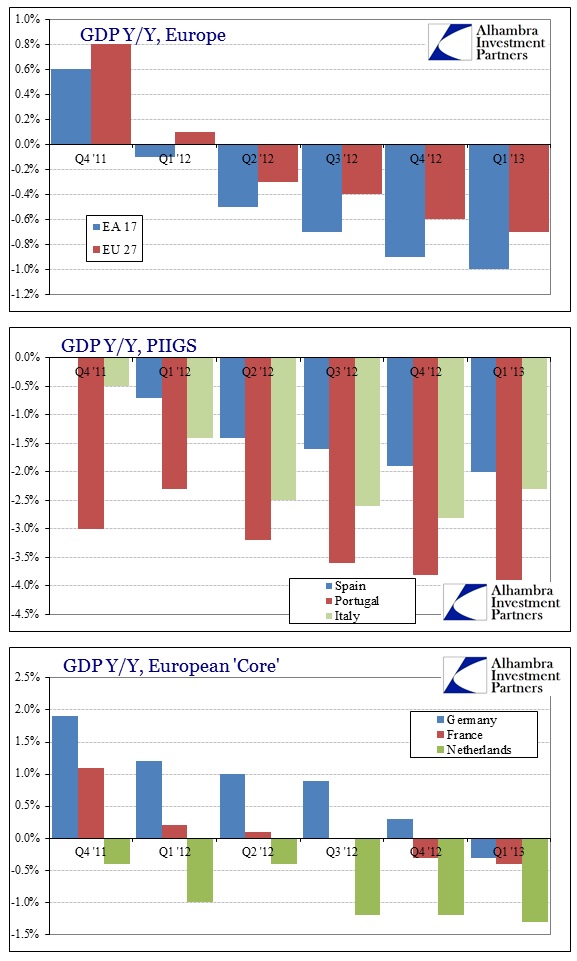

The recession deepened in Europe, but that was not a surprise to anyone outside the economics profession. While Germany stays perched upon the precipice of another contraction (Q/Q), the rest of Europe was not so “fortunate”. While we can label these gyrations in GDP re-recession, double or triple dip, etc., the truth is that this is one continuous descent into a wider depression. You don’t have fifteen consecutive months of GDP contraction without having far greater structural problems embedded in a dysfunctional system.

When viewing Y/Y changes in GDP, the descent is amazingly clear.

The worst part is that this downward trajectory is plainly apparent in not only the PIIGS, but the “core” countries as well. The economic disaster of the periphery is spreading outward at an alarming rate – the exact opposite of what was “expected”. Monetary policy and fiscal authorities in Europe designed their economic countermeasures on the idea that stabilizing the European banking system as a whole would allow the core of Europe to pull the periphery out of misery. They have failed on both accounts, with the banking system still a mess of fragmentation paired with the obvious worsening depression shown above.

But at least asset prices are rising, right?

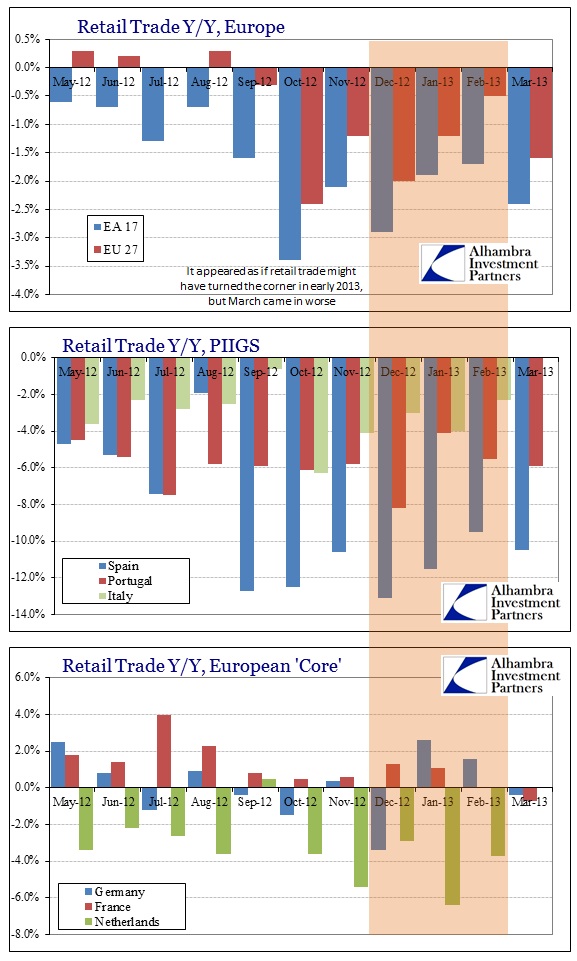

The GDP mess is also apparent across economic sectors. In retail trade:

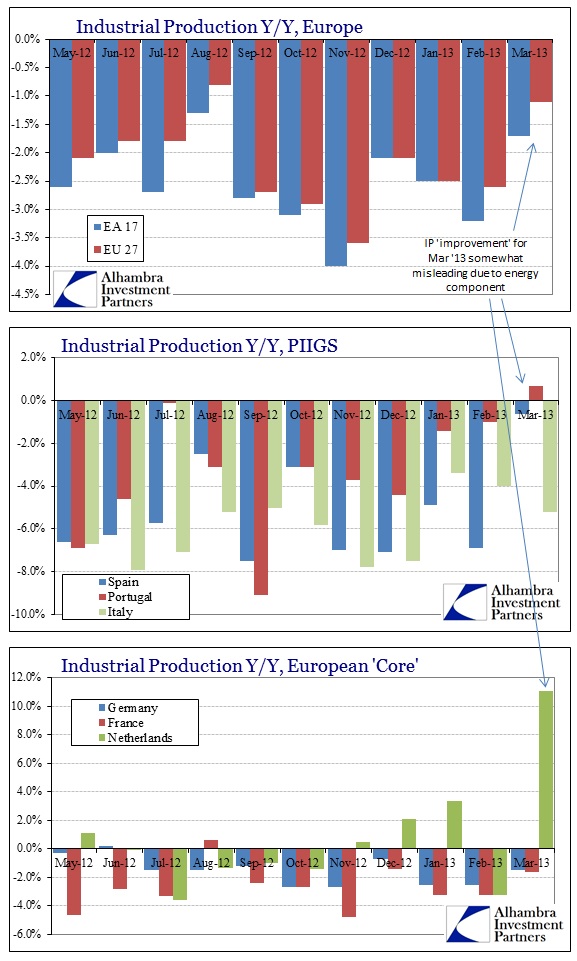

And industrial production:

Event the March turn in industrial production is suspect, given the heavy influence of a dramatic rise in energy production. The volatility in energy is not likely to carry total IP going forward.

Every chart presented here, indeed almost every single data point, is upside down. There is near uniformity in the economic decline – broad in every sense of the word, from geography to economic sector. Despite massive bank bailouts and monetary measures of an unprecedented nature, the real economy continues to suffer. This is bad news for the banking system because, obviously, extended depression leads to another rising tide of “bad” assets (more on this later).

Data on hand for April is not at all re-assuring either. The downturn looks to have continued at a steep pace. From retail trade in France and the service sector in Germany, to Spanish bankruptcies and auto production and sales across the continent. Even German trade, the mighty export engine still keeping the core of Europe somewhat afloat, looks notably weaker in April.

There has always been a tension between the banking system’s need for a strong euro against the real economy (particularly the core) and the idea of a weak, export-oriented euro. This is a no-win situation since either direction produces mostly the same disastrous results (the weak euro of 2011 led to banking problems that kicked off the latest down cycle; the opposite has failed to make any difference as the real economy sinks further).

Stay In Touch