It’s Fed week again, when the monetary mandarins gather to set interest rates and guide the economy according to the latest 3-year plan (central planning may not have worked for the communists but our people are smarter). This is a quarterly meeting when they’ll sift through the tea leaves or gaze into their crystal balls or whatever they do to produce their Summary of Economic Projections, which based on its past accuracy probably shouldn’t be capitalized. These estimates of future growth, inflation, and unemployment are intended, as best I can tell, to prove that economists were invented to make palm readers look good. I’m sure the seers (economists) at the Fed have some really intricate, complex models to help them with this exercise but it always looks to me like they just took the averages of the recent economic data and put future dates on it. So, let me save you some time and tell you, in advance, what they’ll say in the SEP. They will predict that real GDP will grow around 2% for the next three years or so, which is right about average since 2010. They will predict that inflation will fall steadily back to 2%, because…well because that’s their target and of course they’ll hit it, the only question being when. In the June SEP, they thought that would take until 2026 which only seems like a long time if you have to, you know, buy things. They will predict that unemployment will be about 4% for the next couple of years because that’s what it’s been lately. Some of their new guesses will be different from their last guesses, by a tenth of a percent or two, and pundits all over will declare it the most significant change since the last time they made a change.

The big question in the investment world last week was whether the Fed would cut the Funds rate by 25 or 50 basis points, as if the only thing standing between us and recession is a 1/4% change in the interbank overnight lending rate, even though no banks are actually borrowing from or lending to other banks overnight. Of course, if they go for 50 it could be a signal from the Fed about how bad things really are because you know they know things we don’t. Yeah, no. The Fed isn’t hiding anything about the economy and even if they had data we don’t – which they don’t – they sure haven’t made very good use of it in the past. That doesn’t mean the market won’t react to whatever the Fed does and whatever Jerome Powell says in the press conference, because it most assuredly will. The market raised expectations for a 50 basis point cut last week and if the Fed goes 25, some people are going to sell stocks because they think it makes a difference. I assure you it doesn’t. If we get a recession sometime soon, it won’t be because the Fed only cut 25 instead of 50.

The SEP and Powell’s remarks will be pored over for clues about future changes in monetary policy and some investors will make big decisions based on their interpretation of the words and figures handed down from on high. Well, for about a day or two anyway, until some other IMPORTANT DATA diverts their attention or they forget about the economy altogether because Artificial Intelligence is going to change the world this week or surely by next month. Or maybe the punditry will move on to the election and how that might change the economy and markets, not just right now but for the next four years or at least the next two until the midterm elections. As Roseanne Rosannadanna famously said, it’s always something.

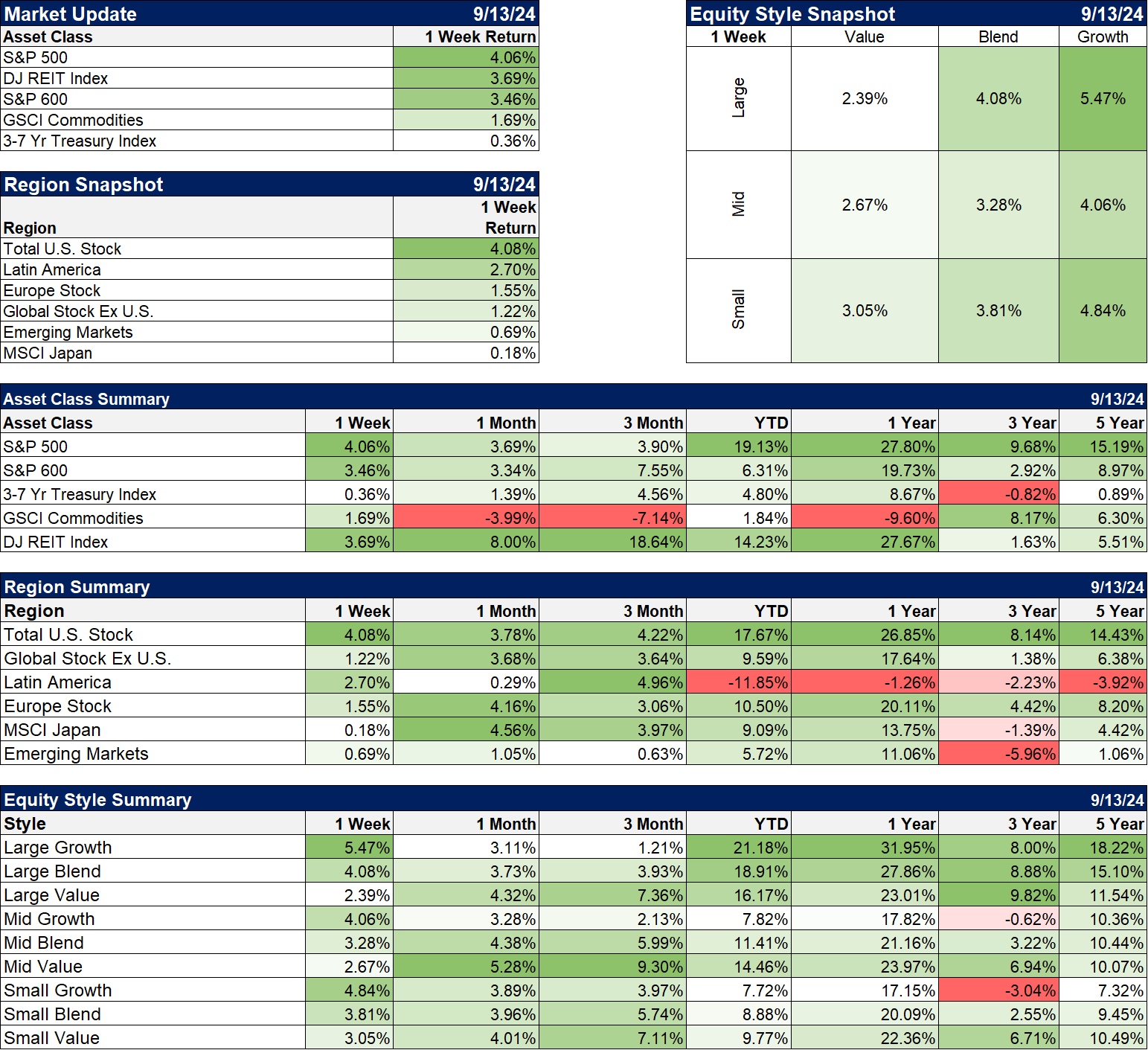

The stock market rallied roughly 5% last week because the odds of a 50 basis point cut at this Fed meeting rose from 30% to 50%. Why did the odds change? It wasn’t, as far as I could tell, from any economic news but there were some monetary influencers (or as they’re also known, former Fed employees) who said they thought a larger cut was justified. That most of those former Fed employees have been dead wrong about the economy for the last few years didn’t seem to matter because, you know, this time they might have some inside dope. There was also some Twitter post from a WSJ reporter who is supposedly the Fed’s preferred outlet when they want to tell the market something but they’re in a blackout period and can’t say anything themselves. He’s known as the Fed whisperer but my guess is that he gets better access because he wrote a book about how the heroic Fed saved us from economic doom during COVID. Flattery will get you everywhere in DC.

All of this speculation about the Fed’s next move is ridiculous, a waste of time for long-term investors. There are a million things that influence the future course of the economy, the change in short-term interest rates being only one. The rate of change of economic growth and/or inflation can and is influenced by monetary, fiscal and regulatory policy, but the economy also changes independent of those things. You cannot disaggregate all the discreet influences over nominal and real economic growth. You can’t quantify the impact on the economy of a quarter or half percent change in short-term interest rates or changes in demographics or new technology developments or the make up of Congress. Economists can’t even agree on what caused past changes in the economy much less ones that haven’t happened yet.

The economic recovery from the COVID recession – I am hesitant to even call it a recession lest anyone confuse it with any of the other 7 we’ve had over the last 60 years – has been odd to say the least. A huge fiscal response, zero interest rates, QE, tangled supply chains, an inflation spike like nothing seen since the 1970s, the lowest mortgage rates ever recorded, huge cash infusions to households and corporations and more have combined to make this economy completely unmoored from the past. The Conference Board’s leading economic indicators, which worked to predict recession for decades, have stopped working. The LEI signaled recession starting in 2022 and continued to do so until about 4 months ago just about the time everyone started fretting in earnest, again, about the onset of recession. The 10/2 yield curve has recently turned positive after spending a record amount of time in negative territory and there is still no recession in sight.

And even though it is a unique period, so are all the other expansions and contractions I’ve experienced in over 30 years of investing. Some of these “surefire” economic indicators were probably nothing of the sort; we don’t have nearly enough data on, say, yield curve inversions to say for sure. The LEI is made up, mostly, of indicators about the manufacturing part of the economy which isn’t nearly as important to overall economic growth today as it was 20, 30 or 50 years ago. Or maybe the LEI isn’t working because of the uneven recovery during COVID, where goods consumption soared in the early part when everyone was stuck at home and the services part has been booming the last two years due to pent up demand that was unleashed after the introduction of vaccines. And I wouldn’t be surprised if we get another shift back toward goods and away from services as interest rates come back down. The aftershocks from COVID may not be over yet.

Simple rules of thumb – like the Sahm Rule or the LEI or the yield curve – are not going to cut it in this economy. Investors need to think more critically about the old ways of doing things. Be skeptical, cynical even, of pronouncements from the Fed or anyone else about the future course of the economy. Pay less attention to the Fed and the other economic soothsayers and more attention to markets. Trust the wisdom of crowds over the wisdom of the 12 people on the FOMC. And just spend more time thinking, about how things have changed and how they haven’t. The economy may have changed since COVID but markets have not. Markets are driven by emotions and those who act unemotionally can take advantage of that fact. But if you spend your time thinking about things like whether the Fed will cut 25 or 50 basis points this week, you are going to get caught in the same emotional trap as everyone else.

I don’t know when the next recession will arrive and neither does anyone else but we will have one. All I can tell you is that, based on the available data, we are not in recession right now and that won’t be changed by whatever the Fed does this week.

Joe Calhoun

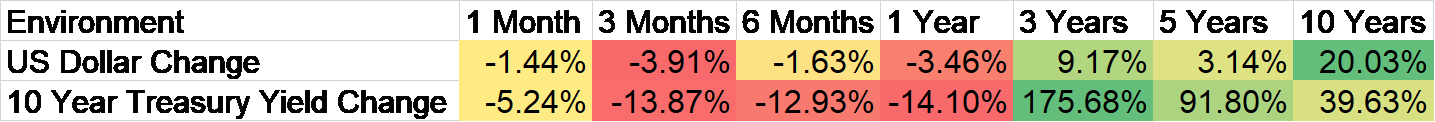

Environment

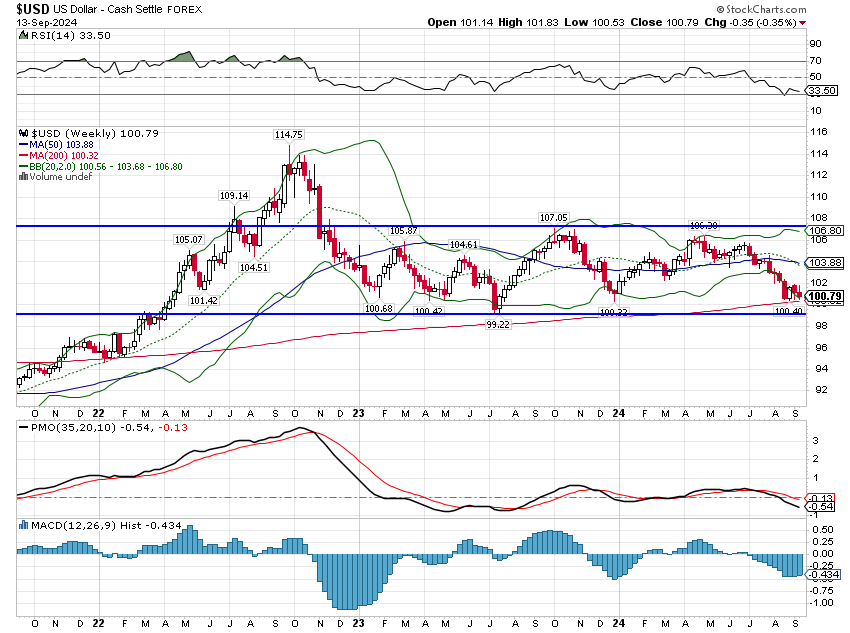

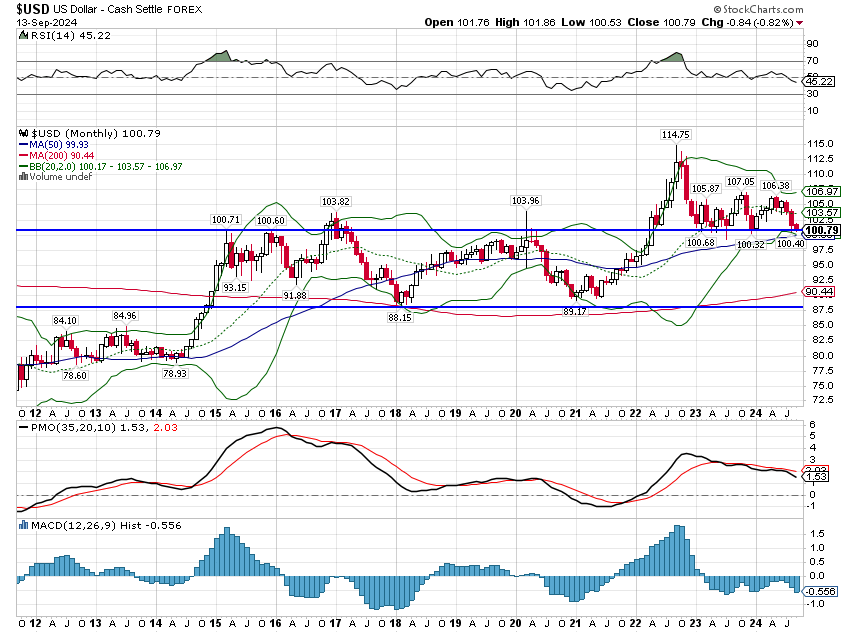

The dollar index has been in a short-term downtrend since the spring but it is still in the same trading range it has inhabited since the end of 2022. This trading range will eventually give way but the timing of that move is not something we can predict in advance. In fact, we can’t even really say whether it will break the range by rising or falling, although I do think a fall is more likely. We won’t act on my expectation though because the future direction of the dollar will depend on a wide variety of factors I can’t predict. I would have to predict not only future US economic policy but also the policies of other countries and the market reaction to those policies. Instead we invest based on the current short, intermediate and long-term trends. The practical implication of the current trend is that we incorporate some weak dollar investments in our portfolio but less than we would if the short-term downtrend were to extend below the current trading range.

The Fed meeting next week seems likely to determine whether the dollar breaks lower or rebounds into the existing trading range. With expectations building last week for a 50 basis point cut, a 25 basis point would likely move the dollar higher short term. If it does break lower into that lower channel, I would expect it to fall pretty rapidly toward the bottom of the range.

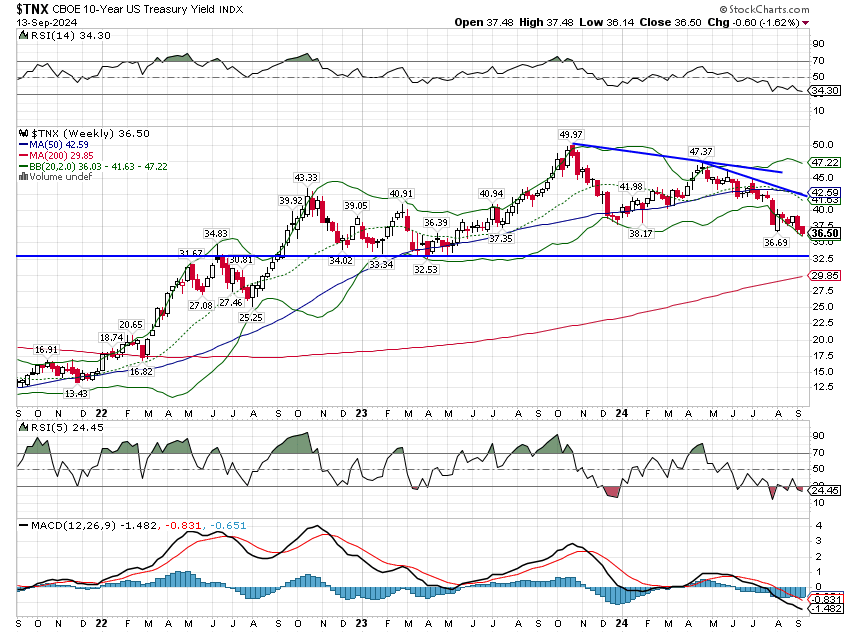

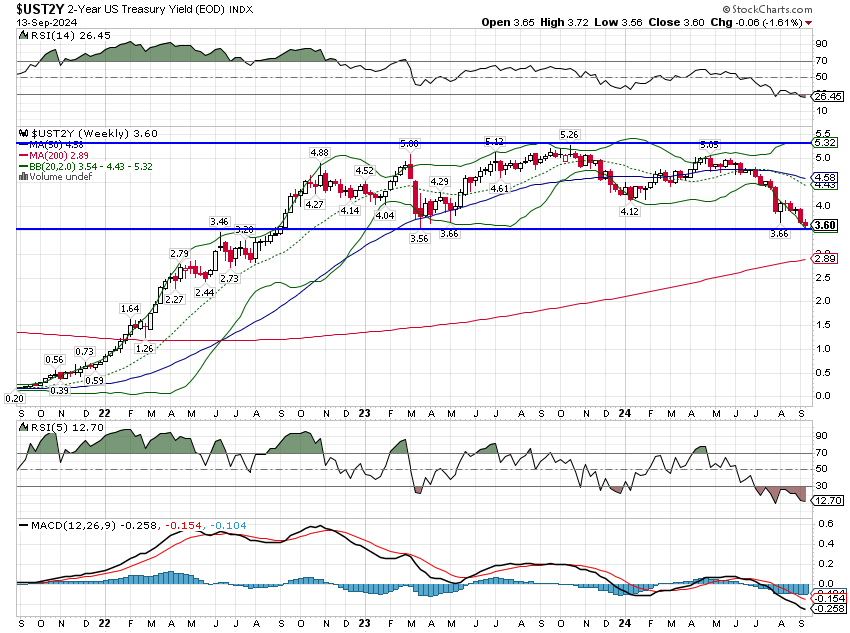

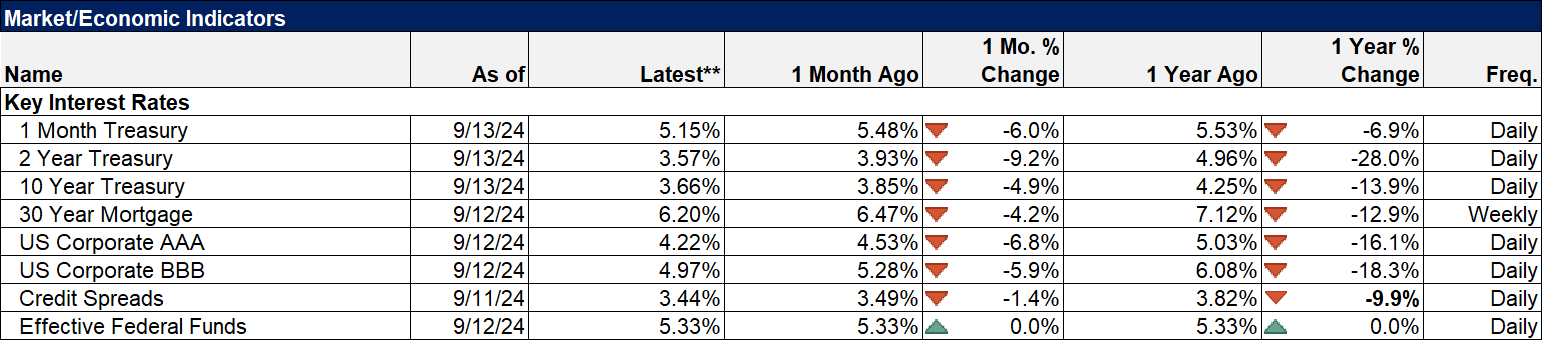

Interest rates were down slightly last week but the 10-year rate continues, like the dollar, trade in a tight range. Yes, it is in a short-term downtrend but it has been a slow grind lower and the rate is essentially unchanged from 2 years ago.

The 2-year Treasury note yield also fell last week but only about 5 basis points. It is also at the bottom of its range and the Fed meeting will likely determine the next move. Assets that respond favorably to falling rates (REITs, bonds, dividends) have had a big surge over the last 3 months. Growth stocks, which usually perform well when rates fall, have not. Looking at the past to see what assets perform well in any given environment gives you tendencies, not certainties.

Markets

Stocks had a very good week based on rising expectations for a 50 basis point cut at this week’s FOMC meeting. Those rising expectations though were based on…not much. The market has done this repeatedly this year, pricing in multiple cuts that have to be scaled back because the economy doesn’t cooperate. At the beginning of the year, expectations had to be dialed back because of some hotter-than-expected inflation reports. Now investors are more focused on economic growth and I suspect the easy money crowd will be disappointed again. There have been some indications of nascent economic weakness but the economy appears to be growing at trend of 2 – 2.5% in the current quarter.

Growth stocks outperformed last week but the last three years still favor value by a nearly 2%/year margin. REITs had another good week but I’d be wary of putting on new positions after a big run. If the Fed disappoints this week and rates move up, REITs will likely get a well deserved correction.

Commodities continue to struggle despite a weaker dollar. That is being driven by crude oil, which is down 12.2% over the last three months. That does not appear to be due to a lack of demand by the way. The futures market remains in backwardation with spot prices higher than futures. That isn’t, as I’ve seen some say recently, an indication the market thinks prices will fall in the future. It is merely a reflection of strong current demand.

Non-US stocks have improved over the last three months as the dollar has fallen with Latin American stocks up nearly 5%. Global stocks ex-US are up 17.6% while the EAFE index (not shown below) is up 19.6%. That lags the US but not as much I suspect as most people think. International stocks are also a lot cheaper than their US counterparts but a large allocation to international probably isn’t warranted until the dollar gets in a more consistent downtrend.

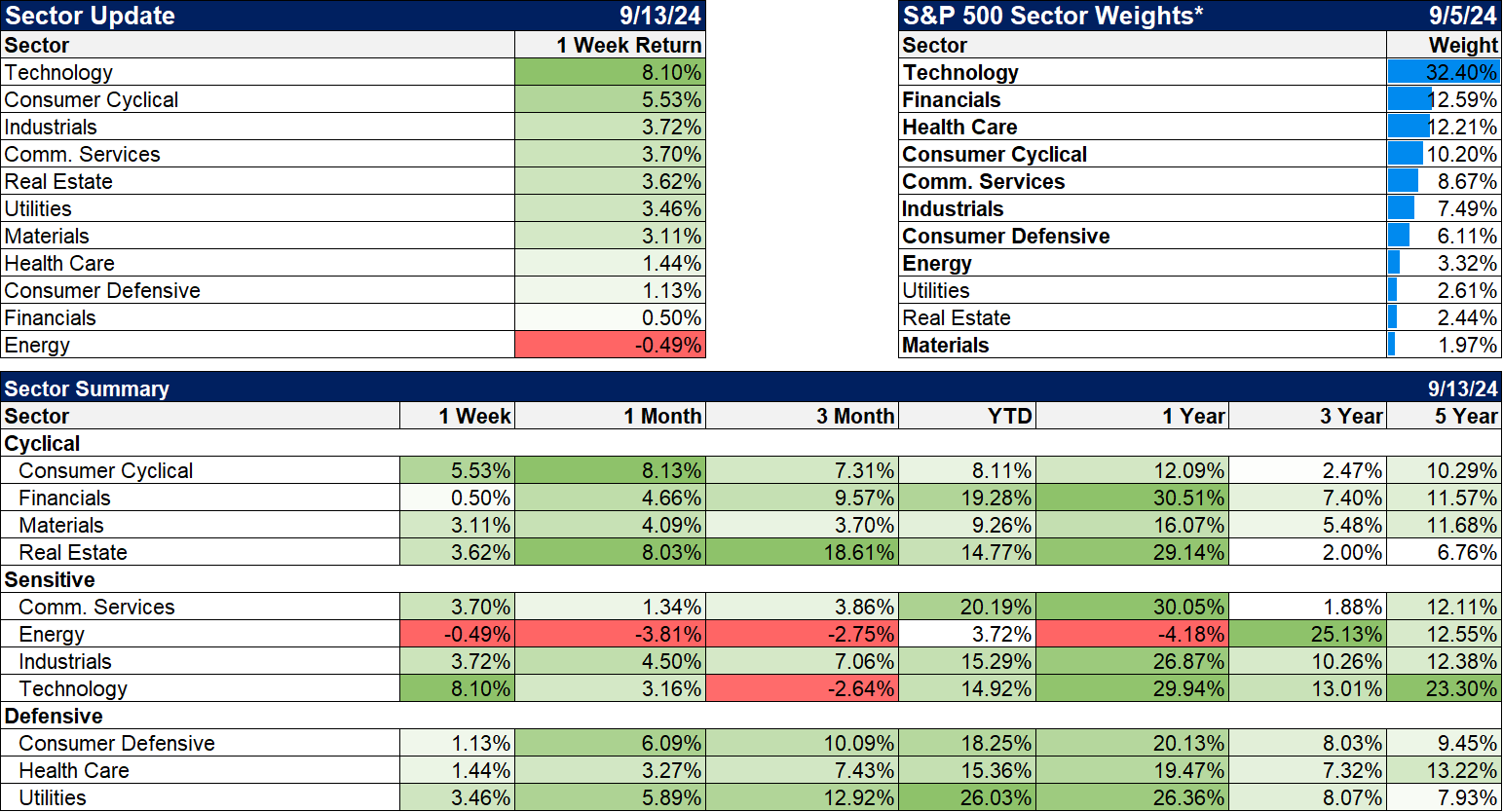

Sectors

Technology surged last week but is still down over the last three months and over 7% from the peak in early July. Energy stocks continue to struggle and are now down 4.2% over the last year.

Year to date, despite a lot of hoopla, technology ranks in the middle of the pack (6th). Communications services, which includes some tech adjacent names, is the second best performer but defensive sectors like utilities, consumer defensive, and healthcare are also near the top. Utilities have been touted as an AI play and they are certainly priced that way at nearly 19 times next year’s earnings estimates. They are also sensitive to interest rates though and that has certainly played a role.

Market/Economic Indicators

Last week’s economic reports:

- Redbook same store retails sales +6.5% year over year. This has been rising since last summer.

- CPI up 0.2%, core up 0.3% month to month, 2.5% and 3.2% respectively year over year. The core was a little higher than expected but no real surprises here.

- PPI up 0.2%, core up 0.3% month to month, 1.7% and 2.4% respectively year over year. Both 0.1% higher than expected but pretty tame.

- Jobless claims 230k. Still no sign of sustained labor market weakness

- Import prices -0.3%, export prices -0.7%. Year over year +0.8% and -0.7% respectively. Most of the drop in import and export prices was due to crude oil. We still import a lot of crude because our refineries aren’t set up for light sweet crude.

The overall economic picture, based on the most recent data, is one of steady, trend growth and inflation continuing to fall back to trend. Inflation is still too high and I wouldn’t bet on it getting back to the pre-COVID trend of less than 2% but for now it is on a trend that should allow the Fed to cut rates. The question is how much.

Stay In Touch