With everything going on in Japan and the US credit markets, Europe has slipped somewhat from the headlines. Part of that is now universal recognition of the durable depression facing the entire continent, no more denials about containment or rapid rebounds. But politicians and policymakers have still maintained that the currency portion of the crisis is over, and that the banking system is no longer the problem despite economic carnage.

There is more than just a bit of hope in that sentiment. My colleague Doug Terry passed along a contrary news story out of Spain yesterday. According to Reuters, Spain will press the EU to remove any limitations from the ESM, the fund that has been set up to disperse bailout “money”. The initial receipt of ESM funds by Spain went to indirectly recapitalize Spanish banks, particularly Bankia.

Apparently, both the Spanish and Italian authorities are concerned about the €500 billion limit that was added to largely appease the Germans. That flies in the face of the rhetoric that the worst days are in the past. If the financial system is working again despite fragmentation, it should follow that sovereign bailouts are no longer needed – at least not in increasing size and scale.

Beneath the surface of the calming and soothing reassurances, policymakers know that all is not well. Beyond the burning depression that continues to rot a hole in the potential for restoring solvency in both Spain and Italy, bond markets in both countries have been supported marginally by their own banks more than anything else (other than perhaps a few hundred billion yen thrown in for good measure). In the first three months of 2013, Spanish banks increased their allocation to Spanish sovereigns by €25 billion, or more than 10%.

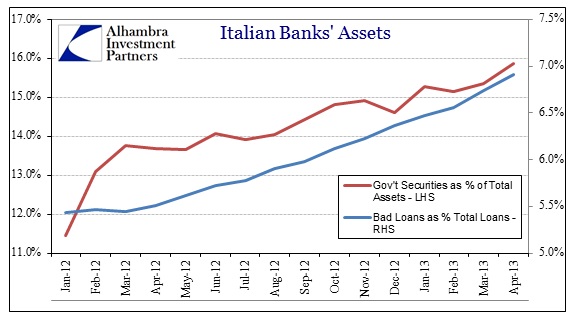

In Italy, Italian banks continue to do the same, having added €43.6 billion Italian government bonds in the first four months of 2013.

While the banks continue with huge support of their respective government credit markets, undoing some of the withdrawals of foreign “money” from last summer, they have been actively and in some cases rapidly shrinking their participations in the real economy. Loans to Italian consumers and businesses from Italian banks fell €33.4 billion in 2013 through April. Bank loans in Spain have declined by more than €100 billion (adjusting for “bad” debts transferred to SAREB).

In addition, deposits of domestic holders fell in both Spain and Italy in April (though we don’t have a good idea of how much was seasonal and how much may have been due to other factors).

When Mario Draghi promised an unlimited OMT to “save the euro”, he essentially created another parallel problem. That floor support in each sovereign credit market gave a green light to Spanish and Italian banks to swap real economy loans for government bonds, exacerbating (in the monetarist framework) the depression in both countries. The impulse to do so was the already set in the economic deterioration.

Plug one leak, and another appears. The problem is not these smaller symptoms, it is the unstable structure and foundation it was all built upon. Policymakers keep floating these “liquidity” schemes to get the markets to “believe” in growth with the idea that belief in growth from markets will actually yield growth. Modern economics is all psychology. Then when there is no growth, or the opposite now, they have to appeal to something else. Or go bigger, a la Krugman & Abe.

We have gone (in Europe) from “no European state will ever need a bailout, ever”, to OMT for Greece & Portugal; to expanded OMT (SMP); to rumors of EFSF and a durable banking union; to 3-month & 1-year LTRO’s coupled with allotted dollar swaps; to full 3-year unlimited LTRO’s with unlimited dollar swaps at a reduced penalty; to now unlimited OMT (theoretically) and recap with ESM. Through it all, growth never appeared.

But the euro crisis is over and “hope springs eternal in the human breast”:

Go, wondrous creature! mount where science guides,

Go, measure earth, weigh air, and state the tides;

Instruct the planets in what orbs to run,

Correct old time, and regulate the sun;

Go, soar with Plato to th’ empyreal sphere,

To the first good, first perfect, and first fair;

Or tread the mazy round his followers trod,

And quitting sense call imitating God;

As Eastern priests in giddy circles run,

And turn their heads to imitate the sun.

Go, teach Eternal Wisdom how to rule—

Then drop into thyself, and be a fool!

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch