As predicted last month, the world markets were headed for a significant downdraft as economic statistics and a worsening Euro crisis took hold. As expected, once the S&P 500 broke its 50-day moving average we at Alhambra thought it would test the next major level of support, which was the 200-day MA. So far the index has been able to hold those levels after briefly crossing past it. 1340 is our next target for the S&P 500, and it will probably be reached on Monday, following news of a $125 billion Spanish bailout in the works.

Latin America suffered steep losses this past month, as a weakening commodities outlook and a strengthening US dollar wreaked havoc in the resource-dependent region. Once the index blew through the 50 and 200 day MAs, it was evident that it would be testing its short-term lows at 40.76. The downturn blew through that too, and now the index has a arduous climb back and a lot of technical damage to repair.

The EMU Index, or the European Economic and Monetary Union, broke down technically, and is now in the process of establishing a bottom. It does find itself right at a crucial support level though, and with news of the Spanish bailout, it seems likely the index will power through. At least for a little bit…

More of the same for Eastern Europe. It should recover nicely come Monday.

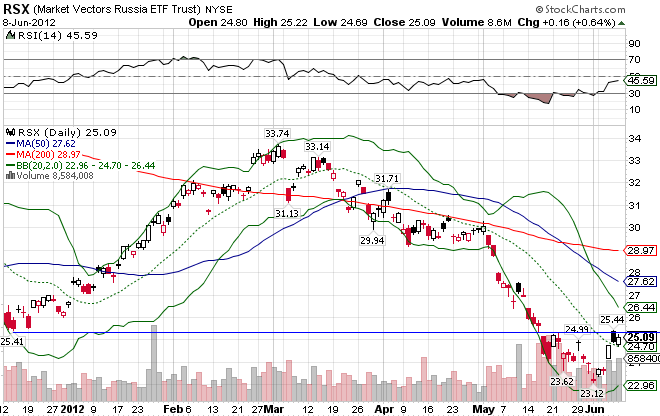

Russia, which is more of a resource-based economy like that of Latin America, has fared a bit worse than mainland Europe. If it breaks through resistance, which seems likely, look for it to test the 50-day MA.

The Middle East has also been hit hard with the decrease in crude oil prices. It currently sits atop support, and is due for a bounce back.

Africa has been a stand-out until recently. Its decline is far less advanced then that of the world, so far. Look for it to test the 200-day resistance level.

Pacific x-Japan is approaching heavy resistance up ahead. Look for the index to test the 41 level, but maybe not before covering up the gap at 38.50.

Japan is slightly worse off than the rest of the region. It does find itself above a key support level at 8.80, so a rebound is likely.

Stay In Touch