The market is a very confusing place right now and there are a lot of cross currents to decipher. I spent the afternoon perusing a lot of charts in the hopes of finding some clarity. I do this about once a week – I look at charts everyday but once a week I sit down for several hours and review hundreds. I find visualization useful and often find themes that I might have missed without doing this. Anyway, here are today’s observations. I hope you find them interesting and useful.

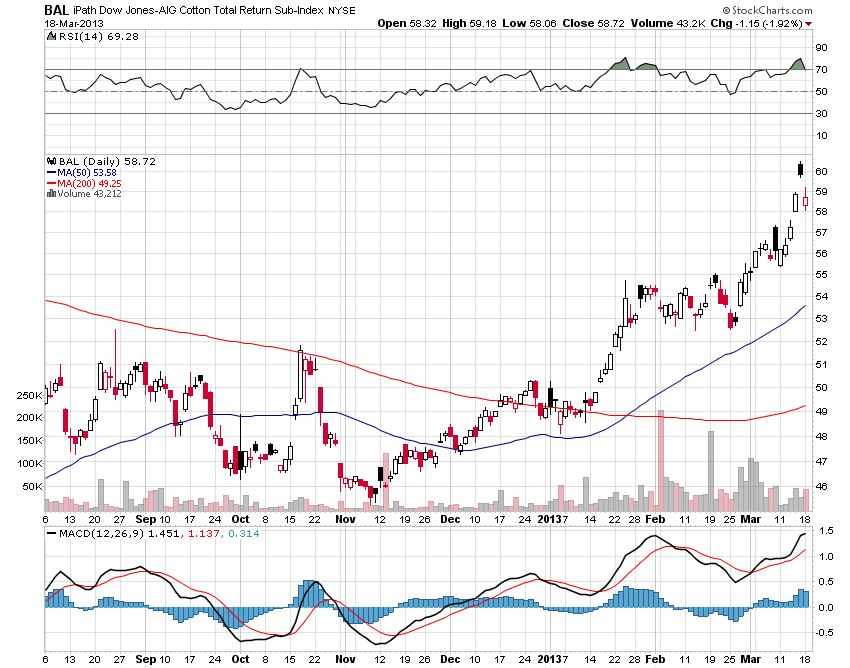

Cotton is on the rise again. It’s still a long way from the all time highs set in 2011 but there is a definite uptrend. Acreage planted in cotton this year will be down considerably in the US as prices under $1/pound aren’t profitable for a lot of farmers. This is an ETF so the price isn’t the actual price of cotton which is now approaching 90 cents. So who benefits and who gets hurt? I don’t really know the answer to that yet but it might be worth investigating.

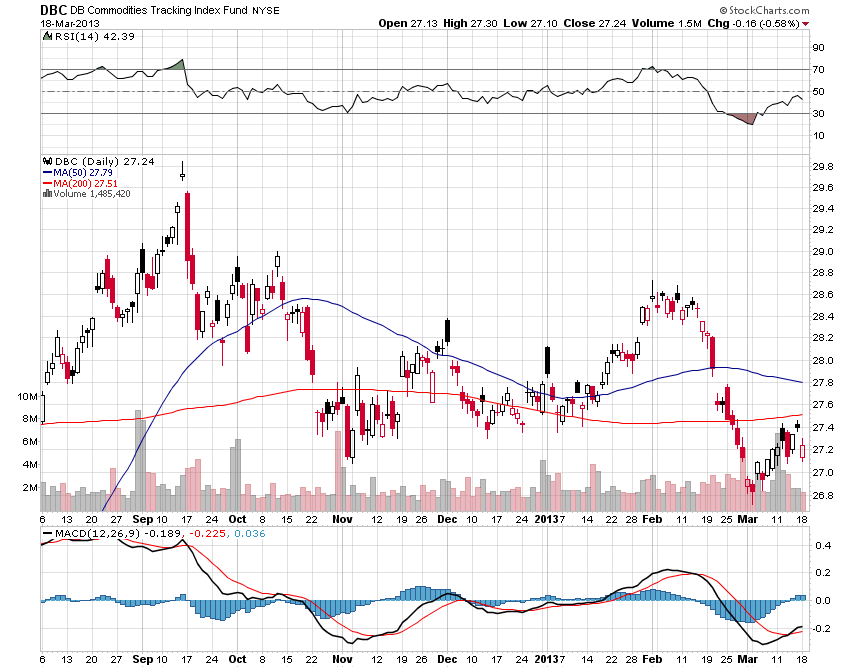

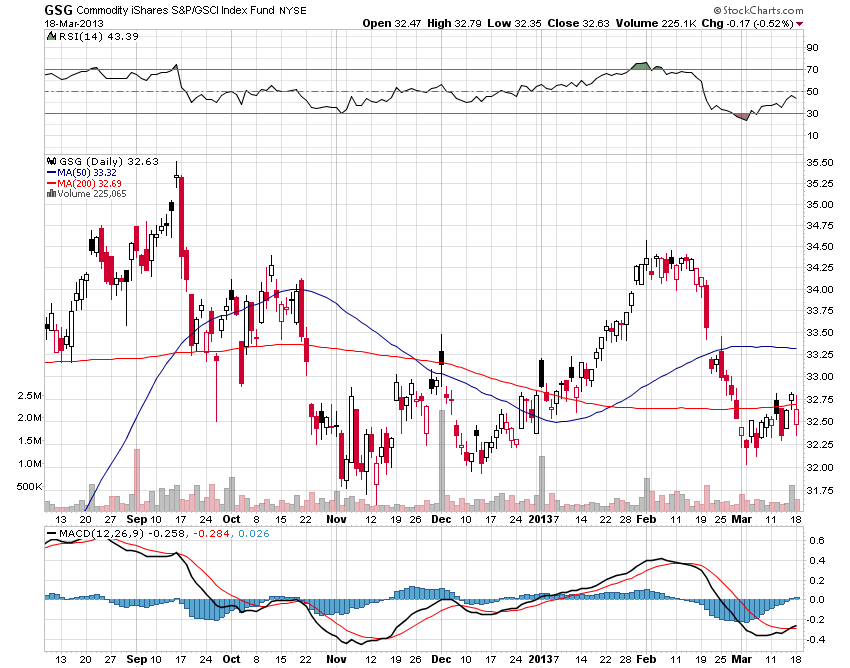

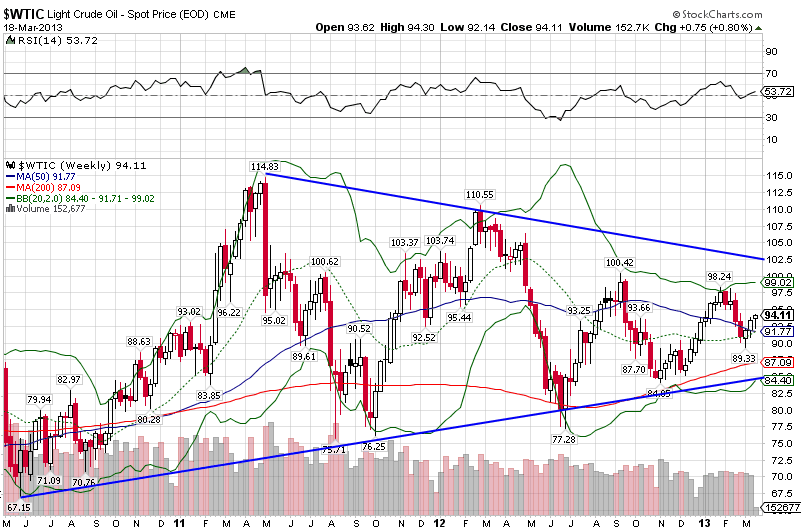

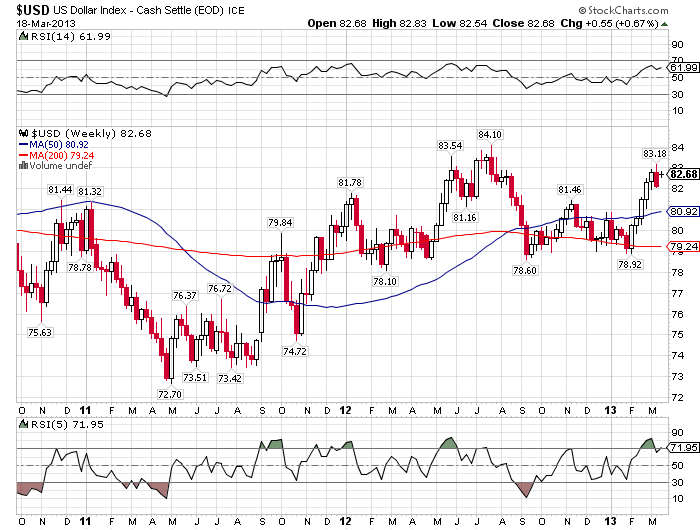

The diversified commodity ETFs are in a downtrend that doesn’t look like it will end soon. A lot of this is due to the rising dollar but it’s also a function of the commodity weightings in the ETF. The GSG (GSCI) index has a heavier weighting in energy and hasn’t been hurt as badly as DBC and DJP which are more equally weighted. If the dollar keeps rising, I would expect energy prices to follow other commodities lower and GSG to follow suit.

GSG is holding support for now.

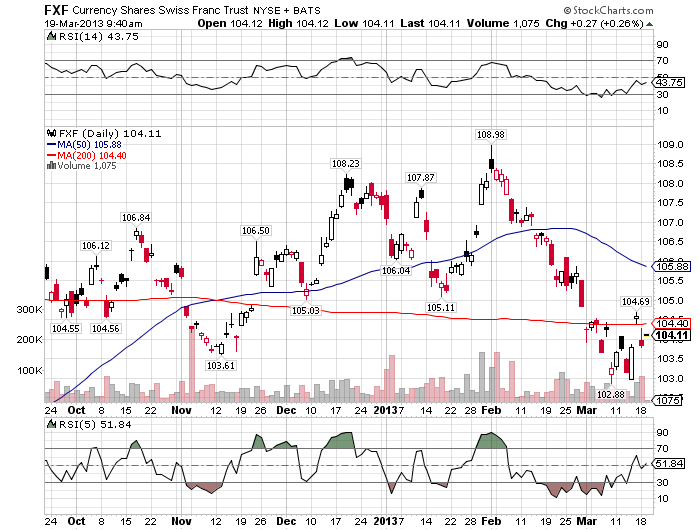

The Swiss Franc is following the Euro lower. The SNB had capped the Franc against the Euro but now that the Euro is falling, I wonder how long they’ll keep that in place. I don’t know yet what the SNB balance sheet implications are for this (Jeff, that would be a good post for you) but my guess is that it won’t be good for the Swiss economy or stock market.

Gold stocks have just been murdered this year as gold prices have fallen and the dollar has risen. We are still fairly bullish on the dollar but that is dependent on continued outperformance by the US economy which isn’t great but a lot better than the rest of the world. Even if the US economy weakens I expect it to be better than Europe so the dollar index might not fall much. However, the Fed response to such a development would be interesting to say the least and even more easing might push the dollar down against gold. For now, GDX is on the radar screen since it has fallen so much and at least appears to be hitting some kind of bottom.

The gold ETF looks similar to the stocks but not as extreme. Again there might be some kind of bottom being formed here but it is way too early to be a buyer.

Industrial metals have been weak and got hit again today. Stronger dollar or expectations of weaker growth? Weaker growth where? US or China? Being old enough to remember the late 90s when we had a strong dollar and commodities were an afterthought for everyone, I know that the direction of commodity prices may not tell us anything about the direction of the economy. In fact, lower commodity prices should act as stimulus to some degree and with prices having been high for so long, it might just be that the increased investment in mining since the early ’00s has just raised supply so far that even a strong economy won’t raise prices. It certainly should make us wary of the idea the economy is accelerating though.

I’m not a technician but I’ve been doing this long enough to know that these wedge patterns often get resolved with big moves. The direction will likely be determined by the course of the US Dollar.

With what looks like a renewed slowdown in China I guess it isn’t surprising that emerging markets aren’t participating fully in the recent stock rally. Another reason is the renewed strength in the US Dollar which tends to direct capital away from emerging markets. It isn’t coincidence that most of the emerging market crises of the past happened during times of dollar strength. Will it happen again? It wouldn’t surprise me in the least. There’s a reason emerging market countries are always emerging. They screw up the boom times when capital is flowing in and don’t prepare for the inevitable bust when the flow reverses. I would not bet on it being different this time.

Is the Hong Kong bull market over already? HK is just one of several Asian markets that look like they are at least correcting and possibly making longer term tops. I’m not sure what effect the drop in the Yen is having but it seems way too soon for there to be an actual economic impact. This bears watching closely.

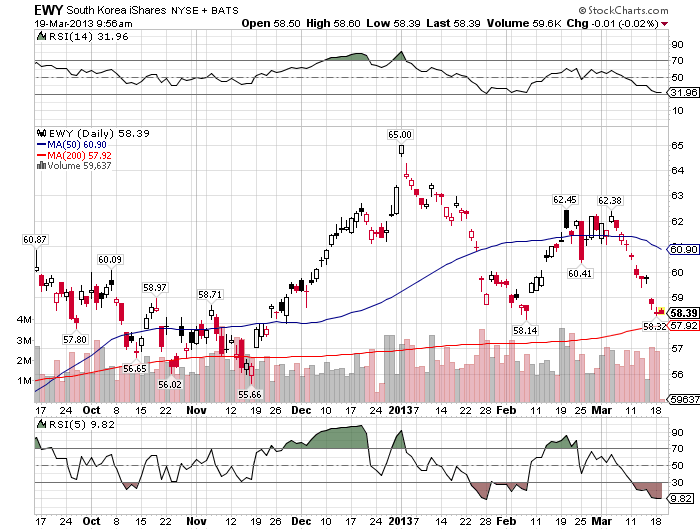

The Korean market is down on the year and doesn’t look ready to improve. They have long term problems similar to Japan and now a currency that is rising against their rivals. Growth this year is expected to get back to 3% but the market doesn’t seem to believe. In broader terms, if many of the Asian markets are rolling over (exceptions: Japan, Thailand) what does that say about global growth? Asia has seemed to be a oasis of stability but I’ve always been skeptical of that. With Japan making a bid to be competitive again, Europe’s economy a basket case and China…well who knows what’s up with China but it doesn’t seem good….Asia is facing greater challenges than it has in a long time.

The shipping ETF is on the rise which would seem to contradict worries about slower growth. It is still a long way from the highs of a few years ago created by excess capacity. I haven’t looked into the supply/demand characteristics of the market recently but it looks like it might be time.

That’s the most interesting charts I came across this afternoon (not including individual stocks). It is a mixed picture for sure but the topping in the Asian and emerging markets more generally is worrisome to me. The rising US Dollar and the falling Japanese Yen appear to be having an effect. Last chart is the Dollar index which is still bullish but maybe a little overbought:

Stay In Touch