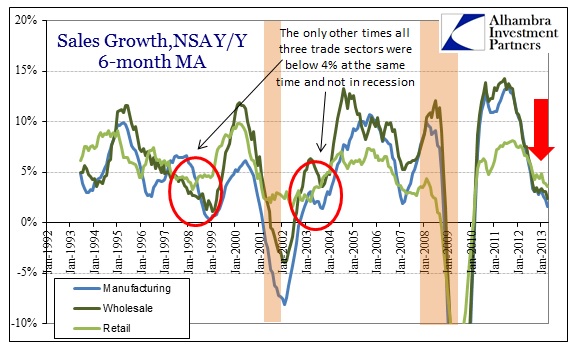

Coincident to the relatively boring retail sales report, the Census Bureau estimated declining trade fortunes across the whole goods supply chain. In the seasonally adjusted data, total trade sales fell 0.1% in April after declining 1.2% in March. Compared to April 2012, total sales were up only 1.5% (meaning they declined on a real basis). Most of the April decline was due to manufacturing contraction, with retail and wholesale sales slightly higher in April from contractions in March.

In the unadjusted data, the trend is the same familiar pattern staked out in nearly every economic data point across numerous data collecting agencies. It looks like an economy stuck in stasis.

The only other periods where growth was so slow has either been in recession or the near-recession of 1997-98 (with the dot-com bubble as a “tailwind”) and the recovery out of the dot-com bust (with the housing bubble as a “tailwind”). While there appears to be numerous asset bubbles in 2013, none have the same channeling into the real economy to create such positive economic pressure.

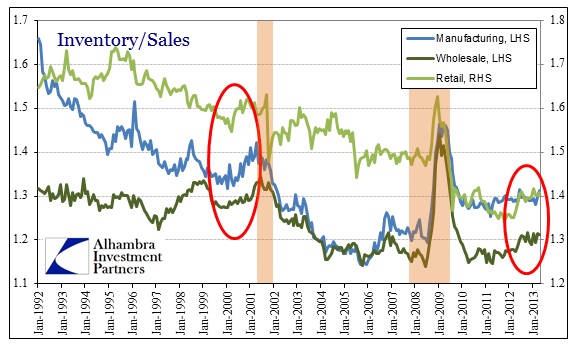

The problem as it relates to the future direction of trade activity is the backup in inventory. Across the entire supply chain inventory levels have been rising.

While there was a similar pattern at the end of 2006, the current period more closely resembles 2000. Regardless of comparisons, it is clear that inventory levels diverged from sales in the first months of 2012, and in manufacturing and wholesale are at highs not seen since 2009.

The timing of this change is not random, as, again, this is the exact same time-frame as inflections across the domestic economy. I noted recently that there was a shift in hiring activity at domestic businesses in this same period.

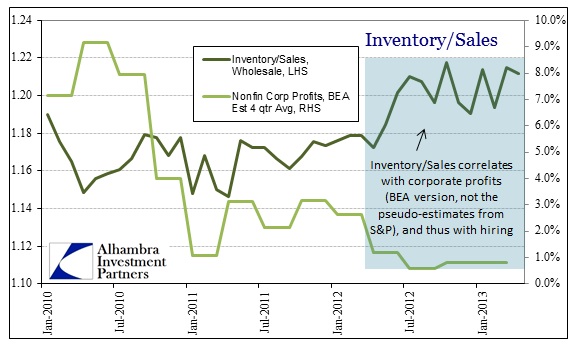

Tracing the trend back further, it corresponds to slowing (and near zero) profit growth. Rather than relying on the estimates provided by S&P, I have used those at the BEA to better assess US corporate performance inside the domestic economy. This is a much better comparison since it strips out profits derived from foreign activities which have far less direct impact on the US economy.

The former monetary doves want us to believe that the improving economy is the reason for their taper talk, but the inventory data shows conclusively otherwise. Sales have slowed across the supply chain, and inventory has built up in all places. We know what the next step is in the economic cycle, unless the latest QE suddenly succeeds where its predecessors conspicuously failed.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch