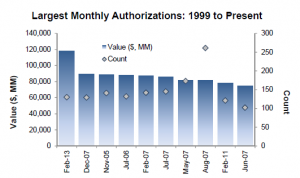

Stock buybacks hit a record last month according to this post from Cardiff Garcia at FT Alphaville quoting a Birinyi Associates post:

We recorded $117.8 billion in buyback authorizations during the month of February, representing a 103% gain over the same period in 2012 ($118 bln vs. $68 bln). February was the largest month, in dollar terms, on record.

That’s good news right? Well, I don’t know about you but the thing that catches my eye about that chart is that 6 of the biggest months for buybacks were in 2007. In case you’ve forgotten that wasn’t a particularly good time to be buying boatloads of stock.

Obviously there are many reasons for companies to buy back stock and some of them are good. With interest rates so low it might be perfectly reasonable to borrow funds cheaply and buy back equity in the open market, especially if it was issued at a lower price. Of the companies executing the top 10 largest buybacks, 9 have issued debt in the last year and some of them as recently as last month. I would note here, however, that 8 of the 10 largest buybacks are being done by companies whose stock prices are at or very near 52 week highs. Indeed 6 of the 10 are at all time highs so it is impossible that they are buying back stock sold at a lower price. So excuse me if I don’t take this as a sign that companies are getting a deal on the stock they’re buying back from the public.

It isn’t just buybacks that these bond issues are funding either. Companies announcing dividend hikes set a record last month as well (298). Interestingly, December set a record for dividend cuts in a month at 98. This post at Political Calculations posits that Hauser’s Law and the fiscal cliff has a lot to do with the dividend shenaningans:

The single thing driving all this unusual record-setting activity for U.S. dividend-paying companies is the so-called “fiscal cliff” crisis.

Here, America’s highest income earners first sought to avoid the risk of having to pay nearly triple the level of taxes on their dividend income by pulling ahead dividend payments from 2013 to the fourth quarter of 2012 instead, where they would only be taxed at a 15% rate.

Since these companies primarily pulled the money to pay those dividends from the funds that were already being set aside to pay dividends in 2013, the desire to avoid the risk of being exposed to those higher taxes that would be taking effect in 2013 is responsible for the record number of special dividends and dividend cuts that took place in December 2012.

Go read the entire PC post and if you haven’t already, bookmark the site. Ironman is doing some of the finest work around the web.

So what does all this mean? About the only thing we can say for sure is that these companies don’t have a better use for their capital. If they could make investments in their business with an expected return in excess of their borrowing costs, they would be doing that. It also tells us something about the effect of the Fed’s quantitative easing. The Fed’s suppression of interest rates is inducing companies to weaken their capital structure by issuing debt and buying in equity. That might be okay right now but it will reduce their ability to weather another recession. It also means that to the extent that the buybacks are for stock that was issued via options it is a direct benefit to management. It goes without saying that this also benefits the big banks and brokers who get the job of selling the bonds and buying the stock.

Is it positive for the economy? Hard to say but I guess one could make the argument that the capital is being returned to shareholders who might find a more productive use for it than the companies. Of course, someone had to buy those new bonds so it is more likely a wash. Factor in the increased leverage in an economy that isn’t suffering from a lack of it and the argument gets even weaker.

Will these companies top tick the market like they did in 2007? I certainly wouldn’t rule it out…

Here are the top 10: HD, GE, PEP, UPS, MMM, UTX, TXN, LOW, TWX, DTV and no we don’t own any of them in our managed portfolios.

Stay In Touch