IDC and Gartner estimates of PC market movements came out and showed a dramatic drop for the 1st quarter of 2013. The decline was not surprising, but the scale according to IDC was:

“Worldwide PC shipments totaled 76.3 million units in the first quarter of 2013 (1Q13), down -13.9% compared to the same quarter in 2012 and worse than the forecast decline of -7.7%, according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. The extent of the year-on-year contraction marked the worst quarter since IDC began tracking the PC market quarterly in 1994. The results also marked the fourth consecutive quarter of year-on-year shipment declines.”

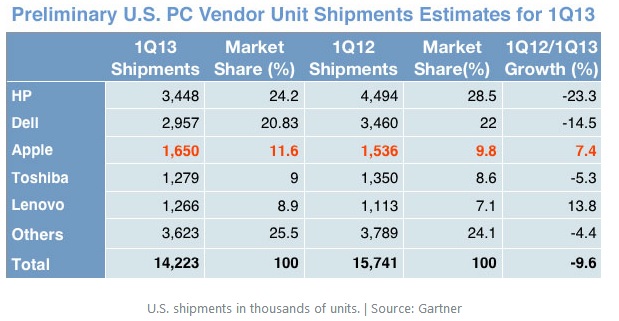

The data was less grim from Gartner, but still stark nonetheless.

For the US market, IDC estimated a similar decline to Gartner, -12.7% Y/Y and -18.3% Q/Q. Total volume of 14.2 million units was the slowest pace since 2006.

There are two explanations for the decline in PC’s – the macro environment and the rise of smartphones. There is no doubt that smartphones are replacing PC’s in the consumer segment (and perhaps to a small degree in the business segment where tablets may be a reasonable substitute), but I don’t believe that offers a full explanation for the sizable decline in computing business.

According to Gartner estimates for the fourth quarter of 2012, total smartphone sales rose from 150.1 million in Q4 ’11 to 207.7 million in Q4 ’13 (the latest data), or up 38%. As a result of relative growth, worldwide market share of smartphones has surpassed 50% – rising from 46.4% in Q3 ’12 to 52%.

However, while smartphones continue to supplant PC’s and less intensive mobile phones, the overall marketplace for mobile technology (including smartphones) actually shrank. Total worldwide mobile phone sales fell 477.7 million units in Q4 ’11 to 472.1 million in Q4 ’12 (-1.2%). Overall in 2012, total mobile unit sales fell 1.7% – the firrs.

Taking these two pieces together I think it says a lot about both the consumer marketplace (mobiles) and business investment in computing (PC’s). Again, it is undeniable that smartphones are displacing older technology, but, at least toward the end of 2012 and into 2013, are not doing so at a pace that keeps the overall technology marketplace advancing at even a modest rate. The dramatic decline in PC’s is of a scale that is not congruent with the rise in smartphones.

This is particularly important given the place computing technology has been given in the modern consumer and business preference. These are not simply luxury goods to be easily left on the shelves, rather they are more likely than not considered non-discretionary by both businesses and computers.

There are other significant factors to consider here as well, including replacement cycles and technological advancements within each segment. Overall, however, it seems that the global economy is having an impact in core segments – the last time shipments in mobile phones actually declined Y/Y was 2009.

Stay In Touch