Despite all the reported safety problems with the Dreamliner 787, Boeing had a terrific month to close out 2012. The company received 183 orders in December, a pickup in pace over the 124 in November (and the 101.8% decline for non-defense aircraft in August 2012). That led to a headline increase in total durable goods orders of 4.6%, cheering markets in the US and elsewhere.

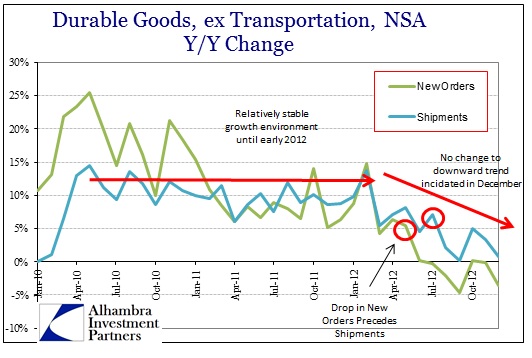

Outside of Boeing, however, the picture is far less robust and the downward channel for the goods economy that has existed since early 2012 remains undisturbed. Stripping out the Boeing effect (as well as the usual seasonal adjustments) we see that shipments and new orders have fallen to very near their lowest pace of the year.

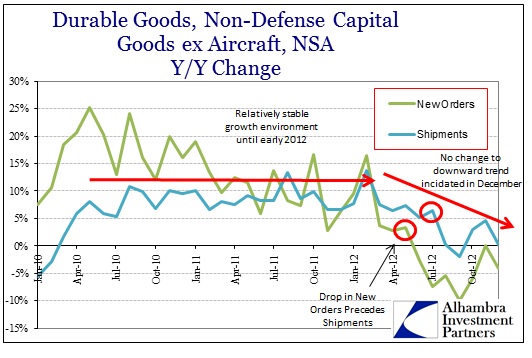

In terms of forecasting capital expenditures, the charts for nondefense capital goods (ex aircraft) are very nearly, and uncannily, identical to the full durable goods chart posted above.

The only difference between them appears to be the degree to which new orders have contracted throughout the middle of 2012 (worse for capital goods). The relation between capital expenditures and the overall goods economy is usually pretty close, but this nearly coincident movement in timing and degree is rather interesting. That would indicate that businesses are very much attuned to the discretionary consumer environment and are reacting in close proximity to changes in consumer appetite.

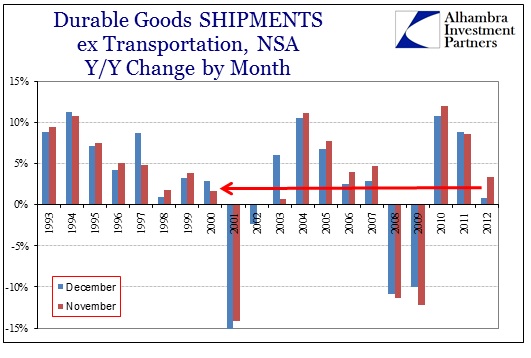

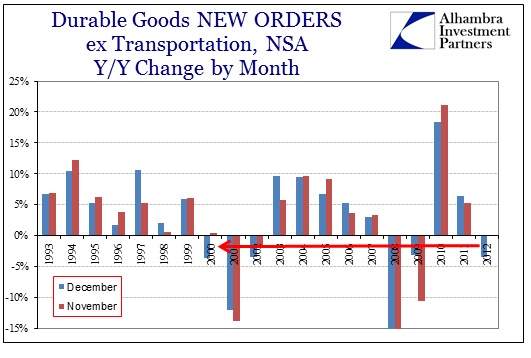

Not only is that disconcerting when compared to the previous steady trend, but the last two months of the year normally convey an upward bias. The fact that both November and December fell well off the recovery trend is good confirmation that contraction in the goods economy has not much abated. In the historical context, November & December 2012 were the worst performance since 2000, meaning that the just concluded year in the goods economy actually underperformed 2007 by a significant degree.

I think we can conclude that a full-blown contraction of any significant scale is not yet apparent, but that is certainly the track that the goods economy is on. Both durable goods and nondefense capital goods (ex trans and aircraft, respectively) unambiguously confirm that analysis despite the headlines of seasonally adjusted strength.

Stay In Touch