Thinking Things Over July 1, 2012

Volume II, Number 26: It’s a Trader’s World Now

By John L. Chapman, Ph.D. Washington, D.C.

“[The EU Summit produced] the first signs that collectively they are starting to understand the issue. If you come out of a summit like this and the mood improves, it means everything rises. The challenge, as always, is how long it lasts.” – William Porter, Credit Suisse

How long will it last? Indeed. Stocks around the globe rallied sharply on Friday thanks to news emanating from Brussels early that morning that the European Council meeting of EU leaders had produced tangible action toward an orderly restructuring of onerous Eurozone debt burdens. U.S. equities gained 2.5% on the day to close out the strongest June for the S&P 500 since 1999, but that was a small reflection of the rallies in Italy, Spain, France, and Germany (ranging from 4.3-6.7%). Irish, Spanish, and Italian bond prices rose as well, in reflection of renewed confidence in banking system recapitalization and sovereign borrowing capabilities.

So, just how real are the prospects for a credible path forward to an end to the European agony? And in the U.S., in the wake of an historic Supreme Court ruling affirming sweeping new regulatory powers for the federal government per oversight of 17% of total spending here ($2.7 trillion), are we set up for a better second half? Alas, the answers remain the same: not very, and not really. In such an environment, it is truly a trader’s game, and likely will be for many years to come (by which we mean, remaining liquid to exploit moments of opportunism when they come is of paramount importance to preserving, let alone growing, wealth) – but having said that, a rally this fall is certainly possible, as we describe below.

What is a Trader’s Market?

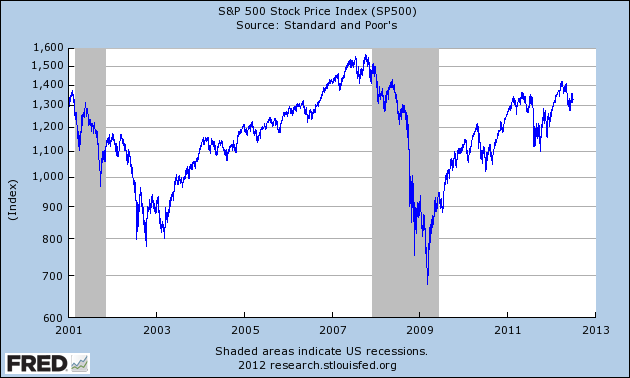

To understand the current environment, it is useful to look at periods in the past where the same base economic conditions prevailed. In this case, we refer to below-trend GDP growth for a multi-year period. In the 11 ½ years since the inauguration of George W. Bush, the U.S. economy has averaged 1.6% in annual output growth (precisely half the 20th century and post-World War II growth rate of 3.3%). The U.S. equity markets have been essentially flat across that time period, rising (pathetically) 0.29% per year in nominal terms (which is to say, the entire gain in the past 46 quarters occurred in the last three days of this past week – again, this is stated nominally, as the real gain across this time-frame was effectively zero, after dividends and inflation). This is seen in the graph below:

Chart I. S&P 500 Index, January 2001-Present (Log Scale)

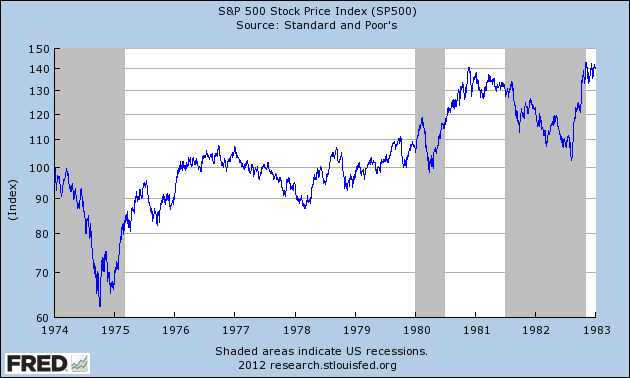

The other time in recent history when real output gains were this bleak were the nine years inclusive between 1974-82, when GDP growth averaged 2.0% per annum. Stock market gains averaged 4.1% annually in nominal terms then, meaning they were negative after inflation:

The other time in recent history when real output gains were this bleak were the nine years inclusive between 1974-82, when GDP growth averaged 2.0% per annum. Stock market gains averaged 4.1% annually in nominal terms then, meaning they were negative after inflation:

Chart II. S&P 500 Index, 1974-82 (Log Scale)

The two eras are different in only one major respect: consumer price inflation was much worse back in the ‘70s and early ‘80s than it has been of late. But even here the larger issue, monetary instability, borne of an activist Fed that favored a weaker dollar and ratified by fiscal profligacy and consequent asset bubbles on a global scale, is highly similar in both cases.

The two eras are different in only one major respect: consumer price inflation was much worse back in the ‘70s and early ‘80s than it has been of late. But even here the larger issue, monetary instability, borne of an activist Fed that favored a weaker dollar and ratified by fiscal profligacy and consequent asset bubbles on a global scale, is highly similar in both cases.

The key insight is that in the ‘70’s and the ‘00’s, the combination of higher debt/GDP levels, sclerotic growth and a vacillating currency during times of geopolitical tension led to very flat equity markets, if not down in real terms. In such times, the only investment managers who will consistently beat benchmark indices will be those who can trade in a fashion contrary to the timing of prevailing investing flows, and these are sustainable only for fairly short periods, as both graphs above show. In other words, to say it simply, investment wins in such eras of slow growth come when one can “buy the dips” and “sell the peaks.” By definition this is a very hard game to play, and requires an interdisciplinary investment approach that includes fundamental asset valuation as well as insights into the interplay of macroeconomic variables, how monetary policy affects asset prices both short term and in the long run, the gauging of investor sentiment (recall Keynes’ famous dictum about judging how others judge beauty contests, rather than judging the contestants themselves), and the micro-focus of credit analysis.

Eurozone Developments Offer a Ray of Hope for Stronger Growth

In any case the operative question is, what dynamic can change a period of weak growth and stunted equity markets into a time of prosperity? Better policy, of course, for which we still search in vain. However, perhaps marginal moves in that direction happened in Europe this week after all. The summit led to three concrete intentions:

- Direct lending to troubled banks, beginning in Spain, by the European Stability Mechanism (ESM), the Eurozone taxpayer-backed bailout/liquidity mechanism. This is billed as a concession of Germany to the recalcitrants; in theory it is an improvement because it will not impair already deeply-indebted sovereign governments. It was a direct reaction to the new loan facility of $125B to Spain a week ago, that failed to placate bond investors.

- Current debt holders will not be subordinated by any newly-issued debt. The inability of any ESM rescue funds to cop a priority claim is important for both current holders of bank debt as well as any future private-sector creditors who may be found. Again this was viewed as a concession by Germany, as in theory German taxpayers will now not only be more on the hook for future bailout lending, but they will have no first claims when things go wrong – thus, their level of pain risk would increase.

- Single authority (likely from inside the ECB) to manage the bank recapitalization proffered by ESM funds. This would lead to – again, in theory – more judicious application and oversight of the recapitalized banks receiving ESM aid. While details are to be worked out, the overseer here will more than likely be able to read Nietzsche and Schopenhauer in the native language.

The devil is in the details, of course, and these will be worked out in the months ahead, beginning with further ministerial-level meetings on July 9. Unfortunately, we remain skeptical, if not cynical, about prospects for Europe. According to economist David Malpass of Encima Global Advisors, the total available funding from the ESM/EFSF backstop facilities is about the size of the U.S. TARP program ($700 billion). But the impaired asset totals, according to Mr. Malpass, may be much higher than was the case in the U.S. thanks to a larger amount of banking assets and liabilities in the Eurozone banking system (he claims 3-4X more, though we have not been able to verify this).

Without the requisite resources for recapitalization coming coincidentally with pro-growth fiscal reforms (which in our mind are the exact opposite of those sought by the new French Premier; in contrast to Mr. Hollande, we hope for down-sized Eurozone government spending and lower tax burdens on all workers and investors, along with a recession in Brussels itself thanks to Eurocrat layoffs), the euphoria of the last few days is once again to be short-lived. In sum, nothing in the Eurozone dynamic has changed in what we still see as a Chinese water-torture play-out in the next few years.

This is most unfortunate, as the Eurozone torpor is item #1A on the list of global investor concerns that at the moment are seriously retarding the return of prosperity, in Europe and around the world.

Developments in the U.S. in the Last Week

Item #1 on that list is, of course, the moribund U.S. economy, which was confirmed as growing at 1.9% in the first quarter (down from 3.0% in the 4th quarter of 2011), with domestic prices advancing at an unexpectedly rapidly 2.6% annual rate (up sharply from the 4th quarter of 2011’s 1.1% rate as revised). Median estimates for the second quarter ended Friday are for 2.1% growth, and a hovering in the 2.3-2.4% range for the rest of this year.

The new GDP estimate, while unchanged, nonetheless was revised in terms of its internal components: positive contributions came from personal consumption expenditures (PCE), exports, both residential and nonresidential fixed investment, and inventory investment (that was shown to be lower than initially thought). Federal, state, and local government spending all declined, while imports increased (which, in the weird world of national income accounting, detracts from GDP even while making lives better for the buying businesses and consumers). We think the rest of the year’s growth estimates in the 2-2.5% range are accurate, as we expect a peaking in U.S. corporate profits along with the wide range of continued global uncertainties.

Weekly jobless claims for June 18-23 totaled 386,000, down 6,000 from the prior week but still well-elevated from a healthy turnover range below 350,000. This is a concern because given the last several weekly reports in this same range, another weak jobs report for June may be in store when reported on July 6, aborting the June rally and confirming business sentiment is still infirm.

On the other hand, personal income increased +0.2% in May (+0.3% on a revised basis, +2.9% nominally year on year, or +1.3% real), with personal consumption flat (-0.3% including downward revisions, but up a nominal +3.5% in the last year, or a healthy +1.9% in real terms). Core inflation (excluding the volatile categories of energy and food) is now up 1.8% year on year, and should not prevent continued spending momentum in the second half of the year.

There was further good news in the last few days as well. New orders for durable goods increased +1.1% in May (+4.6% year on year), and excluding transportation were up +0.4% (ex-transport still up +3.8% year on year. Unfilled orders are +8.3% from last year, indicating a healthy backlog moving into the second half. And new single-family home sales were up by +7.6% in May, to a 369,000 annual rate; sales were up in the Northeast — a good harbinger, as well as in the South as well. May sales drove up the median price of new homes to $234,500, and are now up +5.6% from a year ago. In all housing categories, it appears as though the U.S. economy is not too far from bottoming if not there yet.

All in all, the remarkably durable U.S. economy contintues to “plod along.” A 2% growth rate in many ways may “feel” like a recession, but we have only to gaze across the Atlantic to understand the relative realities. Stock prices may go higher from here, but only if profits for the second quarter come in better than early indications lead us to believe. As always, in a trader’s economy, the goal is to be alert for opportunities as they arise.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com. The views expressed here are solely those of the author, and do not necessarily reflect that of colleagues at Alhambra Partners or any of its affiliates.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch