The tariff rollercoaster continues. This week most of President Trump’s tariffs were ruled to be outside the scope of the law he used to impose them. I was not surprised in the least because, as I wrote a few weeks ago, I actually took the time to read the International Emergency Economic Powers Act and the word tariff doesn’t even appear anywhere in the text of the law. It details a number of things the President can do, such as impose sanctions, and the conditions under which he can do them, but tariffs are not one of the allowed actions. The ruling by the U.S. Court of International Trade is detailed and specific and rules that the Trump tariffs are illegal:

Underlying the issues in this case is the notion that “the powers properly belonging to one of the departments ought not to be directly and completely administered by either of the other departments.” Federalist No. 48 (James Madison). Because of the Constitution’s express allocation of the tariff power to Congress, see U.S. Const. art. I, § 8, cl. 1, we do not read IEEPA to delegate an unbounded tariff authority to the President. We instead read IEEPA’s provisions to impose meaningful limits on any such authority it confers. Two are relevant here. First, § 1702’s delegation of a power to “regulate . . . importation,” read in light of its legislative history and Congress’s enactment of more narrow, non-emergency legislation, at the very least does not authorize the President to impose unbounded tariffs. The Worldwide and Retaliatory Tariffs lack any identifiable limits and thus fall outside the scope of § 1702. Second, IEEPA’s limited authorities may be exercised only to “deal with an unusual and extraordinary threat with respect to which a national emergency has been declared . . . and may not be exercised for any other purpose.” 50 U.S.C. § 1701(b) (emphasis added). As the Trafficking Tariffs do not meet that condition, they fall outside the scope of § 1701.

It is even more interesting when one considers the history of this law. The IEEPA was enacted in response to President Nixon’s imposition of a 10% universal tariff in the wake of his decision to end the Bretton Woods monetary agreement. Those tariffs were eventually ruled to be constitutional under the Trading With The Enemy Act but only because they were limited to 10% and were temporary. Congress specifically passed IEEPA to confer “upon the President a new set of authorities for use in time of national emergency which are both more limited in scope than those of [TWEA] and subject to more procedural limitations, including those of the National Emergencies Act.”

The court’s blocking of the Trump tariffs lasted all of a day. The government was able to get a stay on the order while they appeal the ruling. After reading the entire trade court’s ruling, I don’t think the administration has a prayer of prevailing but I’m not an attorney and rely on common sense in these matters, which doesn’t seem to be in widespread use in the US court system. If you are interested in the history of this and the other laws President Trump has relied on to impose his tariffs on the US economy, you can read the trade court’s decision here. It is fascinating reading.

Even if these tariffs are ultimately ruled illegal, there are other ways the President can re-impose tariffs. The Trade Act of 1974 has several sections that would allow the administration to impose tariffs for a variety of reasons. Section 301 gives the US Trade representative the power to conduct investigations into unfair trading practices and violations of prior trade agreements, although that last one might be tough to justify given we’re the ones violating past agreements. Section 232 of the Trade Expansion Act allows the President to take action to modify imports after a determination by the Commerce Secretary that the imports threaten national security. (I would venture to say that any investigation by the trade representative and/or the Commerce Secretary will always result in a finding that is consistent with the wishes of the President who appointed them.) Section 122 of the Trade Act of 1974 was written specifically to address “fundamental international payments problems”, which would certainly include trade deficits and is the law Trump could have used legally.

The administration has used section 301 and section 232 in this second term to justify tariffs on steel, aluminum, and autos (232) and China (301) but the “reciprocal” and fentanyl tariffs were imposed under IEEPA. Why? Well, section 122 only allows tariffs up to 15% and for a limited time (150 days) before requiring a vote by Congress. That poses some issues if these tariffs are meant to be a negotiating tool. With a small majority in the House and Senate, there is no assurance that Congress would extend the tariffs beyond the 150 day window and that would allow countries to just run out the clock on negotiations. This section also says the authority may be exercised “only if international trade or monetary agreements to which the United States is a party permit the imposition of quotas or tariffs as a balance-of-payments measure”, which would complicate matters considerably since the US has (had?) free trade agreements with 20 countries. I doubt any of those allow for the imposition of tariffs.

The larger point here is that unless the Supreme Court – because that’s where all this is headed – rules all delegations of tariff authority are unconstitutional, including section 301 and 232 tariffs, then tariffs are going to be in place for as long as the President can maintain them. I don’t think tariffs on every country in the world will withstand the court’s scrutiny so the breadth of the tariffs may be limited. I also wonder if tariffs on everything we import from a country can be subjected to tariffs or if they will have to be more targeted. Declaring imports of yoga pants or mangoes a national security threat is going to be hard. Regardless, it seems we’re going to have tariffs, just probably not at “liberation day” levels.

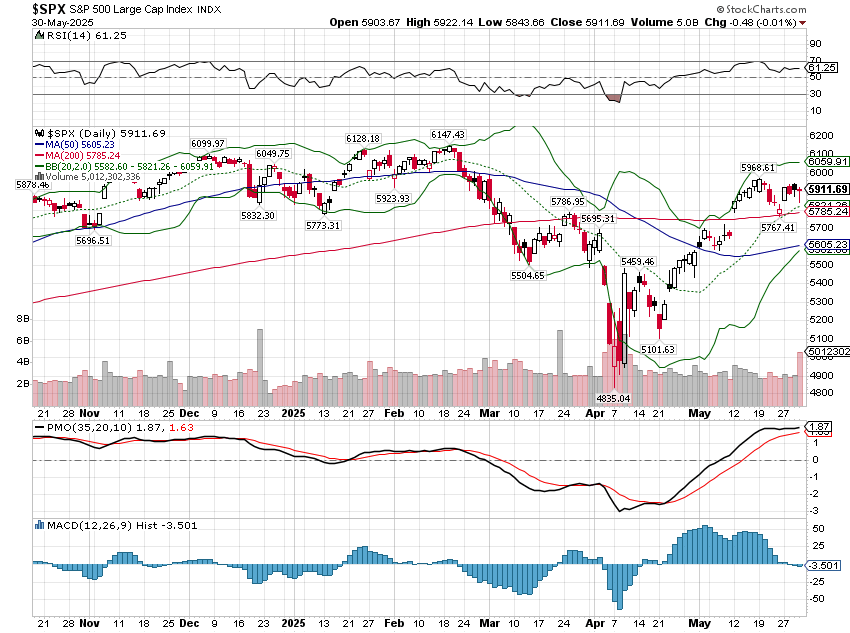

The question for investors is how much of an impact those tariffs are going to have, on the economy as a whole and on specific companies. The answer from markets for the economy as a whole, so far, is not much. Yes, the shock of “liberation day” knocked the markets for a loop but once the tariffs were reduced to 10%, markets recovered. That would seem to say that a higher, but not outrageous, tariff level is something the market believes the economy can handle. Some companies are going to be more affected than others but I’d be reluctant to make any big decisions until we know more about what the final product will be. Retailers’ stocks have been hit particularly hard but that was based on universal tariffs which seem unlikely to survive the court cases. Apple and other electronics makers have also been hit but, again, I’d be careful about making any long-term investment decisions based on what we know right now.

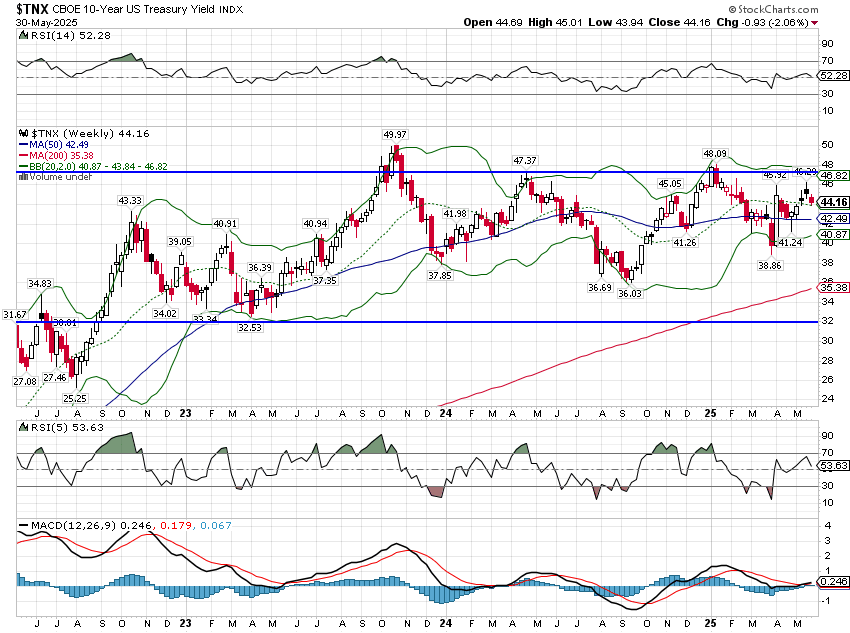

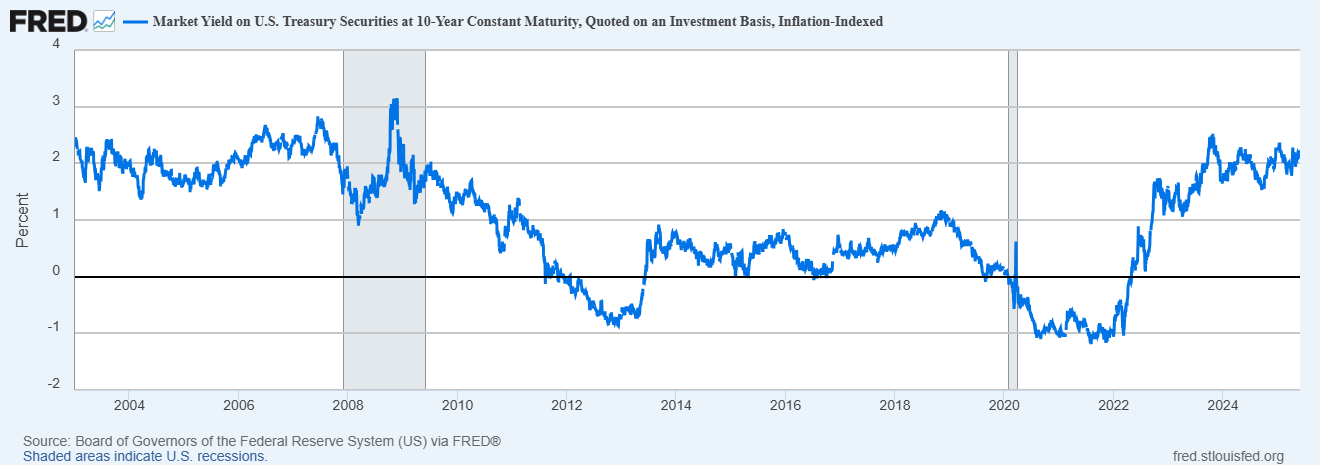

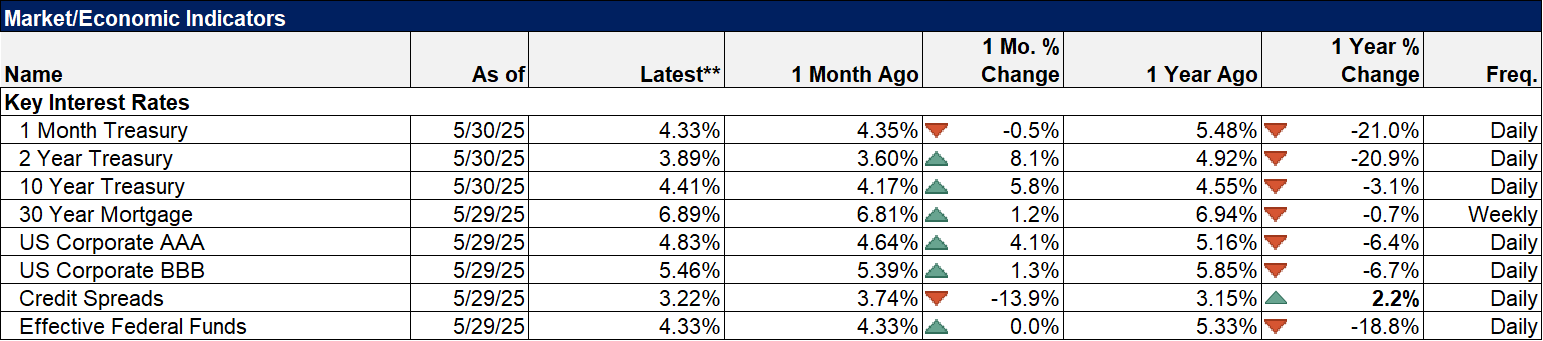

Interest rates have been remarkably well behaved given all the tariff turmoil. The 10-year Treasury note yield is essentially unchanged since election day and the inauguration. 10-year TIPS yields are up modestly since the election, down slightly since the inauguration. Market-based measures of inflation expectations are also largely unchanged.

10-Year Treasury yield

10-Year TIPS yield

10-Year Inflation Breakevens

There hasn’t been much change in stock prices either with the exception of foreign stocks. Since election day, the S&P 500 is up about 3% and since inauguration day it is down about 1%.

S&P 500

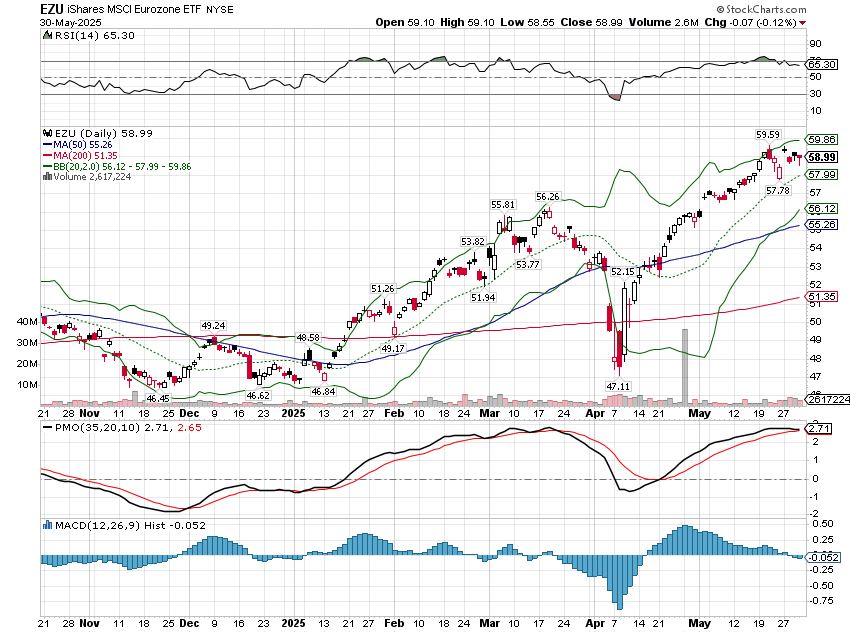

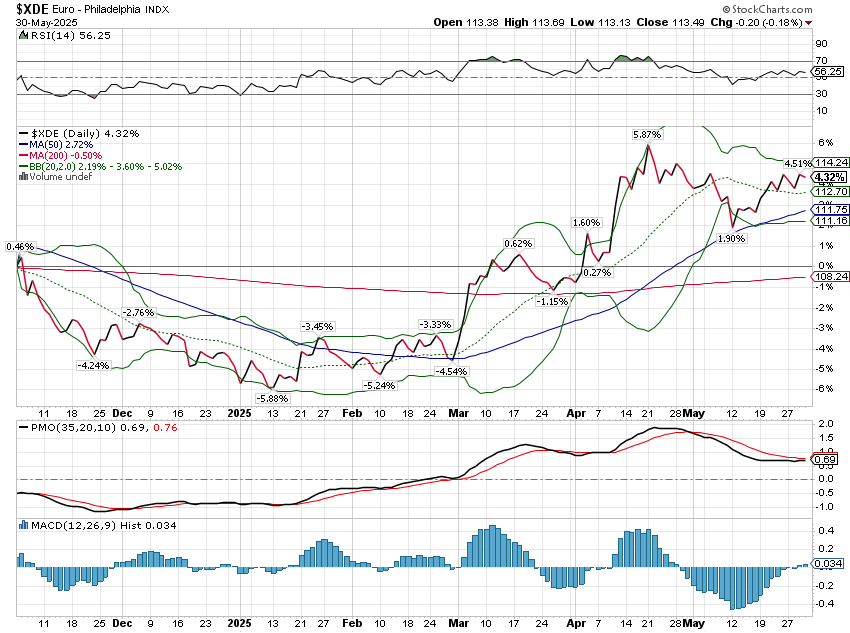

European stocks have been the main beneficiary of President Trump’s economic agenda. Eurozone stocks are up 19.1% since election day and 20.4% since the inauguration.

About 1/4 of the move since the election (4.3%) and 1/2 the move since inauguration day (+10.5%) is just the change in the value of the Euro.

Euro vs USD

President Trump’s trade war has, so far, been nothing but a lot of noise. I suppose we can say the same about his Big Beautiful Bill too. If it was anticipated to have a big impact, markets would already be pricing it in and we’ve seen nothing so far. That may be because no one expects it to survive in its House form or it could be that the bill just doesn’t do much. Frankly, I’d vote for all of the above. There are some items in the bill that I think are dumb – why in the world would we want to make it more costly for foreigners to invest in our markets? – but mostly it looks like status quo to me. And I don’t think it has a snowball’s chance in Hades of getting out of the Senate intact. Considering it passed by one vote in the House, that might be a death knell you hear.

We’ve competed five months of this year and our portfolios are mostly up modestly but that has been accomplished amid constant turmoil. I don’t know about you but I’m tired. I think what all investors need right now is just a rest, a respite from the constant noise coming from the White House. Given the current occupant, that probably isn’t going to happen but it would sure be nice to go through a week, one week, without the President announcing some new tariff or change to a tariff or some other change to economic policy*. A man can still dream, right?

*That won’t be this week. Over the weekend President Trump announced that he was raising steel and aluminum tariffs to 50% from 25%. That is a obvious sop to steel workers after Trump finally approved the Nippon Steel/US Steel hook up. Trump imposed steel and aluminum tariffs in his first term – 25% on steel and 10% on aluminum – but the results left a lot to be desired. An investigation by the Peterson Institute showed that every job saved in the steel and aluminum industries cost $900,000 due to the adverse impact on the economy. The tariffs ultimately reduced manufacturing in the US relative to what it would have been absent the tariffs. And, just to put a cherry on top, the reduced demand due to higher prices ultimately reduced the overall number of jobs in the steel industry. The aluminum tariffs were no more effective. Turns out cheap electricity from hydro-power in Canada can’t be duplicated in the US through the magic of tariffs. Trump abandoned the metal tariffs in 2019 because they didn’t work. I guess he thinks he just didn’t raise them high enough.

Environment

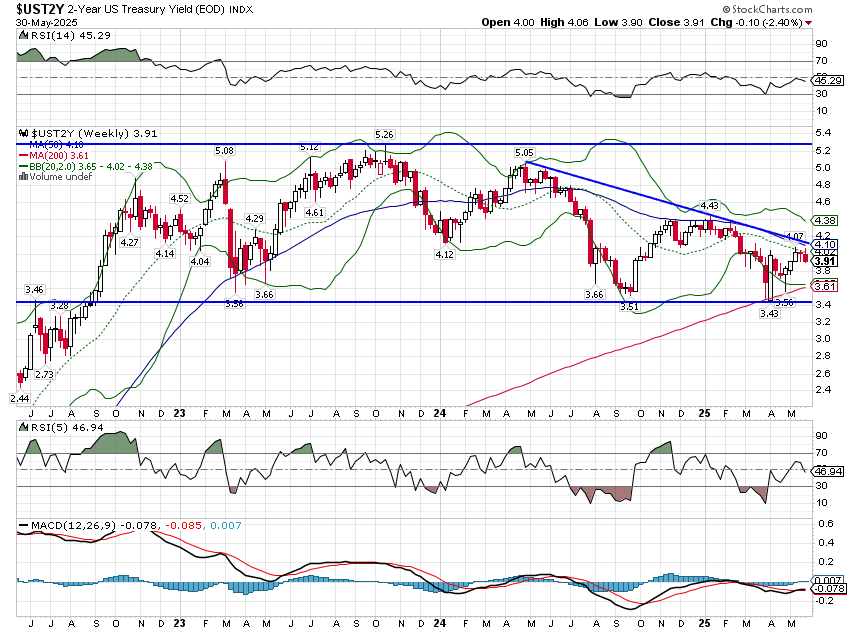

The dollar remains in a short-term downtrend and interest rates continue to trade in the range they’ve been in for almost 3 years. The yield today is just 8 basis points higher than it was in October of 2022.

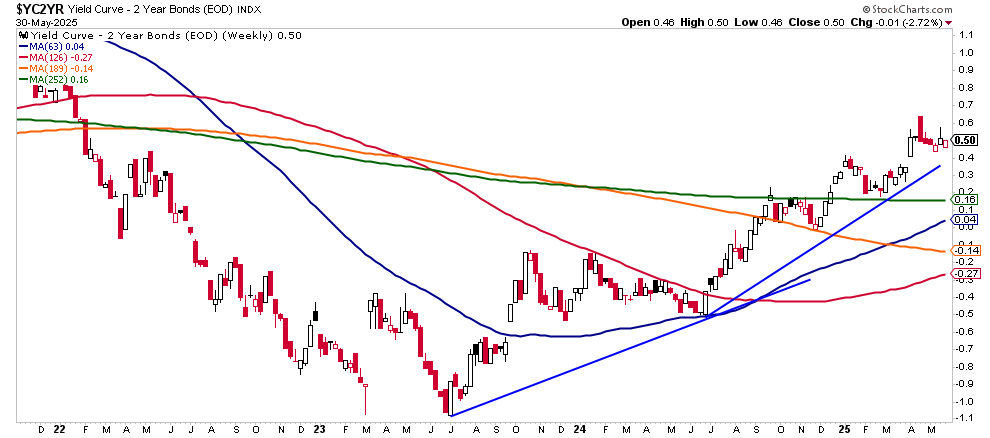

I have been keeping a close eye on the 2-year Treasury yield as it is in a more defined downtrend than the 10-year since mid 2024. This is mostly a reflection of Fed expectations. Currently the odds of a 1/4 point rate cut in September are 57.8%. The odds on another cut by the end of the year are just 40.3%. If the 2-year starts to decline more rapidly. it would indicate a more urgent need for the Fed to cut.

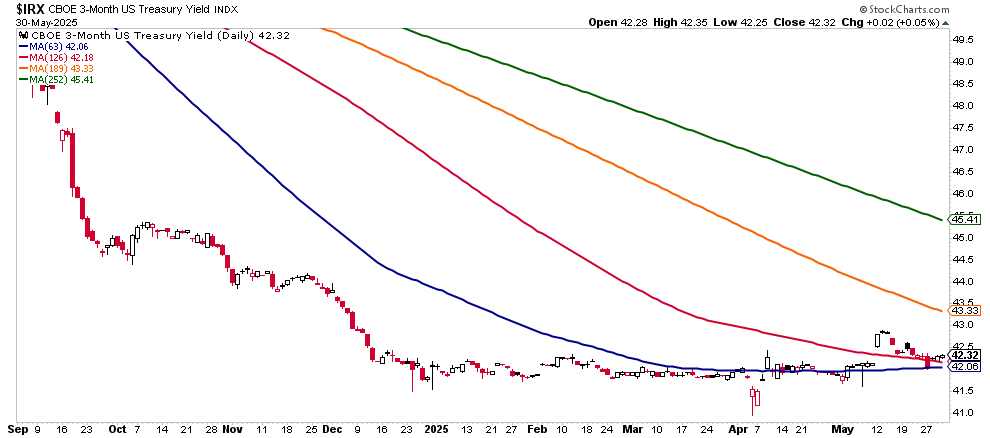

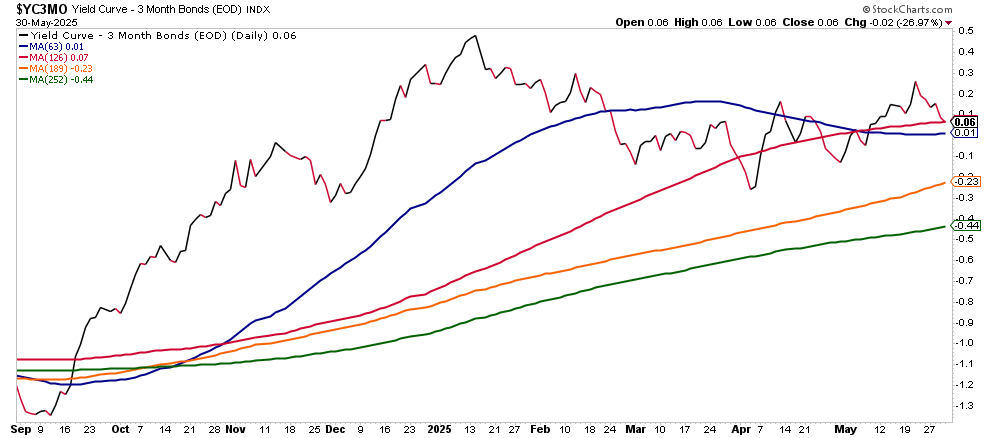

Another interesting tidbit in the rates market is the 3-month bill rate. While the 2-year is in a downtrend, the 3-month bill rate has stabilized and, if anything, appears to be turning up. One of the odd results is that the 2-year/10-year yield curve continues to steepen while the 3-month/10-year curve is flat.

Markets

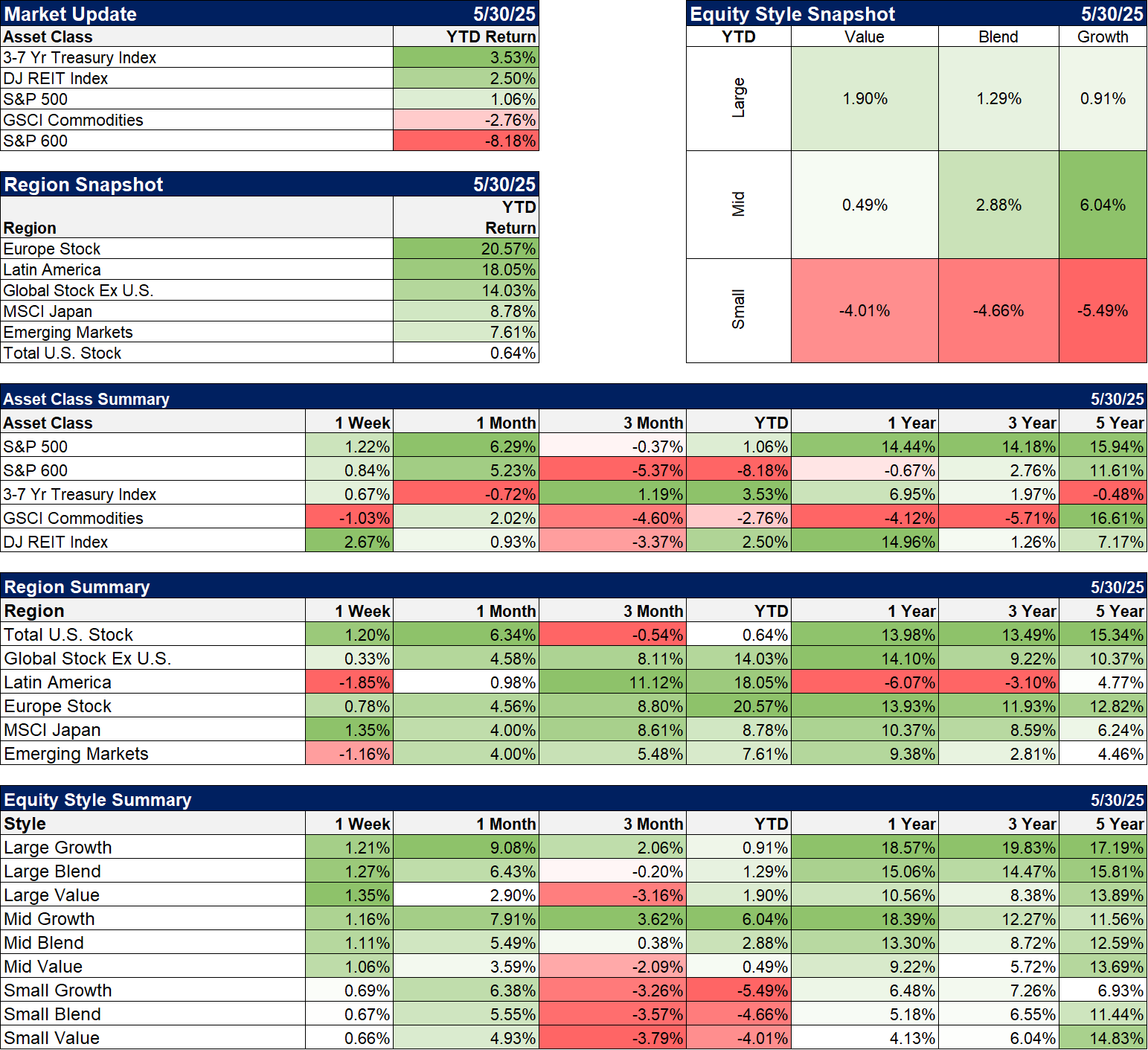

It was an up week for stocks but REITs were actually the best performing asset class. REITs perform best when interest rates are falling and rates were down last week although not by a lot. Maybe more interesting is that REITs have outperformed the S&P 500 over the last year, something no one had on their bingo card.

International stocks didn’t outperform last week but they are the clear leaders YTD and have performed in line with US stocks over the last year.

In the style boxes, mid-cap growth continues to lead, up 6% YTD and over 18% over the last year.

I continue to be somewhat cautious on stocks because sentiment seems overly bullish. Technically, the averages are well above their moving averages and likely to see some kind of correction. That is particularly true of non-US stocks by the way but as long as the dollar downtrend continues, I think you buy any dip in international.

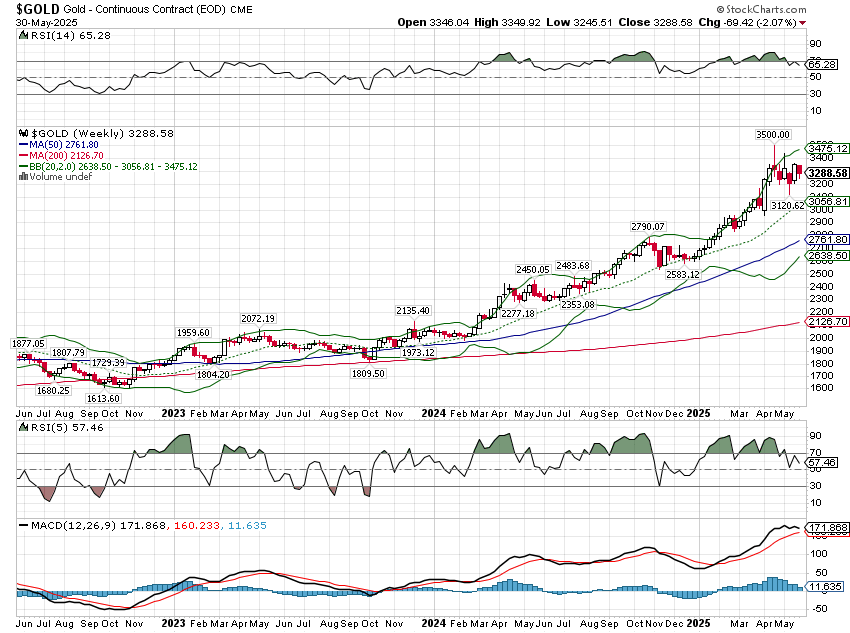

The uptrend in gold has stalled which isn’t surprising after such a big run. Given how much attention it has been getting in the press, I’d expect at least a correction soon. Figure 10% or so at a minimum.

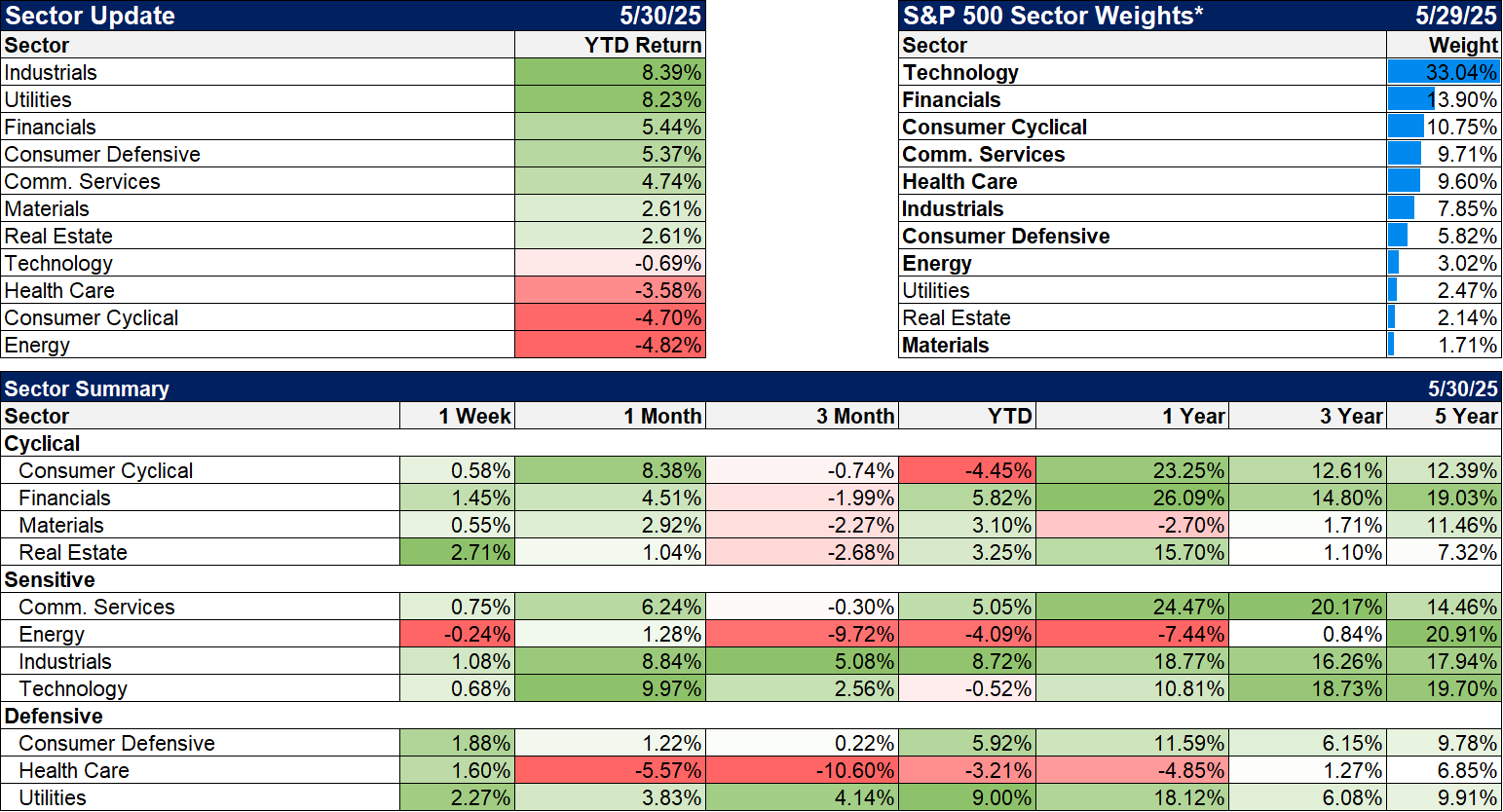

Sectors

REITs and utilities, both interest rate sensitive, outperformed on the week.

YTD, industrials lead the way but I’d be careful about drawing any big conclusions about the economy from that. The sector’s biggest allocation is to GE* which is up 47% YTD while another big winner is Howmet, the old Alcoa aerospace division that was spun off. Both of those companies are benefitting from Boeing’s revival but it doesn’t say much about the industrial sector as a whole.

*Alhambra and/or its clients have owned GE for several years.

Economy/Market Indicators

The compression in credit spreads appears to have stalled. Spreads are still historically narrow so it doesn’t mean anything yet but the downtrend does appear to be broken.

Economy/Economic Data

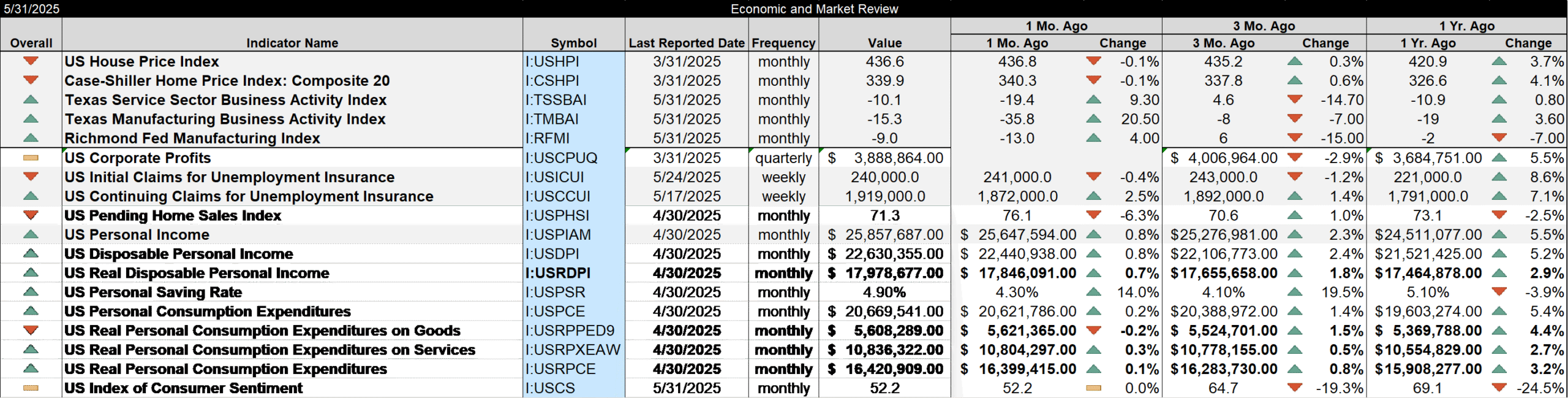

- Durable Goods orders fell 6.3% due to tariff turmoil. Transportation orders were down 17.1% with most of that in non-defense aircraft and parts (-51.5%, Boeing). Capital goods orders were down sharply (-14.6%)

- Case Shiller home prices were up 1.1% in March from February and 4.1% year-over-year. Amazing that even with sales as punk as they are that prices continue to rise

- Conference Board Consumer Confidence jumped from 85.7 to 98.0, a huge move for one month. This is directly related to the tariff pause.

- Dallas Fed Mfg. index rose from -35.8 in April to -15.3 in May. Still a long way from positive but less negative is still an improvement

- Richmond Fed survey also improved from -13 to -9.

- 2nd estimate of Q1 GDP was revised from -0.3% to -0.2%

- Corporate profits (part of the GDP report) fell 3.6% in the quarter. Undistributed profits fell 12%, net cash flow fell 4.7%. Year-over-year profits were up 5.1%

- Personal income rose 0.8% in April while personal consumption rose 0.2%. Goods consumption fell 0.2% while services spending rose 0.3%. The savings rate rose from 4.3% to 4.9%. Seems that people are acting more conservatively with their spending. Gee, I wonder why?

- Unlike the Conference Board’s Consumer Confidence report, the U of Michigan consumer sentiment report showed no improvement.

Stay In Touch