House price data from S&P Case Shiller for May 2013 was about what we have come to expect. There were sharp year-over-year increases in the usual bubbly markets, prompting Robert Shiller to note, “the cities that have bubbled in the past are bubbling again.”

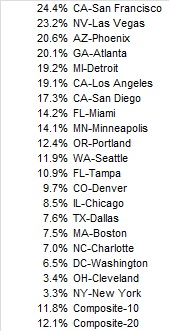

As with much of 2013, the “top” seven cities were all up over 15% Y/Y, with six of the seven above 19%. On the whole, the 20-city composite increased 12.1%. The last time we saw 12+% was March 2006.

As with much of 2013, the “top” seven cities were all up over 15% Y/Y, with six of the seven above 19%. On the whole, the 20-city composite increased 12.1%. The last time we saw 12+% was March 2006.

We don’t know yet if the current rise in mortgage interest rates, and the subsequent collapse in mortgage applications volume, have cut these price rates at all. Initial indications from the Census Bureau seem to suggest that, but it remains to be seen; part of that uncertainty stems from the type of “money” pushing into the housing market (more on that below).

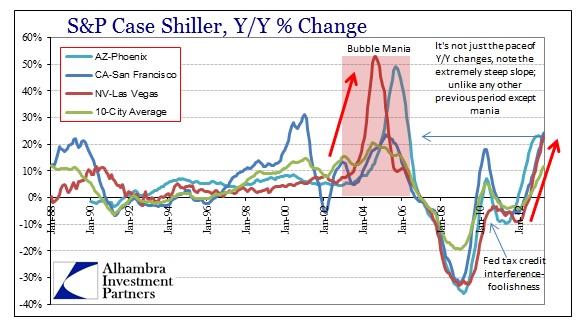

At any rate, to this point price appreciation is occurring not only at bubble-levels but at a speed or acceleration that is unique to the data series. We have simply never seen house prices behave in this manner before. The only instance that can even come close was the “mania” phase of the housing bubble, and even then the acceleration in most cities was nowhere near as steep.

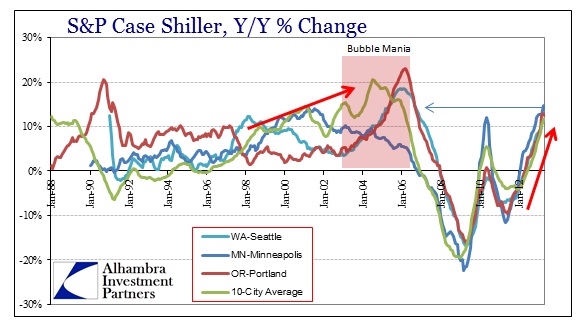

Even in three mid-pack markets (Minneapolis, Portland, Seattle) there is a distinctly bubble-like behavior in prices, but again exhibiting acceleration that is unprecedented.

These kinds of pricing behaviors are distortions on markets that are already distorted, causing unanticipated issues to arise (as if distortions create anything else).

In February 2012, the FHA began a pilot program to help dispose of its REO inventory. At the peak, the GSE’s held about 295,000 properties in the REO classification. By Q1 2012, they had cut a third of that number largely through foreclosure sales directly into the “market”. The pace of the inventory disposal has tailed off considerably since the early quarters of 2011, prompting the FHA (in concert with numerous government agencies and quasi-government entities) to search for other “creative” means of disposal that would not so depress prices.

In February 2012, the FHA began a pilot program to help dispose of its REO inventory. At the peak, the GSE’s held about 295,000 properties in the REO classification. By Q1 2012, they had cut a third of that number largely through foreclosure sales directly into the “market”. The pace of the inventory disposal has tailed off considerably since the early quarters of 2011, prompting the FHA (in concert with numerous government agencies and quasi-government entities) to search for other “creative” means of disposal that would not so depress prices.

The pilot REO-to-rental program consists of bulk sales to investment firms. The terms of the sales seem to favor the GSE’s: they get 90% of cash flows until a pre-specified limit is reached, then the cash is split 50-50 thereon out. That certainly seems like a reasonable deal from the taxpayer perspective, except in the fine print is buried the investment “kicker”:

“In addition to receiving distributions on its equity interest, [the winning bidder] will also receive an asset management fee of 20% of gross rental income actually collected, with such fee to be used to compensate [the winning bidder] for managing the entity and provision of asset management and property management services.”

Before the government ever sees a nickel from the REO-to-rental, the private investment firm, using Federal Reserve-subsidized borrowing to purchase an interest in these joint-ventures, gets to take 20% right off the top as an incentive.

Three pilot sales have been completed; two in September 2012 and an additional in November 2012. The two in September (699 properties in FL valued at $81.5 million and 94 properties in Chicago valued at $13.7 million) both sold at discounts to recognized 3rd party valuations. The third sale (970 properties in CA, NV & AZ, valued at $156.8 million) was completed at a premium to 3rd party values (112%).

There have been no additional sales since then, and very little additional information about the program.

By the end of Q1 ’13, the combined REO in possession of the GSE’s was about 190,000 properties. The pilot program made little difference in the overall trajectory of property dispositions, but if pricing has at all played a role in discouraging further bulk sales then the GSE’s have a real problem.

Back at the end of May the GSE oversight departments (remember the GSE companies are still technically in “conservatorship”) reported that 2.7 million GSE mortgage borrowers are in arrears by more than one payment. All of these 2.7 million are more than 90-days delinquent. This is the shadow supply of the shadow supply; should delinquencies grow again into more foreclosures, the GSE’s will find themselves sitting on an enlarging inventory of homes without an effective means to dispose of them, outside of the normal foreclosure sale into the “market”.

That has been a significant part of the price appreciation dynamic, as banks and the GSE’s have belatedly recognized the need to control the quantity or supply of foreclosed homes for sale, including through REO. The entire pilot program here was to test a method of getting foreclosed properties sold without them ever “hitting the tape” and affecting (downward) marginal prices. In other words, this was supposed to be an off-market pipeline.

But if price appreciation, due in no small part to that effort, has been too far too fast to maintain control as investment firms find their margins too squeezed by prices, then it puts some of the same damaging factors back into the housing market as we saw in the housing bust. The primary problem of such accelerating price action in bubbly markets is their susceptibility to violent reversals.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch