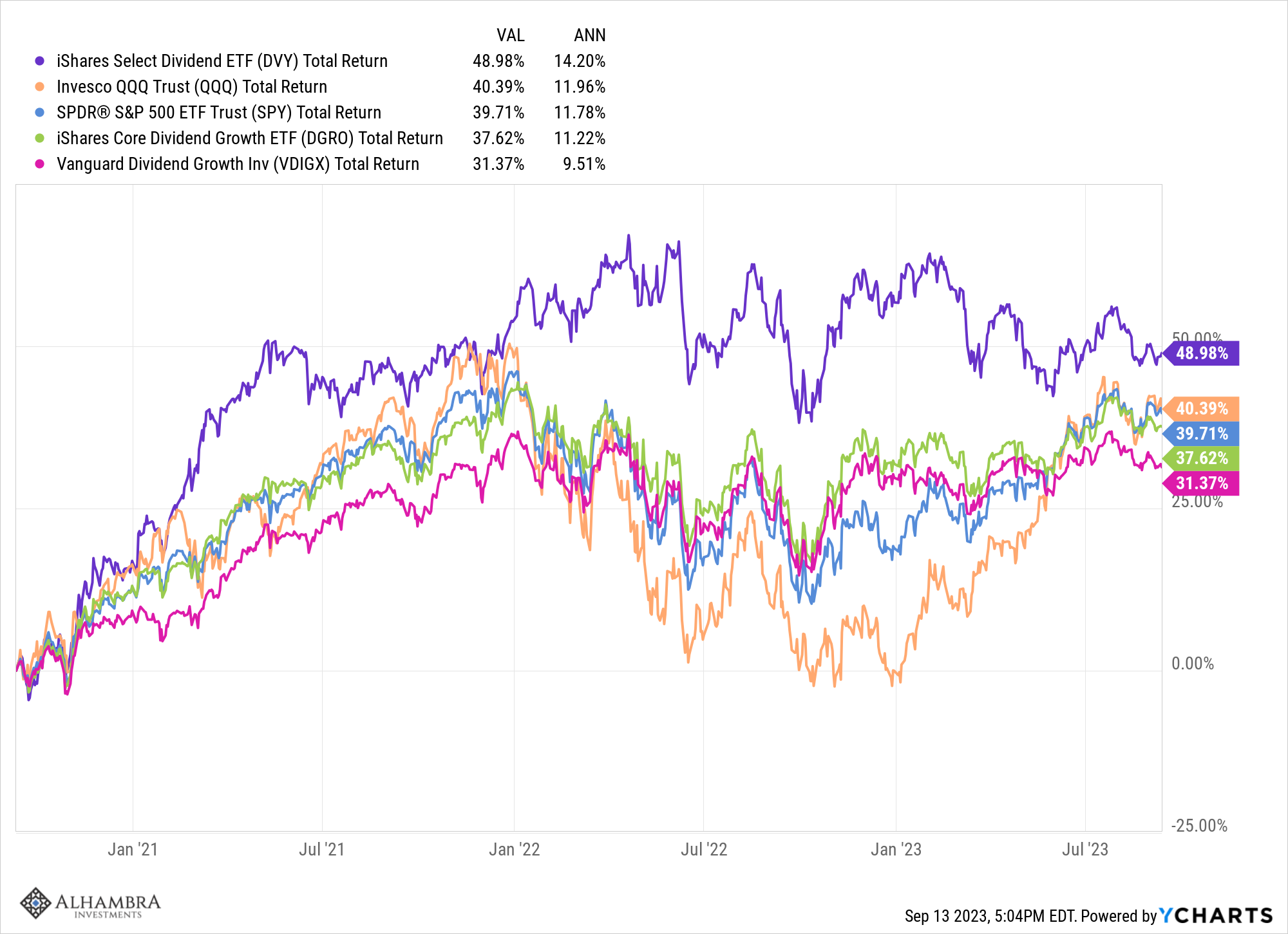

Here’s the most interesting chart of all and shows the power of thinking even a little long term. Here’s the last three years:

Now the best performer is Select Dividend, outperforming even the mighty QQQ. Select Dividend’s largest sector allocation is utilities, its second largest is financials and it only has a little over 5% allocated to technology. Now think about what’s happened over the last three years from meme stocks to crypto to 8% inflation and rapidly rising interest rates to a mini banking crisis and now the artificial intelligence mania. Think about all the volatility you would have had to endure if you were invested in the NASDAQ or even the S&P 500 with its 28% allocation to technology. And realize you would have made more money, with less risk and less volatility by just owning a high dividend ETF.

When you compare the S&P 500, NASDAQ 100, Select Dividend, and Dividend Growth, I think there is an obvious choice.

| ETF | Forward P/E | LT Earnings Growth | Sales Growth |

| DVY | 11.3 | 9.5% | 8.6% |

| DGRO | 15.7 | 10.3% | 12.5% |

| SPY | 20 | 11.8% | 11.4% |

| QQQ | 25.9 | 12.4% | 13.2% |

There is an obvious pick-up in growth with the S&P and NASDAQ compared to the high dividend ETF (DVY) but you pay a hefty price (P/E) for that extra growth. And compared to DGRO you don’t even gain much in the way of growth; sales growth for DGRO is actually better than the S&P 500. That’s because the sector allocation of DGRO is very different than DVY with nearly 17% in tech and 19% in healthcare. Maybe earnings growth for the S&P and NASDAQ will be a lot higher than currently expected and the higher P/Es are justified. But predicting the future earnings of a utility seems a tad easier than predicting the future earnings of, say, Nvidia or Apple or Meta, so there is more certainty with high dividend ETF.

Dividend investing isn’t sexy and when the braggarts down at the country club start talking about their AI stocks, you won’t have much to say. But it does deliver where it matters – on the bottom line. Dividend investing and growth investing are like the story of the hare and the tortoise. I’m betting on the turtle.

Environment

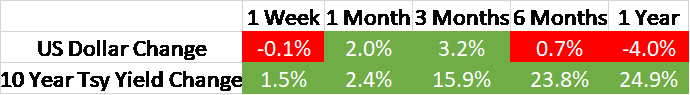

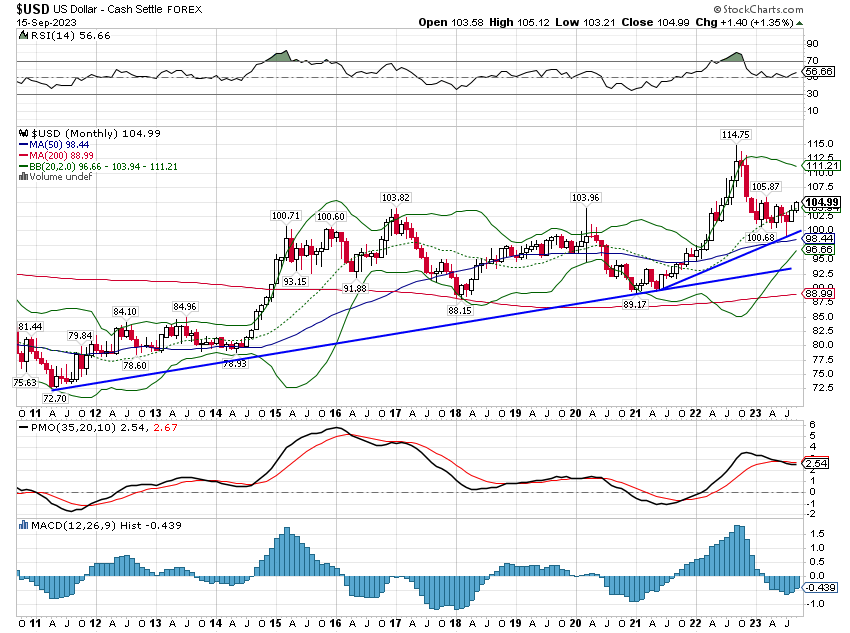

The dollar was unchanged last week; the existing trends persist. The intermediate-term trend, which is the one we put the most emphasis on, is still neutral with the 6-month change less than 1% and the 1-year change a mild -4%. The long-term trend, measured back to 2011, is still up. I would also point out that the long-term trend would still be up even if the dollar index fell to the mid-90s (which is the logical expectation in my opinion).

What that means for investors is that the long-term trend still favors US assets. The intermediate-term neutral trend means that non-US investments can perform well too but it would probably take a change of the long-term dollar trend to produce significant outperformance. In the Markets chart below you can see that the performance of US stocks and non-US stocks over the last year (during the neutral performance of the dollar) is almost exactly the same.

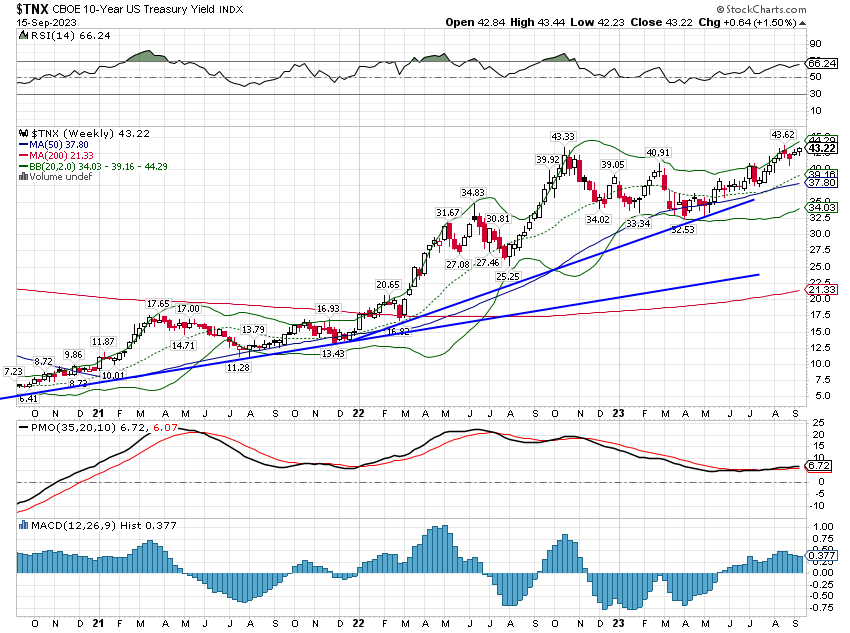

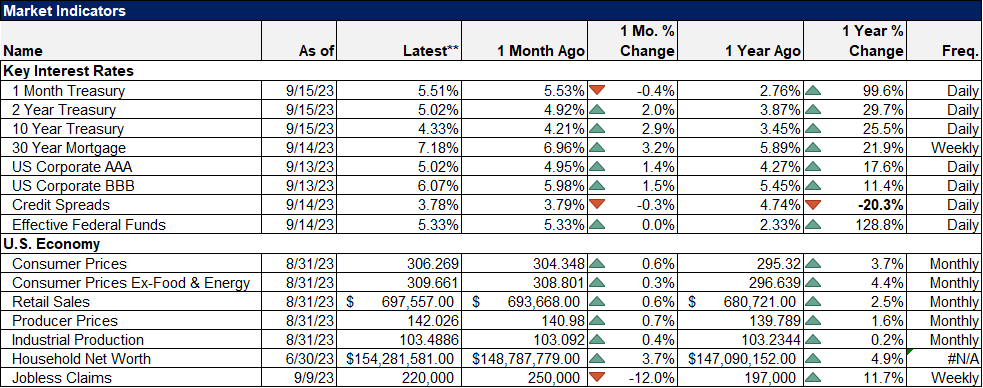

The 10-year Treasury yield rose last week but still has not broken above the August high of 4.36%. It’s very close and it seems almost inevitable that it will but nothing has really changed anyway. The short and intermediate-term trend for the 10-year Treasury yield is still up. Yes, the rate today is no higher than it was last October and that’s why I continue to think rates have likely peaked. But you have to respect the trend until it changes.

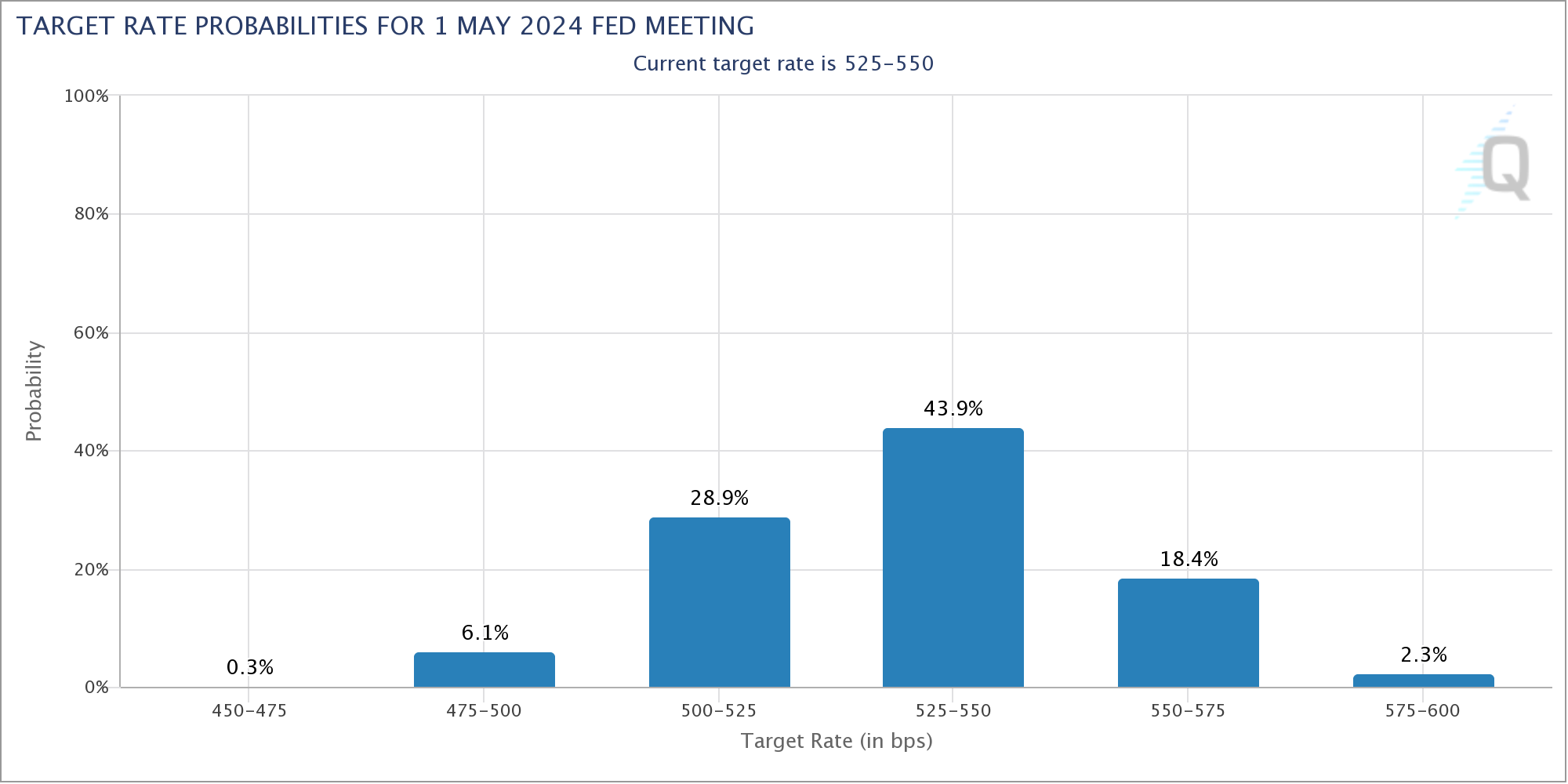

The 2-year Treasury yield continues to trade sideways as it has since the peak in March. The market for short-term rates is pretty clearly saying that short-term rates have peaked. The Fed Funds futures market puts the highest probability on rates being essentially unchanged until May of next year. Of course, those odds change on a daily basis so that is just a snapshot but those are the current expectations. Anything that changes that significantly will have a big impact on other markets.

Markets

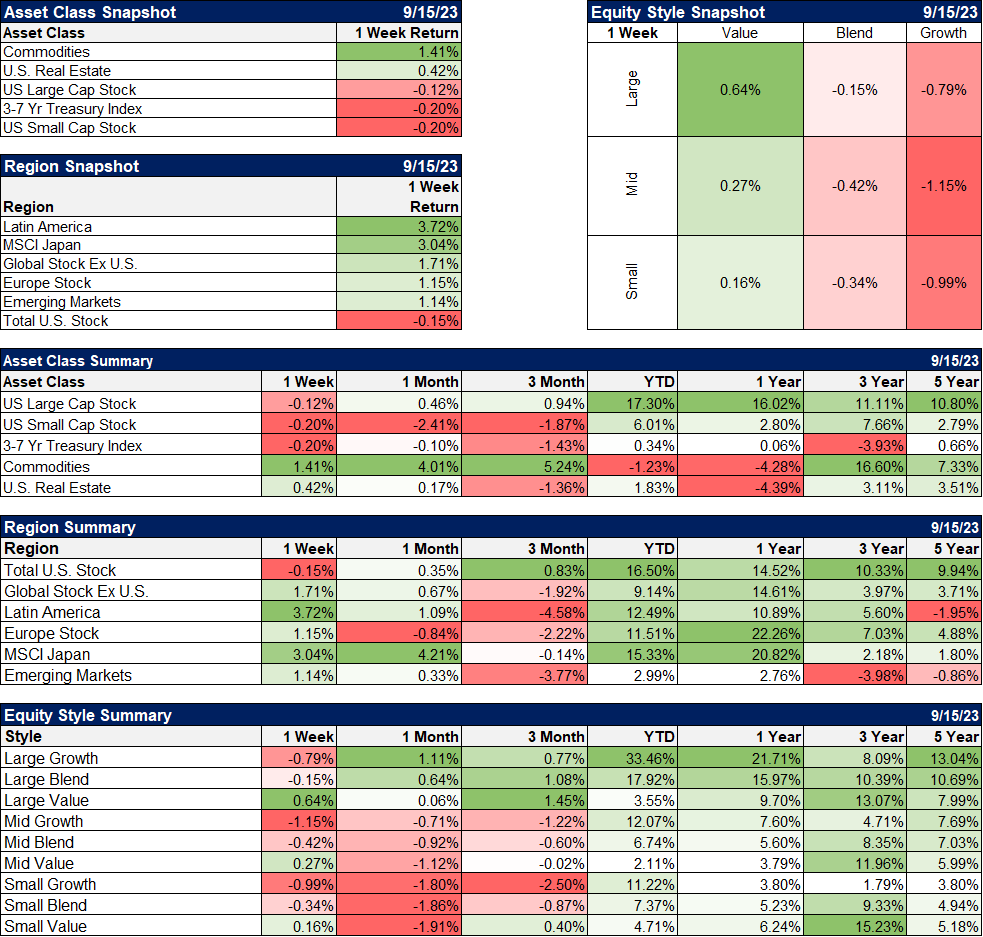

Commodities continue to trend higher with the front month WTIC contract rising last week to above $91 before falling back to $90.40 to end the week. It is a bit unusual to see commodities do so well with the dollar firm but the move in crude seems more about geopolitics than anything else. Last week was a good week for a lot of commodities with platinum, palladium, and copper all up on the week. None of those are in well-defined uptrends like crude oil though so this commodity rally is tenuous for now. That could change if the dollar starts falling again but for now crude is the commodity rally.

It is interesting though – and not widely known – that commodities are the best performing asset class over the last 3 years. And the 5-year record isn’t bad either. Is this a long-term trend? If so, it could be the start of something big. The last time we had a bull cycle in commodities (2002 – mid-2008), the commodity index more than tripled while the S&P 500 flatlined. But, as I said above, that can only happen when the dollar is falling (down 40% from peak to trough 2002-2008).

Value stocks had a good week and while they still lag YTD and over the last year, their 3-year lead is intact. Non-US stocks also had a good week with most markets higher led by Latin America and Japan (again). That was likely spurred by some better-than-expected economic news out of China which has been hard to come by recently. A turning point? Maybe but China still has some pretty severe problems in their economy so any recovery is likely to be slow and uneven.

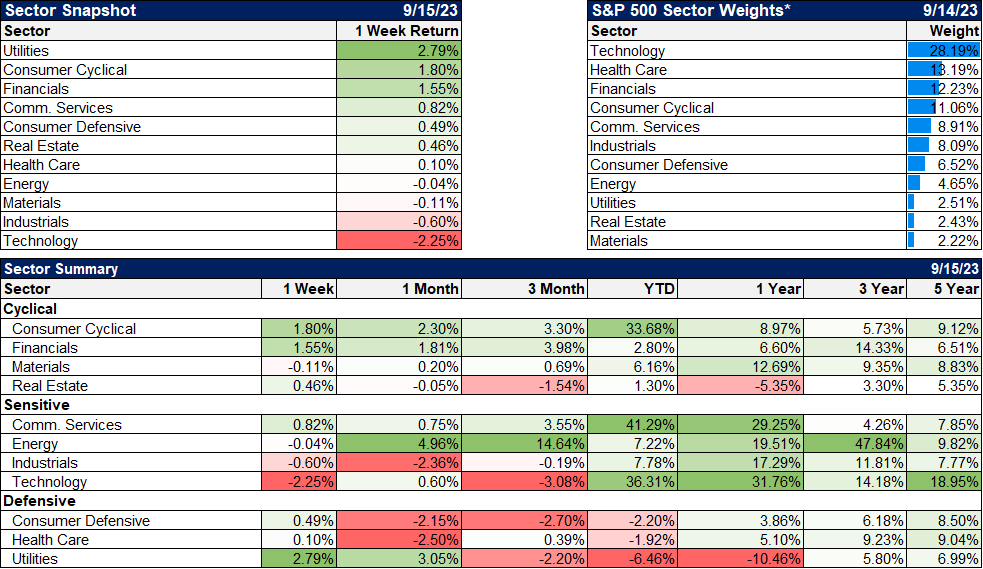

Utilities were the leader for the week but I don’t think that was really driven by economic weakness, as it usually is, since cyclicals and financials did well too. The sector seems a bit washed out, the worst-performing sector over the last year. As I pointed out in the opening, the high dividend factor still has some attractive qualities. Why investors chose last week to recognize them I have no idea.

The economic data last week was a bit confusing. The inflation numbers were okay but not great with core numbers a little hotter than expected. And core CPI is still up 4.4% year over year, which is pretty darn painful for the average American. Retail sales looked good on the headline number, up 0.6%, but most of that gain was due to higher gas prices. Ex-autos and ex-gas, sales were only up 0.2% so with core CPI up 0.3% that means real sales were likely lower. I say likely because the mix of goods in each of those isn’t the same so it’s hard to say exactly.

Industrial production did surprise to the upside as did the Empire State manufacturing survey which has been positive 3 of the last 4 months and 4 of the last 6. A turning point for the goods side of the economy? Maybe but the increase in IP was mostly about oil and gas extraction while manufacturing was up just 0.1%.

The goods side of the economy has been suffering for the last year with higher inventory levels but that seems to be ending. Trucking companies are reporting improved conditions although at this point it is just that things have stopped getting worse. But stabilization is the first step and they are seeing some indications of improved volumes. Most seem to think that any big improvement will come next year though so we probably have more to go. That jibes with inventory/sales ratios which have stopped rising but haven’t had a meaningful drop yet.

There is still no stress in the credit markets, at least as measured by spreads which are still well below the long-term average.

Investing is most often a struggle to do nothing. Investors are constantly tempted to jump from one tactic to another. Growth stocks do well and it is tempting to abandon your conservative dividend strategy. But the time to do that was when growth stocks were performing poorly, not now. And for most people, the choice of growth or value (which is really what dividend strategies are) is more about their own temperament than market conditions. Value investors could only take the NASDAQ in very small doses. And growth/momentum investors never have the patience to make collecting dividends worthwhile. Investor, know thyself.

Patience is said to be a virtue but no one said it was easy. At times, sticking to your plan feels like sheer torture. But good tactics like dividend investing are always good tactics. Dividends haven’t suddenly become unimportant and dividend investing somehow obsolete.

Patience is bitter, but its fruit is sweet.

Jean-Jacques Rousseau

Joe Calhoun

Stay In Touch